AI, culture and well-being: New Spotify CHRO unveils her top priorities

Spotify CHRO Anna Lundström drives AI readiness, culture, and personalized well-being to empower employees and sustain Spotify’s innovative, human-centric growth....

by Didier Bonnet, Jialu Shan Published November 12, 2025 in Artificial Intelligence • 12 min read

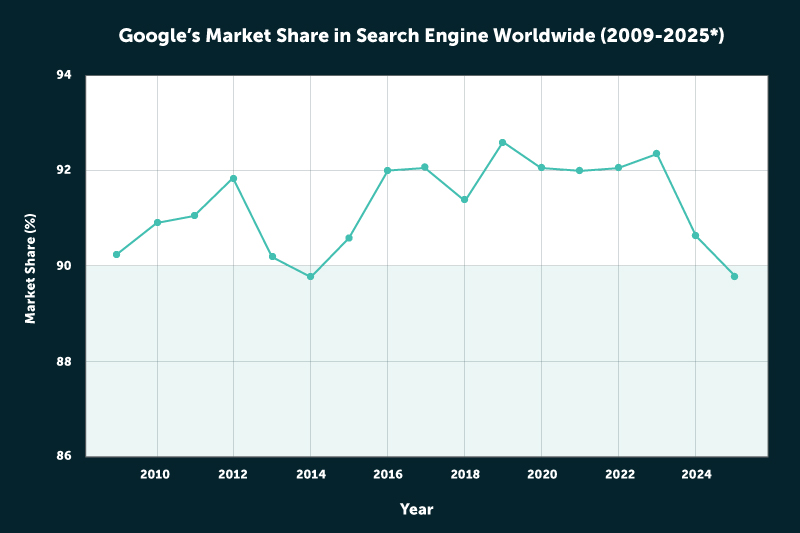

In an era where information is readily available, the search engine is one of the most widely used productivity tools globally. For the past two decades, Google has dominated, holding a 90% share of the global search market. When ChatGPT launched in November 2022, many speculated that powerful large language models (LLMs) would challenge its search dominance. The company took the threat seriously, declaring a “Code Red” and having its two founders, Sergey Brin and Larry Page, return to the company to face the challenge. According to the New York Times, the stellar rise of ChatGPT was seen as a potential threat to Google as it “looked as if it could offer a new way to search for information on the internet.” As The New York Times also reported, “For Google, this was akin to pulling the fire alarm. Some fear the company may be approaching a moment that the biggest Silicon Valley outfits dread – the arrival of an enormous technological change that could upend the business.” This was a plausible outcome as, historically, what disrupted a dominant technology was a better one. So, nearly three years on, have we seen the demise of traditional search – or are we witnessing its transformation into something new?

For decades, search engines like Google have been the navigation system of the internet, offering straightforward query-and-click interfaces. But the search paradigm is evolving fast. The era of keyword-based searching and link sorting is giving way to conversational search, where users ask natural language questions and receive direct, AI-generated answers synthesized from data across the internet. Why is this happening? Two major trends are reshaping the search landscape.

First, younger generations are increasingly turning to platforms like TikTok and Instagram for searches related to shopping and travel. Over 40% of Americans and 65% of Gen Z are using TikTok as a search engine, according to Adobe. This generational shift signals a move away from traditional text-based search engines toward visual and socially driven discovery tools.

Second, as is often the case in major technological shifts, the outcome is often more a complementarity than a substitution story. For example, Perplexity has emerged as a leader in LLM-powered search. Established in August 2022, the company has been one of the fastest-growing AI platforms, with website visits increasing nearly fivefold from 2023 to 2024. Perplexity has also integrated various advanced models, including GPT-5, Claude 4.5 Sonnet, and China’s AI poster child, DeepSeek’s reasoning R1 model, to enhance search accuracy, focusing on personalized, context-aware responses. The field is indeed moving fast, and Perplexity is not alone.

