IMD business school for management and leadership courses

How Nio and BYD become the next Tesla

Who will become the next Tesla?

Carmakers, previously preoccupied with the chipset bottleneck, are now recognizing the need for future readiness, particularly in the realm of electric vehicles (EVs). Companies like Tesla, BYD, and other leading automakers are spearheading this transformation, emphasizing the importance of EVs in the automotive landscape.

The pursuit of EV technology is becoming the next battleground for automakers worldwide, including established giants like Toyota and Ford and new players from China. This shift is driven by various factors such as increasing environmental concerns, governmental policies favoring emission reductions (especially in Europe), and consumer demand for more sustainable transport options.

In this rapidly evolving scenario, the auto industry must recalibrate its strategies. These companies now heavily lean toward electrification, new technologies, and robust partnerships within the value chain. The focus is no longer just on overcoming the immediate disruptions like the pandemic or the semiconductor shortage but on embracing a transformative approach towards EVs.

The Future Readiness Indicator by the IMD Business School highlights automotive companies that are effectively embracing the future. We’ve evaluated how well companies are adapting to the changing landscape, with a keen focus on the transition to electric vehicles.

We’ve identified which companies are positioning themselves to become the next Tesla, indicating their potential to lead in the era of EVs.

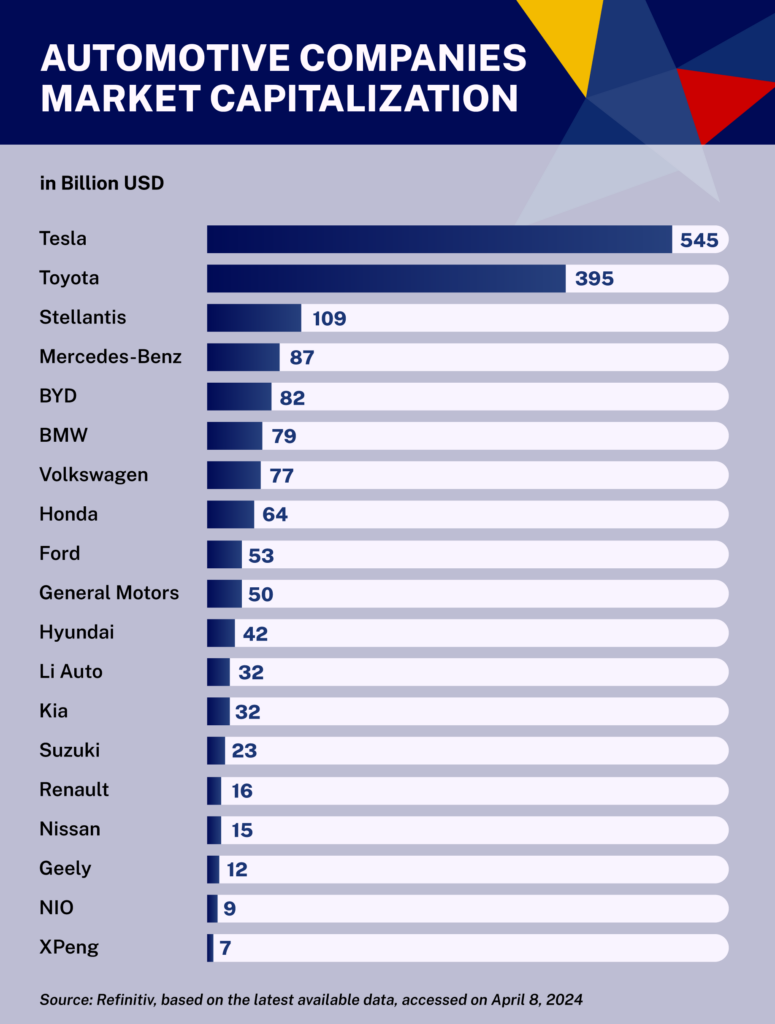

The market capitalization of automakers

Market capitalization reflects the total market value of a company’s shares, often indicating a company’s size, market influence, and financial strength.

