Digital sustainability: it pays to be a leader, not a laggard

Companies that excel in both digital and sustainable transformation attract a stock market premium, according to research. So, how do you tap into that value? ...

by Vanina Farber Published 10 December 2021 in Sustainability • 6 min read

Investing in social entrepreneurs and communities that seek to deliver positive and sustainable change poses a significant dilemma for investors: How can we identify sustainable business models that can scale to provide financial returns as well as impact?

Once those opportunities have been identified, it also means working to find the right financial instruments and innovative market solutions to support the diverse objectives of impact investors and social enterprises.

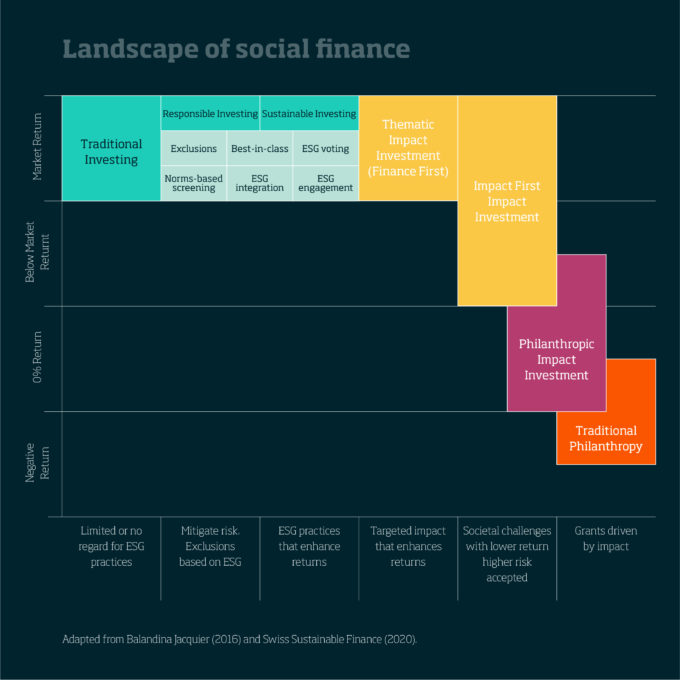

Thankfully, the spectrum of impact investment has evolved rapidly in recent years to bridge these gaps. Today, impact investing attracts a variety of players with different risk-return-impact profiles. However, there is a common mindset based on finding the appropriate solution for each scenario through tailored financing.

On their Discovery Expedition to Peru, our EMBAs explored how the growth of the impact sector in Latin America and the global shock waves of the COVID-19 pandemic were creating further diversification opportunities and challenges as they prepared to make investment recommendations on the Peruvian social enterprises to local impact investors.

Indeed, one of our guest speakers, Andes Impact Partners (AIP) Managing Partner Natasha Barantseva, observed that the pandemic had been a “booster for a ton of fascinating new startups … and very impactful models” that have the potential to scale, particularly in Peru and Colombia, which she described as an “innovation center” in the region.

Here are some of the ways that impact investing caters to different kinds of private capital mandates and social enterprise needs.

An impact investor actively places capital in enterprises that generate a measurable, desired and beneficial social and/or environmental outcome that would not occur but for his/her investment, with expected financial returns ranging from the highly concessionary to above market.

Adrian Ackeret, the CFO of the elea Foundation for Globalization and Ethics, explained how his organization invests early growth stage capital, technical resources and capacity building in social enterprises to help them scale up and attract further investment to build a sustainable business.

Philanthropic impact investment allocates funds to parts of the social innovation market that have proven solutions and scalable business models, but are too risky for market-rate investors given the high engagement needs and the long time horizon for profitability. Non-financial support and tailored financing (e.g., grants, convertible debt and/or equity) are key to the survival of the social enterprises at this stage. Once the business has scaled to a certain size and it is ready for more commercial funding, the philanthropic impact investor can exit and recycle the money into other social enterprises.

Some impact funds invest in “early growth” companies that have made it out of the risky “seed” stage, thanks to profitable unit economics – where each unit of production or services generates more revenue than it costs the social enterprise to produce – but are now struggling to access the capital required to accelerate their growth and reach sufficient economies of scale.

ALIVE – short for Acumen LatAm Impact Ventures – is one such fund, focusing on providing equity or mezzanine financing – a hybrid form of investment between riskier equity and safer debt – to companies primarily in Colombia and Peru that are engaged in three areas of impact: agribusiness, access to energy or access to formal jobs.

Maria Pia Morante, Investment Manager for ALIVE, said that impact is as important as financial returns, “so it is critical, when starting due diligence, to make sure that impact is embedded in the company’s business model”.

As impact enterprises mature and become significant players in local and regional markets, they become safer bets and seek different types of support from impact investors to grow and ensure longevity.