Most AI companies are adding search functionalities. OpenAI’s ChatGPT introduced a search feature in October 2024, integrating curated answers and links, combining conversational AI with traditional web resources. Building on this foundation, OpenAI further enhanced its search capabilities by releasing a ‘Deep Search’ function, which employs advanced reasoning to break down complex queries, conduct thorough research across multiple sources, and synthesize comprehensive analytical responses. Mistral AI soon followed with a similar approach. In February 2025, xAI released Grok 3, featuring ‘DeepSearch’ and embedding it directly into X (formerly Twitter), enabling users to conduct research and access targeted answers within the social platform. Meanwhile, AI assistants like Google’s Gemini and Meta AI are being integrated with web-based indexing to offer faster, more accurate, and interactive search experiences.

But while conversational search is gaining traction, a more fundamental shift may be underway: the rise of AI agents. Now, LLMs are no longer just answering questions – they’re executing tasks, invoking external tools, managing multi-step workflows, and iteratively refining results. ChatGPT’s Agent, for instance, is enabled to browse the web, summarize findings, draft emails, or run code, often without the user ever seeing a search result page.

We are seeing a paradigm shift in information retrieval, transitioning from keyword-based searches to AI-powered conversational interfaces. Predictably, the competitive field is getting crowded – but does this also predict the end of the Google search as we know it?

“The short answer: not quite. Despite these shifts, Google’s dominance remains largely intact.”

The short answer: not quite. Despite these shifts, Google’s dominance remains largely intact. Google’s advertising revenue model, which accounted for 72.5% of its $102.3bn revenue in Q3 2025, underpins this enduring dominance.

But the empire is starting to show some cracks. Although Google’s market share remains high, it has been gradually decreasing, and for the first time since 2015, it fell below 90% in Q4 2024 (Figure 1). Despite reporting over 10% year-over-year growth in its core advertising business , Google is under quiet pressure from shifting user behavior. Advertising revenue from Google Network, including AdSense and AdMob, is also declining. Revenues fell from $31.3bn to $30.4bn in 2024, reflecting a year-over-year decline of over 3% and a nearly 8% drop from its peak two years ago.

While AI agents are still in the early stages of adoption, their potential impact is already visible. As tasks like planning or booking shift from manual browsing to automated delegation, users visit fewer websites and generate fewer clicks. With pageviews declining, so too do the impressions and engagement that Google’s ad business relies on. Search advertising won’t vanish, but as agents, not users, drive interactions, its dominance will inevitably erode.

Another strategic risk could compound Google’s dominance: its ecosystem of strategic alliances. By leveraging Android, Google bundles its search engine into the operating system, ensuring widespread use. Apple is also a key partner, but securing its position on Apple devices comes at a significant cost. In 2022, Google reportedly paid Apple $20bn to remain the default search engine in Safari, a substantial increase from previous years. Although this “bundling” approach has been the cornerstone of Google’s success over the years, this strategic reliance also exposes vulnerabilities. Apple is reportedly exploring the expansion of its own internet search technology, which could disrupt Google’s access to iOS users and potentially reshape the competitive landscape. Beyond Apple, Google’s alliances are both extensive and precarious. It committed $8bn over four years to Samsung to secure default status for its search engine, voice assistant, and Play Store on Galaxy devices. Similarly, revenue-sharing agreements with browsers like Mozilla’s Firefox ensure Google’s search dominance in exchange for a cut of ad profits.

And then there are regulations. Google’s ownership of Chrome, which commands over 65% of the global browser market and reinforces dependency on Google Search, faces antitrust uncertainty. The U.S. Department of Justice is pushing for a Chrome sell-off, threatening a critical channel for user retention. Ironically, this regulatory pressure has even attracted opportunistic bidders – in August 2025, Perplexity made a surprising $34.5bn bid to acquire Chrome, despite the AI search company’s valuation being only $18bn at the time. While Google

Together, these pressures highlight the fragile balance between Google’s costly partnerships and a potential slipping grip on the search ecosystem.

In addition, large language model players are moving upstream into the browser itself. Perplexity released Comet, an AI browser that pairs search with agentic task execution, while OpenAI recently launched ChatGPT Atlas, a new AI-native browser with ChatGPT built in. It’s early days, but the battle is squarely on as to who will control the front door to the internet.

