WEF Unplugged: Geopolitics, sustainability, and a look behind the scenes

Live from Davos: IMD’s Julia Binder and David Bach cut through the headlines on geopolitics, AI, energy – and competing visions for the international order....

by David Bach Published April 20, 2021 in Strategy • 5 min read

The rise of CEOs taking a stance on controversial political issues is not just a US phenomenon. European business leaders must learn to address the politics that matter to their stakeholders.

Last week, almost 100 prominent US CEOs joined a meeting convened by my friend and former Yale School of Management colleague Jeff Sonnenfeld. The goal? Coordinate opposition to a new law passed in the US state of Georgia that most experts agree will make voting more difficult, especially for black and brown voters and other marginalized communities. The meeting followed protest against the law by prominent Atlanta-based businesses, such as Coca-Cola and Delta, as well as Major League Baseball, which had moved a marquee sports event out of the state in response.

Conservatives swiftly denounced these business leaders as “woke CEOs” and former President Trump, still the de-facto leader of the Republican party, called for boycotts of dozens of companies. Even the usually more soft-spoken Republican leader in the Senate Mitch McConnell warned business leaders of consequences for sticking their necks out too far.

Across the Atlantic, unprecedented political polarization is forcing CEOs to weigh in on often contentious political issues, from voting rights to immigration and transgender policies. In contrast, most European CEOs have so far chosen to avoid the political spotlight.

But how long will this European fence-sitting last? And what are the risks of staying quiet or speaking out?

Research on the effects of CEO political activism so far remains inconclusive. Studies have shown that customers are willing to reward companies whose leaders take a stance – provided they agree with them. When Dick’s Sporting Goods, the largest company of its kind in the US, banned guns from its stores following yet another horrific school shooting in 2018, customers who favored tighter gun laws professed increased loyalty to the brand. However, those opposed to new restrictions vowed to boycott the stores in protest. In a recent survey by Weber Shandwick and KRC Research, 64% of Democrats in the US supported CEOs taking a stance versus only 32% of Republicans. Not surprisingly, some scholars conclude that CEO political activism is a “double-edged sword.”

In light of these headaches, most European business leaders I have spoken with would happily see the trend confined to the US. Many believe that it was the particularly divisive Trump presidency that mobilized business and that CEO political activism will recede as some measure of normalcy returns to US politics.

However, this reasoning ignores four fundamental drivers of CEO political activism that are at play in Europe as well.

The most important reason why CEOs are increasingly wading into contentious politics is because customers and employees expect it, particularly the younger ones. According to a 2018 survey, 51% of millennials say they are more likely to buy from a company whose CEO takes a stand on a prominent political issue versus just 33% of Gen X and 30% of boomers. Similarly, 44% of millennials say they would be more loyal as employees if their CEO spoke out on important issues versus just 16% for Gen X and 18% for boomers. The effect is particularly pronounced in the tech industry where 75% of US respondents say they would be more loyal to their organization. The figure in the UK? A very similar 74%. And according to Edelman’s 2020 Trust Barometer, while employees across industries and regions are particularly interested in CEOs speaking out on work-related issues such as the impact of automation on jobs (81%), 78% expect their leaders to take a stance on income inequality, 73% on climate change, and 62% on immigration.

2. The rise of values-based branding

The effect of increased expectations is enhanced by companies that have built their brands around values and purpose rather than features or lifestyle. Starbucks founder and former CEO Howard Schultz famously said: “If people believe they share values with a company, they will stay loyal to the brand.” The flipside, however, is that customers may abandon a brand when they sense a values incongruence. In addition, younger generations often view silence as complicity, effectively forcing CEOs’ hands. Value-based branding is not just the purview of Nike or Patagonia. Increasingly, European outfits from Adidas to Volvo and from LEGO to Novo Nordisk are placing values at the core of their strategies and brands. While powerful as a way to galvanize both employees and customers, such moves will inevitably come with greater expectations on CEOs to lean in rather than look the other way as societies grapple with controversial issues.

3. The always-on nature of social media

Social media is the third driver and closely linked to the previous two. Gone are the days when CEOs could decide when to communicate. Twitter has replaced news conferences. A company’s social media presence is a not just a powerful to way to connect directly with stakeholders, but also the easiest way for stakeholders to lodge protests and bring pressure. In the age of social media, “the red light is always on.”

