How the digital highway code aims to curb internet violations

UNESCO guidelines for the governance of digital platforms offer lessons for more effective collaboration between companies, civil society, and governments....

Audio available

by Corinne Post, Kaitlin Wowak, George Ball, David J. Ketchen Jr Published 24 March 2022 in Human Resources • 6 min read

Allergan’s carcinogenic breast implants were on the market for years, a delay that may have caused hundreds of women to develop a rare type of T-cell lymphoma, and dozens to die from it. Bayer’s Trasylol, a drug used to reduce bleeding during major surgeries, remained on the market, despite indications that it led to kidney failures, potentially causing tens of thousands of unnecessary deaths. According to a US Senate report, Olympus failed to act on information it had about how its duodenoscope (a device used to examine the small intestine) spread bacteria and caused infections, with sometimes potentially lethal consequences.

Delaying the recall of faulty products not only has potentially devastating consequences for end-users; it also disrupts a firm’s supply chain, and can result in large fines, lawsuits, and reputational costs for the companies.

With growing pressure on companies to act in socially responsible ways, product governance – the management of risks to a firm’s customers of using its product or services – is likely to become increasingly important for organizations. ESG analysts looking to identify companies that take care of their customers are likely to start scrutinizing a firm’s approach to informing end-users or responding to complaints about unanticipated side effects. Pressures to disclose product governance practices is also expected to rise. At Swiss private bank Pictet, product recalls are already on the ESG scorecard. So, addressing ESG risks in the pharmaceutical sector could attract more ESG investments into the industry.

Having analyzed the considerable evidence about how women on boards can improve a firm’s profitability, we wondered whether female board representation could affect how a firm makes operational decisions along the supply chain. Could having more women on boards influence the timing and frequency of firms’ recall decisions?

To answer this question, we conducted a study analyzing 4,271 medical product recalls from 2002 to 2013 across 92 publicly traded firms regulated by the US Food and Drug Administration (FDA). The study was based on recall data obtained via a Freedom of Information Act (FOIA) request and recall timing data provided by senior FDA leaders. To our knowledge, this is the first study to examine how women board representation relates to operations management, specifically in product recall decision-making.

In the medical products industry, firms with more women directors behave very differently when it comes to recall decisions for products such as prescription drugs or life-sustaining medical devices. Severe product problems that injure or kill consumers are recalled much faster when there are more women on the board. Additionally, lower severity product defects that can be hidden from regulators are more likely to be recalled when there are women directors.

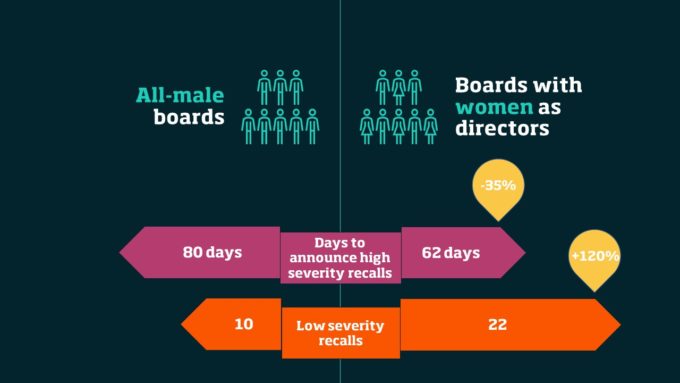

Compared to firms with all-male boards, those that have added women as directors:

Central to this link between board composition and product recalls is the notion that boards are established specifically to oversee and set the tone for how managers make critical firm decisions. We reasoned that boards with more women might set a tone for stricter abidance by FDA rules, have higher aversion to risk when it comes to possible product harm, and be more responsive to a diverse set of stakeholders, including at-risk customers.

The experience of more likely exposure to adverse effects from product recalls may also make this issue more salient in the minds of women board members. After all, medical products and innovations often have more negative side-effects for women, most likely because male scientists are less likely to incorporate gender and sex analyses in their research. Most recently with COVID-19 vaccines, women have reported more side-effects than men.

