The future-solving methodology: Insights on AI and leadership

Brian Evergreen shares radical insights from his book Autonomous Transformation: Creating a More Human Future in the Era of AI with IMD’s Stefan Michel....

by Jialu Shan, Michael R. Wade Published March 7, 2024 in Finance • 10 min read

The rapidly evolving digital landscape has prompted industries across various sectors to reassess their strategies and perspectives. In light of this, the findings from the latest Digital Vortex survey, the latest version of a biennial study that we first carried out in 2015, offers valuable insights into how the financial services industry perceives different waves of digital disruption.

According to IMD’s Global Center for Digital Business Transformation, digital disruption refers to the impact of emerging digital technologies and innovative business models on an organization’s value proposition and market position. A wide range of technologies are included, such as mobile applications, social media, blockchain, and artificial intelligence. Notably, digital disruption can be both an opportunity and a threat.

In the 2023 ranking, the financial services industry jumps to third place as one of the sectors currently most affected by digital disruption, marking a significant shift from its previous fifth position. Only the technology and education sectors rank higher in terms of vulnerability to digital disruption.

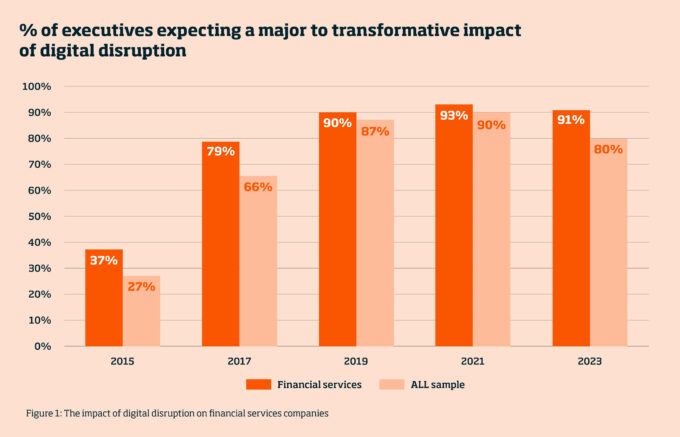

Indeed, two-thirds of industry respondents report that digital technologies are already disrupting their business. Moreover, 91% believe the sector will undergo a ‘major or transformative’ change and that the rate of change will accelerate in the next five years. In other words, while disruption is happening now, almost all surveyed respondents believe more significant changes are yet to come across the financial services industry. It is also worth noting that this belief is higher than the average across all sectors.

Worryingly, while a third of those surveyed deem their organization’s IT systems well prepared for the impact of digital disruption, almost as many (30%) report that they are not ready to meet those challenges. Clearly there remains much to be done to be ready for the impact of disruption.

When examining the evolution of perceptions from 2015 to 2023, the data tells a compelling story. More than three-quarters of executives today believe that digital technologies have already brought about disruptions in the financial services industry. This is in sharp contrast to the results of the first Digital Vortex survey in 2015, when a mere 10% of the respondents held this perspective. It is worth noting that a surge in perception coincided with the peak of the COVID-19 pandemic, which likely accelerated the adoption and reliance on digital technologies in financial services.

Similarly, there has been a sharp increase in concerns about disruption in the future, with the percentage of respondents within the financial services industry believing it to be major or transformative, rising from 37% in 2015 to 91% in 2023 (refer to Figure 1).

