From trade-offs to paradoxes

By Vanina Farber

In 2026, sustainability leadership is no longer defined by managing trade-offs. Trade-offs assume a zero-sum logic: limited resources, competing goals, and clear choices where gains in one area require losses in another. That logic no longer fits the challenges companies face.

Today’s sustainability dilemmas are persistent, interconnected, and self-reinforcing. Progress in one domain rarely resolves tension in another; it often intensifies it. We have entered the age of paradox, where opposing forces coexist, and leadership is measured by the ability to navigate, not eliminate, contradiction.

Consider the Global-Local Paradox. Climate, biodiversity, and migration demand coordinated global action. Yet legitimacy, trust, and execution remain fundamentally local. Companies must operate at scale while staying rooted in context. You need reach and relevance at the same time.

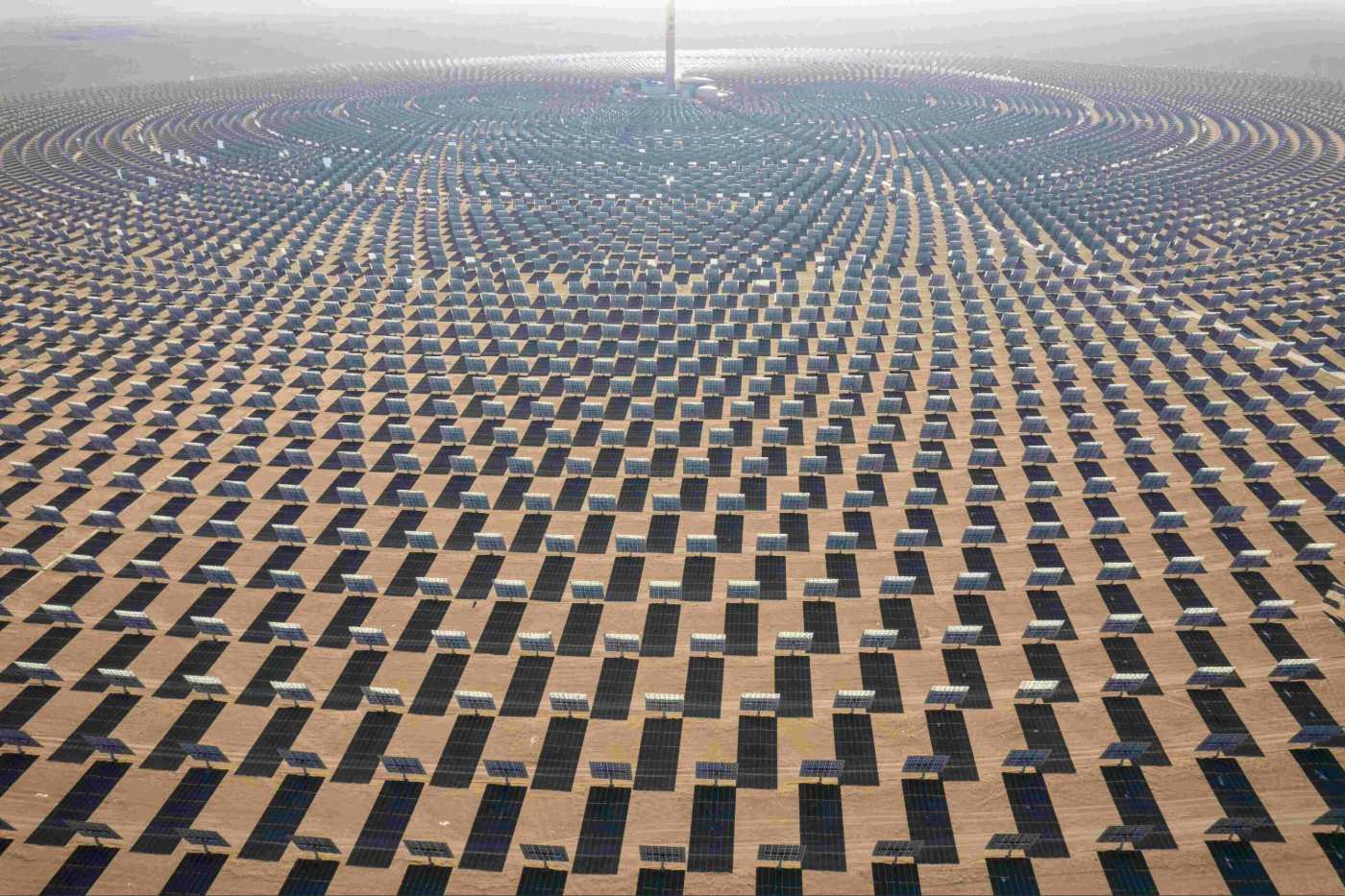

The Innovation–Risk Paradox is equally acute. The climate transition demands new solutions: circular systems, regenerative models, and AI-enabled efficiency. Yet innovation depends on experimentation, and experimentation entails failure and uncertainty. Organizations are expected to move fast and prove outcomes in advance. To disrupt without destabilizing.

Then there is the Transition Paradox. Moving away from harmful practices is non-negotiable. Yet real transitions rarely begin in a state of perfection. If companies wait for purity, progress stalls. If they move too fast, they risk accusations of greenwashing. The path forward runs through unavoidable gray zones.

Finally, the Regulatory Paradox is becoming more visible. Stakeholders call for bold first movers, while regulatory frameworks are still evolving. Regulation demands clarity and comparability; sustainability solutions emerge from complexity and experimentation. The tension can unintentionally suppress the very innovation systemic change requires.

These are not contradictions to solve. They are tensions to hold. The defining challenge of sustainability leadership in 2026 is no longer choosing sides but building the capacity to operate across them: to balance speed with integrity, ambition with legitimacy, experimentation with accountability. To act and reflect. To lead and learn, all at the same time.

Audio available

Audio available