How to succeed as an enterprise co-pilot: Three priorities for the modern CFO

Schindler CFO Carla De Geyseleer explains how today’s CFO acts as a strategic co-pilot, uses sustainability to drive growth, and develops future finance leaders....

by Andreas Rothacher, Karl Schmedders Published November 17, 2025 in Finance • 6 min read

Investments through passive index funds may not be as diversified as the average investor thinks. Many major indices are heavily dependent on the performance of stocks from a handful of major companies, many of them concentrated in the tech sector. This trend has intensified over recent years. So, even investors who intentionally opt for a broad global equity allocation are increasingly dependent on a small number of large individual stocks.

While concentration risk can also apply to other asset classes, in this article we shall focus on equity index concentration. This is where a small number of companies account for a disproportionately large share of the total weight in stock indices. This is especially relevant in capital-weighted indices and indices with a low total number of constituents. A primary concern associated with this concentration is the idiosyncratic risk inherent in these stocks (stock-specific risk). This unsystematic risk could be diversified away and is not compensated

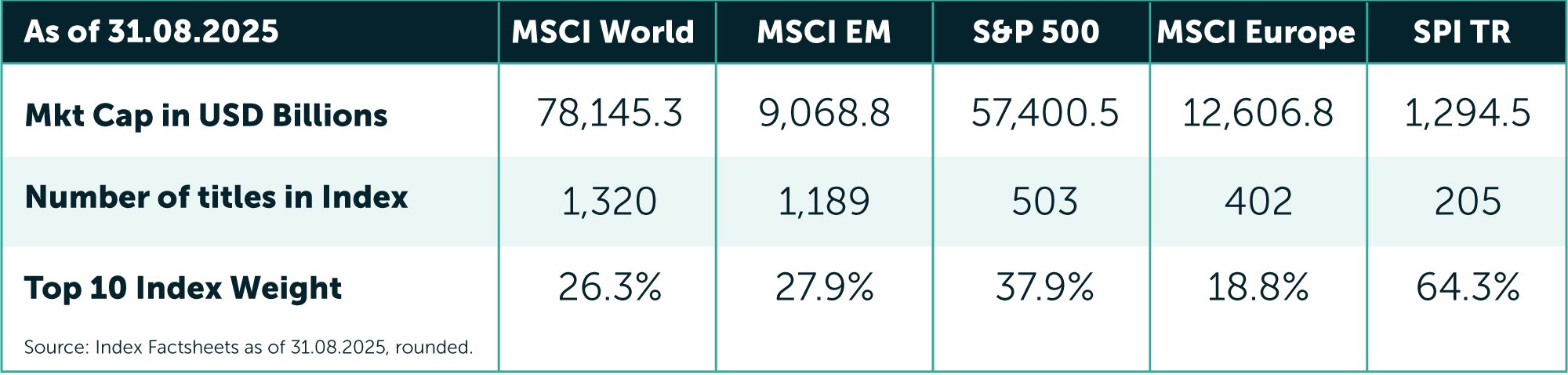

The top 10 companies now represent a significant share of the overall market capitalization of these indices, including the S&P 500, the MSCI World Index, and the MSCI Emerging Markets Index. The table (below) provides an overview of various indices, both global and regional.

This heightened concentration means that investors face significant idiosyncratic risks.

This heightened concentration means that investors face significant idiosyncratic risks. A substantial decline in the stock price of a dominant company could severely impact the overall index and negatively affect the performance of a broadly diversified portfolio.

Investors should be aware that the overall market development will be influenced by these dominant companies, which can significantly alter the diversification and risk-return profile of their portfolios.

“The trend is partly driven by the strong performance of shares in the technology giants.”

Index concentration is not limited to individual countries – even widely diversified global indices are affected. For example, around 26% of the total index weight of MSCI World is accounted for by the 10 largest companies. The figure is even higher in the MSCI Emerging markets (around 28%), with Taiwan Semiconductor Manufacturing Company (TSMC) contributing roughly 10%. For the S&P 500, the top 10 represent almost 38% of the index market capitalization, with Nvidia Corporation accounting for 7.8%.

The trend is partly driven by the strong performance of shares in the technology giants, fueled by their strong revenue growth and sustained high profitability. It is also worth noting that the index heavyweights not only represent a large share of the market capitalization but also a substantial share of the profits.

Concentration is particularly evident in smaller country indices (particularly when these contain global players). For instance, Novo Nordisk has an index weight of almost 48% in the MSCI Denmark Index (the following two largest companies combined account for only around 19%), and the top 10 accounts for 93%. However, it should be noted that the index comprises only 15 companies in total. A similar picture emerges regarding MSCI Netherlands, where ASML represents 34% of the market capitalization, and the top 10 accounts for almost 77% (out of 27 index constituents). In Switzerland, the top three names – Novartis, Nestlé, and Roche – of the SPI TR represent almost 36% of the index, while the top 10 account for 64% of the index’s market capitalization. For a European investor, this concentration may mean that they allocate more to an MSCI Europe index than to a single-country index (especially for non-CHF European investors).