4. Widespread frustration with traditional politics

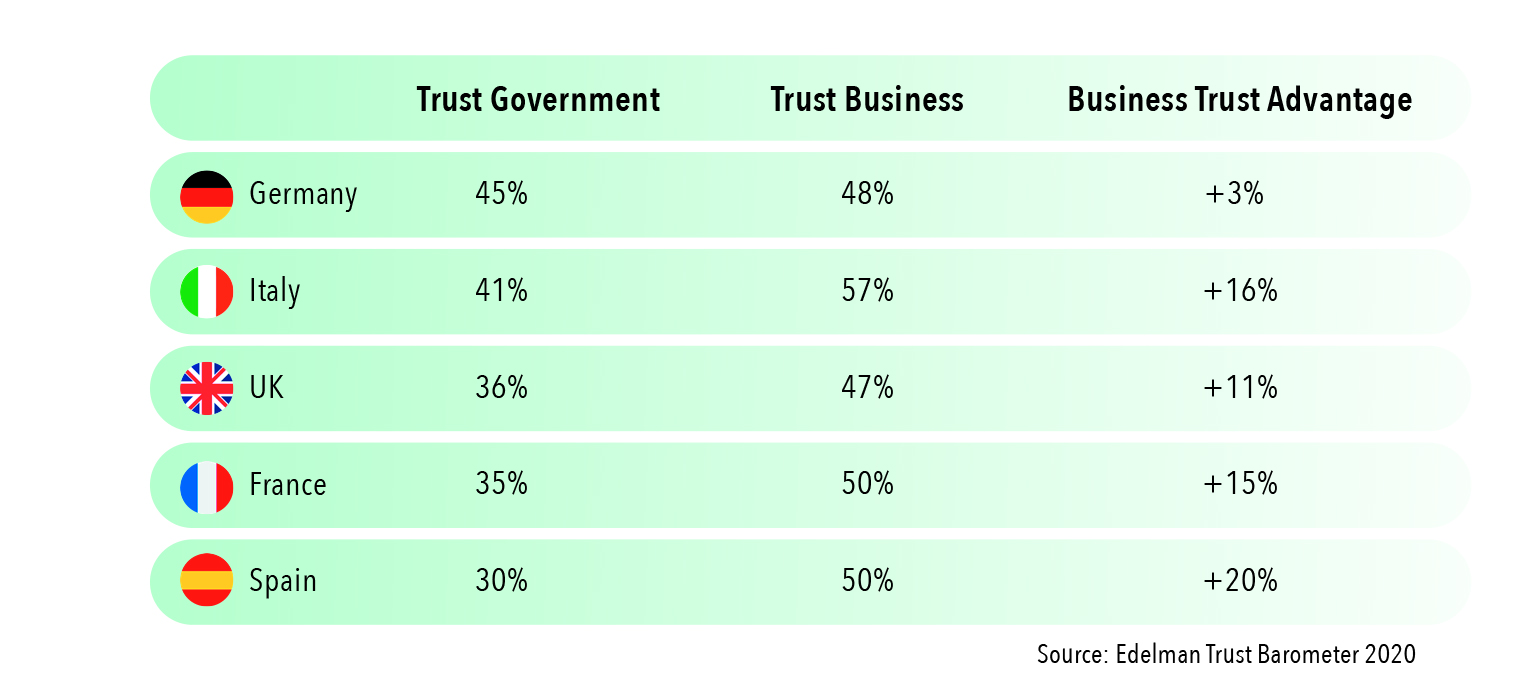

The fourth and final factor is the public’s growing dissatisfaction with traditional politics. The stalemate and growing hostility between the two major political parties in the US has certainly been a reason why a growing number of stakeholders are looking to business for leadership. But the public is equally dissatisfied with politics in Europe, with fewer than half of respondents in Edelman’s 2020 survey trusting government across major markets in contrast with substantially greater trust in business.

As major European economies grapple with the third wave of COVID-19 infections, vaccine rollout remains slow, and the economic toll on small businesses in particular increases, trust in governments could erode further. Already European CEOs are grappling publicly with questions about whether to require COVID-19 vaccines of employees and what privileges holders of possible immunity passports might enjoy.

The drivers that have thrust US CEOs into the political spotlight are here to stay in Europe too. European CEOs would be well-advised to follow developments across the Atlantic closely, to discuss with their boards and leadership teams key issues and where they stand, to develop organizational capabilities, and to be ready when the spotlight is on them.

President of IMD and Nestlé Professor of Strategy and Political Economy

David Bach is President of IMD and Nestlé Professor of Strategy and Political Economy. He assumed the Presidency of IMD on 1 September 2024. He is working to broaden and deepen IMD’s global impact through learning innovation, excellence in degree- and executive programs, and applied thought leadership. Recognized globally as an innovator in management education, Bach previously served as IMD’s Dean of Innovation and Programs.

2 hours ago • by David Bach, Julia Binder in Strategy

Live from Davos: IMD’s Julia Binder and David Bach cut through the headlines on geopolitics, AI, energy – and competing visions for the international order....

3 hours ago • by David Bach, Julia Binder, Arturo Bris, Frédéric Dalsace, Simon J. Evenett, Florian Hoos , Jennifer Jordan, Sara Ratti, Karl Schmedders, Sarah E. Toms, Ginka Toegel in Strategy

From Trump and transatlantic tensions to AI’s reality check and sustainability’s reinvention, Davos 2026 signals a shift toward values-based pragmatism....

January 16, 2026 • by José Caballero in Strategy

South Korea continues to invest heavily in science and technology, yet a climate of entrepreneurial decline envelops it. What takeaways are there across the board for leaders in other economies?...

January 15, 2026 • by Michael D. Watkins in Strategy

CEO successions rarely fail because of poor selection – they fail in execution. As Sergio Ermotti prepares to step down, UBS has the opportunity to turn leadership transition from a risk-management exercise...

Explore first person business intelligence from top minds curated for a global executive audience