Users worldwide have become addicted to traditional search engines as the go-to tools for navigating with speed and precision the vast expanse of the internet. Whether it’s finding a particular website, checking the weather, or booking a holiday, search engines deliver reliable results in milliseconds. Because of its continuous indexing and crawling of the web, users have access to the most up-to-date information available, which is particularly important for time-sensitive queries and breaking news. But the most compelling benefit to users is economic: It’s free. Democratizing access to information and allowing anyone with an internet connection to find answers and explore the web.

Traditional search engines also have limitations. They rely on keywords and struggle to understand the context or intent behind a query. This results in literal answers relevant to users’ needs.

LLMs have their own information search limitations.

By design, LLMs offer a more conversational and context-aware approach to information retrieval. Their strength lies in natural language understanding, providing nuanced responses to complex queries. LLMs generate human-like text, making them ideal for tasks that require explanations, summaries, and even engaging in dialogue to clarify user intent. LLMs deliver a coherent narrative that ties together various pieces of information. So, is the LLM user experience better than traditional search?

Not always. LLMs have their own information search limitations. First and foremost, they hallucinate, confidently producing factually incorrect responses. As LLMs will likely hallucinate forever. LLMs can inadvertently fabricate details, misattribute sources, or oversimplify explanations, eroding user confidence and forcing knowledgeable users to become quality reviewers and fact-checkers. Tools like ChatGPT and Perplexity do provide source citations as footnotes or clickable elements, but they still require user effort to move from the self-contained answer to consult the source material.

The idea of LLMs as a substitute for search, however, doesn’t feel straightforward.

It’s early days, and the technology is advancing at breakneck speed. But the real magic would appear to be marrying traditional search engines with the nuanced capabilities of large language models (LLMs). The journey has already started.

In February 2023, Microsoft integrated ChatGPT into Bing, significantly boosting user engagement. Since then, Bing’s daily active users have surpassed 100 million, with a 15.8% increase in page visits, while Google’s traffic declined by nearly 1% during the same period. In response, Google introduced AI Overviews in May 2024 – a feature that synthesizes complex search results into concise, AI-driven summaries – and then rolled out AI Mode in March 2025 (initially via Search Labs) before opening it more broadly in the US in May, aiming to retain Google’s search leadership while meeting the growing demand for conversational interactions.

Recent results suggest Google’s AI strategy is beginning to bear fruit. In Q3 2025, Alphabet reported a 14.5% year-on-year increase in search and related services revenue, driven largely by the rollout of both AI Overviews and AI Mode. Executives noted that these AI-enhanced search experiences are helping sustain user engagement and unlock new monetization opportunities.

Users today, therefore, should still approach these AI-driven results with a dose of “healthy skepticism,” cross-checking critical claims with traditional search engines or authoritative databases to ensure accuracy.

But the direction of development appears clear. Integrating LLM-based chatbots with search engines will enhance user satisfaction and pave the way for future innovations in the search landscape. It will be more about technology complementarity and integration rather than pure substitution.

For instance, Google’s AI Overviews now incorporate ads within AI-generated summaries, offering product suggestions labelled as “sponsored” for commercially oriented queries.

Should Google’s longstanding dominance continue to erode, a much more fragmented landscape might become the rule as many AI players integrate search and discovery features. The race has already started. OpenAI, with its ChatGPT search enhancements, and Microsoft, via Bing and Copilot. While emerging players like Perplexity, Anthropic’s Claude, and Grok’s xAI will continue to challenge Google’s hegemony. Google will respond, rapidly enhancing its own AI offerings through Gemini and AI Overviews. Its latest models, Gemini 2.5 Pro and Gemini 2.5 Flash, released in spring 2025, support seamless inputs across text, image, audio, and video. These features enable more nuanced, context-rich queries and make multimodal search (combining, for instance, text and images) mainstream.

Meanwhile, fresher entrants like You.com, niche applications from startups like PicnicHealth, and regional players like Swiggy in AI-driven food discovery will further contribute to redefining the AI-driven search and discovery experience. This brings fragmentation and more choice for users.

