What this means for global business: a new operating reality

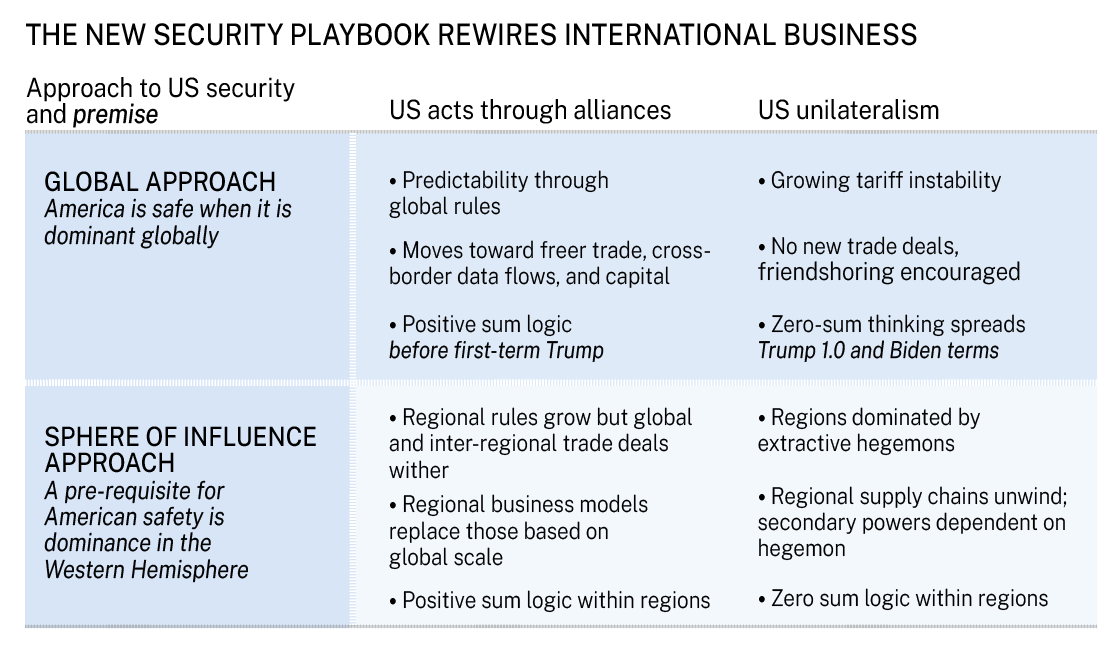

These developments have direct implications for the global business community. Multinational firms are accustomed to managing political risk at the country level. However, they now face systemic geopolitical risks that cut across jurisdictions and redefine the terms of engagement. Three dimensions merit consideration:

Fragmented integration. Under this scenario, the world does not split into closed blocs, but the global trading system becomes increasingly compartmentalized. Dual supply chains emerge, one geared to Western standards and alliances and the other to Chinese-led networks. Firms must navigate divergent rules, standards, and expectations, often with duplicated operational structures.

Deliberate containment. Here, the emphasis is on stalling or reversing rival influence. Governments compete to shape regulatory norms, subsidize strategic sectors, and enforce export curbs. Cross-border flows remain, but they are increasingly politicized. Companies are required to signal alignment as well as compliance with the strategic priorities of key jurisdictions.

Sectoral decoupling. In this more extreme outcome, interdependence in key sectors – semiconductors, artificial intelligence, quantum computing, and biotechnology – is deliberately unwound. Trade in these domains becomes highly restricted. Whether they liked it or not, global firms would have to choose sides; neutrality becomes increasingly untenable.

Each aspect entails a high degree of uncertainty, and transitions in focus may be sudden. The default assumption of a single, rules-based trading system is clearly no longer valid. The global economy is being reshaped not by market forces but increasingly by strategic and political intent.

Global businesses can no longer rely on reactive measures or outdated risk-management playbooks. Strategic deliberation must now revisit operational design, executive accountability, and even which customer segments to target. To navigate a world where geopolitical calculation increasingly overrides classic commercial logic, companies must adapt at the level of business model, mindset, and organizational capability. This calls for a deliberate, systemic response that turns geopolitical exposure into a source of strategic advantage rather than vulnerability.

Transform geopolitical risk into competitive advantage

Meeting this challenge requires more than vigilance; it may amount to the next transformation of forward-looking business. The following 10 imperatives offer a roadmap for executives seeking to future-proof their organization against geopolitical disruption. These are not theoretical recommendations but actionable shifts in leadership orientation, organizational structure, and strategic focus. Embracing them can help firms evolve from passive observers of geopolitical events to proactive shapers of their destiny in a fractious world.

