IMD business school for management and leadership courses

Why Tesla and BYD are Pulling Ahead of Rest

This article was originally posted in the South China Morning Post.

It’s clear that the market is experiencing a seismic shift and we need to react accordingly,” Uber CEO Dara Khosrowshahi wrote. The shift is in the collapse of tech stocks this year. From Netflix and Spotify to Coinbase and Robinhood, they have all lost more than 60 per cent from their peak.

It is in this environment that Khosrowshahi said he would slash Uber’s marketing spend and freeze hiring.

Much of the acceleration by tech companies seems to have halted amid the pandemic. Not only are people starting to return to their offices, but all that cheap money and government stimulus

measures are drying up. But business as usual is exactly what carmakers cannot afford to do now.

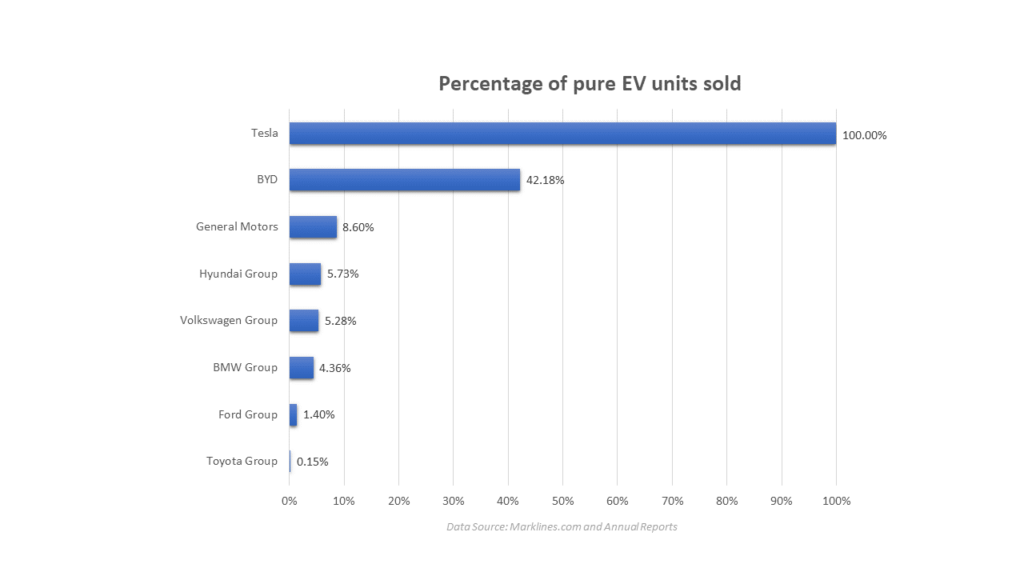

While Tesla is selling pure electric vehicles, practically everyone else is making hybrids.

And everyone agrees that hybrids are the transition to all-electric models. Like any transition solution, it is a hedging strategy that is useful when a company should wait for a stronger signal. But it can become a burden by preventing the management team from furthering the commitment to an eventuality.

A company’s percentage of sales of pure electric vehicles helps indicate corporate commitment to that eventuality. After Tesla, the world’s second-largest pure electric-vehicle seller is Shenzhen-based BYD, with more than 42 per cent of sales, according to MarkLines. General Motors comes third with slightly above 8 per cent. Giants such as Toyota Motor stand at a meagre 0.15 per cent.

The general conservatism of the big carmakers thus stood out. Toyota and Volkswagen face challenges not just in mastering new skills. They also need to convert their sprawling factories from building petrol-guzzling cars to those powered by lithium-ion batteries.

When you are a maker of pure electric vehicles like Tesla, you will pursue world-class battery technology and master it inside out. However, when you keep producing hybrids, you can always use petrol to power an engine when the battery runs out. By avoiding the hard work, engineers may fail to master the skills required in electrification. Worse, they may get stuck in the transition solution and never move past it.

At a time when all the traditional carmakers are being hurt by the semiconductor shortage, only Tesla has the flexibility in sourcing the parts.

“We design circuit boards ourselves, which allow us to modify their design quickly to accommodate alternative chips like power chips,” one Tesla employee said.

In other words, Tesla’s pursuit of vertical integration has enabled the company to venture into areas other traditional carmakers had shunned. And the effort has now paid off for it.

BYD is also busy expanding its own semiconductor manufacturing. Already self-sufficient on chipset supplies, it will soon become a supplier for others, too.

And that is how Tesla and BYD are going to pull further ahead.