But there is an even more compelling reason why tech giants will remain relentless in their pursuit of AI-driven search. Controlling search means dominating how billions access digital content, and with it, the advertising ecosystem. As LLMs reshape search, the traditional ad model will be disrupted. Instead of traditional banner ads or sponsored links, advertisements are increasingly embedded within AI-generated content, providing users with seamless, contextually relevant suggestions. This approach not only enhances user experience by delivering personalized recommendations but also blurs the lines between organic content and paid promotions. For instance, Google’s AI Overviews now incorporate ads within AI-generated summaries, offering product suggestions labelled as “sponsored” for commercially oriented queries. Imagine asking, “What’s the best budget laptop for students?” and receiving an AI response followed by a subtle prompt like, “Interested in exclusive back-to-school discounts? [Brand X] is offering 20% off this week.” This approach prioritizes relevance over distraction, turning ads into actionable next steps rather than static displays. That is the move from attention to action.

New players like Perplexity are reimagining this ad-driven future through a free-premium hybrid model. In addition to sponsored follow-up questions, which are similar to Google’s model, Perplexity’s experimentation with impression-based pricing further disrupts legacy pay-per-click models. Advertisers pay not for clicks but for guaranteed visibility within high-intent conversational threads, aligning costs with brand exposure rather than user actions. This appeals to businesses seeking broader awareness campaigns or those targeting niche audiences, such as indie software tools aiming to reach developers via coding-related queries.

So, what’s the direction of travel? More offering fragmentation, more user choices, and new revenue models.

For technology providers, the shift could be seismic.

History teaches us that technological shifts rarely completely substitute the old, but instead force a reinvention. Just as streaming coexists with live TV and e-commerce thrives alongside brick-and-mortar stores, LLM-driven search will redefine the purpose of information discovery. This reinvention is being accelerated by next-generation search systems that blend traditional retrieval methods with LLM-based generation. Conversational retrieval-augmented generation (RAG) grounds answers directly in retrieved evidence, reducing hallucinations and increasing factuality, while generation-augmented retrieval (GAR) improves query decomposition and produces pseudo-data for sharper accuracy. These tightly integrated systems are transforming how we engage with knowledge.

For technology providers, the shift could be seismic. By dismantling traditional paradigms, reducing reliance on static links, disrupting legacy ad models, and, in the process, challenging Google’s longstanding dominance, this shift will also forge a new equilibrium where AI-driven and conventional search coexist. Good news for users? Yes, as they will gain access to highly contextual and conversational answers. But the convenience gain will demand heightened vigilance given LLMs’ current shortcomings.

The true winners will be users and businesses agile enough to navigate this blended landscape, where the synergy of human-critical thinking and machine intelligence unlocks richer, safer, and more meaningful connections to knowledge.

Professor of Strategy and Digital Transformation

Didier Bonnet is Professor of Strategy and Digital Transformation at IMD and program co-director for Digital Transformation in Practice (DTIP). He also teaches strategy and digital transformation in several open programs such as Leading Digital Business Transformation (LDBT), Digital Execution (DE) and Digital Transformation for Boards (DTB). He has more than 30 years’ experience in strategy development and business transformation for a range of global clients.

Research fellow at the Global Center for digital business transformation

Jialu Shan is a research fellow at the Global Center for Digital and AI Transformation, and an associate research director at the Center for Future Readiness at IMD Business School. Her research areas include digital business transformation, business model innovation and new practices, and corporate governance practices. She is particularly interested in the Asian market. Jialu has a PhD in economics (management) from the Faculty of Business and Economics at the University of Lausanne. Before joining IMD she worked as a lecturer at the International Hotel School of César Ritz Colleges in Brig, Switzerland.

February 25, 2026 in Artificial Intelligence

Spotify CHRO Anna Lundström drives AI readiness, culture, and personalized well-being to empower employees and sustain Spotify’s innovative, human-centric growth....

February 18, 2026 • by Faisal Hoque, Paul Scade in Artificial Intelligence

Transform your AI adoption strategy from a high-stakes gamble into a portfolio of calculated moves using this plan, write Faisal Hoque and Paul Scade....

February 18, 2026 • by Michael Yaziji in Artificial Intelligence

Organizations should let departments choose the right balance between humans and AI, and focus on outcomes, not rigid processes, to keep pace with rapid technological change. ...

February 17, 2026 • by Julia Binder in Artificial Intelligence

CSOs should harness artificial intelligence to embed sustainability at the center of strategy and growth. We explore how the most successful companies are already doing this. ...

Explore first person business intelligence from top minds curated for a global executive audience