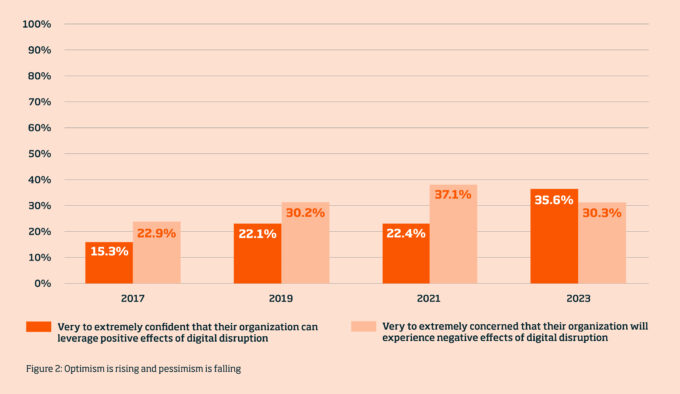

From 2017 to 2023, the financial services industry has reported a growing confidence in its ability to leverage the positive effects of digital disruption. While concerns about the adverse impacts of digital disruptions peaked in 2021, by 2023, they had dropped below 2017 levels. Indeed, in 2023, approximately 75% of executives expressed some degree of confidence, while 52% reported being more concerned. These figures were 50% and 62%, respectively, in 2017, indicating that many more financial services executives are now confident that they will be able to leverage the opportunities that come with digital disruption.

In fact, we do not have to look hard to find proof of digital opportunities in the industry. The fintech sector, for instance, is booming. According to CBInsights, there are already 218 fintech unicorns – startups whose valuation exceed $1bn – and a staggering 182 of these joined the club after the onset of the COVID-19 pandemic.

Interestingly, as shown in Figure 2, financial services executives are becoming more optimistic and less concerned about their ability to respond to digital disruption.

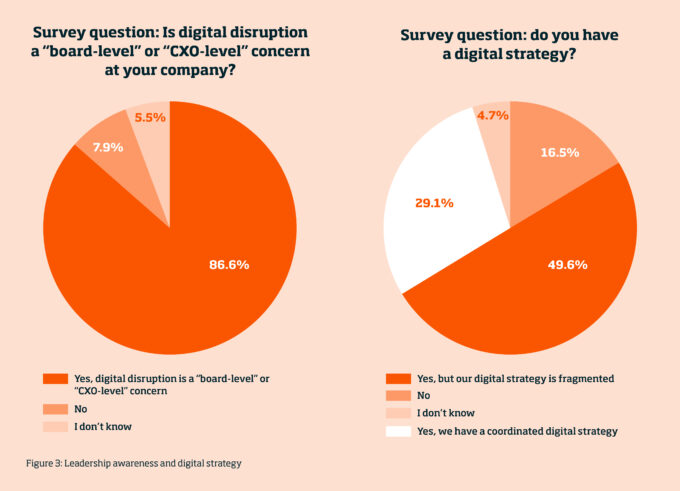

Respondents broadly acknowledge that digital disruption is a “board-level” or “CXO-level” issue. According to our survey, the percentage of executives who consider digital disruption a top priority at their organization has steadily increased over the years, reaching 87% in 2023.

Nevertheless, as Figure 3 shows, a significant portion of financial services companies still need to fully embrace a coordinated digital strategy, with less than 30% of the companies surveyed reporting having a well-coordinated digital strategy in place. Half of the surveyed companies do have a digital strategy, but a fragmented one. This suggests that while most companies have taken steps towards digital transformation, there is still work to be done in terms of aligning and integrating their various digital initiatives. 16.5% of financial services companies have no digital strategy at all, leaving them at elevated risk of falling behind their competitors in an increasingly digital-driven landscape.

The financial services industry is relatively more advanced than the average for all sectors when it comes to having a coordinated digital strategy. In fact, within the broader sample, which includes all sectors, only 22% of respondents are said to have a coordinated digital strategy.

However, despite this relative advantage, our research suggests there is still a significant lag in the pace of digital transformation within the financial services industry. In fact, the 2023 Digital Vortex report reveals that a significant number of the surveyed financial services companies, approximately 30.7%, either lack awareness of the importance of digital disruption or are not responding appropriately. This indicates a concerning gap in understanding and readiness within the industry. Furthermore, only 28.3% of financial services companies are reportedly actively responding to digital disruption, while most (40.9%) are choosing a “follower” approach, waiting for others to innovate and then imitating their actions.

