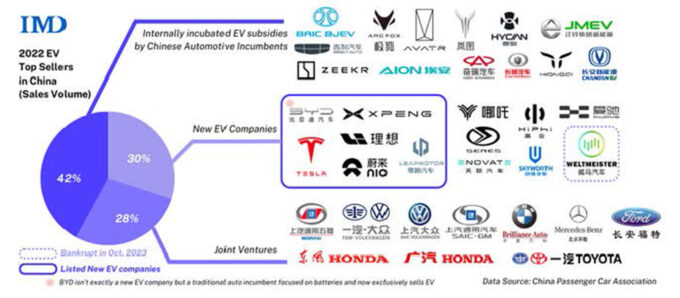

IMD’s China Company Transformation Indicators, a pioneering research project, delves deep into the innovation and competitiveness of Chinese enterprises. One of its recent studies on the auto industry offers a comprehensive breakdown of the top 50 EV companies in China by sales numbers. The findings are both intriguing and indicative of the current market dynamics. The top 50 EV companies by sales volume in 2022 in China can be categorized into three distinct groups:

Internally incubated EV subsidiaries by Chinese automotive incumbents (42%): Companies like GAC Aion fall into this category. Traditional Chinese automotive giants like GAC, SAIC, and Geely have incubated these entities as separate EV subsidiaries. This strategic move allows them to operate with agility in the fast-paced EV market, while still leveraging the strengths of their parent companies, such as significant capital support and brand endorsement.

New EV companies (32%): These companies, often referred to by consumers as “EV natives”, are unique in that they were born in the era of electric vehicles, much like Tesla in the US. Their strength doesn’t just lie in branding and marketing. Starting from a clean slate, they don’t carry the ‘baggage’ of legacy systems and approaches. This allows them to be nimble, innovate without constraints, and be entirely customer-centric. They are able to develop superior auto software and introduce features that resonate with the modern consumer. Examples include Li Auto’s in-car fridge and NIO’s in-car chatbot, Nomi. Of these EV natives, only six have been listed so far, while others, like Neta Auto, have announced their intentions for IPOs in the near future. A large number – some observers count over 500 – of these new ventures are competing relentlessly; ultimately only a few will survive. A case in point is Byton – once raising around $700m in funding from prominent investors such as FAW Group, Qidian Holdings, and CATL – which entered bankruptcy in 2020.

Joint ventures (28%): These are collaborations between Chinese and foreign automakers. A prime example is FAW-Volkswagen, which not only sells EVs under the VW brand but also continues to market VW’s combustion engine cars. Essentially, these JVs represent the efforts of incumbent foreign brands trying to transition into the evolving market. They predominantly sell EVs under the foreign brand, indicating the transformation attempts of these established players. The emergence of “reverse joint ventures,” like Volkswagen’s investment in XPeng Motors, indicates foreign firms’ growing interest in Chinese EV technology.

Tech players: A very recent addition to the landscape is the Tech player. Xiaomi has launched its first EV, an SUV, boasting super acceleration faster than Tesla and Porsche. If you walk into a Huawei flagship store these days, you do not see phones, but cars as well – the telecom giant launched its rival to Tesla’s Model S in 2023. Although it remains to be seen how fast these companies can scale up production of EVs, they certainly have the deep pockets to persist for a while.

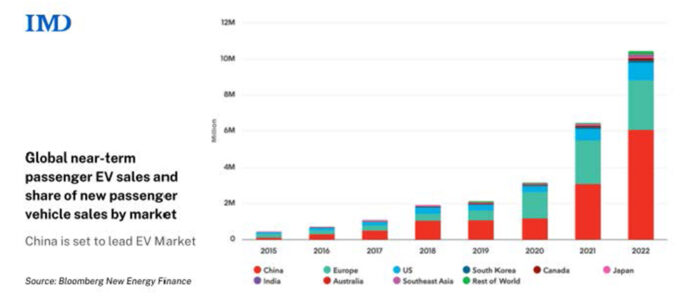

From 2015 to 2022, sales data shows that independent domestic NEV brands carved out a significant advantage. They rapidly captured market share, with joint venture brands seeing a decline of 17%. Additionally, the demographic of automobile consumers is becoming younger. These younger consumers prioritize advanced features like assisted autonomous driving, comfort, and vehicle appearance over basic functionalities.