Four lessons from BYD's rise – and why Tesla should be worried

BYD overtook Tesla’s EV annual market share in 2025 as it mastered unglamorous fundamentals and built capabilities sequentially while competitors chased disruption and moonshots....

by Jennifer Borrer, Saule Serikova Published December 4, 2025 in Innovation • 10 min read •

The quest for eternal life has captivated humanity since ancient times, yet only now are we witnessing a fundamental transformation in our approach to aging and longevity. The present-day pursuit of longevity transcends the idea of merely living for longer. It signifies a paradigm shift in healthcare, well-being, and human potential.

The implications are profound. In the near future, we will need to reimagine career arcs spanning multiple professions, financial systems supporting decades of active retirement, educational models designed for lifelong learning, and family structures where four or five generations coexist. For organizations, it means rethinking talent development and succession planning, redesigning workforce models, and optimizing employee performance to accommodate a multigenerational talent pool with extended productive capacity. Simultaneously, governments and policymakers must confront far-reaching ethical questions about resource allocation, intergenerational equity, and the meaning of a “normal” lifespan.

The concept of longevity has existed in the English language since the 16th century, reflecting an enduring fascination with extending life. Throughout history, our approach to health has evolved significantly: from a focus on terminal care and the treatment of infectious diseases to the management of chronic conditions. Now, we stand on the cusp of a seismic turn toward disease prevention and the personalization of care. However, despite remarkable medical advances in recent decades, the extension of the human lifespan has plateaued. This reveals a critical limitation in our healthcare systems: they are not designed to address aging as a distinct and modifiable endpoint.

In response, the emerging longevity industry is driving transformation across three interconnected dimensions, which represent a redefinition of healthcare:

These three dimensions create a framework with an ambitious yet increasingly tangible goal: extending the healthy human lifespan potentially to more than 100 years through comprehensive methods that prioritize wellness over the treatment of illness.

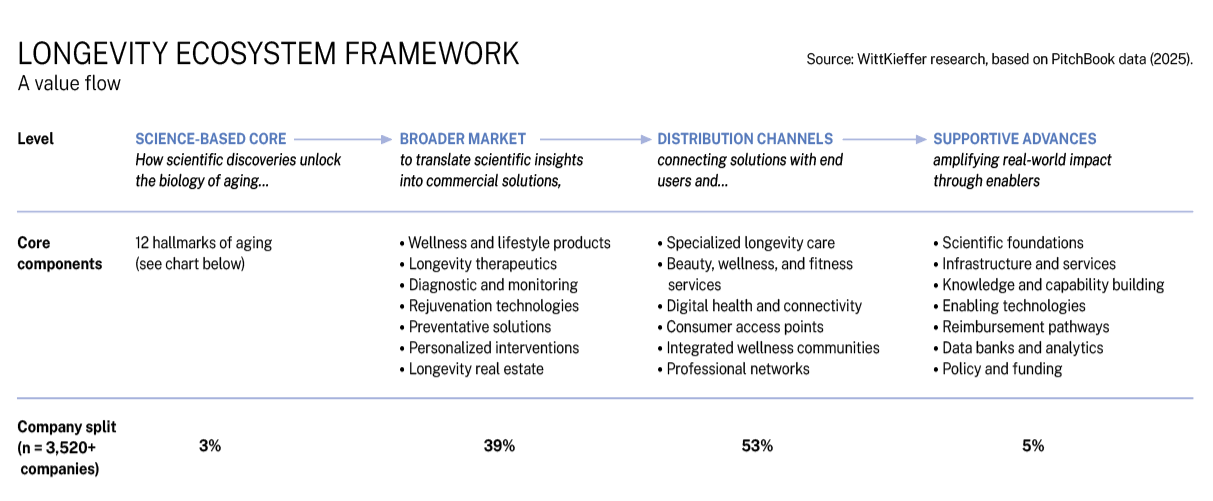

The evolving longevity market is an integrated ecosystem where scientific discoveries are translated into commercially distributed solutions. To explain and navigate this complex landscape, we have developed the Longevity Ecosystem Framework, which traces the flow of value from science to real-world applications across four interconnected levels. Each level builds on the previous one, turning scientific insights into practical solutions.

An unprecedented surge of interest from industry participants is evident, with PitchBook data as of July 2025 revealing over 3,520 companies tagged with “longevity” or “anti-aging”. Unsurprisingly, investment capital is pouring into the sector at an accelerating pace, totaling $25.4bn across more than 1,160 deals since 2020 alone. Investment is moving from reactive “sick care” toward proactive wellness and prevention, creating profit pools in preventative treatments, diagnostics, and personalized interventions.

