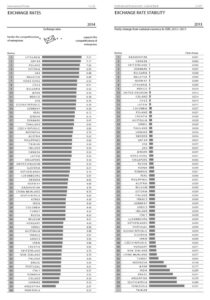

How will currency fluctuations impact competitiveness?

The latest currency fluctuation wave in Europe will indeed impact several competitiveness criteria. In terms of the World Competitiveness Yearbook hard statistics, such an impact will be felt in the long-term. Changes in exchange rates will resonate, for example, in indicators such as stock prices and export sales for 2016 (if not later).

Currency stability, however, is fundamental for the degree of confidence that economic actors have in a particular economy. In this sense, there are competitiveness indicators that will display the impact of fluctuations more substantially in the short-term. We expect therefore that data gathered through our 2015 Executive Opinion Survey will exhibit such an impact. For example, we largely expect survey participants residing in directly affected countries to conceive of exchange rates as a hindrance for the competitiveness of enterprises. In addition, opinions about the resilience of those economies to withstand economic cycles could become unfavourable.

The image abroad or branding of some countries may be affected negatively, which could eventually impact business development in those economies. Respondents may take an adverse stand in regards to the government. For example this could affect their impressions about the adaptability of government policy to changes in the economy, the effectiveness of the implementation of government decision and, in some cases, the likelihood of an increased risk of political instability.

Perceptions about credit availability and the financing of companies could also suffer. It could be the case that respondents find that credit is not easily available for businesses and that the levels of financing to companies are inadequate. In addition, opinions about the banking and financial services could shift. Respondents may perceive a decline in the support that these institutions provide to businesses. Undoubtedly, assessments of risk factors in the financial system will be affected as well as the relationship between the cost of capital and business development. Capital markets (foreign and domestic) could be found as inaccessible. At the same time, survey respondents may find that the investment environment in their respective countries lacks attractiveness for foreign investors.

To sustain competitiveness it is fundamental for countries to maintain the levels of confidence that their institutions enjoy which in turn depends on the perceptions of market agents. In this sense, our Executive Opinion Survey is an accurate tool to gauge and capture market sentiments about current economic events. Be ready then for a “reality check,” we compile the 2015 survey results by the end of May.

Research Information & Knowledge Hub for additional information on IMD publications

The past year has shown how geopolitical disruptions can simultaneously raise risk levels and generate new opportunities across sectors. Trade fragmentation, intensifying strategic competition in technology, and pressure on supply chains have made...

China’s export-driven economic model is sharpening a trade-off western policymakers know all too well: shielding domestic industry usually comes at the cost of higher prices. Politicians face an uncomfortable choice: disappoint voters worried abou...

When European Central Bank president Christine Lagarde warns that Europe’s “old growth model” has aged and its reliance on exports is now a “vulnerability”, it is worth listening. Central bank heads rarely use such choice language. In an eye-openi...

They threaten traditional car industries but are good for consumers and bring investments. The region will have to recalibrate its strategy. This is the third in a limited Opinion series on the Chinese economy. The first on the squeezed middle cla...

The Gulf’s search for influence beyond oil now runs through Africa. Sovereign wealth fund the Qatar Investment Authority is investing $500 million in Ivanhoe Mines, a Canadian company that produces copper and other key minerals in Africa. The deal...

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications