Why leaders should learn to value the boundary spanners

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

by Jean-François Manzoni, Julia Binder Published September 18, 2023 in Sustainability • 21 min read

We live in extraordinary times. Over the last few decades, the globalized world economy has generated huge amounts of wealth and helped to lift hundreds of millions of people out of deep poverty. Advances in health care have raised life expectancy in almost all countries in the world, access to knowledge has increased dramatically, and the world of work has become more inclusive.

Despite the prosperity and progress of recent times, the world urgently needs to transition to a more sustainable economic model. Among many signs thereof, the last eight years have been the warmest on record. And July 2023 was the hottest month ever recorded by a wide margin – a grim reminder that climate change is already disrupting life around the world. The scientific consensus is unequivocal: greenhouse gas emissions are harming our way of life, and there is an urgent need to reduce them.

Sadly, the climate crisis is not the only major challenge. We are also headed for crises involving water scarcity and decreasing biodiversity. Beyond the environment, we observe significant civil unrest all over the world, powered by individuals and communities who do not believe that their governments and “the system” are operating in their best interests. Trust in leaders and corporations is decreasing, too, and anxiety about the future is rising.

At IMD, our purpose is to develop leaders and organizations that contribute to a more prosperous, sustainable, and inclusive world. In this article, we will often use the word “sustainable” in a holistic sense, including environmental sustainability but also going beyond to refer to a form of stewardship. Hereafter, a “sustainable business” contributes to the success of all its stakeholders and helps the next generation achieve its goals and enjoy a prosperous future. This includes not only environmental sustainability but also social and economic inclusion. In simple terms, we want to help leaders and organizations to do well (financially) by doing good (for the world).

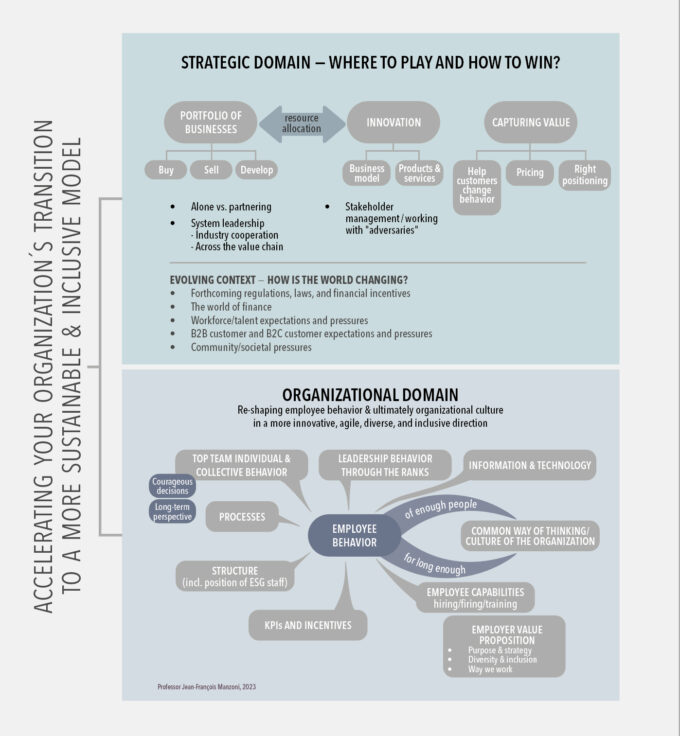

We are very fortunate to have been able to study and work with organizations that started earlier than most on their sustainability transition. Studying the trajectories of these pioneers, we have realized that their transformations have some things in common, including that they always involved significant changes on both the strategic and the organizational fronts.

In the rest of this article, we present a conceptual framework that identifies some of the key decisions that leaders and organizations must make to guide their organizations in a more prosperous, sustainable, and inclusive direction.

For quite some time, our discussions with boards and top management teams tended to include a lot of time and energy spent explaining why sustainability-related threats and opportunities were much broader and more important than mere “corporate social responsibility”. Top teams thought of sustainability as a cost and an imposition, and they often tried to minimize their spending on it. Nowadays, conversations no longer revolve around “why?”; they are much more centered around “how – and how fast – to manage the sustainable transformation?” This evolution stems from four interdependent and complementary transitions:

First, regulators are and will increasingly be penalizing companies that degrade the environment. Carbon prices are in place in many parts of the world, and the US, long a laggard on climate policy, has finally passed major legislation in the form of the Inflation Reduction Act. It focuses more on carrots (subsidies) than sticks (taxes), but the outcome is the same: companies involved in decarbonization are being given a considerable advantage relative to those reliant on fossil fuels. And the pressure from regulators goes beyond climate: in 2021, the European Union announced the Corporate Sustainability Reporting Directive (CSRD) that will significantly increase the amount of sustainability reporting that companies are required to do. At the same time, it provides incentives for companies to engage in sustainable investments and innovation through the “European Green Deal”.

From linear to circular – unlock sustainable business opportunities

Second, employees and customers increasingly demand environmental and/or social performance from the companies they work for and buy from. Executives we’ve spoken with have joked that they can’t believe they complained about the “war for talent” 10 years ago since hiring has grown even tougher since. The people they hope to hire want to work for an organization they believe in, and that includes a genuine, demonstrable commitment to sustainability and inclusion. The same holds true for customers, spanning both B2C and B2B sectors. This is particularly evident in the case of B2B firms selling to large corporations. Notably, 60% of Fortune 500 companies have set climate-related goals – some of them very ambitious – and they are explicitly communicating to their suppliers that the continuation of their business relationships hinges on active support in meeting these sustainability goals.

Third, companies increasingly face communal and social pressure to act. And, in the age of social media, they ignore these pressures at their peril. Poor social and environmental practices can trigger a backlash from activists and community groups. For instance, consider a corporation that fails to address workplace harassment issues raised by the #MeToo movement. This neglect may result in a public outcry with the movement’s advocates using social media to amplify their concerns, organize protests, and call for boycotts. These actions can significantly damage the company’s public image and brand reputation. Within the company, employees may become disheartened, impacting workplace dynamics and productivity. Furthermore, customers may opt to avoid the company’s products or services in solidarity, potentially leading to financial losses. In today’s interconnected world, these issues can quickly draw the attention of regulatory authorities and legal entities, opening the door to further legal actions.

Fourth, investors increasingly demand sustainability and have made it a common part of the due diligence process. In 2020, 73% of investors conducted structured and formal reviews of ESG, according to a study from EY, up from 32% just two years earlier. Another telling example: in our “CEO Dialogue” series, Temasek’s CEO Dilhan Pillay explained that sustainability is a core pillar of the investment firm’s strategy and that he is pressing portfolio companies to develop their own forward-looking strategies around it.

Keep one eye on the microscope and the other on the telescope.Ilham Kadri, CEO of Solvay

“I think if you’re a long-term investor, you look at what the value of a portfolio is going to be, not in terms of a three, five, 10-year timeframe, but even 15, 20 years,” he said. “And if you look at all the events that would impact the portfolio over that timeframe, you cannot ignore the impact of climate change on the value of your portfolio.” This pressure from investors is increasingly common and not limited to climate. Pillay says his firm takes a “stewardship” approach, emphasizing that “we are here to ensure that future generations benefit from what we do today”.

For example, Solvay, a leading material science company, employs a specialized matrix designed explicitly for a strategic sustainability assessment, aptly named the Sustainable Portfolio Management Guide. This matrix utilizes two primary axes: one quantitatively evaluates a product’s environmental impact during its manufacturing, known as “operations vulnerability”, while the other qualitatively assesses the product’s social and environmental merits and challenges, viewed through the lens of customers and other stakeholders, referred to as “market alignment”. Adding a dynamic dimension to the grid, sales volume is visually represented through color gradients. Products on this matrix are categorized as “solutions” when they exhibit low operational environmental footprint and high market alignment, while “challenges” encompass products that perform poorly in either measure. Within each business unit, a designated “correspondent”, typically the marketing strategy manager, oversees the assessment of their respective business line on the matrix. It’s worth noting that this tool extends beyond mere greenhouse gas emissions measurement, encompassing a broad spectrum of sustainability factors, from water efficiency to raw material usage and potential exposure to toxic substances. The primary objective of such a tool is not to provide definitive solutions but to initiate thoughtful discussions. Solvay leverages this matrix not only for evaluating its existing products and business lines but also as a foundation for decision-making concerning product development and potential mergers and acquisitions.

