Digital sustainability: it pays to be a leader, not a laggard

Companies that excel in both digital and sustainable transformation attract a stock market premium, according to research. So, how do you tap into that value? ...

by Christos Cabolis Published 1 September 2022 in Competitiveness • 5 min read

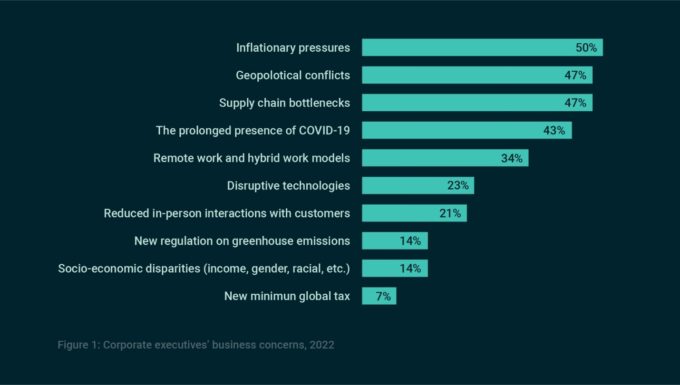

The 2022 IMD Executive Opinion Survey showed that the top three concerns of executives in the first half of 2022 were inflationary pressures (50%), geopolitical conflicts, and supply chain bottlenecks (both 47%). The fourth most pressing business concern was the prolonged presence of COVID-19 at 43%.

The annual survey is a major component of the IMD World Competitiveness Ranking, which combines the results with a carefully curated set of hard data to measure economies’ relative capacity to generate sustainable value creation. Some 4,200 executives from 63 countries this year offered their opinions on the trends shaping the global economy.

The results were not surprising: throughout 2022, inflation has returned to levels that last occurred several decades ago. In their July update, the IMF lowered world growth projections for 2023 – partly due to the high expectations of inflation, actions subsequently taken by central banks and governments, the disruption of international supply-chains, and a high probability of geopolitical risks.

However, when grouped regionally, the survey responses suggest something less obvious: a potentially new phase of globalization, with wide-ranging implications for governments and companies alike.

The executives surveyed were asked to appraise many tangible, as well as intangible, aspects of the economic landscape. In addition, they were asked to reflect on key economic trends from corporate leaders’ points of view, and to identify what they considered to be the three top priorities out of ten available.

When classifying business leaders’ 2022 responses by region, we found strong global patterns. These were:

Analysts have been discussing the issue of a move from globalization to regionalization for the past few years, as there have been major disruptions in the way that economies relate to each other. From an increase in tariffs to fighting the pandemic, economies have turned more heavily inwards when trying to solve their challenges.

And yet, most of the different regional concerns raised by executives are interconnected. For instance, COVID-19 worsens supply chain bottlenecks, which in turn exacerbate inflation. Even though our data shows that challenges appear with different region-specific intensity, addressing them relies on one connecting thread: the continued interdependency and interconnectedness of economies with respect to the flow of goods, services, people, capital, and ideas – that is, globalization. So how can firms foster this flow? Here are three major ways:

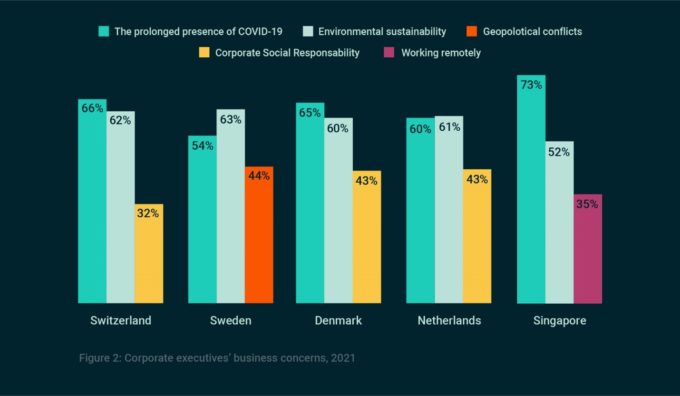

Our data backs this up. The same IMD Executive Opinion Survey in 2021 showed that business leaders were concerned with broad global issues such as the COVID-19 pandemic and environmental sustainability, both of which necessitated public-private coordination. Companies were implementing, and sometimes strengthening, existing governmental regulations.

In contrast, in 2022, executives are focusing more on businesses’ operational issues, placing 2021’s concerns at a much lower priority level. Take the issue of environmental sustainability, for example: it moved from being the second highest concern (60% for the top five most highly ranked economies) in 2021 down to eighth place (14%) in 2022.

Executives must draw upon newly embedded digital technology from the pandemic along with expanding investment in artificial intelligence and machine learning to assist their teams in confronting the current challenges. Technology helps improve transparency within a company which enhances the understanding, for example, of cost spending; an important first step in tackling inflation. At the same time, transparency eases a very complex process as the supply chain becomes more manageable.

Most importantly, technology improves the accuracy of estimating everything from future demand and costs to supply chain challenges. It allows retailers to have an accurate understanding of their inventory and to estimate subsequent orders more accurately, and to better understand future challenges in a supply chain.

The combination of governments performing tax hikes and central banks increasing interest rates will result in reduced demand for goods and services, as well as a decrease in investments which will place downward pressure on prices. At the same time, and as previously mentioned, a decrease in estimated economic growth means a potential recession. And the increase in the price of energy worldwide may lead to higher levels of inflation and a recession. Economies are working hard to avoid this combination.

The major disruptions we have experienced globally since early 2020 have not, in fact, affected the traditional pillars of competitiveness: the rule of law, institutions and the underlying processes for investment in infrastructure and education. Whether these pillars of competitiveness will continue to be the most significant in the face of the triple onslaught of today’s unpredictable health, economic and geopolitical crises will become clearer over the course of time.

Chief Economist at the IMD World Competitiveness Center

Christos Cabolis is the IMD World Competitiveness Center’s Chief Economist and Head of Operations and Adjunct Professor of Economics and Competitiveness at IMD. His research focuses on competitiveness in its broadest sense, such as the challenges inherent to ESG and the need to respect citizens’ privacy in an increasingly digitalized world.

17 July 2024 • by Michael R. Wade, Evangelos Syrigos in Competitiveness

Companies that excel in both digital and sustainable transformation attract a stock market premium, according to research. So, how do you tap into that value? ...

8 July 2024 • by Richard Baldwin in Competitiveness

As the world’s largest democracy prepares to overtake China in terms of economic growth, it offers a huge investment opportunity, explains IMD’s Richard Baldwin....

26 June 2024 • by Arturo Bris in Competitiveness

Don’t be deterred by doom-laden narratives. To create societies that are prosperous and inclusive, it’s time for leaders to focus on facts and future readiness, says Arturo Bris...

14 June 2024 • by Howard H. Yu in Competitiveness

This weekend’s G7 summit will see renewed calls for protectionist measures against Chinese EV manufacturers. But tariffs would be misguided and universally damaging, warns IMD’s Howard Yu ...

Explore first person business intelligence from top minds curated for a global executive audience