Four ways to unlock strategic business advantage

Companies and investors must bear in mind that the energy transition goes beyond procurement or compliance – it is a source of long-term strategic advantage. Unlocking that advantage depends on recognizing the scale of transformation underway and aligning business action with the emerging realities of varied transitions, evolving technologies, and complex market dynamics. Here are four actions business leaders can take:

1. Reframe growth markets

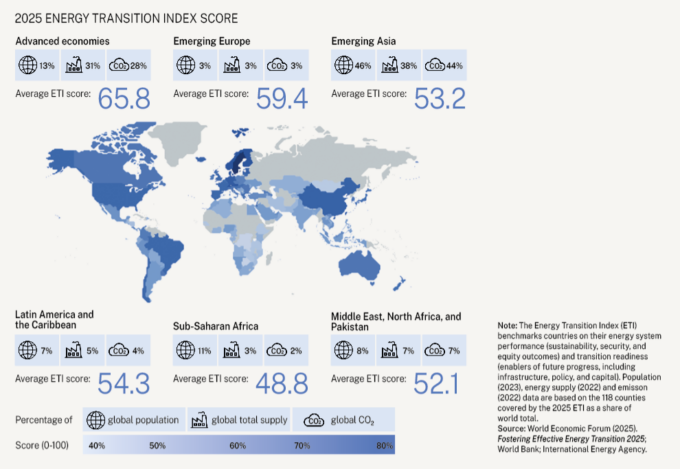

Emerging economies are driving innovation in energy, pioneering policy reforms, and shaping industrial strategies. Markets like China, India, Brazil, and parts of Southeast Asia are leading in clean energy deployment, digital grid reform, and sector-specific solutions such as green hydrogen and biofuels.

These economies are shaping the technology pathways of the future and will increasingly influence global standards, supply chains, and capital flows. This presents an opportunity for businesses to update their models of risk and value: growth markets are not just where demand will come from – they are where a significant part of the future is being built.

2. Close the capital gap

There is a $2.2tn annual investment shortfall in clean energy standing between emerging economies and a viable energy transition. This is more than just a funding need – it’s a significant commercial opportunity.

Southeast Asia alone could generate $300bn in green revenue over the next five years, with the potential for 5.8 million new jobs by 2050. Findings from the Energy Transition Index 2025 highlight other regions that are showing encouraging signs of momentum and emerging investment potential. For example, Mozambique’s resurgence as an emerging energy player underscores what is possible when regulatory reform, infrastructure development, and strategic capital allocation align effectively. China leads in innovation and investment, having made substantial progress. It remains the world’s largest clean energy investor, contributing over $818bn to global investment in 2024. With the highest renewable capacity additions and the majority of new nuclear projects, China is also scaling energy infrastructure at an unmatched pace.

De-risking tools, blended finance, sovereign green bonds, and public-private investment platforms should become standard parts of corporate and investor toolkits. Companies that step into this space early can shape markets, secure strategic footholds, and unlock new value pools.

3. Build local capacity and leadership

The energy transition hinges on people, institutions, and localized solutions. Advancing this transition could benefit from prioritizing investments in workforce development and institutional partnerships. Partnerships – whether between companies and universities, public agencies, or local governments – play a critical role in piloting new models, advancing R&D, and building trust with communities. Forward-looking businesses are also collaborating with government stakeholders to modernize permitting processes, standardize clean energy procurement, and de-risk low-carbon investments. These partnerships help ensure that solutions are scalable, socially grounded, and locally relevant.

Additionally, workforce development is critical to bridging the skills gap in clean energy industries. The Energy Transition Index report finds that top-performing countries like Finland, Germany, and China are expanding vocational training and technical education aligned with cleantech industries. India has a program that is preparing a new generation of grid technicians and energy entrepreneurs, building capacity and inclusive access to clean energy jobs. These examples highlight a vital point: human capital is transition capital.

4. Navigate risk with flexibility

Emerging markets are complex and not uniform, but they are where the greatest upside lies. From permitting challenges to policy shifts, the risk landscape is real. But businesses that bring agility and a long-term mindset can draw lasting advantage.

The lesson from leaders across regions is that success depends on adaptive strategies anchored in local reality. This includes understanding sub-national opportunities, responding to regional industrial strengths, and working across public-private lines.

For example, India demonstrates how regional alignment with industrial and labor strengths can accelerate the transition. It has prioritized vocational training and regional workforce development programs that support clean energy deployment. Initiatives such as the Suryamitra Skill Development Program, implemented across solar-rich states, help build local talent pipelines that align with solar manufacturing and deployment clusters.

Likewise, the UAE has adopted a multi-level engagement approach, working across federal and emirate levels to align long-term clean energy goals with regional development. Initiatives such as Masdar City and the Dubai Clean Energy Strategy 2050 reflect how targeted local planning and public-private collaboration are central to the country’s energy ambitions. The goal is not to avoid risk, but to manage it deliberately, recognizing not only that different players have different risk tolerances, but that opportunities vary accordingly.

Unlocking the next phase of global competitiveness

The 2025 Energy Transition Index confirms what many forward-looking companies already sense. The momentum of the energy transition is shifting, geographically and strategically. Countries like China, India, Brazil, and Latvia are shaping the frameworks of innovation, equity, and infrastructure that will define global competitiveness in the years ahead.

Emerging economies are establishing their own approaches, not adapting to models set elsewhere, while learning from the successes and challenges faced by others. They are proving that energy transition is not a single path, but many – each shaped by national strengths, industrial priorities, and context. These local models are sources of strategic insight and practical direction for how progress can be achieved across different contexts.

The companies and investors best positioned for the future will align with this momentum by moving capital, talent, and technology into the systems that are already transforming. Building for this future calls for humility, collaboration, and a willingness to learn from the diversity of global experience.

The most successful transitions – whether in emerging or advanced economies – share certain features: clear national targets, stable and supportive policy frameworks, deep public-private collaboration, and innovative financing that de-risks investment and accelerates delivery. These competitive assets enable countries to attract capital, retain talent, and anchor industrial value chains for the long term.

For global companies, this presents a strategic opportunity. Where operating across multiple geographies used to be about scale, it’s now a chance to create synergy between diverse energy systems, to drive cross-border investment, and to help shape the new energy economy from the ground up.

The future of energy is decentralized, digitalized, and deeply strategic. We are witnessing a profound transformation of economic and industrial systems. In this rapidly evolving landscape, resilience will come not from holding on to legacy systems, but from having the agility to navigate complex transitions and the vision to lead them. This transformation is no longer optional – it is the foundation of future growth, industrial leadership, and national relevance.

Audio available

Audio available

Audio available

Audio available