The primary objective of this undertaking is to enhance transparency regarding the implementation of industrial policies. While governments and analysts may find this information useful to evaluate the impact of industrial policy, corporate executives will find the contents a valuable input to strategic and operational decision-making.

Government action is recorded in the NIPO database if it meets the following criteria:

- The state action was announced or implemented on or after 1 January 2023.

- The action is a strategic plan affecting commercial activity or a policy or regulation enacted by that state (potentially in pursuit of a strategic plan), or the action involves firm-specific interventions arising from the implementation of a policy or regulation, such as decisions regarding Foreign Direct Investment (FDI) authorization or subsidy awards.

- The objective of the measure, as publicly stated by the implementing government, is rooted in national security concerns, geopolitical considerations, security of supply, domestic competitiveness, or climate change mitigation.

To facilitate the use of the NIPO database, where possible, policy intervention is linked to pre-specified groups of products in strategic sectors, namely medical, semiconductors, critical minerals, military/civilian dual-use, low-carbon technology, and other advanced technology.

For nearly 15 years, the GTA team has systematically tracked government trade, investment, and subsidy policies. A combination of digital tools and human expertise has been used to build a database of over 64,000 policy interventions worldwide, making this the largest publicly available inventory of commercial policy interventions available. Companies, business associations, international organizations, and governments frequently refer to GTA findings. From the beginning of 2023, that machinery was directed towards tracking the uptick of industrial policy action by governments.

Industrial policy trends in 2023

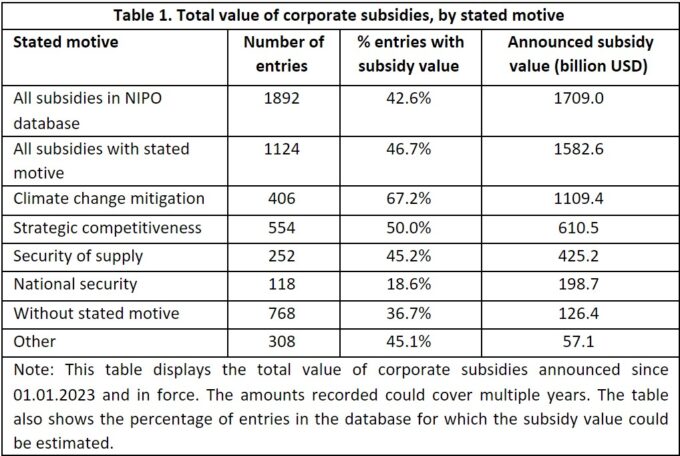

As of 4 January 2024, the NIPO database contains information on more than 2,500 novel industrial policies undertaken by 75 jurisdictions. Notably, 71% of these policies explicitly tilt the commercial playing field in favor of national or local firms. That is, these measures distort trade and investment flows and will be viewed by some critics as protectionist.

Already, certain patterns are emerging in industrial policy response.

Region matters:

Industrial policy initiatives have primarily centered around major economies, with China, the European Union, and the United States collectively accounting for 48% of these measures. Handing out subsidies to companies is the predominant form of industrial policy. Still, regional disparities are observable in the choice of industrial policy instruments. Figure 1 shows that countries in Europe, Central Asia, and North America resort more to national and local firms compared to other regions. Conversely, governments in the Asia Pacific, Latin America and the Caribbean, and South Asia exhibit regions rely more on erecting barriers to imported goods. While the utilization of localization measures – such as Buy America rules – is not widespread, South Asian and North American nations employ them relatively more frequently than their counterparts in other regions. When it comes to resorting to restrictions on exports, the Asia Pacific and Europe regions, along with Central Asia, are the most active users.

Audio available

Audio available