More than 40 executives attended an IMD Discovery Event that delved into some of the opportunities and challenges of doing business in Africa, the third fastest growing region in the world. The guest contributors ranged from senior executives in multinational and African companies to a local entrepreneur and a senior journalist with a particular interest in the continent. The participants, from a variety of industries and companies with different exposure to Africa, shared their experiences and contributed to the debate.

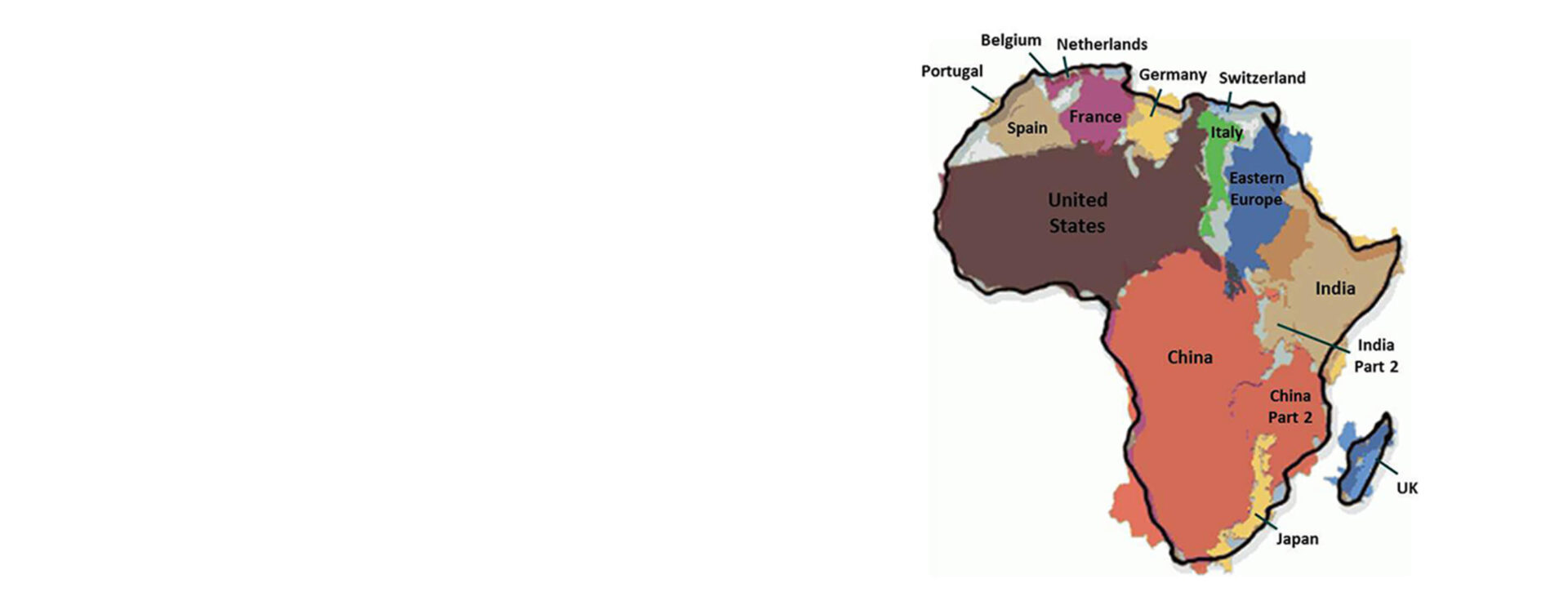

Africa is larger than the United States, China, India, Japan and the whole of Europe put together (see map), yet many in the West are ill-informed about it: If there’s a riot in Liberia, companies want to pull out of Nairobi in Kenya more than 5,000 km away. A lot of attention is being paid to BRIC countries, but Africa hardly rates a mention, except in a negative context. Yet over the past decade, six of the world’s ten fastest-growing countries were in Africa. With a population of over one billion – the fastest growing and youngest in the world – and an emerging middle class, Africa has consumers who are more prosperous today than ever. However, the sheer number of countries (54), currencies, languages and physical and cultural borders – not to mention poor infra-structure, corruption and political instability – are major obstacles for businesses interested in capitalizing on the Africa Opportunity.