For automakers, it can provide insight into their economic health, investor confidence, and their potential for growth and innovation in the industry. High market capitalization can suggest a company’s strong position to invest in new technologies, expand operations, or weather economic downturns.

This is particularly relevant as the industry evolves with electric vehicles and autonomous driving technologies.

Elon Musk’s Tesla is at the top with a market capitalization of $695 billion, reflecting its pioneering role in the EV industry. Tesla’s aggressive expansion into new markets and innovation in battery technology have been key drivers.

Furthermore, Tesla’s ability to generate buzz, its direct-to-consumer (D2C) sales model, and its global brand recognition contribute to its valuation. The company’s market cap is also a reflection of its growth prospects, which investors often value highly in the technology sector.

Japanese automaker Toyota follows with a $262 billion market cap. The company’s cautious approach to EVs could be seen as a strategic lag due to its desire to capitalize on its existing investment in hybrid technology, but there’s a risk that this strategy may cause it to miss out on the burgeoning EV market, which is rapidly changing with consumer preferences and regulatory pressures favoring zero-emission vehicles.

BYD, with $91 billion, signals its growing prominence, especially in the EV sector. The company has seen substantial sales growth, especially in its home market of China. In fact, BYD ended 2023 with annual sales of over three million, outpacing even Tesla.

BYD’s vertical integration strategy, producing its own batteries, gives it a competitive edge in cost and supply chain management. Its focus on pure electric and plug-in hybrid vehicles shows a clear commitment to the EV space, which is an area of significant growth within the automotive sector.