In 2006, Shinya Yamanaka made a groundbreaking discovery that earned him the 2012 Nobel Prize for Physiology or Medicine about how to reprogram adult cells back to a younger state – essentially creating a biological reset button for aging cells. The commercial applications of this finding began accelerating in the 2010s, when companies started developing tests to measure biological age through DNA analysis, creating a new market for age assessment and intervention tracking.

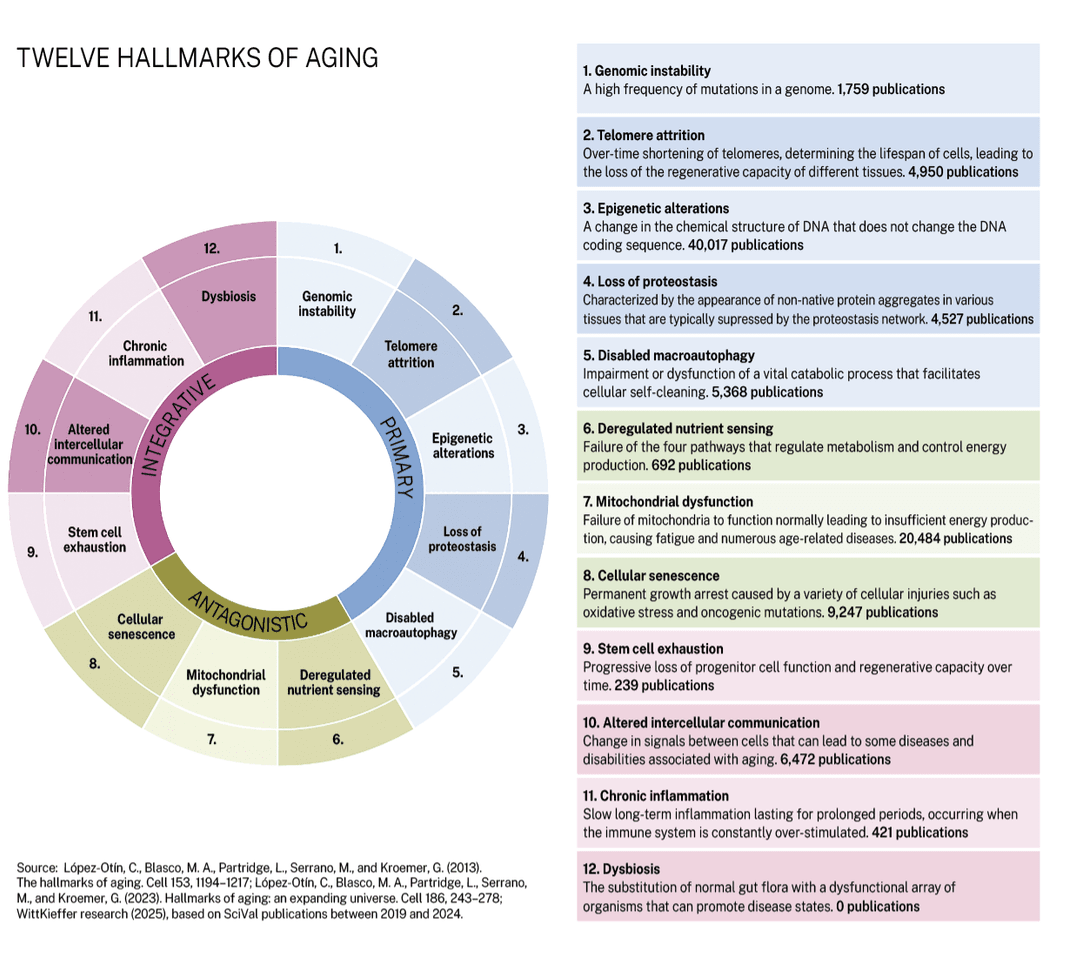

Our framework is centered on the 12 hallmarks of aging – biological mechanisms that contribute to the aging process. These hallmarks, first outlined as nine mechanisms by Carlos López-Otín and colleagues in a landmark 2013 paper in Cell and expanded to 12 in 2023, form the scientific bedrock upon which the longevity industry is built.

Scientific interest in this area has grown exponentially, with significant research activity between 2019 and 2024. Epigenetic alterations and mitochondrial dysfunction, in particular, have received considerable attention, with more than 40,000 and 20,000 publications, respectively, according to the bibliometric tool SciVal.

