The US and IT sector lead the way in generating economic profits

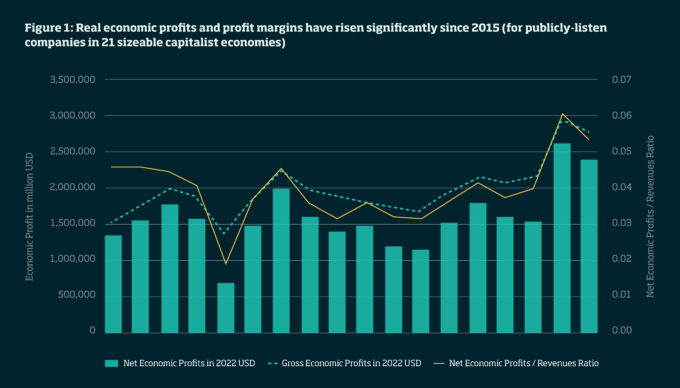

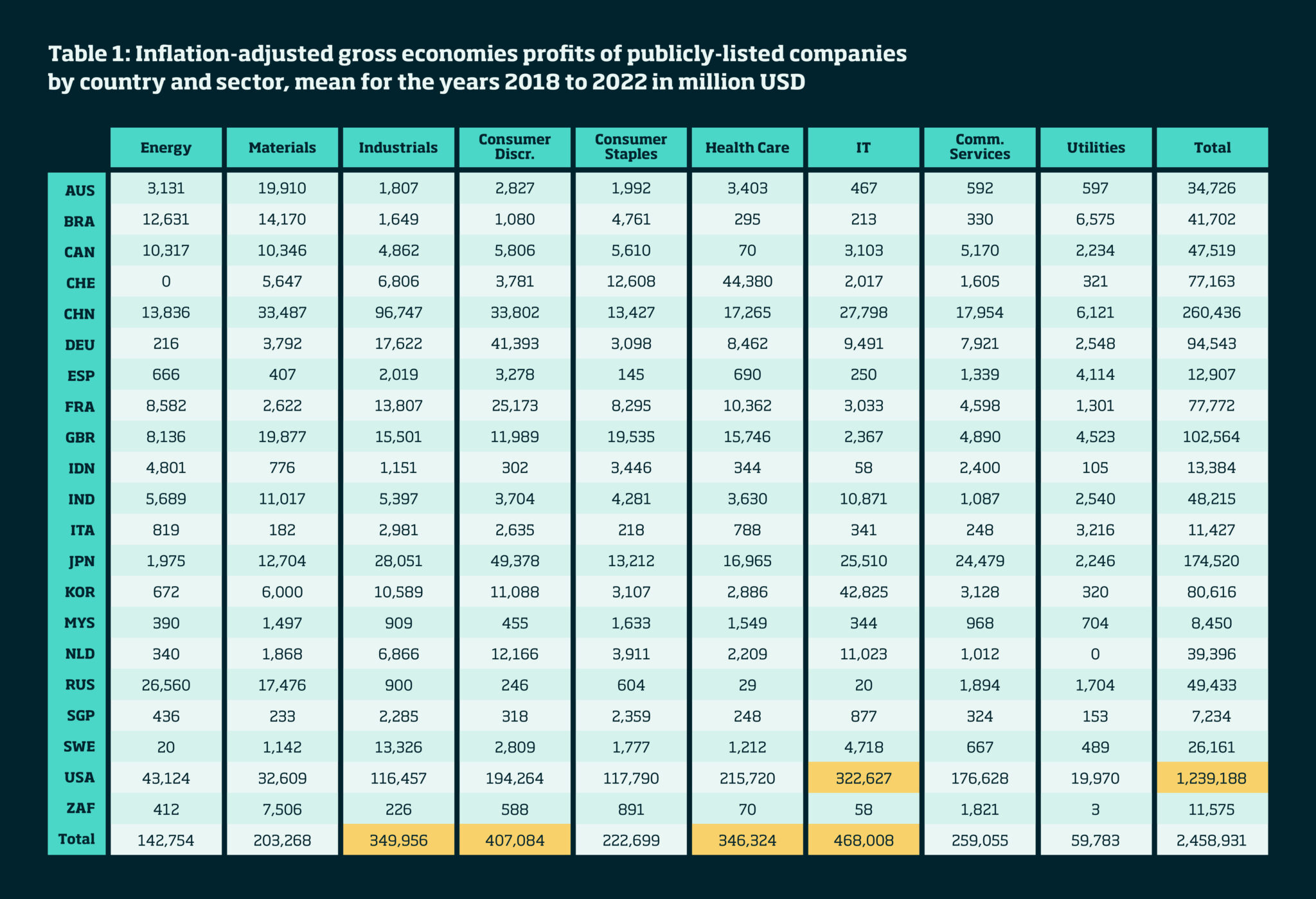

Second, our economic profits data reveals how much publicly listed firms in different regions and sectors could contribute to financing societal imperatives. Table 1, which only looks at firms with positive economic profits (i.e., our gross economic profit measure), shows that between 2018 and 2022 more than half of these profits were generated in the US. The IT sector created the most value during that time frame (19% of the total gross economic profit), followed by the consumer discretionary (17%), industrial (14%), and healthcare sectors (14%). Table 2, which analyses net economic profits, paints a similar picture. The much lower values in the energy, utilities, materials, and industrial sectors, however, imply that there were ‘value destroying’ companies with negative economic profits in these sectors.