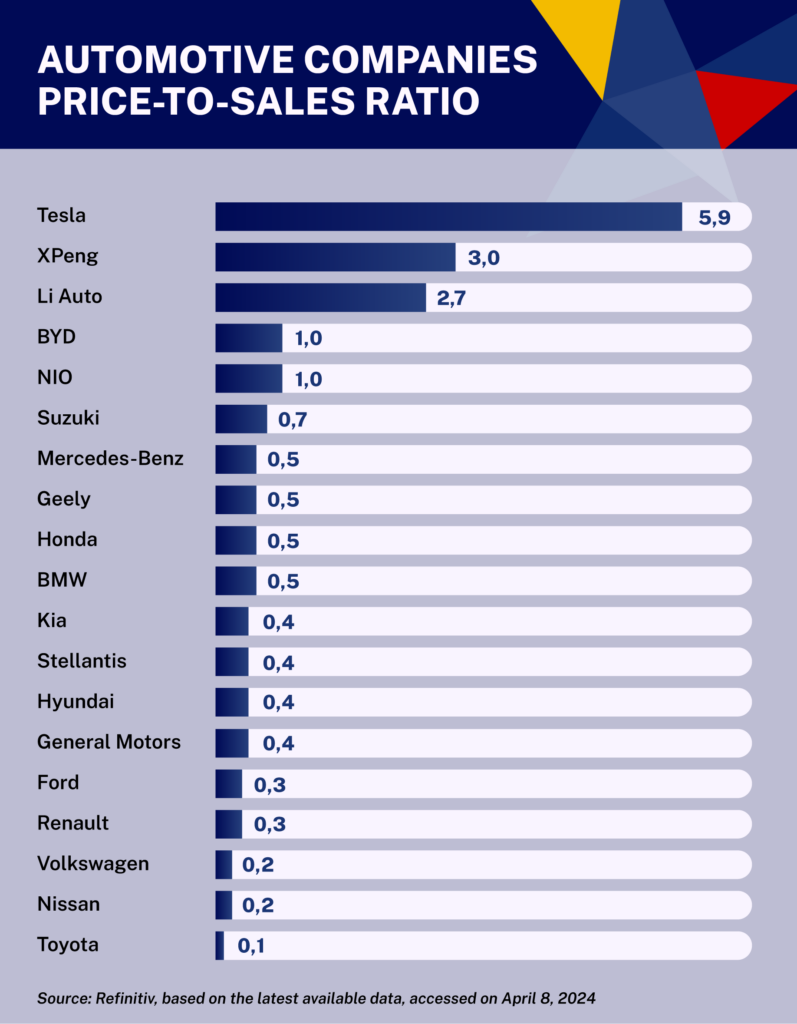

Automotive companies’ price-to-sales ratio

The price-to-sales ratio is a valuable metric for evaluating automotive companies. It’s calculated by dividing a company’s market capitalization by its annual revenue. This ratio helps in assessing a company’s value relative to its sales, offering a clearer picture of its financial health and market valuation.

A lower ratio could indicate a potentially undervalued company, while a higher ratio might suggest overvaluation. It’s particularly insightful in the automotive industry where sales figures are crucial indicators of company performance and market position.

Tesla stands out with the highest ratio of 7.6, suggesting high market expectations for future growth relative to its current sales. Nio and Xpeng, also in the EV sector, show elevated ratios, which could indicate investor optimism about their growth prospects.

BYD and Toyota have moderate ratios, reflecting a balance between their market valuations and sales revenue. Traditional automakers like Volkswagen, Nissan, and Renault have the lowest ratios, potentially indicating undervaluation or mature markets with less growth potential.

Disruptive dynamics in electric vehicle innovation

To break into an old industry, you have to play a new game. What’s clear is this: Nio and BYD are built on the capabilities of the future, not of the past. Whether there’s a semiconductor shortage or not, they’re busy preparing for the next battleground. Traditional carmakers should be on high alert.

BYD

BYD is a classic case of low-end disruption. From day one, it never intended to be a car company. In the mid-1990s, it was a battery manufacturer making nickel-cadmium batteries for Motorola, Nokia, and Sony Ericsson.

Then, like all things in China, BYD scaled up and moved up the value chain. It entered segments such as electric bikes and then went into electric scooters and mopeds. Next, it got into electric buses. Every step along the way, the company reverse-engineered other brands’ vehicles. It copied, improved, and started to innovate on its own.

What BYD innovates is the engineering process. It’s a company that loves manufacturing, investing in battery factories, assembly lines, and the fabrication of semiconductors. BYD invested exactly in those areas that require heavy capital investment and also happen to be labor-intensive. They are also areas that BYD’s Western counterparts have shunned for a long time.

So, when BYD began building its sedans, it was the only car company with an integrated supply chain. It feeds itself with batteries and semiconductors, yet it’s smart enough to follow the playbook of TSMC — the world’s biggest semiconductor manufacturer.

BYD extends its reach beyond competing with other carmakers by supplying critical components like batteries and electronics to players like FAW and Toyota. Their semiconductor division, a key player in securing chip supply for BYD itself, remains an internal growth priority for now, unlike earlier plans for an external IPO.

So, if manufacturing in the past was about the mastery of internal combustion, then BYD is the powerhouse of tomorrow.

Nio

Nio stands out in the automotive world, especially among Chinese companies, with its focus on business model innovation in the high-end electric vehicle (EV) segment.

After establishing Norway as its initial beachhead, Nio has begun deliveries in Germany and recently announced entry into Denmark, marking a confident expansion into the European market. Unlike traditional joint ventures, they’re opting for a direct-to-consumer (D2C) sales model.

While not as heavily invested in massive manufacturing as BYD, Nio prioritizes cutting-edge software development. They’ve made strides in over-the-air (OTA) updates for user interfaces and infotainment systems. A recent partnership with Tencent highlights their focus on cloud technology and high-precision maps.

Overall, Nio represents a bold adaptation to the future of mobility, distinct from BYD’s emphasis on vertical integration and battery technology. Their focus on premium, lifestyle, and technology positions them as potential game-changers in the industry.

Traditional carmakers should indeed be on high alert, as Nio’s innovative approach has the potential to redefine the electric vehicle experience.