As we look ahead to the coming year, a range of transformations is taking shape across the tech, pharmaceutical, and fashion sectors.

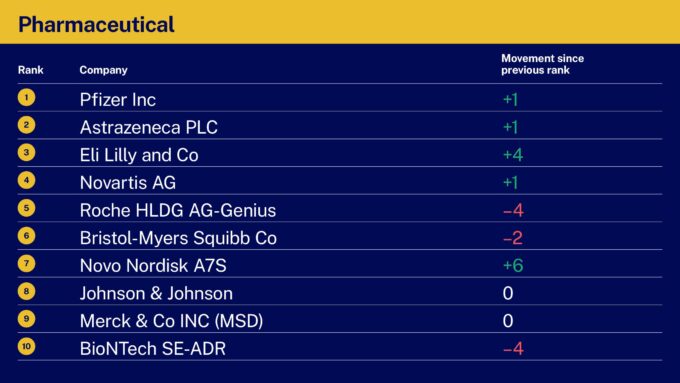

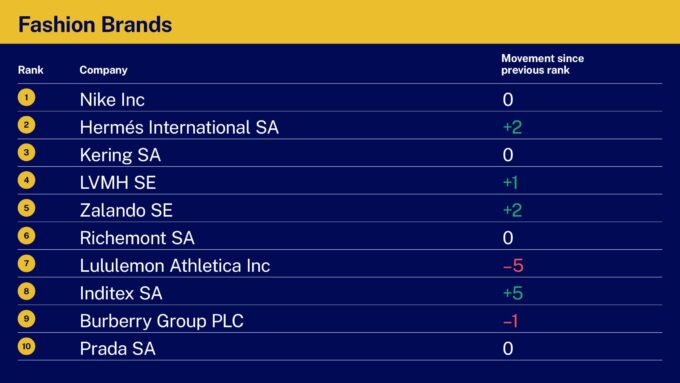

In the tech sector, giants like Nvidia and Microsoft are reshaping the landscape with AI and integrated software solutions. Meanwhile, the pharmaceutical industry, led by companies like Pfizer and Eli Lilly, is boldly stepping into the era of personalized medicine and digital therapies. At the same time, the fashion industry, led by brands like Nike and Hermès, adapts to the relentless ebb and flow of market demands and consumer behaviors.

This tapestry of change, woven by leaders in their respective fields, has been tracked by IMD’s Center for Future Readiness in its latest rankings. These rankings – comprising the Future Readiness Indicator – paint a vivid picture of which industry leaders are dominating into the new year and offer key insights into what others can learn from their examples.

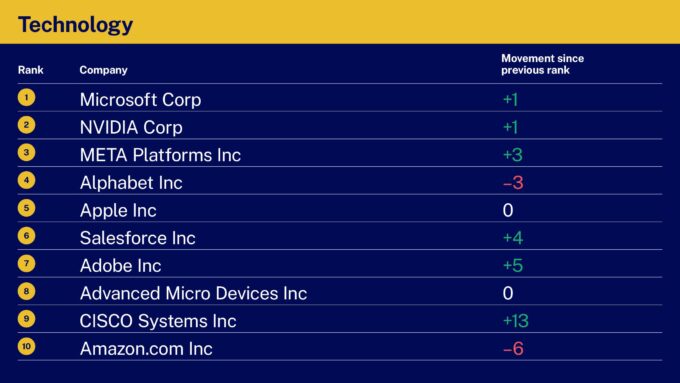

From Alphabet’s slip to Nvidia’s rise: The 2023 tech sector shuffle

With Microsoft out front, Alphabet saw a slight dip in its position, falling from second to fourth, while Nvidia edged upward, securing the second spot from its previous third. Amazon experienced a more pronounced drop, descending from sixth to 10th place. Netflix, despite the increasing competition in the streaming sector, managed to sustain its rank at 12, and Tencent maintained its position at 11, showing resilience in the gaming industry.

Audio available

Audio available