The two central questions in strategy are “where to play” and “how to win”. Sustainability transformations often require new answers to both. The companies we have studied and worked with often make major changes to their portfolios through investments, divestitures, and innovation.

Royal DSM is an unlikely candidate to top the Dow Jones Sustainability Index. The company was formed by the Dutch government in 1902 to mine the country’s coal reserves, which it did for the first half of the last century (DSM stands for Dutch State Mines). In 1965, the government closed the coal mines and DSM had to reinvent itself by focusing on its growing chemicals business. But by the turn of the century, DSM was struggling. Its growth had stagnated, it was being rocked by volatile oil prices (a key input into its chemical business), and the tide was turning toward antipollution regulations that could seriously affect its operations. Once again, business as usual was not looking like a good bet.

DSM was forced to come up with a new strategy. DSM’s new CEO, Feike Sijbesma, wasted no time in responding. Following his appointment in 2007, he reoriented the company toward life sciences, sold the more carbon-intensive petrochemicals business for $2 billion, and used the funds generated to make 25 acquisitions over the ensuing decade. Ten years into DSM’s journey, the Dow Jones Sustainability Index ranked DSM number one in the chemicals industry. DSM’s transformation was notable, in part, because the chemicals sector is invariably environmentally intensive. But as its evolution shows, even hard-to-abate sectors like chemicals are undergoing a shift toward more sustainable strategies.

Many, if not most, companies face some version of this dilemma, though it is sometimes less acute. Some of their lines of business are unsustainable and/or carbon-intensive; others are much less so but may be more nascent. The challenge is to forge a new answer to the question of “where to play”, in real time, while finding a way to fund and manage the transition.

In 1970, BCG’s Bruce Henderson introduced the “growth share matrix” to advise companies on where they should focus their portfolios. Market share was on one axis, growth prospects on the other. The prevailing belief was that low-growth, high-market-share businesses could fund investment into ventures with superior growth potential. However, in the contemporary business landscape, a transformative shift is underway as companies increasingly recognize that they must go beyond growth share considerations and incorporate sustainability factors into their strategic equations.

At an inflection point, you have to challenge the assumptions that made you successful, but which may not be valid for the future.Jim Hagemann Snabe, Chair of Siemens and Maersk

For example, Solvay, a leading material science company, employs a specialized matrix designed explicitly for a strategic sustainability assessment, aptly named the Sustainable Portfolio Management Guide. This matrix utilizes two primary axes: one quantitatively evaluates a product’s environmental impact during its manufacturing, known as “operations vulnerability”, while the other qualitatively assesses the product’s social and environmental merits and challenges, viewed through the lens of customers and other stakeholders, referred to as “market alignment”. Adding a dynamic dimension to the grid, sales volume is visually represented through color gradients. Products on this matrix are categorized as “solutions” when they exhibit low operational environmental footprint and high market alignment, while “challenges” encompass products that perform poorly in either measure. Within each business unit, a designated “correspondent”, typically the marketing strategy manager, oversees the assessment of their respective business line on the matrix. It’s worth noting that this tool extends beyond mere greenhouse gas emissions measurement, encompassing a broad spectrum of sustainability factors, from water efficiency to raw material usage and potential exposure to toxic substances. The primary objective of such a tool is not to provide definitive solutions but to initiate thoughtful discussions. Solvay leverages this matrix not only for evaluating its existing products and business lines but also as a foundation for decision-making concerning product development and potential mergers and acquisitions.