It is particularly striking that these numbers have remained unchanged since the baseline in 2015, despite the heightened awareness of digital disruption over the years. This shows that there is still a significant gap between awareness and readiness within the sector. Established banks may face challenges in adopting new technology due to their outdated legacy systems, which may not work well with modern solutions. Moreover, regulation and compliance issues may also hinder digital transformation, as they may restrict the scope and speed of innovation. However, these factors should not stop companies from taking a more proactive role in embracing digital disruption and enhancing their competitiveness.

“It will take fearless leadership to change the corporate culture and respond to market changes quickly and efficiently.”- Response from the Digital Vortex survey

In 2023, financial services executives are less worried about the negative effects of digital disruption than they were in 2021. They have also gained more confidence in their ability to leverage the positive impacts of digital disruption over the past seven years. Our results suggest that the financial services sector is aware of the challenges and opportunities that digital disruption brings and is willing to adapt and innovate to survive and thrive in the digital age.

However, the “knowing-doing gap” should not be ignored, and businesses must take proactive steps to bridge this gap to stay competitive in the digital age. While the financial services industry has made progress in digital transformation, there is still work to be done to fully embrace a coordinated digital strategy. Many companies have yet to seamlessly integrate digital initiatives throughout their organizations. To unlock the full potential of digital disruption, financial services companies should invest in digital innovation and adopt a proactive mindset. By doing so, they can stay ahead and meet evolving customer needs, positioning themselves for long-term success in the digital age.

The 2023 Digital Vortex survey paints a vivid picture of the changing perceptions across key industries. As the winds of digital change continue to blow, it’s evident that sectors are bracing themselves for the challenges and opportunities ahead. The findings also serve as a benchmark and a wake-up call for the companies lagging behind or following the crowd, and as a source of inspiration and motivation for the companies leading the way or aspiring to do so.

Research fellow at the Global Center for digital business transformation

Jialu Shan is a research fellow at the TONOMUS Global Center for Digital and AI Transformation, and an associate research director at the Center for Future Readiness at IMD Business School. Her research areas include digital business transformation, business model innovation and new practices, and corporate governance practices. She is particularly interested in the Asian market. Jialu has a PhD in economics (management) from the Faculty of Business and Economics at the University of Lausanne. Before joining IMD she worked as a lecturer at the International Hotel School of César Ritz Colleges in Brig, Switzerland.

TONOMUS Professor of Strategy and Digital

Michael R Wade is TONOMUS Professor of Strategy and Digital at IMD and Director of the TONOMUS Global Center for Digital and AI Transformation. He directs a number of open programs such as Leading Digital and AI Transformation, Digital Transformation for Boards, Leading Digital Execution, Digital Transformation Sprint, Digital Transformation in Practice, Business Creativity and Innovation Sprint. He has written 10 books, hundreds of articles, and hosted popular management podcasts including Mike & Amit Talk Tech. In 2021, he was inducted into the Swiss Digital Shapers Hall of Fame.

May 30, 2025 • by Brian Evergreen, Stefan Michel in Digital transformation

Brian Evergreen shares radical insights from his book Autonomous Transformation: Creating a More Human Future in the Era of AI with IMD’s Stefan Michel....

May 13, 2025 • by Mark J. Greeven, Sophie Liu, Wei Wei in Digital transformation

How CR Beer, the brewer of Snow beer and the exclusive Chinese partner of Heineken, redefined its legacy by shifting from mass‑market volume to premium innovation and Baijiu diversification under the bold...

May 12, 2025 in Digital transformation

In an era defined by advanced AI and behavioral data, Apple’s 'Evil Steve' test exemplifies a proactive approach to ethical decision-making and responsible data governance....

May 12, 2025 • by Julia Binder in Digital transformation

Sustainable corporate change is a challenging feat to pull off. Julia Binder examines the barriers and drivers of change to increase your chances of success....

Explore first person business intelligence from top minds curated for a global executive audience