Opportunities and Challenges

While most foreign investment targets the populous and more developed countries such as South Africa, Nigeria and Kenya, there are opportunities for doing business throughout the continent. Stéphane Paquier, president of Dow Africa, cited some positive megatrends:

- Large and growing consumer class: A recent African Development Bank report found that Africa’s middle-class consumers now constitute more than a third of its population, over 300 million people, which matches India.1

- Wealth: Contrary to perceptions, several countries in Africa – including Libya, Algeria and Angola – have no debt and a considerable amount of money to invest in any vision for the future.

- Nutrition and agriculture: Africa has most of the non-cultivated land in the world.

This is balanced with the recognition of common challenges that multinational corporations (MNCs) face:

- Commitment: MNCs have struggled with being consistent and having a long-term commitment to African markets. This is often down to ignorance and lack of direct experience.

- Visibility from headquarters: It is hard to attract business partners and support within the executive team.

- Cultural differences: Face to face relationships are valued above all others and patience is needed to cultivate them.

- Supply chain to the continent is long and expensive: Until infrastructure improves, there will be challenges in bringing products to Africa.

- Corruption: A zero tolerance approach to corruption is essential from the start of new alliances and joint ventures.

- Threats to intellectual property rights: MNCs need to protect their IP and fight against counterfeit products.

- Difficulty of benchmarking: How do you know what your competitors are doing?

Jonathan Ledgard, Africa Correspondent for The Economist, believes that there will be economic growth in many African countries, but the key issue is whether the growth is inclusive and if all of society benefits. The population of Africa will reach an estimated 2 billion in the next 30 years, and currently over 50% of the population in sub-Saharan Africa is under 19 years old. Africa is poised to benefit from a “demographic dividend” – a huge number of youth entering the workforce. This young talent must be harnessed to maximize opportunities and avoid political and social risk.

The combination of economic growth and population growth means that the big future for Africa has not yet been written. However, factors such as frustrated youth due to unemployment; the effects of climate change, which could lead to food shortages; and non-inclusive cities could lead to a disconnect, with some parts of Africa advancing while others are left behind. Technology and urbanization will be the big drivers, offering the chance to rethink what a city might be like – 800 million new people will be living in cities that do not even exist yet!

Ramon Bastida, senior manager marketing, EMEA for Eaton Corporation, highlighted the megatrend of increasing power needs throughout Africa as the population explodes, and the imperative to use energy more efficiently, sustainably and safely. He also pointed out the need to separate risks into three categories when deciding how to invest in Africa – political, ethical and economic. But he also stressed that it is impossible to do business without taking on some risk and that all geographies have their own inherent risks.

Asked about their biggest concerns over doing business in Africa, participants overwhelmingly noted the distribution challenge and the quest for talent.

The Distribution Challenge

How can companies reach the emerging consumers at the bottom of the pyramid? Nganga Wanjohi, CEO of Kaskazi Network Ltd, described how his company manages the distribution of fast-moving consumer goods (FMCGs) to low income areas (slums) in Kenya using bikes and motorcycles. He has capitalized on opportunities in the fragmented Kenyan micro retail market, consisting of over 130,000 kiosks, primarily in low income areas. This market, which represents 75% of the Kenyan retail market, has been largely neglected by many FMCG companies.2

The system works on hourly credit, which means timing is critical. Typically traders’ stock purchases are divided into two categories: daily purchases, such as milk, bread, cigarettes and airtime, and periodic purchases, such as tea, coffee, flour, sugar and oil. The cash float for buying stock is based on these two categories and Kaskazi needs to have a predictable sales cycle to ensure a “share of float.” If the cycle is too short, traders may be overstocked; too long and there are stock-outs. Far from being just a margin game, the business is built on relationships and loyalty. Sales people make 40 to 50 calls a day, immediately uploading details of each transaction onto the company portal.