Patent activity provides a valuable lens for understanding innovation intensity and intellectual property development. According to PitchBook, the top 10 companies focusing on the hallmarks of aging collectively hold over 310 active patent documents. Leading the pack is Unity Biotechnology with 109 active patents, followed by Calico Life Sciences (Alphabet’s longevity venture) with 67, and Proclara Biosciences with 27.

The investment landscape is equally impressive. In the PitchBook database, we find around 100 companies focused on targeting the hallmarks of aging, with more than 470 investors participating across 277 deals. The investment momentum is substantial, with $11.8bn total capital invested in the sector. Between April 2024 and March 2025, $1.6bn was invested, with the median deal size reaching $10.6m – a 51% year-over-year increase. Perhaps even more telling is the 49% year-over-year growth in median post-money valuation, which reached $61.4m, signaling strong investor confidence in the sector’s potential.

The core market features well-funded startups and established players pursuing diverse scientific approaches. Altos Labs, founded in 2021 and backed by Jeff Bezos among others, has raised an extraordinary $5.6bn to pursue cellular reprogramming technologies. Human Longevity, established in 2013, has secured $1.1bn for its genomics-focused approach to extending healthy lifespan. Other players include InSilico Medicine (founded in 2014, $536.3m raised), which leverages AI for drug discovery targeting aging pathways, and Unity Biotechnology (founded in 2009, $355.3m raised), which leads the field in senolytic therapies. Juvenescence (founded in 2017, $231.7m raised) and Life Biosciences (founded in 2017, $175.2m raised) round out the top tier of well-funded companies, both pursuing platform approaches to longevity.

The scientific understanding of the biological mechanisms of aging is being translated into commercial solutions across multiple market segments. This represents the next level of our framework.

Consumer goods companies are at the forefront, manufacturing wellness and lifecycle products that represent 26% of the ecosystem. These range from anti-aging skincare, hair, and body products to nutraceuticals, supplements, food, and drinks. Companies like Nestlé Health Science offer products that target specific aspects of aging, such as Celltrient, which focuses on cellular nutrition and mitochondrial health. ChromaDex’s Tru Niagen supplement aims to boost NAD+ levels, a coenzyme that declines with age and is critical for cellular energy production. This sub-market is also seeing a rise in biohacking products and services: tools that enable consumers to measure, analyze, and modify their biology through data-driven experimentation, such as glucose monitors or sleep optimization.

Longevity therapeutics companies (8%) are focusing on reversing age-related damage through cellular rejuvenation, tissue engineering, and regenerative medicine. Diagnostic and monitoring technologies (5%) measure biological age and track the effectiveness of interventions, from biomarker panels, multiomics platforms, and wearable devices to medical devices for regenerative therapies.

Thanks to the research and development efforts of these companies, preventative solutions such as microbiome optimization or metabolic health interventions can address aging before damage occurs. Personalized interventions recognize variations in aging, providing custom formulations and protocols. Finally, an emerging longevity real estate sector is creating living environments designed to promote health and wellness.

Longevity products and services can only create impact when they reach consumers. The next level of our framework maps the distribution channels that connect scientific innovations and commercial solutions with the individuals who benefit from them.

These channels have evolved to address the unique needs of longevity interventions, which often require specialized knowledge, ongoing monitoring, and integration across multiple approaches. Specialized longevity care providers (44%) offer anti-aging and regenerative medicine services through various settings such as longevity clinics, med spas, integrative and functional medicine practices, and compounding pharmacies.

Beauty, wellness, and fitness service providers (6%) combine offerings such as fitness training with nutritional guidance to support longevity goals. Digital health and connectivity platforms (3%) have dramatically expanded access through AI-powered health monitoring and virtual aging clinics, allowing remote engagement with longevity solutions.

Consumer access points, including membership programs and direct-to-consumer testing, make consumer-oriented interventions more widely accessible, while integrated physical and virtual communities combine multiple longevity interventions with social support networks, creating environments where preventative practices, monitoring technologies, and lifestyle changes are integrated into daily living. Professional networks support specialized knowledge requirements through physician education and certification programs.

The fourth level of our framework encompasses the advances that amplify the potential and impact of longevity solutions.

What makes the scientific foundations of longevity particularly powerful is their interdisciplinary nature. The field draws from comparative biology, evolutionary medicine, systems biology, and translational geroscience. This convergence has led to breakthrough insights, such as understanding how loss of proteostasis contributes to neurodegenerative diseases like Alzheimer’s and Parkinson’s, or how metabolic activity influences neurodegeneration.