A similar approach is to plot businesses on a 2×2 grid where one axis represents their sustainability and the other their financial performance. Once that mapping is complete, a company can strategically utilize financially successful yet “less sustainable” businesses to fund investment in more sustainable businesses, ultimately aiming for both sustainability and financial profitability. That’s what DSM did when it sold its petrochemical business to fund its shift toward life sciences and less carbon-intensive approaches to chemicals. In some cases, like DSM, this transition may entail divestiture. In other cases, as in the original growth share matrix concept, declining businesses can generate cash. However, it’s crucial to note that this approach carries certain risks, as such declining businesses may negatively impact employee and customer perceptions of the company’s portfolio.

Of course, sustainability strategy extends beyond M&A activities. Many companies adjust their portfolios through internal innovation, as DSM did with its “Project Clean Cow”, a decade-plus research and development project. That project culminated in Bovaer, a feed additive that effectively reduces methane emissions from dairy cows by 30% and from beef cattle by 45%. New product development of this sort requires companies to foster innovation and agility, which in turn may require major shifts to an organization’s capabilities.

Plenty more could be said about sustainability and strategy, but two strategic skill sets and one big question bear mentioning:

Pricing. Sustainable products and services can create new value for customers and for the world, but sustainability strategies can only lead to favorable financial returns if the organization manages to capture a sufficient fraction of the value that they are creating. This requires organizations to learn to price products and services differently, to learn to build a narrative for their customers that makes the – often higher – pricing acceptable to key stakeholders, and oftentimes also to escalate discussions beyond procurement departments.

For instance, consider a shipping company that faced difficulties convincing its client’s procurement department to accept a significant price increase associated with the use of more renewable fuels. Upon closer examination, they realized that while the fuel-induced price increase was non-trivial, the ultimate impact translated to a mere 10 cents per pair of sneakers. This seemingly modest increase was deemed acceptable by the client’s CEO, who recognized its value in reducing the sneakers’ carbon footprint.

Partnering and cooperating. In the pursuit of sustainability, strategic decisions often extend beyond individual organizations and spill into collaborative efforts among competitors. We have observed instances where industry rivals chose to set aside competition to instead collaborate on some aspects of the value chain or business model to collectively drive substantial reductions in their industry’s environmental footprint. For example, Suntory succeeded at convincing Japanese beverage companies to standardize some packaging to enhance recycling efforts. Furthermore, even in fiercely competitive sectors, such as the automotive industry, competitors like Volvo and Daimler recognized the potential benefits of cooperation and established a groundbreaking fuel-cell joint venture in 2021. Yet, deciding where to embrace collaboration amid competition remains a complex question.

How fast can you (afford to) go? When you’re right about something 20 years ahead of time, you’re essentially wrong for the first 19 years! Transforming toward a more sustainable and inclusive model often involves challenging considerations. How fast to exit businesses that will “very likely soon” face growing headwinds? How much to invest into new lines of activities that “undoubtedly will” be very successful someday, but when? Management teams and boards ought to aim to be ahead of the curve to be ready to catch the wave when the wave hits. But being ahead of the curve for very long can be an extremely uncomfortable situation.

Everything was in place … except that our customers, investors, and employees didn’t believe in our story.Matti Lievonen, CEO of Neste

One of the organizations we studied, Finnish power company Wärtsilä, illustrates this tension well. Its two business units focus on the energy and marine sectors, two carbon-intensive sectors that hold particular relevance for the European Union’s 2019 goal of carbon neutrality by 2050.

On the positive side, Wärtsilä has been developing products that can improve their users’ footprint significantly. On the other, the long-lasting nature of the assets in these sectors is encouraging clients to “wait and see” before committing to one future technology. While Wärtsilä’s investments in more carbon-efficient products will inevitably lead to long-term success as technological uncertainties diminish, it also must navigate the transitional period, necessitating challenging decisions for its top management team in the meantime. Cato Espero, a sales director at Wärtsilä, clearly laid out the challenge in an IMD case study we are writing on the company: “You have to make money now, but you also have to look at the future. When you are on the stock exchange, like Wärtsilä, you have to focus on ‘next week’. This is the continuous battle we are facing: make money now and at the same time progress towards our goals.”