Wanjohi identified how his company manages some of the key distribution challenges in low income areas:

| Challenge | Solution |

| Narrow pathways and insecurity | Use bicycles and motorcycles; employ residents from the area |

| Limited space for brand visibilty | Focus on merchandising and raising awareness through effective point of sale (POS) materials such as “wash lines” |

| Payment defaults | Know all of the dynamics in your market so that if one cog in the supply chain is broken it is possible to continue serving customers |

| Counterfeits and stolen goods | Create distribution structures and loyal traders who support the channel; monitor trends and be vigilant in uncovering suspicious situations and then act fast |

| Discriminatory trade offers | Targeting only one level of distribution will lead to overstock (wholesalers) and no trickle down (retailers); effective trade offers must flow everywhere in the system |

| Quality issues | Have a clear company return policy for products with quality issues e.g. leakages, empty sachets |

Kaskazi has developed an in-depth understanding of the entire supply chain and relies on extensive market data and real-time analytics to make decisions on how to serve its customers and create consumer awareness of their brands.

Innovative Business Models in Emerging Markets

IMD Professor Pasha Mahmood discussed how MNCs can overcome the challenges of operating in Africa and other emerging markets. First, several gaps ne ed to be addressed. The income gap can be dealt with by producing smaller products, e.g. sachets for one-time use, or stripped down versions. The infrastructure gap, for example in energy supply, requires products that are not power hungry and robust to volatility. Dealing with the sustainability gap needs a different approach to what is “the norm” in more developed markets. And, finally, the regulatory gap, which is acute in Africa, presents both risks a nd opportunities. For example, people cannot be sure whether anti-malaria drugs are real or fake, yet some pioneering medical treatments may be possible because they are not subject to strong lobbies that exist in other co untries, for example the US. However, institutional voids do need to be addressed. In order to capitalize on opportunities in environments where customers are highly price sensitive, MNCs must focus on frugal innovation.

While the traditional model of innovation is based on targeting the world market, the new model of “reverse innovation” targets the bottom to middle of local markets, and the middle class is redefined to include those spending $2 to $20 per day. Value innovation is no longer sufficient by itself; business system innovation is also required. Value innovation starts with the sp ecific need to be met and works backward to develop appropriate solutions at the right price by thinking beyond features and focusing on customer benefits and value. This involves considering whether to reduce, eliminate, enh ance or add features. One example is M-Pesa, the mobile-phone-based money transfer service for Safaricom and Vodacom in Kenya and Tanzania: through a simple application that resides on a phone’s SIM card, individual s who might not have a bank account can access financial services including: transferring cash from one individual to another; purchasing airtime credits; paying wages, salaries and bills; and purchasing goods and services. Bu siness system innovation involves innovative and efficient ways of bringing products to market.

The War for Talent

A number of speakers and participants reflected on the challenges of attracting and retaining the right people in a difficult environment. Many believe an undersupply of leadership across all sectors is the root cause of many of Africa’s problems. Terrence Taylor, senior group manager, Learning & Development at Ecobank, shared lessons about attracting, developing and retaining talent in a Pan-African context.

The Ecobank story is about a group of 1,200 visionary shareholders from 14 West African countries who in 1985 – with limited resources – decided to create a Pan-African bank to further the development of Africa. Today, Ecobank is a full-service bank with 10 million customers, 18,000 employees and a footprint that covers 32 African countries – more than any other bank in the world.3 The bank has its headquarters in Togo and has two official languages: English and French. The affiliate banks in individual countries operate in their national language, but contact with head office is in the official languages.

Because of Ecobank’s rapid expansion it has had to hire talent from its competitors worldwide. But in June 2012, the bank launched the Ecobank Academy with three goals: (1) to build world class senior and mid-level managers for the bank; (2) to improve professional and technical skills in Africa’s banking sector; and (3) to foster the creation of knowledge capital for Africa’s financial integration and economic growth. The leadership model is very much action based. Ecobank is partnering with global academic institutions as well as local business schools for content and expertise.

A unique feature of Ecobank’s personnel is their strong sense of mission – most Ecobankers do not think of it as just a bank, but almost as a movement. The Ecobank movement is about attracting talent with the same ideals. When it comes to retaining talent, Ecobank has identified three success factors:

- Keep them challenged: working on interesting assignments, projects and day-to-day work.

