Before our interview at IMD in Lausanne this month, environmental philanthropist Alexa Firmenich took part in a workshop in the Arctic Circle with a group of experts that included American marine biologist and explorer Sylvia Earle and Johan Rockström, the Swedish climate scientist who originated the concept of planetary boundaries.

Their goal? To come up with ideas to shape an alternative future to what Alexa calls “the ground zero of climate collapse.”

“When you cross these planetary boundaries, you reach tipping points, and tipping points are states beyond which ecosystems flip into a new state and they don’t go back,” she explained, as we discussed her approach to philanthropy and impact investment at a recent philanthropy event at IMD.

“This is really hard to model because a lot of these changes are happening at once and they’re happening faster than we thought they would. I share this because as a next-generation wealth holder, as a caring citizen, as someone who’s in love with the world, I think that’s my responsibility,” she said. “My approach is to face the reality front on, not to shy away from it, not to ignore it, but to say: ‘OK, practically what can I do about this?’”

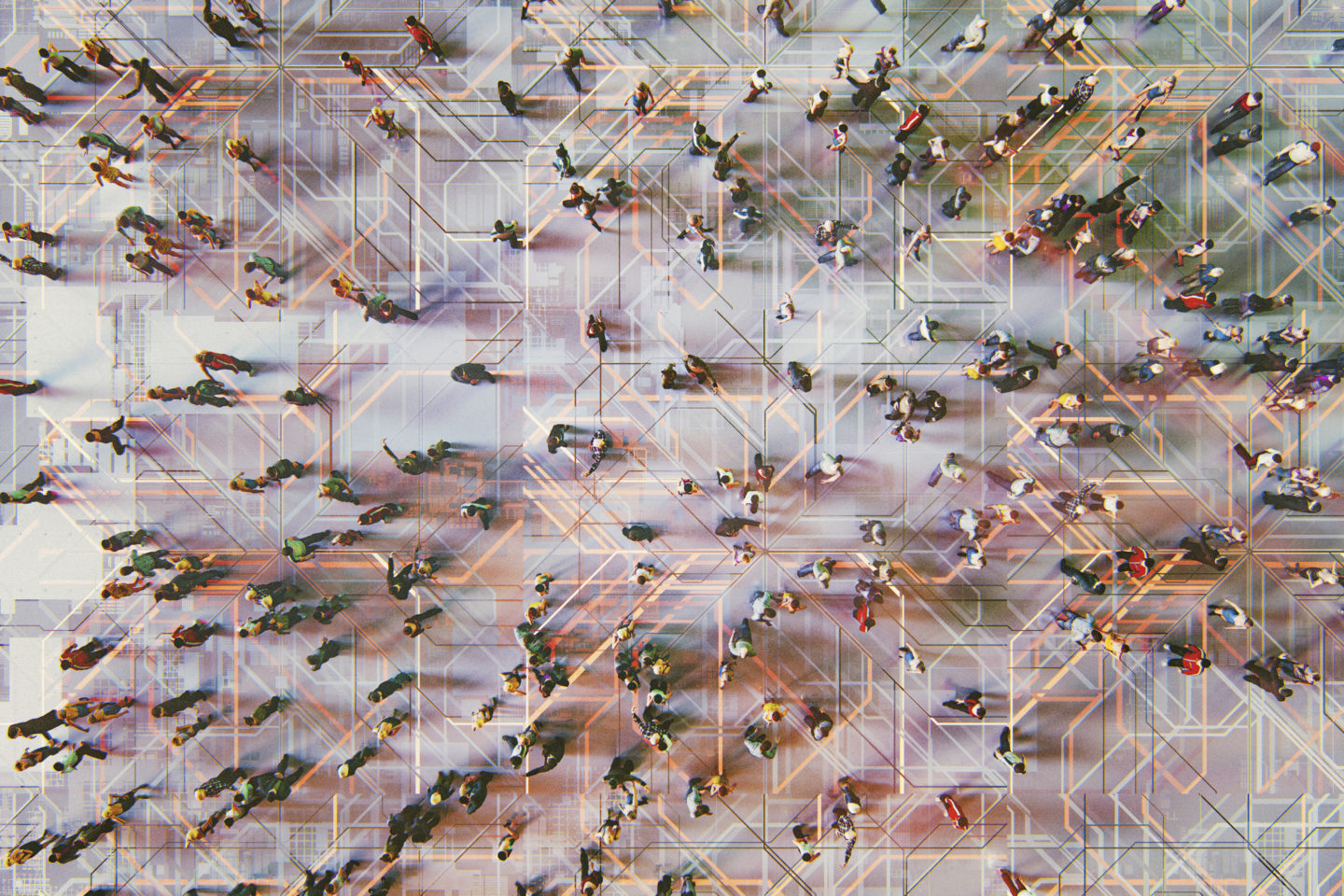

Alexa is an instructive example of a disruptive new wave who are redefining the art of philanthropy: next-generation family wealth owners seeking to make a sustainable, lasting impact by forging a distinct professional path away from the family’s legacy enterprise and overhauling the old ways of charity-focused giving.

A member of the entrepreneurial Firmenich clan behind the world’s largest flavors and fragrances company – a business with its roots firmly in the natural world – Alexa has built an impressive career as a climate investor, consultant, philanthropist, and educational facilitator. She serves as co-director of SEED Biocomplexity at ETH University Zurich – an initiative that assesses the health of the world’s biodiversity – and co-founded the “animist” investment vehicle Ground Effect, which directs capital into areas such as regenerative agriculture, ecosystem restoration, and food systems. She has even trained as a wilderness guide.

Giving back with purpose and intent

After a recent identity crisis for the philanthropy sector in which Roche shareholder André Hoffmann said the traditional forms of philanthropy had “failed,” we are witnessing the emergence of a new type of philanthropic activity – a focus on cohesive, professionalized philanthropy and innovative, targeted investments capable of delivering sustainable, lasting impact for the world and for the family enterprise system, rather than a solitary focus on “charitable” project grants.

As we have seen with many of the affluent families that we have supported on their philanthropic journeys, a well-defined personal or collective purpose and a commitment to “live your values” are crucial for success in philanthropy. As is the move towards greater professionalism. More and more next-generation family members are, like Alexa, combining their personal passions and sense of social responsibility with a “career” approach to philanthropy and impact investing.

We have also observed that philanthropy tends to have more impact externally and on the overall health of the family ecosystem when family members take a holistic and cohesive approach to philanthropy – that is, when the philanthropic activity has a clear connection to the core family business.

“As someone whose wealth comes from nature – flavors and fragrances – I believe that this is part of me giving back and creating new economic models around the valuation of nature, which has been at zero on the balance sheet,” she said.

When executed effectively, this export of family talent can reap benefits for the family business, for example, by introducing new perspectives, expertise, and market opportunities.

“Because I am in the climate and biodiversity space but working more in an entrepreneurial environment, I think I am more useful outside of the family system, in the world bringing ideas back in, than necessarily being inside of it 100% of my time.” Alexa explained.

YouTube

Podcast available

Podcast available

Podcast available

Podcast available