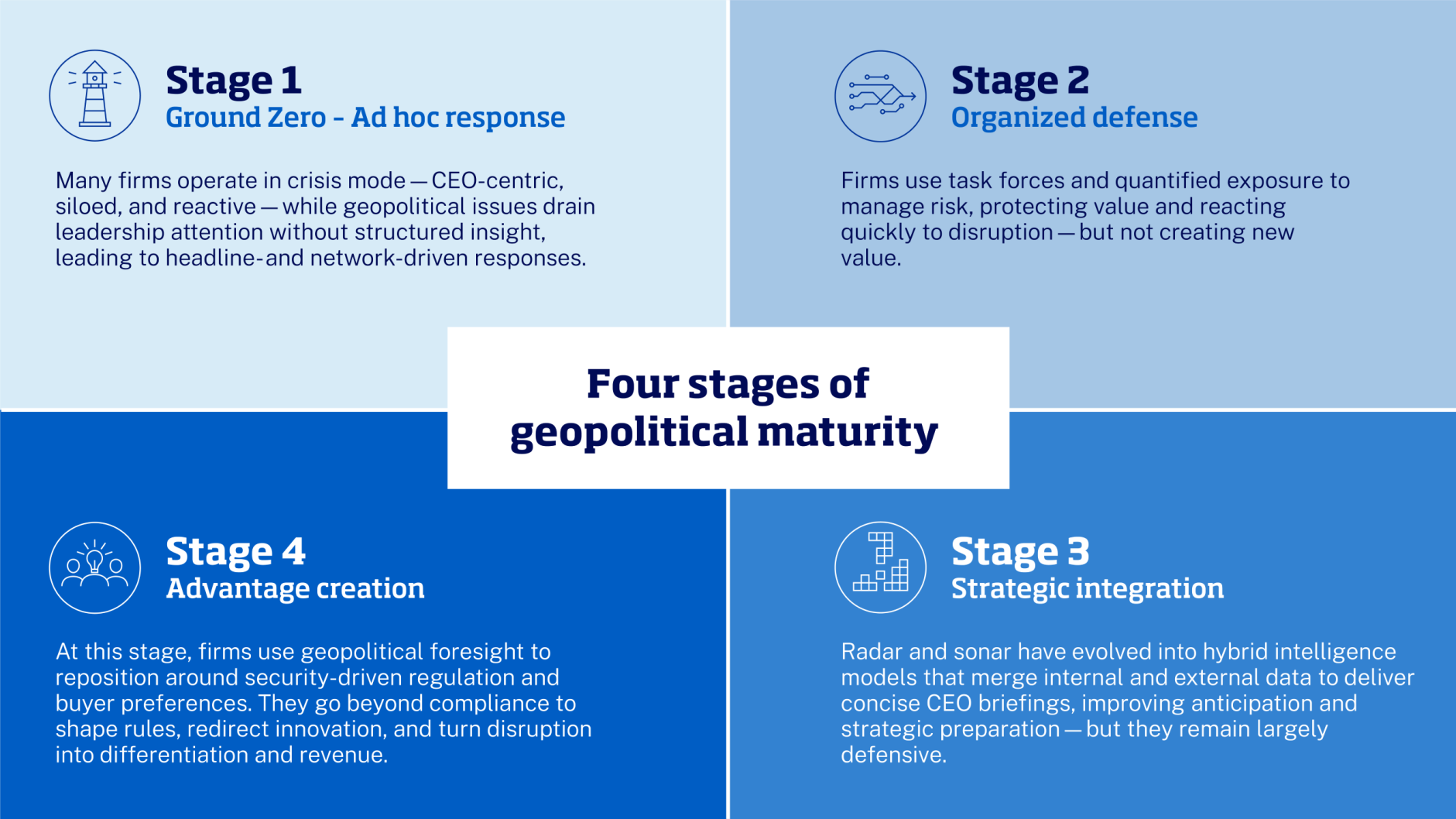

Stage 4: Advantage creation

At this critical stage, firms recognize that geopolitical foresight reveals where and how consumer behavior and regulatory compliance are being shaped by state security imperatives and seek to reposition themselves accordingly. Sovereignty concerns, supply chain transparency, and national champion preferences shape buyer preferences and influence the revision of value propositions.

Stage 4 firms do more than just comply with regulations; they help shape the regulatory environment and rethink innovation trajectories, turning disruption into differentiation and foresight into revenue, capturing first-mover advantages through regulatory influence and market positioning.

In practice: One healthcare company used geopolitical analysis of the US “most-favored nation” drug pricing proposals to anticipate that entering certain markets would set floor prices too low to replicate globally. Based on this insight, it fundamentally revised the product launch strategy and market sequencing.

A critical infrastructure company maintains regular dialogue with at least 10 governments on infrastructure resilience regulation, contributing to inform standards while positioning commercially.

EDF’s network-based model, led by a former diplomat as trusted adviser to the CEO, supports business units in business-to-government interactions and bidding while engaging French and EU institutions to shape the regulatory environment. This proved critical during recent mergers and acquisitions. The team was involved from the outset, navigating political complexities, aligning with state actors, and securing deals after months of negotiations.

LATC shifted from firefighting to developing its own “house view” on geopolitical developments. The company added a chief trade officer role to the chief strategy officer’s responsibilities, enabling it to shape conversations with regulators and trade bodies, creating differentiation.