AIP operates under strict impact and financial criteria to offer long-term mezzanine debt financing, which gives lenders the right to convert their investment into equity in the case of a default on debt repayments, and advise established social enterprises in Latin America.

“These are not unicorns, but the ‘zebras’ that have the right to exist – they’re companies that have already consolidated operations,” said AIP Managing Partner Barantseva. “They are very important economic agents in the market. They generate a lot of jobs. They have already developed a product and they have a market. They are going to grow at moderate rates and probably not by using disruptive innovation, but by making incremental improvements to the model, by implementing efficiency improvements, etc.”

She said these companies typically grow at 10-15 percent a year, which AIP supports with debt financing to buy machinery or provide long-term working capital to create “higher growth in the first year – maybe 20-30 percent growth – as a result of this investment”.

It is critical, when starting due diligence, to make sure that impact is embedded in the company’s business modelMaria Pia Morante

Another way to invest in impact is to provide capital for the banks, credit unions, NGOs or non-banking financial institutions that, in turn, offer finance to microentrepreneurs and SMEs in emerging economies. This increases the pool of resources available on the ground and helps firms acquire loans they may not otherwise be able to access.

BlueOrchard is an international impact fund manager that, as part of its activities, pools resources from investors and, using specially designed tools, conducts due diligence on the credit ratings and impact of various financial institutions before allocating funds.

“The main target and objective is to fund institutions that capture segments of microentrepreneurs and SMEs,” said BlueOrchard Impact Investment Officer Gustavo Muchotrigo.

Funds such as Bamboo Capital Partners cater to startups between seed and growth stages with an agile and flexible approach to tailored financing, from debt to equity. They also offer practical expertise to help their portfolio enterprises grow.

“Everything has to be connected with impact, and this is what we look for first,” said Bamboo Investment Director Jorge Farfan. “We don’t look first at the financial return. What we ask ourselves first is: Is this business solving a problem for impact? Is it providing the opportunity for people to access any specific service or basic services in areas such as energy, health or agriculture? Second, how can we measure impact?”

Aligning impact trajectory with financial returns is a specific challenge that all impact investors face.

One of the biggest challenges facing the rapidly-growing impact investment ecosystem is the gap between social enterprises on the ground and investors, often based several thousands of kilometres away. It is key for the development of the sector to proactively enhance collaboration and foster resource mobilization at the ecosystem level.

Juan David Ferreira of Latimpacto, a regional network in Latin America of impact and philanthropic investors, says fostering impact investor communities improves the efficiency and results of deploying resources from the full range of actors across the impact investment spectrum by sharing knowledge and creating connections.

“We have to understand that doing an investment or grant in Africa or Asia is not the same as in Latin America, so we have to start doing a more nuanced approach to what is useful and impactful in Latin America,” the organization’s Program Director for the Latin American and Caribbean region said.

As our EMBAs found out on their Discovery Expedition, the impact investment industry has evolved rapidly in recent years, both to meet the diverse risk-return-impact profiles of investors and to provide tailored financing and other support to social enterprises at various stages of maturity.

This evolution has put impact investment in the vanguard of changing attitudes around purpose and economic growth, showing us how private capital can create wealth and impact to address global imbalances, challenges and inequalities.

With so many professional funds and funding organizations working in different environments around the world, investors seeking to make a positive difference – not just financial returns – have never had so many options available to explore.

elea Professor of Social Innovation, IMD

Vanina Farber is an economist and political scientist specializing in social innovation, sustainability, impact investment and sustainable finance with also almost 20 years of teaching, researching and consultancy experience, working with academic institutions, multinational corporations, and international organizations. She is the holder of the elea Chair for Social Innovation and the Program Director of IMD’s Executive MBA program and IMD’s Driving Innovative Finance for Impact program.

17 July 2024 • by Michael R. Wade, Evangelos Syrigos in Sustainability

Companies that excel in both digital and sustainable transformation attract a stock market premium, according to research. So, how do you tap into that value? ...

11 July 2024 • by Stéphane J. G. Girod in Sustainability

A series of watershed events forced CHANEL out of its comfort zone, culminating in the launch of CHANEL Mission 1.5°. With this new strategy, the luxury fashion house embarked on a journey...

5 July 2024 • by Avni Shah in Sustainability

Creative industries have a key role to play in creating positive social change. Here are six key insights to help them achieve their goals. ...

3 July 2024 • by Richard Baldwin, Salvatore Cantale in Sustainability

The EU Corporate Sustainability Reporting Directive (CSRD) will impose comprehensive and standardized sustainability reporting responsibilities on firms, adding unprecedented complexity to mergers and acquisitions. ...

Explore first person business intelligence from top minds curated for a global executive audience