Trump’s data wrecking ball has echoes of Greek tragedy

The US President is gouging out chunks of America’s long-established economic data apparatus because he doesn’t like what he sees. It’s unlikely to end well....

Audio available

by Catherine Agamis, Hischam El-Agamy Published February 11, 2026 in Finance • 9 min read

The concept of “sustainable finance,” which emerged in the 1990s, has evolved rapidly from a niche initiative to a strategic imperative for many banks. Sustainable finance refers to the process of taking environmental, social, and governance (ESG) considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects.

Sustainable finance enables financial institutions to influence corporate behavior, accelerate innovation, and promote collective progress toward a net-zero, resilient economy, all while ensuring that profits are aligned with purpose. This has prompted financial actors to reconsider their models, risk management frameworks, and long-term strategies.

However, as the world becomes increasingly fragmented, competitive, and unpredictable, the transition to a more sustainable economy remains uncertain. This uncertainty demands a new approach to strategic planning – one that is adaptive, resilient, and capable of navigating multiple potential futures.

This article presents a scenario-based framework, inspired by a strategic foresight analysis from First Abu Dhabi Bank (FAB). It is designed to help financial institutions develop robust strategies in an evolving and highly dynamic sustainable finance landscape.

“At FAB, we see sustainable finance as a powerful lever for positive change, enabling our clients, communities, and the wider economy to accelerate the transition to a low-carbon, inclusive future. By mobilizing capital, innovating new financial solutions, and embedding ESG at the core of our strategy, we are not only meeting our own ambitious goals but also empowering others to achieve theirs. Together, we are shaping a resilient and sustainable tomorrow.” Shargiil Bashir, EVP & Chief Sustainability Officer, FAB.

The trajectory of sustainable finance is being shaped by a complex interplay of driving forces.

“To navigate the inherent uncertainty of the sustainable finance market, a scenario-based approach is an invaluable strategic tool for envisaging a range of plausible futures and developing more resilient and adaptive strategies.”

To navigate the inherent uncertainty of the sustainable finance market, a scenario-based approach is an invaluable strategic tool for envisaging a range of plausible futures and developing more resilient and adaptive strategies.

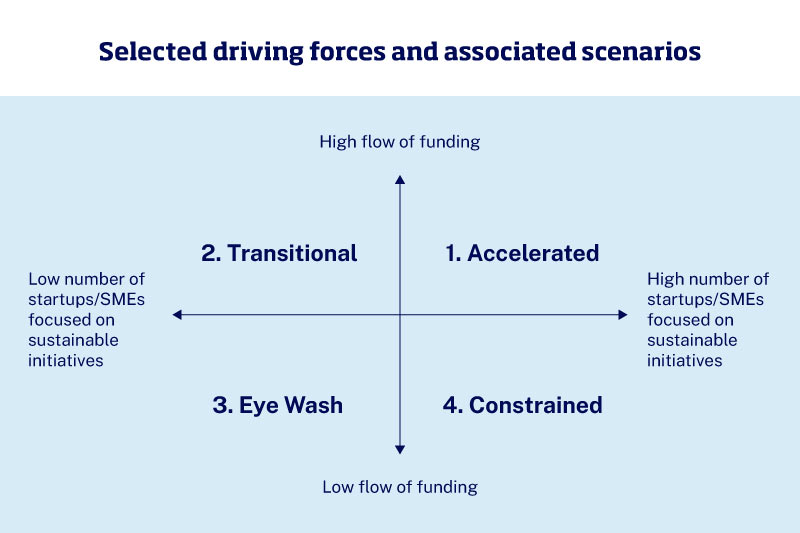

To construct a 2×2 scenario matrix, we have selected two forces based on their high impact on business and degree of uncertainty: the level of funding available for sustainable projects and the number of startups and SMEs focused on sustainability entering the market. This matrix yields four distinct scenarios.

High flow of funding, low number of startups and SMEs focused on sustainable initiatives.

The strategic focus is on achieving profitability while having a clear sustainability agenda integrated into the strategy.

The concept of sustainable finance, which emerged in the 1990s, has evolved rapidly from a niche initiative into a strategic imperative for banks and financial institutions globally.

Scenario planning is a powerful strategic tool that enables organizations to navigate uncertainty by exploring multiple plausible futures shaped by different assumptions and drivers of change. When applied to the design of sustainable solutions, scenario planning supports decision-makers in better understanding – and proactively responding to – the complex challenges of reducing carbon emissions, conserving natural resources, and fostering inclusive and equitable economic development.

The concept of sustainable finance, which emerged in the 1990s, has evolved rapidly from a niche initiative into a strategic imperative for banks and financial institutions globally. Sustainable finance refers to the systematic integration of environmental, social, and governance (ESG) considerations into financial decision-making. This allows long-term value creation while strengthening resilience against climate and societal risks.

More importantly, sustainable finance enables financial institutions to influence corporate behavior, accelerate innovation, and mobilize collective action toward a net-zero and climate-resilient economy, while ensuring that profitability remains aligned with purpose. As a result, financial actors are increasingly reassessing their business models, risk frameworks, governance mechanisms, and long-term strategic priorities.

The four scenarios presented in this article illustrate how financial institutions can apply scenario planning to stress-test assumptions, expand strategic options, and develop robust strategies for sustainable finance, ultimately strengthening their ability to make long-term investments that generate both financial returns and sustainable impact.

The article is based on the work and interpretations developed by the team listed below as part of their assignment in the FAB program Frontiers in Sustainability in 2024.

Learning & Transformation project lead, IMD

Catherine is Learning and Transformation project lead at IMD. She is an advisor and action learning designer. A strong advocate of digital and collaborative approaches as powerful levers of value creation and efficiency, her practice also includes academic research on innovation ecosystem and community building.

IMD Executive Director, Middle East, Africa and Turkey

As Executive Director of IMD, Hischam El Agamy is responsible for IMD’s activities in Africa, the Middle East, and South-Central Asia, where he teaches and leads development programs. El Agamy’s expertise and teaching experience include scenario planning, business transformation, family business transformation, public-private partnership, and stakeholder engagement. He teaches regularly in IMD custom programs and has taught several IMD open programs, including its EMBA and MBA programs.

For over 14 years, El Agamy has occupied various international functions in seven European countries as part of a long career with major Swiss multinational corporations in Zürich. During these years, he has driven a number of business transformation initiatives in several European countries.

He has contributed to several advisory assignments for governments in the Gulf region and in the area of competitiveness and human capital development for the government of South Africa.

El Agamy obtained two master’s degrees in applied science from the University of Fribourg and Lausanne in Switzerland. He received his Doctorate from the University of Pierre & Marie Curie in Paris.

January 9, 2026 • by Jerry Davis in Finance

The US President is gouging out chunks of America’s long-established economic data apparatus because he doesn’t like what he sees. It’s unlikely to end well....

Audio available

Audio available

January 7, 2026 • by Salvatore Cantale in Finance

At critical moments that can shape a company’s long-term future, the balance of CEO ambition, CFO vigilance, and board oversight can determine success or failure. IMD’s Salvatore Cantale outlines how CFOs can...

November 21, 2025 • by Eric Matt in Finance

With even the most seasoned investors growing uneasy, the analysts who foresaw the 2008 market crash share how they view the current state of the financial markets. ...

November 17, 2025 • by Andreas Rothacher, Karl Schmedders in Finance

Big-name stocks dominate global equity indices, creating hidden risks for investors. Here are strategies to mitigate concentration and volatility. ...

Explore first person business intelligence from top minds curated for a global executive audience