The Power Triad: Three moves to reignite progress for women leaders

Women’s progress has stalled because organizational systems fail them. Fixing this means recalibrating three things: succession slates, sponsorship, and executive feeder roles....

by Howard H. Yu Published July 23, 2025 in Innovation • 5 min read

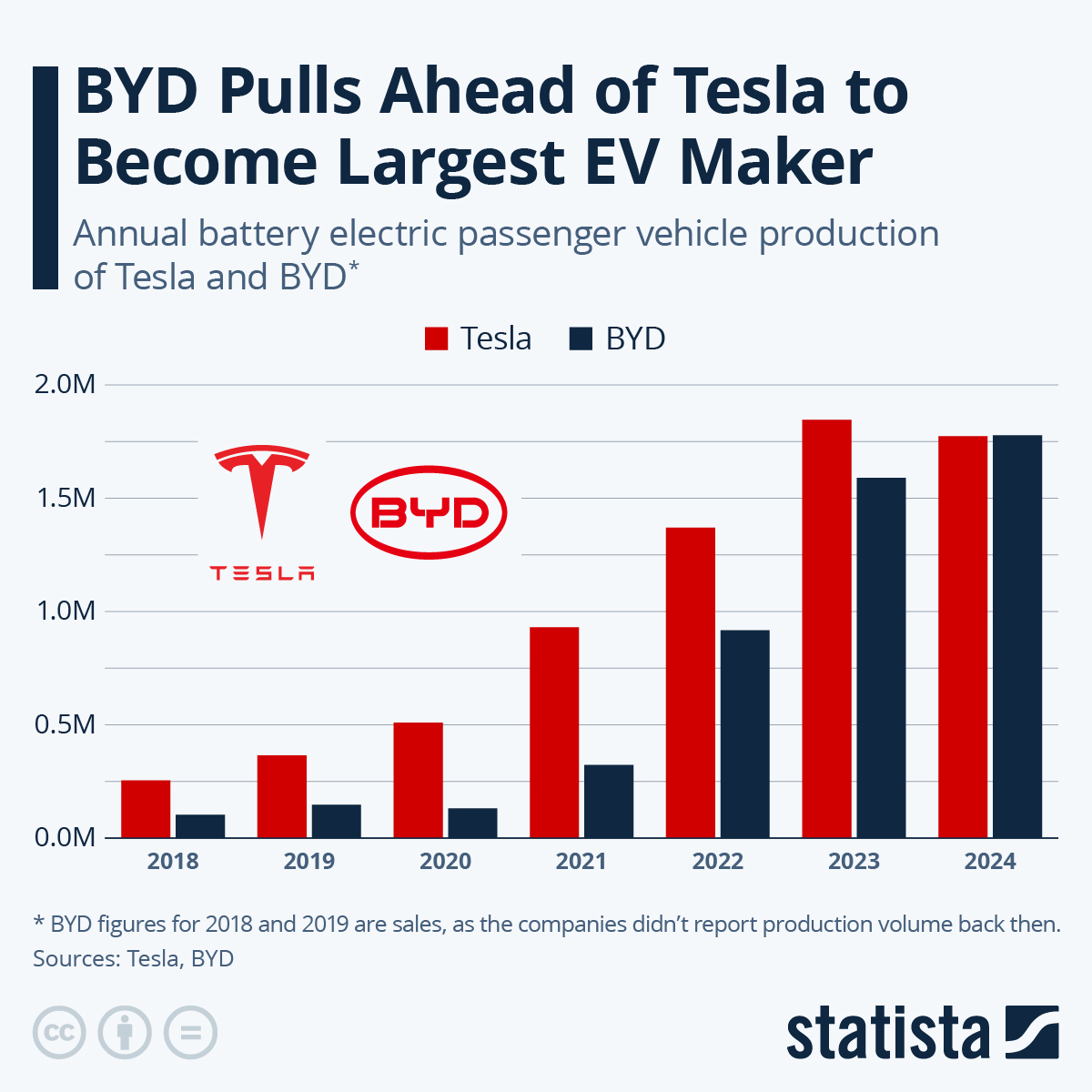

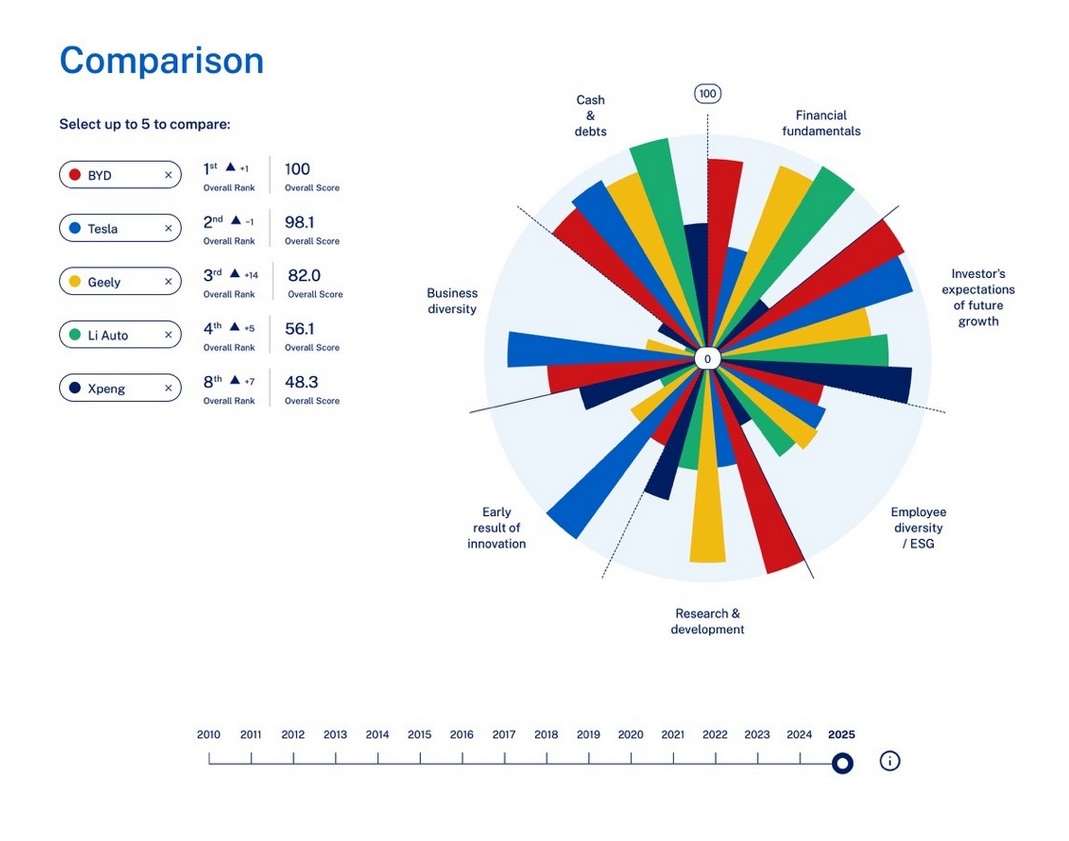

IMD’s latest Future Readiness Indicator for the automotive sector, released in May 2025, corroborates this trend, with Chinese automakers securing three of the top four spots ahead of traditional incumbents, including Kia, VW, Toyota, Ford, and GM. BYD led this year’s indicator (ahead of Tesla), with Geely securing the third spot, and Li Auto fourth. Another EV manufacturer, XPeng, took eighth position overall.

The Future Readiness Indicator assesses a company’s preparedness for the future. We use a rule-based methodology to arrive at a composite score for each company, enabling us to identify industry leaders. We can then investigate the behaviors and attitudes of specific companies. This includes evaluating key factors such as financial fundamentals, investor expectations of future growth, business and employee diversity, research and development, innovation, and cash and debt management.

Chinese automakers all climbed in the rankings this year, with notably strong scores in the Investors’ Expectations of Future Growth and Research and Development categories. This reflects the technical prowess of companies like BYD, XPeng, and Li Auto. XPeng has done well because of its heavy investment in the self-driving space, and Li Auto stands out because it launches new models or updates in half the time or less than traditional OEMs, thanks to a start-up style organization.

For more in-depth analytics and comparative graphs of our top companies, visit our automotive industry webpage.

However, competition in the world’s largest car market has become fierce, with price wars abounding. For Chinese automakers to ensure their future, they need to look beyond China. BYD, for example, has set the ambitious target of selling half its cars outside of China by 2030. Tariffs and regulations have effectively excluded it from the US, so its focus is on Europe and Latin America, and it is making headway with BYD registering more pure EV cars in Europe than Tesla for the first time in April 2025, despite increased tariffs on Chinese-made EVs.