The sector/country pairings that produce the biggest economic profits

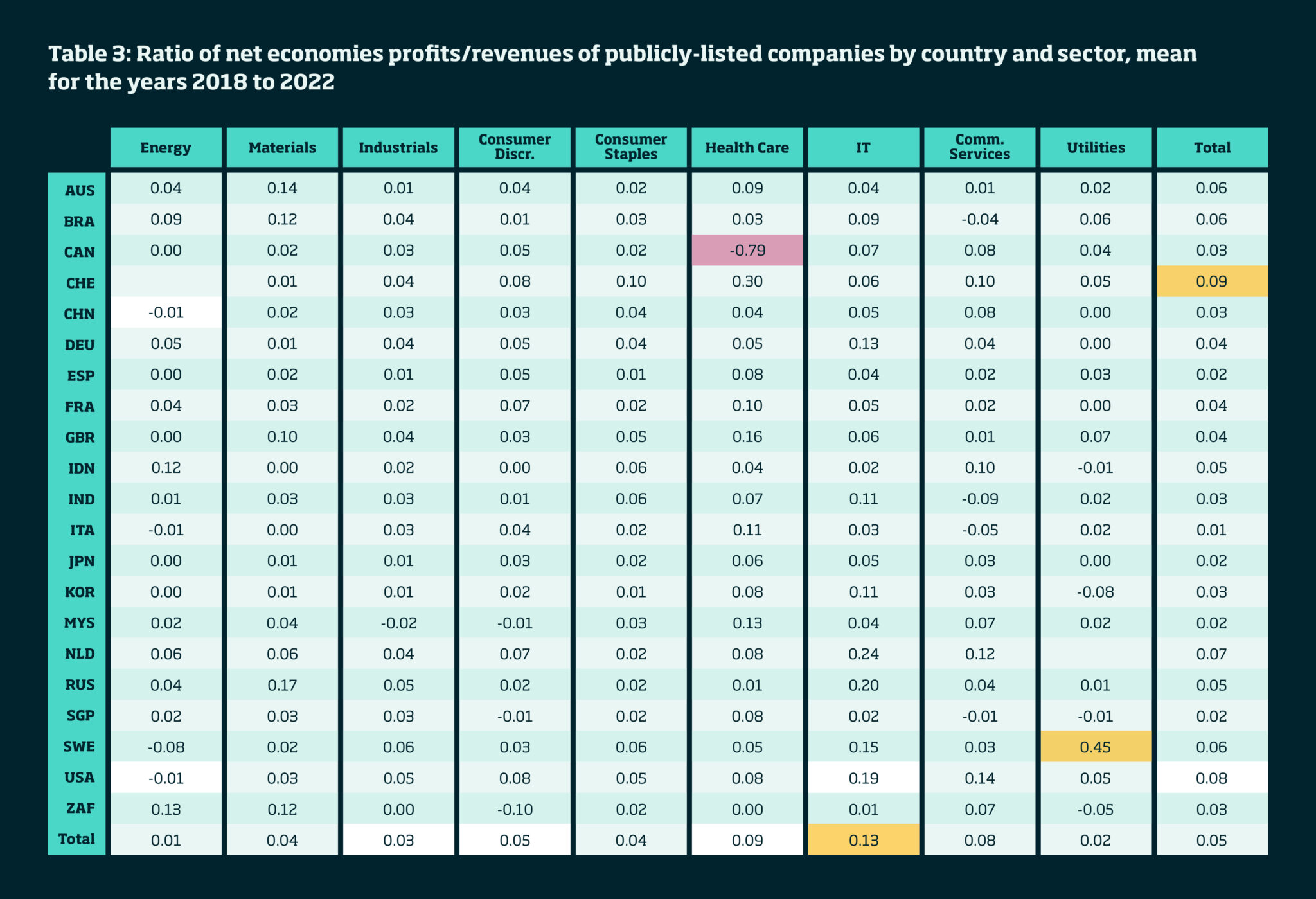

Third, our analysis highlights that some sectors, countries, and sector/country pairings were particularly strong at generating economic value relative to corporate revenues during the 2018-2022 period. Table 3 shows that the IT, healthcare, and communication services sectors have featured especially high net economic profits/revenues ratios. For example, $13 of economic profits earned in the IT sector out of every $100 in revenues were economic profits and could, in principle, have been used to finance societal improvements. Switzerland, the US, and the Netherlands hosted the companies with the highest economic profit margins in the world. Nine dollars of every $100 in revenues earned in publicly listed Swiss firms, for instance, were economic profits. Within these sector/country pairings, Swiss healthcare firms as well as Dutch and US IT firms were particularly strong value creators. Thirty dollars of every $100 earned by Swiss healthcare and pharma behemoths were economic profits.

Overall, the world’s largest publicly listed firms seem to be well-positioned to contribute to financing the most pressing global challenges of our time. However, our analysis also shows that their ability to do so varies across countries, sectors, and time. Successfully navigating the tension between vastly different capacities for economic profit generation across countries as well as sectors and the pressing need to jointly solve urgent global problems may become a litmus test for corporate and political leaders. And to the extent that recessions, higher interest rates, and poor government policies towards business erode economic profit levels, no one should take it for granted that the corporate goose keeps laying golden eggs.