The difference in product recall decisions between firms with and without women directors is striking. One could call it a matter of life and death.

Compared to firms with all-male boards, those that that have women directors announce high severity recalls 28-days faster or a 35% reduction in recall timing, which for these types of recalls, is truly a matter of life or death. Furthermore, we found that when a board has just one woman director seriously defective products are not recalled more quickly. It’s only when there are at least two women directors on the board that the timeliness of severe product recalls increases; when there are three women directors, the recall decision moves along even faster.

Recall decisions are risky for firms. While consumers have the most to gain by defective products being recalled faster, companies have the most to lose, because these recalls expose them to public, regulatory and stock market penalties. Such high-risk decisions that put customer safety ahead of the bottom line apparently happen more quickly when a larger number of women directors sit on a firm’s board.

In contrast to high severity recalls which are difficult to hide from the public in the long run, low severity recalls can be hidden from regulators. Yet, even for these types of recalls, which are of low severity and for which executives have much higher discretion, boards with women directors announce 120% more recalls, in comparison to a board that has no women directors. That is equivalent to 12 additional recalls per firm. In this case, the addition of just one female director causes a change in how these decisions are made, and the number of recalls of this type announced continue to increase as firms add each additional woman director.

Our study shows that there is a difference in very real and important consumer safety outcomes between firms who have added women to their boards and those who have not.

Medical products and innovations often have more negative side-effects for women, most likely because male scientists are less likely to incorporate gender and sex analyses in their research.

Yet, we call for caution in interpreting the findings and offering prescriptions, because:

More broadly, we align ourselves with recent calls for all directors on all boards to look beyond the bottom-line and be more responsive to their firm’s stakeholders, especially when defects in their products may harm or kill.

This article is based on the research paper The Influence of Female Directors on Product Recall Decisions which was published in Manufacturing and Service Operations Management in March 2021.

Visiting Faculty at IMD

Corinne Post is Visiting Faculty at IMD, where she directs the Inclusive Leadership Program. Her research addresses questions related to diversity and diversity management, notably on women and boards and in top management teams. It also examines the role of diversity as enabler or impediment to group and organizational performance.

Associate Professor of IT, Analytics and Operations at Mendoza College of Business, University of Notre Dame

Kaitlin Wowak is Associate Professor of IT, Analytics and Operations at Mendoza College of Business, University of Notre Dame. Her research focuses on strategic supply chain management and product recalls.

Associate Professor and Weimer Faculty Fellow at Kelly School of Business, Indiana University

George Ball is Associate Professor and Weimer Faculty Fellow at Kelly School of Business at Indiana University. His areas of expertise include the causes and effects of the recall decision-making process.

Harbert Eminent Scholar and Professor of Management at Harbert College of Business, Auburn University

David Ketchen is Harbert Eminent Scholar and Professor of Management at Harbert College of Business, Auburn University. His research focuses on strategic supply chain management and the determinants of superior organizational performance.

8 May 2024 • by Tawfik Jelassi in Governance

UNESCO guidelines for the governance of digital platforms offer lessons for more effective collaboration between companies, civil society, and governments....

Audio available

Audio available

9 April 2024 in Governance

When the going gets tough, the behavior and decisions of board members can heavily influence the fate of companies and have far-reaching repercussions. When the going gets tough, the behavior...

Audio available

Audio available

26 January 2024 • by Hischam El-Agamy in Governance

Though they may find it an invaluable tool, scenario planning isn’t just for business leaders. It has also been successfully used in brokering peace between conflicting sides. This is why it should...

25 January 2024 • by Siri Terjesen in Governance

As companies grapple with economic uncertainties, the progress towards more inclusive boards is slowing down. Broadening the talent search and investing in training programs are crucial for redressing the slide....

Explore first person business intelligence from top minds curated for a global executive audience