A similar picture emerges in the MSCI Taiwan Index, where TSMC alone represents more than 54% of the index. The second and third-largest positions combined account for just over 11%, emphasizing the extent to which a single company can dominate a country-specific index.

Investors have a range of strategies at their disposal to address the challenges posed by concentration risk:

Even passive investors should periodically review the composition of their chosen benchmarks and indices. It is essential to identify any emerging concentration trends and engage in periodic discussions to assess whether the current index composition remains aligned with investment objectives. Adjustments may be necessary to mitigate any risk of increasing concentration.

The exposure to individual stocks should not be evaluated solely at the level of equity allocation, but rather within the broader context of the overall portfolio. For example, Apple accounts for around 4.4% of the MSCI World Index. If an investor maintains a global equity allocation of 20%, the exposure to Apple would account for 0.88% of the total portfolio. Consequently, a 10% decline in Apple’s stock price would result in a minimal negative impact on the overall portfolio’s performance. An investor might also be exposed to the corporate bonds of an issuer, but the volatility for these investments tends to be much lower (for highly rated bonds).

Diversifying investments across equity markets can help mitigate concentration risk. This approach not only alters the composition of the individual stocks within the portfolio but also impacts sector allocations, style exposures, and risk-return profiles. For example, a Swiss investor could enhance diversification by allocating to small- and mid-cap indices, which would reduce reliance on the country’s big three. At the same time, an investment into a small- and mid-cap index might increase exposure to the industrial sector, which in turn could increase the portfolio’s sensitivity to the economic cycle.

Incorporating alternative asset classes, such as real estate, alongside equities and bonds can further broaden diversification and provide distinct risk-return characteristics. However, investors must ensure they possess the expertise or engage external specialists to effectively navigate these asset classes. This type of diversification is easier to achieve for institutional than private investors, but there is an increasing number of products that offer access to private markets. Diversification should always have a clearly defined purpose, such as reducing portfolio risk or enhancing return potential. To achieve effective diversification, a purposeful and strategic approach is required. The goal is to optimize the portfolio’s risk-return profile.

The application of a bandwidth concept helps investors to take profits in booming markets while maintaining their target allocation. This approach can help mitigate excessive overweights in concentrated asset classes. Regular rebalancing ensures that the portfolio remains aligned with the overall investment strategy, maintaining the intended risk-return profile.

In certain market conditions, it may be advantageous to complement the portfolio with active management to enhance diversification. However, the potential benefits of active management must be carefully weighed against the higher costs and risks associated with manager selection.

It will pay dividends for passive investors to be a just a little more hands-on.

Investors in financial markets are advised to periodically review the composition of their portfolios and develop an understanding of the investment universe and the respective benchmarks. This is also true for investors implementing passive strategies across various market segments. Portfolio weights within an index are subject to change and can vary considerably over time. Investors should periodically review the composition of the index. It is crucial to assess counterparty risks within the broader context of the entire portfolio (equity and bonds).

For institutional investors, regularly reviewing the investment strategy through an asset-only or ALM study can ensure the portfolio remains on track and achieves long-term investment goals. For private investors, a periodic review is also highly recommended. This will ensure that return goals, risk appetite, and the capacity to take risk are balanced. For larger investors, a sophisticated reporting system can further support the ongoing monitoring process, particularly in identifying and managing concentration risks effectively.

In short, it will pay dividends for passive investors to be a just a little more hands-on.

Head of Investment Research and Senior Investment Consultant at Complementa AG

Andreas Rothacher is the Head of Investment Research and Senior Investment Consultant at Complementa in Zurich. In his current role he advises Swiss and German institutional investors on their strategic asset allocation and manager selection. In addition, he is one of the co-authors of the annual Complementa Risk Check-Up pension study. He is also the author of various articles and publications. He holds a Master’s degree in accounting and finance from the University of St. Gallen (HSG).

Professor of Finance at IMD

Karl Schmedders is a Professor of Finance, with research and teaching centered on sustainability and the economics of climate change. He directs the Strategic Finance (SF) program and teaches in the Executive MBA programs. Passionate about sustainable finance, Schmedders believes that more attention needs to be paid to on the social (S) and governance (G) aspects of ESG to ensure a fair transition and tackle inequality.

February 24, 2026 in Finance

Schindler CFO Carla De Geyseleer explains how today’s CFO acts as a strategic co-pilot, uses sustainability to drive growth, and develops future finance leaders....

February 11, 2026 • by Catherine Agamis, Hischam El-Agamy in Finance

How banks can position themselves across multiple futures to deliver on sustainability commitments while maintaining financial performance...

January 9, 2026 • by Jerry Davis in Finance

The US President is gouging out chunks of America’s long-established economic data apparatus because he doesn’t like what he sees. It’s unlikely to end well....

Audio available

Audio available

January 7, 2026 • by Salvatore Cantale in Finance

At critical moments that can shape a company’s long-term future, the balance of CEO ambition, CFO vigilance, and board oversight can determine success or failure. IMD’s Salvatore Cantale outlines how CFOs can...

Explore first person business intelligence from top minds curated for a global executive audience