IMD business school for management and leadership courses

Future Readiness Indicator

Fast-tracking and future-proofing financial services

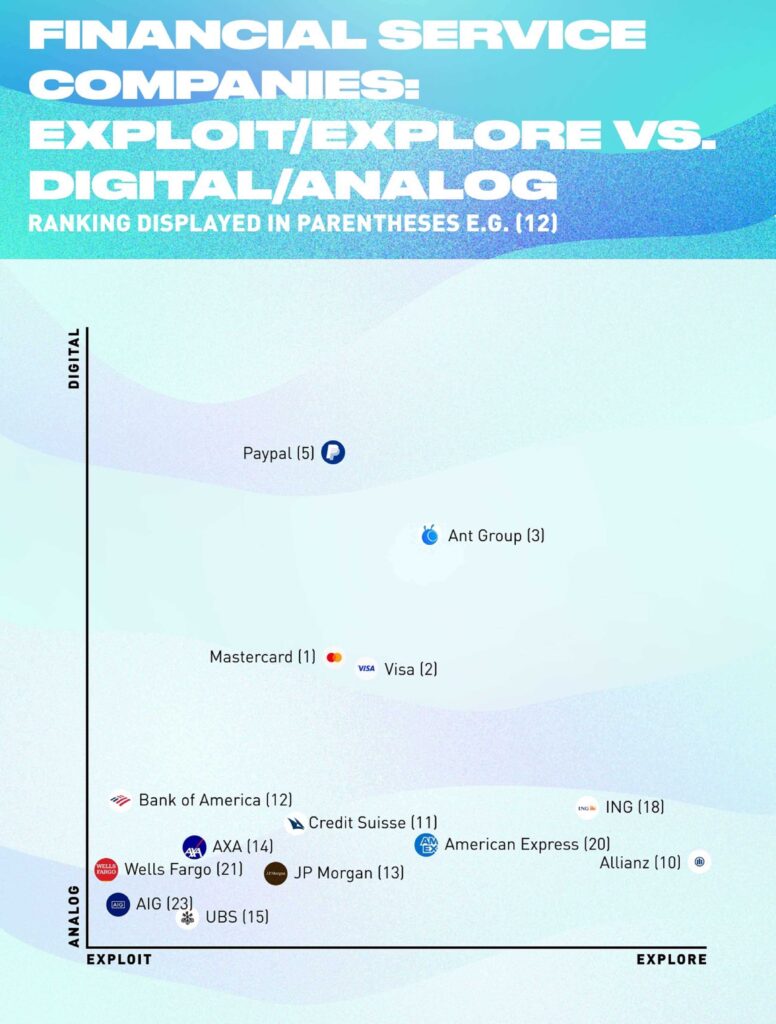

Square and PayPal are the obvious winners, but incumbents such as Mastercard and Visa are also faring well.

To calculate the composite score, we used only hard data that is publicly available and has objective rules. We avoided soft data such as polls and surveys. We measured fundamental drivers that fuel innovation, including the health of a company’s current business, its workforce diversity, its governance structure, the investments it has made against its competitors, and the speed of its new product launches. You can review our methodology here.

An obvious question arises: How did Mastercard and Visa prosper at a time when the “plastic card” has been deemed irrelevant in the age of Apple Pay and Google Wallet? The answer lies in the idea of “if you can’t beat ‘em, join ‘em”. Mastercard and Visa were both quick to realize that they couldn’t outrun other fintech upstarts or tech giants, but instead needed to partner with their rivals. By making their infrastructure useful to their enemies, they were able to prosper at the same time as their rivals.

Mastercard and Visa are now working with PayPal, Apple, and Google to create new market opportunities. They make collaboration easy by investing in application programming interfaces (APIs) that are both secure and easily accessible. This ensures tech giants like Apple feel comfortable, while cryptocurrency exchanges such as CoinBase find them to be valuable partners.

However, we also ran another type of analysis. As a second step, my research team downloaded every annual report available from the last 10 years, together with all the transcripts of investors’ earning calls, and then fed these into an algorithm. We wanted to see how companies write about themselves and how CEOs and CFOs defend themselves during tough questioning by Wall Street analysts. Specifically, we wanted to look at how digitally obsessed their companies are.

Of course, it’s not enough to just talk a lot about digital. Companies must also bring digital innovations into the marketplace, which requires them to focus on a few targeted areas. Spreading investments everywhere can waste both money and resources, meaning there are tough choices to make. Without such, a company can end up making a millimeter of progress in a million directions.

Therefore, we added a second dimension to the study. We wanted to see how focused and committed these companies are. Are they merely open-minded and exploring everywhere, or are they committed to exploiting a few chosen areas to their full potential? Do they rigorously monitor their progress?

How does it look when we combine this exploit–explore spectrum with digital? On the two-by-two grid below, the numbers are the companies’ ranking from the first chart.

Here are the takeaways. First, in finance a company has to be digital to win. There will be no banks in the future, only tech companies that happen to lend money or process payments.

Second, to prepare for the future is to walk the line between exploring new areas and exploiting existing opportunities. Keeping an open mind is important in the early phases of innovation, but to win in digital these days, it isn’t enough to keep running prototypes and taking on new pilots. Companies need a targeted allocation of resources, and that demands a strong focus to scale up early successes that have already been validated. They need to track new progress rigorously. And most of all, they need commitment.

In short, the organization must align with a shared viewpoint.