Infrastructure and services (3%) provide the operational backbone, including research organizations that accelerate clinical trials, laboratories that support biomarker testing, and manufacturing and business-to-business services that enable stakeholders to scale across the value chain. Knowledge and capability building (2%) plays a critical role through educational institutions, coaching providers, professional associations, and publishing platforms that disseminate research and best practices.

Enabling technologies accelerate progress through computational biology tools, machine learning algorithms, and predictive modeling systems. The integration of AI with biological research has slashed the time and cost of identifying potential longevity interventions.

Reimbursement pathways are evolving, from value-based care models and preventative care coverage to subscription-based health plans. These models are necessary for making longevity solutions accessible beyond wealthy early adopters. Policy and funding frameworks are evolving too, including government initiatives, philanthropic foundations, and innovative investment vehicles.

The multidirectional flow of information, capital, and innovation between levels is what makes this ecosystem robust. Scientific breakthroughs inform commercial development, while market feedback guides research priorities. Distribution channels provide evidence on safety and efficacy, which shapes scientific inquiry and product development. Simultaneously, supportive advances create the conditions necessary for the ecosystem to flourish.

As the longevity field matures and gains traction, it is important to consider the impact of the transition: the implications stretch far beyond the healthcare sector. Extended healthy lifespans could reconfigure labor markets, retirement systems, and social structures. While the economic potential of this market is substantial, with longer productive careers potentially helping to address pension challenges in aging societies, several critical challenges could significantly impact its growth trajectory and ultimate societal value. These challenges will not only shape investment flows but determine whether the longevity transformation delivers on its promise of an extended healthy lifespan for all, rather than for a privileged few.

To realize the potential of the longevity market, several considerations must be addressed:

The emerging longevity market represents a paradigm shift that extends far beyond healthcare into virtually every aspect of human experience, society, and business. Our Longevity Ecosystem Framework illustrates how this field integrates scientific discoveries, commercial solutions, distribution channels, and supportive advances into a cohesive value flow with revolutionary potential.

Success in the longevity space will demand a multidisciplinary approach that transcends traditional boundaries. Companies in the sector that develop long-term longevity strategies – through M&A, partnerships with startups and academic institutions, or leveraging core competencies – will be best positioned to thrive in this evolving landscape.

This initial market mapping raises profound questions: How might education systems evolve to support multiple careers across century-long lives? What financial products will emerge for extended retirements or mid-life sabbaticals? How will intergenerational wealth transfer change when multiple generations remain active simultaneously?

As we stand at the threshold of this new era, our challenge is clear: to harness scientific advances and enabling technologies to create a future where humans live not just longer lives, but healthier, more vibrant ones, while also redesigning our social and economic systems to maximize the shared benefits of this transformation.

Managing Director at WittKieffer Switzerland

Jennifer Borrer is a Managing Director at WittKieffer Switzerland, with a Global Practice affiliation to Consumer Health and Wellness. With two decades of experience in senior executive talent management roles, she has operated across global markets, bridging cultures and functions to deliver international leadership solutions at board and executive committee levels. Her focus on consumer health centers on longevity and healthy aging science.

Global Leader for Commercial Strategy and Insights at WittKieffer

Saule Serikova is the Global Leader for Commercial Strategy and Insights at WittKieffer, transforming market and talent intelligence into strategic advantages for organizations across healthcare, science, and education. Previously steering commercial operations at a global executive search firm and leading business and market analytics at Sandoz and McKinsey, she brings over two decades of leadership experience at the intersection of data-grounded decision making, executive talent, organizational advisory, and corporate strategy.

February 16, 2026 • by Howard H. Yu, Jialu Shan, Lawrence Tempel in Innovation

BYD overtook Tesla’s EV annual market share in 2025 as it mastered unglamorous fundamentals and built capabilities sequentially while competitors chased disruption and moonshots....

February 13, 2026 • by Stéphane J. G. Girod in Innovation

The next decade will bring significant changes for China's luxury sector. But to see where it's heading, we need to understand where it's been....

February 10, 2026 • by Winter Nie, Yunfei Feng in Innovation

China's economy shows contradictory signals – macro headwinds yet surging innovation investment and competitive intensity. To decode this evolving reality, here are the nine key trends global businesses must understand about operating...

January 13, 2026 • by Murat Tarakci in Innovation

Satya Nadella swapped Microsoft’s old Microsoft-first playbook for a customer-first, collaboration-driven strategy, demonstrating what it takes to succeed in today’s business environment. ...

Explore first person business intelligence from top minds curated for a global executive audience