- Pay them well: give them a total package with lots of value, including schooling, car allowances and status.

- Keep them connected with the ethos:for Ecobank this means that banking is the vehicle to making a difference in Africa.

Participants stressed the need to develop talent internally by offering training and internships to the many talented graduates unable to find work. Initiatives such as the African Leadership Academy, launched to develop 6,000 leaders in Africa over 12 years, aim to develop strong leaders throughout society.

Mentoring is an important part of the equation – certification is not enough. Many people may not have technical competence, but they are willing to learn. Some companies send high potentials to factories in other countries on train-the-trainer programs. It requires advance planning and a medium-term outlook. To generate lasting growth and prosperity, additional leadership development initiatives are needed across the board.

North Africa: Between Today’s Challenges and Tomorrow’s Opportunities

North Africa – which includes Algeria, Egyp t, Libya, Morocco, Sudan, Tunisia and Western Sahara – provides a unique set of challenges and opportunities. IMD executive director Dr. Hischam El-Agamy pointed out that while this region is both part of Africa and part of the Arab world, it has never been able to exploit these dual identities. As a consequence, there has been little integration in North African markets and a failure to create an economic bloc.

The trajectory of North Africa changed dramati cally in just two months as a result of the Arab Spring, which started in late 2010. Disruptive changes are continuing and the ramifications are still being felt throughout the region as 100 million young Arabs remain in a system with low living standards, no freedom of expression, poor education and few job prospects. One of the direct consequenc es of the Arab Spring could be that the private sector will grow due to the new and important role it will play in the current political and socio-economic transformation.

While the region faces major challenges, incl uding lack of fresh water, food insecurity, corruption and above all unemployment, it will also create great business opportunities especially in the field of developing infrastruct ure. For example, experts are estimating that the region will have to invest at least $300 billion over the next 10 years to repair the damage caused during the last two years and to meet the immediate needs of the population. These investments and more will b e required to repair and develop oil fields, to construct social housing for a large portion of the population living in very rudimentary conditions, and of course to improve basic infr astructures for healthcare and education. There are also major investment opportunities in the telecommunications, tourism and renewable energy sectors. Real success will re quire open borders and free movement of goods and people. The journey to prosperity for North Africa, like the rest of the continent, will not be easy but may be shorter t han commonly assumed.

Time to Do Business

After decades of slow growth and uncertainty, Africa’s impressive growth looks likely to continue.

Key takeaways from the event include:

- The private sector is the future, whether SMEs or MNCs, not only the public sector or NGOs.

- Last-mover advantage could be valuable.

- The demographic dividend requires out of the box thinking: in Europe the goal is to employ the least possible labor because it is expensive; in Africa the opposite is true.

- Many disruptive innovations could come out of Africa; reverse innovation has been powerful in the mobile sector and could come to bear in a variety of industries.

References

1-Mthuli Ncube, Charles Leyeka Lufumpa and Desire Vencatachellum. “The Middle of the Pyramid: Dynamics of the Middle Class in Africa.” Market Brief, 2011.

2-Source: Sjoblom, Leif, Winifred Karugu, Lisa Schuepbach. Kaskazi Network Ltd – Distributing to the Bottom of the Pyramid. IMD case series IMD-3-2017, 2008.

3-Sjoblom, Leif and Hischam El-Agamy. “Ecobank: A Passion to build a World-Class Pan-African Bank.” IMD case no. IMD-3-2326, 2012.

Discovery Events are exclusively available to members of IMD’s Corporate Learning Network. To find out more, go to www.imd.org/cln.

![How to develop future-ready talent – and do it fast [Video]](https://www.imd.org/ibyimd/wp-content/uploads/2024/02/future-talent-720x630.jpg)

![Adapting, innovating, and learning from failure, with Zhike Lei [Podcast]](https://www.imd.org/ibyimd/wp-content/uploads/2024/01/IbyIMD-Cards-5_3-1250x725-1-720x630.png)