For many of the companies we work with, the organizational transformation required to become more “sustainable” is proving as challenging as, and sometimes even more challenging than, the strategic change. Such was the feeling of Jean-Pascal Tricoire, the CEO of energy management company Schneider Electric, when in 2013 he tapped one of his most successful line managers to become the company’s CHRO. “We’re doing well on the hardware side,” said Tricoire. (And indeed they were: through a series of divestments, acquisitions, and investments to grow key activities, Schneider was successfully building a very different portfolio of products and services.) “But we also need to transform on the software (people) side.”

Why must the organization change as well? Because the key strategic decisions we evoked above must a) then be translated into a large number of smaller decisions taken throughout the organization by a large number of individuals, and b) employees throughout the organization must be willing and able to produce the behaviors required by the strategy.

“At an inflection point you have to challenge the assumptions that made you successful, but which may not be valid for the future,” said Jim Hagemann Snabe, then chair of Siemens and A P Moller Maersk. In particular, he explained that both companies had identified innovation as a key strategic lever and were increasingly focused on improving the speed at which they could innovate, i.e., on developing new capabilities supporting the deployment of their new strategy.

There is no one perfect playbook for managing organizational change. However, we have found that sustainability pioneers all made important decisions and investments in the following six areas:

Leadership. In all of the cases we studied, the transformation of the organization toward a more sustainable and inclusive model required a strong vision and persistence at the top. This is not to say that having a visionary and courageous CEO and top management team is sufficient – it is not. But it does seem to have been a necessary condition. We have already mentioned CEOs like Ilham Kadri (Solvay), Jean-Pascal Tricoire (Schneider Electric), and Feike Sijbesma (DSM, where he was succeeded by the duo of Geraldine Matchett and Dimitri de Vreeze). Another such leader is Matti Lievonen, who between 2008 and 2018 led the transformation of Neste Oil – as it was called back then – into a renewable fuel powerhouse and stock market darling Neste. Early on, the going was quite tough for Lievonen, who later joked that for a while he was “the most hated man in Finland”. “Everything was in place,” he said of the company’s transformation. “Except that our customers, investors, and employees didn’t believe in our story.” Lievonen’s tenure ended on a very positive note, but getting there required considerable courage and persistence on his part. It also required building around him a strong management team, willing and able to face the headwinds and disappointments that invariably appear along the way. Building such a strong team requires a powerful sense of shared purpose and direction. It may also involve separating from a few individuals who will be unwilling and/or unable to contribute to the transformation. As Sijbesma put it: “When transforming, you need to realize that the whole top of an organization rose through the ranks because they had expertise in that part of the portfolio (i.e., chemicals), which was core. That does not mean they will work well in the new portfolio.”

“Sustainability transformations require somebody to take on the role of conductor, the orchestrator across the organization.”Judith Wiese, Chief People and Sustainability Officer at Siemens

Structure. Transforming the organization in a more sustainable direction “requires somebody to take on the role of conductor, the orchestrator across the organization,” says Judith Wiese, Chief People & Sustainability Officer at Siemens. At the core of this framework sits the CSO, a novel addition to the C-suite hierarchy, entrusted with orchestrating sustainability endeavors. Wiese’s perspective underscores the essential nature of this position. To maximize its impact, the CSO should sit within the upper echelons of leadership – whether as part of the executive committee or the managing board. That sends a resounding message about the organization’s dedication to sustainability and its elevated status. This placement not only signifies a commitment to sustainability but also underscores its alignment with the broader corporate strategy. It highlights that sustainability isn’t a peripheral endeavor but a pivotal component tightly interwoven with the organization’s overarching vision.

Beyond the importance of the CSO’s positioning, important decisions must be made regarding where “CSR-related” roles and responsibilities get distributed. How much gets done centrally at headquarters? How much gets distributed to the various business units? Where should key capabilities be positioned?

