The C-suite journey is riddled with trade-offs between sustainability, growth, profitability, and geopolitics. Executives are tasked with steering organizations through uncertainty and making climate-aligned decisions that are economically viable and competitively advantageous. Bloomberg Media’s Energy Transition Report, based on a study of 9,000-plus global business leaders, including C-suites, reveals a compelling but complex picture. Most executives agree that the energy transition is not happening fast enough, but that agreement doesn’t translate to alignment on solutions.

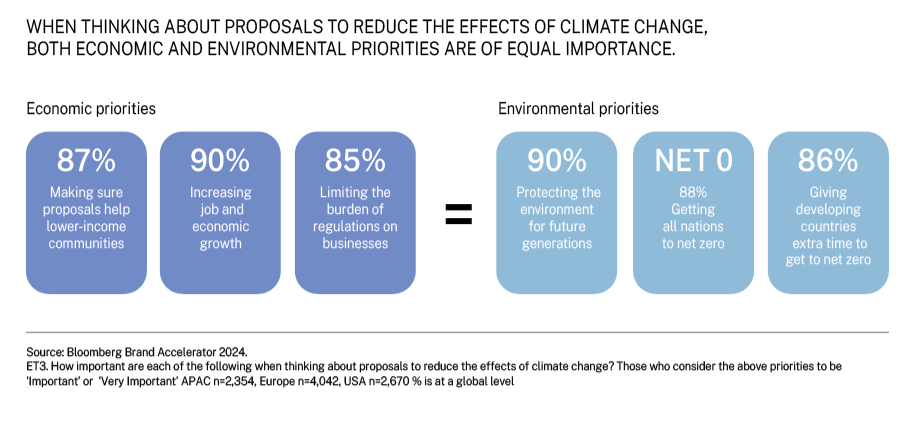

Based on the report, we understand that 90% of business leaders prioritize economic growth and job creation when evaluating climate-related proposals, but 90% also believe in protecting the environment for future generations. The study reveals that 66% of financial and banking leaders believe the transition must accelerate. Yet, 65% of all leaders still see oil and gas as essential to the global economy in 25 years. These apparent contradictions suggest executives recognize that sustainability goals cannot be achieved in isolation from business performance. The pressure to drive transformation while delivering shareholder value is intensifying.

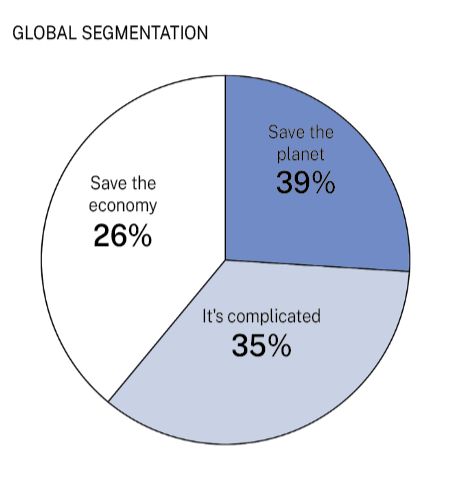

A segmentation analysis, based on our study, reveals three distinct leadership mindsets when it comes to the energy transition:

- Save the planet (39%): Environment-first champions driving green innovation.

- Save the economy (26%): Leaders prioritizing economic stability.

- It’s complicated (35%): A C-suite segment caught in the middle.

The third segment consists of predominantly C-suite decision-makers who hold a dual ambition: to lead sustainable transformation and protect profitability. This segment is the most conflicted and most influential. They are not resistant to change and are keen to act responsibly. They seek clarity, evidence, and a framework for action that is credible and grounded in commercial objectives. They are the largest segment in the US (39%) and Asia Pacific (38%), and the second largest in Western Europe (32%).

In Western Europe, often considered a frontrunner in the energy transition, the size of the ‘Save the economy’ segment (28%) is larger than in the US (23%) and Asia Pacific (25%), which underscores the region’s dual pressures and highlights the divisive nature of energy transition.

Audio available

Audio available