Chinese automakers should invest in building brand recognition and trust if they want to become serious contenders on the global stage.

To continue to grow and thrive takes more than just leading from a technical perspective. As EV technology becomes commoditized, Chinese automakers should invest in building brand recognition and trust if they want to become serious contenders on the global stage. Many Western consumers may not have heard of XPeng or Li Auto. BYD is better known, mostly thanks to Warren Buffett’s backing and some public transit buses being sold abroad, but it still lacks the household name status of Toyota or Ford.

Building a brand takes time, along with a proven track record of reliable vehicles and excellent customer service. To win over skeptical Western consumers, Chinese automakers will need to significantly invest in marketing and demonstrate that they can meet – if not exceed – local safety and quality standards. Any early missteps, such as a high-profile reliability issue, could set back the whole cohort by feeding into biases that Chinese products are lower quality – a stereotype they must actively disprove. Chinese automakers also have to work with their government to allay rising fears that buying a Chinese-made EV is a security concern.

Building a brand takes time, along with a proven track record of reliable vehicles and excellent customer service. To win over skeptical Western consumers, Chinese automakers will need to significantly invest in marketing and demonstrate that they can meet – if not exceed – local safety and quality standards.

Another challenge is that consumer preferences and design tastes vary by region. What Chinese customers want, such as certain AI features, in-car karaoke systems, or specific styling cues, may not directly translate to Western tastes.

There is also the issue of regulatory and political acceptance, which may force Chinese automakers to invest in foreign factories. This is something BYD is already doing with a BYD EV factory in Hungary set to begin production later this year. ‘Going global’ will require Chinese firms to become more multinational in operations and evolve beyond the status of exporters. That means hiring local teams, complying with local labor and environmental norms, and possibly partnering with local players.

The Japanese and Korean entry into Western markets offers an important lesson.

The reality is that there is precedent for what Chinese automakers are attempting. Just as you can look back at moments of volatility to scenario plan, we can look back at past successes and learn.

The Japanese and Korean entry into Western markets offers an important lesson. Japanese cars in the 1970s-80s transformed from being cheap, fuel-efficient curiosities to dominant, trusted global brands (think Toyota, Honda, Lexus, and Mazda), through consistency and understanding local needs. The same goes for other Japanese brands like Sony and Panasonic. What these companies have in common is that they have mastered the art of softening their brands to cater to Western consumers. Similarly, Korean automakers Hyundai and Kia faced a “cheap and cheerful” reputation in the 90s, but by investing in design and quality, they are now considered on par with many established brands.

Chinese companies will try to compress this cycle, but it will take years of studying local consumer behavior and culture to understand why onboard karaoke may not be something that your typical German consumer is looking to pay a premium for. Chinese companies will do well to place key people in these target markets for years, not months at a time, to truly understand their customers and to take that knowledge back to their Chinese headquarters. This is a significant step change for companies built on data and manufacturing prowess, but it has to be done to ensure their future success.

LEGO® Chair Professor of Management and Innovation at IMD

Howard Yu, hailing from Hong Kong, holds the title of LEGO® Professor of Management and Innovation at IMD. He leads the Center for Future Readiness, founded in 2020 with support from the LEGO Brand Group, to guide companies through strategic transformation. Recognized globally for his expertise, he was honored in 2023 with the Thinkers50 Strategy Award, recognizing his substantial contributions to management strategy and future readiness. At IMD, Howard Yu co-directs the Strategy for Future Readiness program and the Future-Ready Enterprise program, which is jointly offered with MIT.

21 hours ago • by Ginka Toegel in Leadership

Women’s progress has stalled because organizational systems fail them. Fixing this means recalibrating three things: succession slates, sponsorship, and executive feeder roles....

21 hours ago • by Misiek Piskorski in Strategy

The value of data lies in combining and analyzing a proprietary strategic core with models that predict outcomes and prescribe responses, argues Misiek Piskorski....

March 5, 2026 • by Michael Yaziji in Artificial Intelligence

CHROs must navigate AI adoption carefully, balancing speed and direction while making trade-offs that protect people, skills, and long-term value...

March 5, 2026 • by Denise H. Kenyon-Rouvinez, Paul Strebel in Brain Circuits

Three common ‘traps’ impact boards across the world in private and publicly listed businesses alike. Here’s how to identify which trap is standing between you and success in the boardroom....

Explore first person business intelligence from top minds curated for a global executive audience