Turning disruption into opportunity

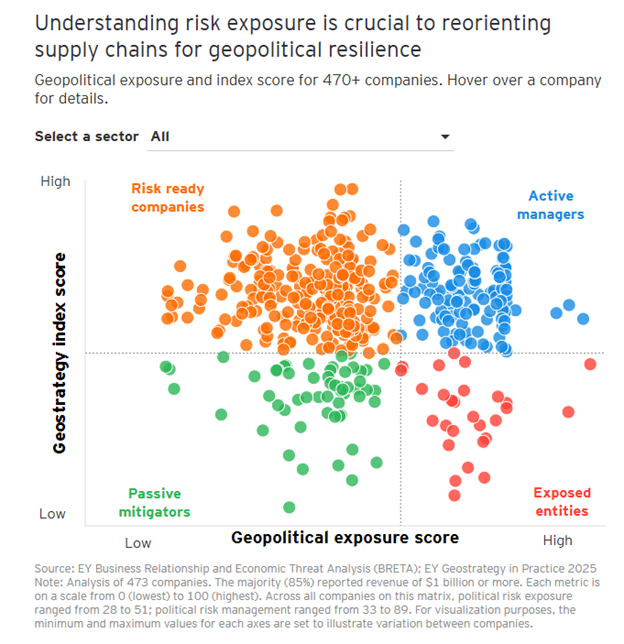

Despite the oft-noted challenges, geopolitical volatility creates substantial opportunities for strategically prepared organizations willing to move decisively when competitors retreat or hesitate. Research indicates that 14% of companies report net positive effects from political risks that disrupted competitors, creating market openings for those ready to capitalize on temporary dislocations and long-term shifts in global trade patterns.

Capitalizing on geopolitical opportunities requires deliberate investment in organizational capabilities that function effectively amid constant change and uncertainty. This means building strategic flexibility through systematic diversification of markets, suppliers, and production bases – creating “option value” that enables rapid adaptation to changing geopolitical conditions while maintaining operational efficiency and competitive positioning.

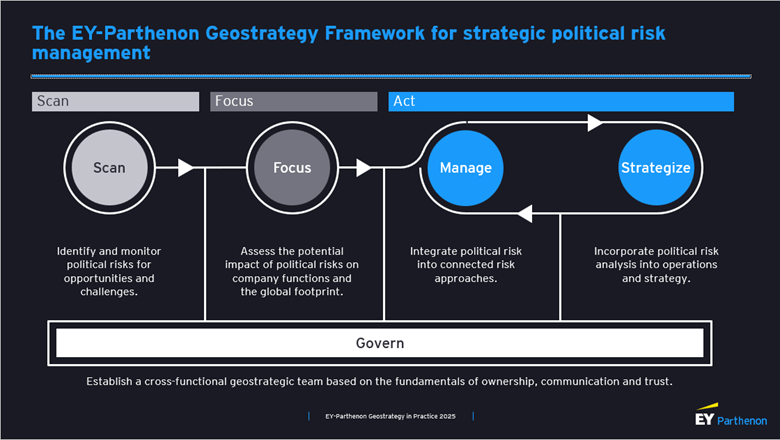

The integration of geopolitical considerations into core business processes, rather than siloing them in specialized government affairs or traditional risk management functions, distinguishes market leaders from laggards in volatile environments. When geopolitical thinking becomes embedded in strategic planning, investment decisions, operational protocols, and regular management practices, organizations can respond swiftly and decisively to emerging opportunities while competitors remain paralyzed by uncertainty.

Understanding what motivates national security officials and other key policymakers enables more effective stakeholder engagement and better anticipation of policy directions. The growing availability of high-quality open-source intelligence resources, including specialized podcasts and analytical publications, helps executives develop a sophisticated understanding of officials’ worldviews, strategic priorities, and decision-making frameworks. This knowledge facilitates more productive interactions with government stakeholders and enables better anticipation of regulatory or policy changes that create competitive advantages for prepared organizations.