KPIs and incentives. When trying to change how an organization operates, don’t hope for “A” while rewarding “B”. Changing behavior often requires changing key performance indicators (KPIs) and even employees’ incentives. At DSM, Sijbesma tied half of his 300 most senior executives’ compensation to sustainability goals. The new incentives took three years to enact, but as soon as they were in place, the company’s sustainability metrics began seeing marked improvement. Schneider Electric followed a similar path, developing and regularly updating a sophisticated set of “sustainability and inclusion” metrics that became integrated into executives’ variable compensation and later on a company-wide bonus scheme. Of course, bad KPIs can be gamed, and sustainability is no different. Schneider spent years developing and evolving its own “Sustainability Impact” index, tailored to its engineering-centric culture. By the time executives were compensated based on it, the KPIs had been refined and so were harder to game.

Information and tech. For employees to produce the behaviors that are required to successfully deploy the new strategy, employees need to have access to information that will enable them to make effective decisions. Over the last few years, many companies have found that they need to invest in new sources of data, both internal and external, that allow them to track progress toward their sustainability goals and to communicate them to investors, regulators, and other stakeholders. This can often require new hires and technical teams that specialize in tracking and managing ESG data for the organization. Wiese, of Siemens, emphasizes that digitalization and sustainability naturally fit together because “they both leverage data”. Even beyond reporting, sustainability products and services often require new IT capabilities, for example energy monitoring or building automation.

Employee capabilities. Employees fail to produce desired behaviors for a range of reasons; often, these reasons pertain to employees being provided with the wrong incentives and/or information – problems that are often related to structural problems and/or bad examples from top management. But another cause of employees failing to produce desired behaviors is simply that they do not know how to produce these behaviors under real-life conditions – a capability problem.

No organization can escape the need to transform to become more sustainable. The need to act is urgent. It calls for strong leadership, difficult decisions, and deep cultural change. In Issue XI, we explore how to build sustainable organizations to succeed in turbulent times.

In our experience, pioneers all made considerable investments into developing their employees’ capabilities at scale. This investment always includes three streams of effort: hiring new competencies and/or mindsets, shedding some old competencies and mindsets, and training everybody else in a set of values and behaviors carefully selected to support the new strategy. Too many organizations underestimate the importance of substantial investments in helping develop individual and organizational capabilities. Pioneers all understood this point and designed and deployed several waves of capability-building interventions.

Changing behavior or changing culture. Few academics are as closely associated with the notion of leadership and culture than John Kotter, who wrote several articles and books explaining to managers how to go about changing their organization’s culture. For many years, Kotter’s and others’ view was that since the biggest impediment to creating change in a group was culture, it would make great sense to tackle culture first. Once the culture had shifted, the change effort would become much easier to effect.

This focus on changing culture first is misguided, because as Kotter came to realize: “Culture is not something that you manipulate easily … you can’t grab it. Culture changes only after you have successfully altered people’s actions for a period of time.” Culture comes down to a common way of thinking that drives a common way of acting. And paradoxically, human beings act their way into new mindsets and values much more than they think their way into new actions. This is somewhat paradoxical, but it is not exactly new; more than two thousand years ago, Aristotle observed that “(human beings) do not act rightly because we have virtue or excellence, but we rather have those because we have acted rightly. (Human beings) acquire a particular quality by consistently acting in a particular way.”

Hence, smart top teams focus on identifying the behaviors that they need to observe throughout their organizations, and then put in place a set of levers (discussed above) that will shape the behavior of enough employees for long enough, thus ensuring that enough individuals gradually internalize the desired behaviors. Behavior change comes first, culture change is the result of a job well done over a long enough period of time.

The late Sumantra Ghoshal liked to say: “Leaders are not paid to preside over the inevitable. They are paid to make happen what otherwise wouldn’t happen.” That is very true. Anyone can ride a positive economic cycle and can be lifted by tailwinds. The difficulty lies in winning when things are not going your way – in making things happen that would not have otherwise happened.