1. Accept the new normal: geopolitical dynamics are here to stay

The era with a stable, predictable global business environment is over. Geopolitical uncertainty, supply chain disruptions, and regulatory fragmentation are not temporary challenges to overcome but permanent features of the operating landscape. Organizations must shift from seeking stability to building capabilities that thrive in recurring volatility.

2. Design for uncertainty: make risk a competitive advantage

Instead of traditional risk mitigation approaches that seek to mitigate uncertainty, design business models that exploit volatility as a core feature. Build uncertainty into strategic planning as an opportunity generator, create organizational structures that benefit from market disruptions, and develop competitive strategies that turn competitors’ risk aversion into your market advantage.

3. Design for fragmentation: not just market but digital too

So many previously successful formulas for creating value were based on scaling globally intellectual property, brands, or tech. As trade barriers, nationalistic regulations, and tribal industrial policies spread, worldwide scale isn’t realistically on the table for firms operating in sensitive sectors. That’s the bad news. The good news is that there are other ways to create value, particularly charging premiums after adapting product offerings to deliver the enhanced security that firms and governments crave as fears about geopolitical rivals intensify.

4. Owning the big picture is at an ever-greater premium

Without dedicated senior leadership attention, geopolitical considerations will fragment across departments and lose strategic coherence. Assign clear C-level accountability for geopolitical strategy integration, or watch competitors exploit opportunities while your organization delays.

5. Embrace structural transformation: from focused multinationals to more diversified and decentralized forms

Geopolitical pressures are driving a fundamental shift away from lean, centrally managed multinationals toward more diversified business portfolios and decentralized structures. Consider expanding into broader ranges of business activities to build resilience by diversifying and reducing dependence on any one sector or geography. Stakeholder management and customer relations imperatives will push international firms toward greater decentralization, with regional units gaining autonomy to respond to local imperatives.

6. Protect internal team cohesion against geopolitical polarization

Geopolitical tensions threaten to fracture internal teams along national lines, undermining organizational effectiveness. Proactively manage how global events impact internal workforce dynamics, from addressing diverse perspectives on international conflicts to preventing talent flight when geopolitical tensions affect specific employee populations. Build deliberate management practices that maintain professional unity while acknowledging legitimate personal concerns about geopolitical developments affecting employees’ home countries or communities.

7. Align external stakeholders across fragmented geopolitical contexts

External stakeholders – investors, customers, regulators, suppliers, and local communities – increasingly hold conflicting expectations shaped by their geopolitical mileu. Develop sophisticated external engagement strategies that satisfy divergent demands without compromising core business objectives. This requires moving beyond universal messaging to contextualized relationship management tailored to each stakeholder group’s geopolitical reality.

8. Expand executive accountability beyond traditional silos

Navigating geopolitical risk is no longer the sole job of strategy or government affairs –it’s a shared obligation across the executive team. Functional heads will be expected to comment insightfully on proposals from senior colleagues to address geopolitical factors, even if only part of their day-to-day responsibilities are implicated. As to the latter, finance directors need to understand the impact of sanctions, HR leaders must navigate talent mobility restrictions, and operations executives require supply chain resilience strategies. This isn’t optional expertise – it’s table stakes for leadership credibility.

9. Build comprehensive geopolitical intelligence and literacy

Combine systematic early warning capabilities (geopolitical radar) with deep organizational expertise to create sustainable competitive advantage. Deploy geopolitical intelligence systems that trigger specific business responses while developing internal fluency programs that reduce reliance on third parties. Establish centers of excellence that merge regional expertise with functional knowledge, creating career pathways that reward geopolitical competence alongside technical skills.

10. Upgrade business continuity protocols

Traditional business continuity planning assumes discrete, temporary disruptions. Geopolitical volatility demands continuous adaptation protocols that treat disruption as the new normal. Develop dynamic continuity frameworks that can manage multiple interconnected geopolitical pressures while maintaining operational effectiveness. This requires moving from crisis response to sustained proactive vigilience.

Thriving as the next chapter of globalization unfolds

The reassertion of geopolitics is not a transient shock but a structural transformation of the global business environment. It is dismantling long-standing assumptions about the even-handedness of trade policy, the permanence of market access, and the applicability of efficiency-driven models that can be scaled globally. The firms that will thrive in this new era are those that recognize geopolitics not as a peripheral concern but as a central pillar of competitive strategy.

Successfully navigating this environment demands a reorientation of the executive mindset. Resilience, agility, and geopolitical fluency are becoming as critical to success as innovation and scale. By embedding these imperatives across the enterprise, companies can withstand unanticipated shocks and seize opportunities born of disruption. Geopolitics is now a defining variable in international business. The question is no longer whether and when firms should respond but how they will do so decisively.

Audio available

Audio available