IMD business school for management and leadership courses

Future Readiness Indicator

In our ranking, Kering—the owner of Gucci, Saint Laurent, and other brands—sits at number three while Hermès comes in at a close fourth. Louis Vuitton comes in at fifth place, while Richemont—with Cartier and Mont Blanc under its belt—appears at sixth.

At IMD’s Center for Future Readiness, we track how ready companies are preparing for a changing future. Being future-ready is also a source of resilience during a recession. Our approach is quantitative. We use only hard market data to arrive at a composite score. We focus on measures that have been shown to fuel innovation, and we look at the financial health of a company and its growth prospects. We also review employee diversity, brand value, and degree of internationalization. You can read more about our method here.

The only non-luxury fashion companies that managed to break into the top ranks in 2022 were Nike and Lululemon. This is largely due to their stellar direct-to-consumer channels. It’s not because they operate their own retail stores—anyone can do that. However, they use technology—apps, digital supply chains, and omni-channels—to build a community of users.

Digitalization is not merely about front-end consumer experience: it doesn’t equate to e-commerce.

Every company on our ranking already has a decent website and a high quality app, but these are merely starting points. Top companies like Nike have mastered digital supply chains, allowing consumers to personalize their products and have them arrive within weeks. Nike can make a good profit from such seemingly complicated operations.

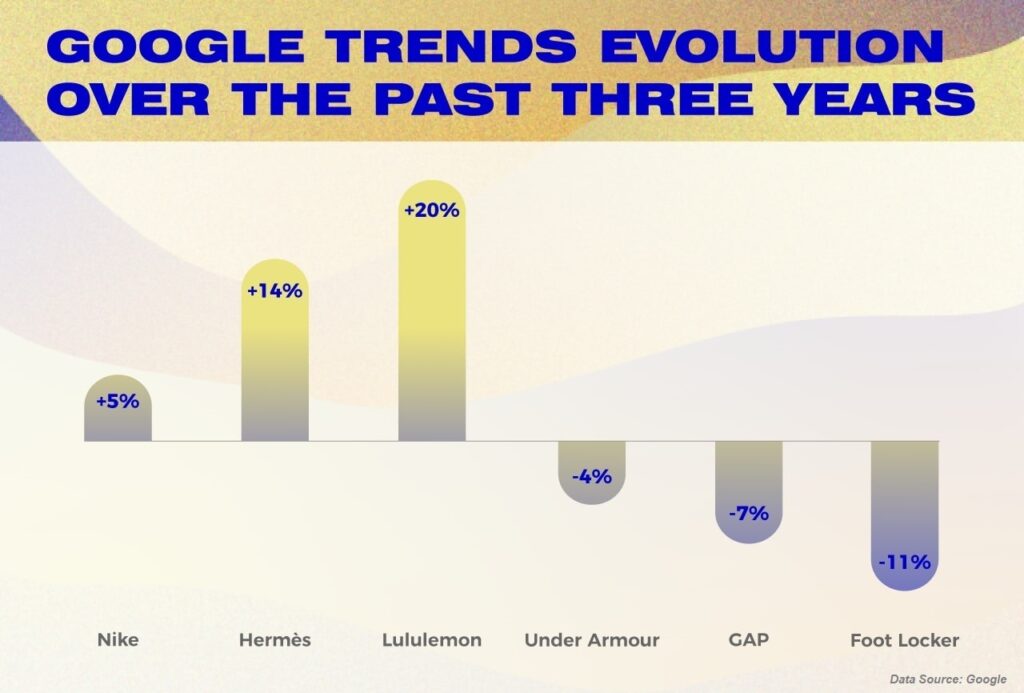

More importantly, however, is the fact that Lululemon and Nike are as strong brand-builders as are Gucci and Hermès. Nike markets itself to professional athletes. Its top-end running shoes contain very real technologies for optimum performance. Hermès, another top-ranking brand, sells to the chic ultra-rich. But in reality, these brands sell by the billions because their entry-level goods are intended for mass consumption.

The implication is that brands must think of themselves as platforms for expression rather than as product designers. The top companies in our readiness ranking all work with key opinion leaders to ensure the leaders don’t just endorse a brand. Instead, the leaders engage in an artistic endeavor or athletic performance through the brand itself. These opinion leaders may or may not be elites in the economic sense—their creativity and social influence can come from anywhere.

With everyone being so connected nowadays and with social media platforms driving the majority of people’s attention, all successful brands are changing themselves to depend less on standard advertising. Brands are now looking for ways to capture happy accidents that will lead to sales and—more importantly—make the brand become a cultural phenomenon.

This is why Metaverse and NFTs are new playgrounds for top-ranking brands to explore. There, these brands can work with artists and video gamers to keep themselves relevant with the cool crowd. On the online gaming platform Roblox, a virtual Gucci bag fetched more than its real-life equivalent. Roblox also created an interactive playground called Nikeland, where players could find Nike buildings, fields, and arenas. On Nikeland, people played basketball and football matches as well as various mini games. Rewards were earned by completing challenges while unique items could be unlocked.

In order to maintain a brand’s prestige, it must express itself in an avant-garde way that is appealing to “cool people.” A brand’s image is no longer solely controlled by the company— instead, cool people help shape and define the company’s public persona. If this relationship is managed well, then both casual consumers and money will follow. This is the strategic logic that future-ready brands will use in 2023.