4 – Rethink your markets and consumers

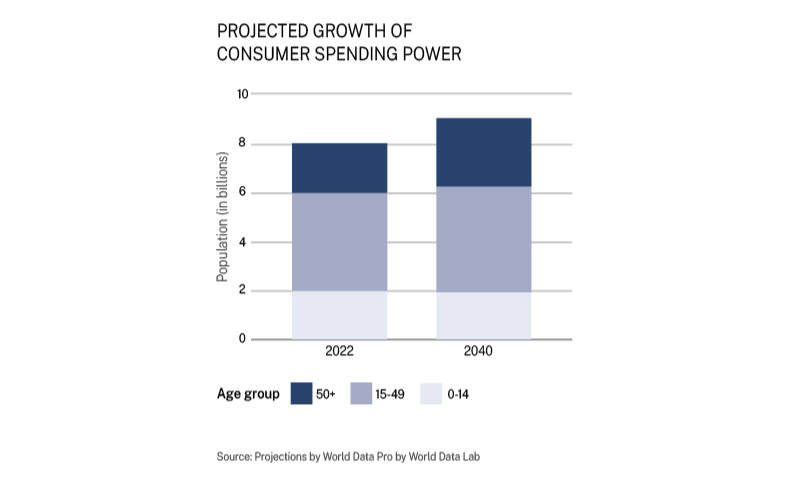

For decades, marketing has been obsessed with youth. Bright young things. Fresh starts. Future growth. But look at the numbers: 50+ is the world’s fastest-growing consumer segment. They own most of the wealth, and are healthier, more active, and more ambitious than any previous generation at their age.

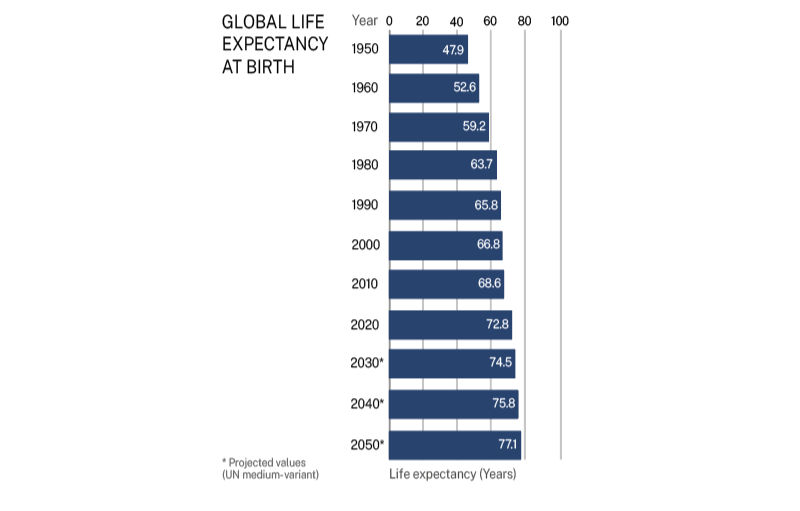

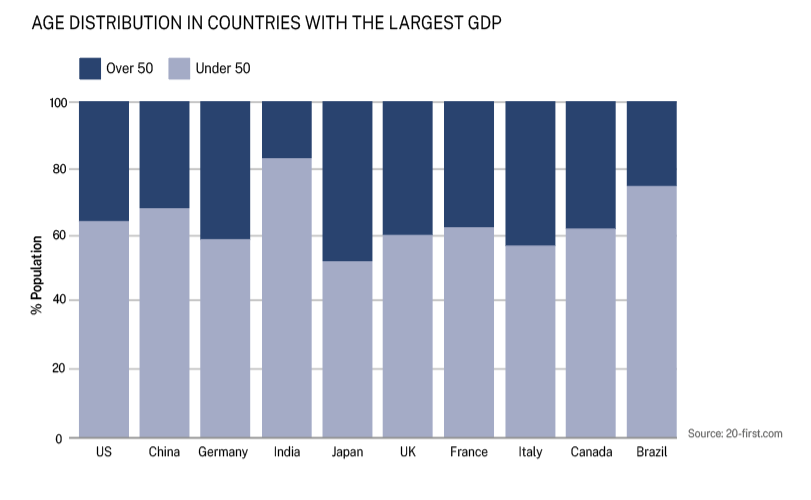

The over-50s account for half of global consumer spending, and this is expected to rise to nearly 60% by 2050. In the US alone, they hold close to 80% of stock market wealth and over 70% of housing wealth, making them the third-largest economy in the world, if counted as a nation. They are healthier than any previous generation at their age, with global healthy life expectancy rising by more than five years since 2000. They are also more active and ambitious – 64% of 55- to 64-year-olds across the OECD are still working, and over one in five new entrepreneurs in the US are now in this age group.

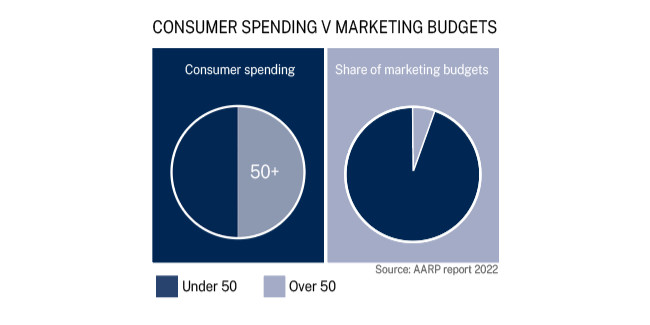

So why are they so often invisible in marketing campaigns? Only a fraction of advertising budgets is directed toward the over-50s. When older adults do appear, they are too often shown through outdated or patronizing stereotypes.

AARP’s research highlights progress – negative portrayals in media have dropped significantly over the past five years – but two-thirds of consumers over 50 still feel misrepresented. Industry regulators have even called out advertisers for offensive depictions of people in later life. The disconnect is stark: marketing continues to chase youth while ignoring the group with the greatest disposable income, growing longevity, and rising participation in work, travel, and entrepreneurship. Companies that close this gap have the chance not only to access a massive, underserved market but to reshape cultural narratives about what it means to age today.

The winners of the longevity economy will be the companies that see their Q3 and Q4 customers for who they are: savvy, aspirational, experienced, and with decades of life ahead of them, along with an overwhelming share of the purchasing power.

Ask yourself:

- Do your products and services resonate with 50+ customers?

- Do you have older voices in your design and marketing teams?

- Are you learning from sectors that are already serving longevity markets, such as financial services, healthcare, and travel?

Insurers are moving fast with Fidelidade and its peers reframing longevity as a growth market, not just a risk pool. The travel industry is discovering that big spenders are aged 50 and above and is adapting adventures to suit every age group. The health sector is surging: preventive health diagnostics (NEKO Health), women’s midlife medicines (Theramex), and hearing-health innovators (Eargym) are targeting prevention and quality of life. The housing and educational sectors are reinventing retirement. For example, Arizona State University’s Mirabella at ASU blends university life with purposeful living, while universities worldwide are launching midlife transition programs. Finally, customer engagement is maturing; sales and marketing company Senior Response specializes in over-50 client contact, signaling a service layer forming around the 50+ economy.

Audio available

Audio available

Audio available