But if Ghoshal was alive today, he might complement this first sentence by adding that leaders are also paid to make happen things that leave the system – the organizational, the ecological, and the social systems – stronger than they found it. Leaders are stewards of the organizations they lead, and we are all stewards of the world we are borrowing from our children. A good steward leaves the system in a better state than they found it. As of now, the generation leading governments and organizations is not exactly excelling on this front. We are continuing to create economic wealth, but we are doing so in a way that is increasingly unsustainable socially and ecologically.

Wayne Gretzky, arguably the greatest ice hockey player ever, once said he succeeded because he was skating to where the puck was going to be, instead of where the puck was. We at IMD believe that smart organizations, too, must skate to where the puck is going to be. They must prepare their organization to excel in a world that will increasingly force organizations to internalize the social and environmental cost of their actions.

To do so, they must work on their strategy and on their organization. The graphic toward the beginning of the article summarizes our current understanding of some of the key domains that we have seen successful innovators tackle. The specific decisions that each company made were always context-specific and hence changed across companies and contexts, but decisions had to be made on the dimensions that we discussed above. We believe that this framework highlights some of the areas that your organization will have to tackle to accelerate its transition toward a more prosperous, sustainable, and inclusive model.

This is not an easy undertaking. It requires organizations to be performing at the same time as they are transforming. That requires leaders to keep “one eye on the microscope [and] one eye on the telescope,” as Kadri puts it, where the microscope provides a granular view of current activities and capabilities, and the telescope helps to start picturing the future. A more sustainable and inclusive, and yet prosperous model for business is possible. Making it a reality requires clear vision, bold leadership, and transformational management.

Professor of Leadership and Organizational Development at IMD

Jean-François Manzoni (JFM) is Professor of Leadership, Organizational Development and Corporate Governance at IMD, where he served as President and Nestlé Professor from 2017 to 2024. His research, teaching, and consulting activities are focused on leadership, the development of high-performance organizations and corporate governance. In recent years JFM has also been increasingly focused on finding ways to ensure leadership development interventions have lasting impact, particularly through the use of technology-mediated approaches, and on closing the growing managerial “knowing-doing gap”, i.e., the gap between what managers kind of know they should be doing and the extent to which they actually behave that way in practice.

Professor of Sustainable innovation and Business Transformation at IMD

Julia Binder, Professor of Sustainable Innovation and Business Transformation, is a renowned thought leader recognized on the 2022 Thinkers50 Radar list for her work at the intersection of sustainability and innovation. As Director of IMD’s Center for Sustainable and Inclusive Business, Binder is dedicated to leveraging IMD’s diverse expertise on sustainability topics to guide business leaders in discovering innovative solutions to contemporary challenges. At IMD, Binder serves as Program Director for Creating Value in the Circular Economy and teaches in key open programs including the Advanced Management Program (AMP), Transition to Business Leadership (TBL), TransformTech (TT), and Leading Sustainable Business Transformation (LSBT). She is involved in the school’s EMBA and MBA programs, and contributes to IMD’s custom programs, crafting transformative learning journeys for clients globally.

From linear to circular – unlock sustainable business opportunities

July 3, 2025 • by Eric Quintane in Audio articles

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio available

June 24, 2025 • by Jerry Davis in Audio articles

The tech broligarchs have invested heavily in Donald Trump but are not getting the payback they bargained for. Do big business and the markets still shape US government policy, or is the...

Audio available

Audio available

June 19, 2025 • by David Bach, Richard Baldwin, Simon J. Evenett in Audio articles

As governments lock horns in our increasingly multipolar world, long-held assumptions are being upended. Forward-looking executives realize the next phase of globalization necessitates novel approaches....

Audio available

Audio available

June 2, 2025 • by George Kohlrieser in Audio articles

Leadership Honesty and courage: building on the cornerstones of trust by George Kohlrieser Published 17 April 2025 in Leadership • 5 min read DownloadSave Trust is the bedrock of effective leadership. It...

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience