How to succeed as an enterprise co-pilot: Three priorities for the modern CFO

Schindler CFO Carla De Geyseleer explains how today’s CFO acts as a strategic co-pilot, uses sustainability to drive growth, and develops future finance leaders....

by Patrick Reinmoeller, Markus Nicolaus Published July 7, 2025 in Finance • 8 min read

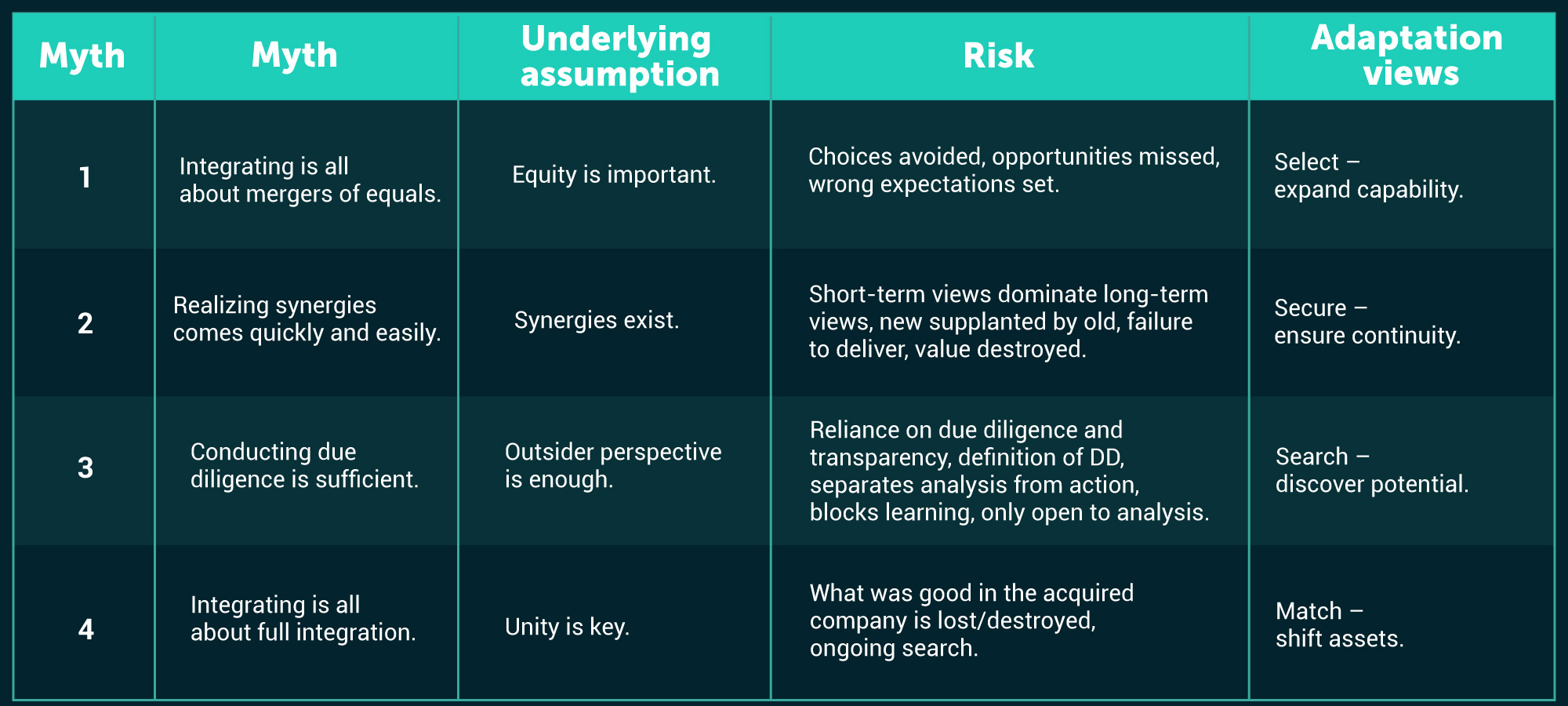

Most mergers and acquisitions fail to deliver the expected results. Four myths are largely to blame: the belief that it must be a merger of equals, that synergies will come quickly and easily, that conducting due diligence will be enough, and that full integration is necessary.

In reality, both parties in the M&A process need to develop a shared understanding of their future (and not necessarily of their shared future). Based on our research findings, we suggest companies select, secure, search, and match.

Let’s look at each requirement in turn:

You should set priorities on capability building/strengthening (capability expansion). Amazon, for example, is adept at acquiring targeted capabilities, including Zappos for shoes, Audible for audiobooks, Whole Foods for high-end natural foods, Metro-Goldwyn-Mayer for its film library, and iRobot for its Roomba remote vacuum cleaners.

It’s vital to ensure continuity over elusive synergies (continuity assurance). Successful acquirers of successful companies seek to keep existing customers and ensure the acquired company is not disrupted. For example, the luxury goods company Chanel maintains and strengthens the brand identities of many of its acquired companies, which continue to compete quasi-independently in their markets. Among them are the designer swimwear specialists Orlebar Brown, leather goods firms Colomer and Samata, and the shoemaker Ballin.

Due diligence before the deal does not cut it. You must take the time to explore and learn about the acquired company, its various units, and its respective capabilities to discover fresh opportunities (discovery of potential). We call this the “parking algo” – a way of analyzing an acquisition while it is temporarily parked. Such engagement prevents any hasty or rash decisions from being made. The “parking algo” can be created in a similar way to Siemens, which set up an umbrella structure in 2019 to create value from non-core businesses. Siemens Portfolio Companies target improving business performance and/or spinning off non-core businesses from the group. One success story is Flender, a manufacturer of mechanical and electrical drive technology, which was acquired by Siemens in 2005 for €1.2bn and sold 15 years later to The Carlyle Group for €2bn after its potential was spotted.

Even after you acquire, keep looking for potential acquirers (asset reallocation) that will make the asset’s most suitable match. Some units in acquired companies may not help grow the acquirer’s competitiveness and may be a much better fit for other companies. Thinking in alternative contexts/complementarities will help acquirers find more suitable owners for the benefit of all. For instance, IAC/Interactive Corp listed its travel-related units as Expedia on the public stock exchange in 2005. While TripAdvisor was part of Expedia, its growth and strength over time showed that its potential might be restricted. Therefore, the decision was taken to spin off TripAdvisor as a separate company to chart its own course.

Each perspective deserves more attention:

The acquirer and acquiree must understand and support priority areas for strengthening existing capabilities or building new ones. This can be the deal breaker. Without shared views on the priority areas, adaptation cannot be successful. Too many justifications for a merger lead to the dispersal of attention and confusion. Both sides need to reaffirm why the acquisition was made in the first place and align on enhancing key capabilities. Moving fast to align, share, and adjust helps raise the chances of success.

Acquired firms are very good at parts of their business. Keeping these intact and running smoothly is an essential part of adapting for both sides. Acknowledging the strengths of the acquired firm, even when not central to the acquisition, is important for a successful adaptation. Safeguarding the continuity of such business lines and processes presents excellent opportunities to benefit from undisturbed operations and continued cash flow that help with quicker ROI. Understanding the importance of the acquired company’s continued success opens space to explore the acquired company and find unexpected potential.

Even after due diligence, no acquirer fully knows the acquired company. Some units may seem to offer potential, but how this could be realized remains unclear. Systematic exploration of potential future uses of assets needs engagement. We found that “parking” such assets and iteratively reviewing them to discover what adaptation will help to unlock their potential over time. This kind of parking should not go on forever, but generative learning does require time. An internal search for unexpected potential allows us to determine with greater certainty what might better match another owner, which helps link the shifting assets.

For assets that don’t fit the acquirer’s portfolio, it is important early on to consider the possible complementarities of these assets for other interested parties. Looking broadly, as opposed to staying confined to the specific industry context, can offer great rewards. Searching for possible buyers or a public listing is a task of creative learning; it involves finding third parties that could be interested and assessing the assets, taking their perspectives. Also, the fourth theme can partly be frontloaded, and a deliberate, iterative approach to (re)consider assets for sale can increase speed but, at the same time, undermine the opportunities to learn from experience.

“The views suggest a strong emphasis on selecting what creates value.”

All four views should play a role before the acquisition. Such frontloading helps to greatly accelerate adaptation. Yet devising and executing a detailed plan on what to focus on and what to transfer to other companies without benefiting from the new perspectives and experiences only available to owners may reduce potential upsides.

Frontloading analysis of the business case by taking all four views leads to better targeting and early value-creation efforts. Greater speed of integration is necessary because the impact on earlier ROI is strong. However, the greater insights gained after the companies came together allow for profound exploration after the acquisition. In short, frontloading helps, but not everything can be frontloaded.

Our four views are counterintuitive as they are novel responses where old myths confuse many involved in PMI. Focusing on the strongest view usually makes the business case stronger. This implies that the order of the themes roughly indicates the likelihood of success. If capability expansion and continuity assurance are not at the top of the agenda, the question of why the acquisition was made might arise.

The views suggest a strong emphasis on selecting what creates value. In turn, this points to abandoning the idea of fully integrating the acquired company, as full integration takes time, distracts management, carries high costs, and keeps the working capital needs higher than necessary.

Adapting what needs adaptation, continuing what works, discovering new potential, and reallocating assets to external partners are four activity patterns that can be performed in sequence. However, as speed is essential, parallel processing is often preferred. For such parallel processing, our cases show specialized teams working on selecting, securing, searching, or matching effectively. While different teams may not be necessary for the themes, it greatly reduces the task complexity if the teams can focus on one theme only.

A formally established program management office can ensure a minimum yet necessary level of coordination and alignment across the preferably diverse teams. The approach to the adaptation process – ideally a continuous process that does not stop at the announcement – allows thinking, acting, and reflecting on the degree of autonomy needed by the acquired company.

To reduce uncertainty and strike the right balance between adaptation and autonomy, your adaptation checklist should include these key dimensions: stakeholders, relationships, infrastructure, and assets to provide sufficient clarity. Employees, suppliers, and customers need to learn if their ways of working, employment conditions, and contractual arrangements are still valid or will have to adapt. How will the relationships change between employees at the acquired company and representatives of customers and suppliers? Will the two companies coming together maintain separate customers and suppliers, or will they be integrated and become relations of the new company?

There are many complaints about legacy systems. We need clarity about how the extant corporate infrastructure (including the IT environment, HR systems, finance, and reporting systems) must adapt or maintain its autonomy. Autonomy can greatly motivate staff, but it can also reinforce boundaries and create silos. By reviewing the appropriate degree of autonomy and adaptation across the three dimensions, leaders will better understand how to apply the four adaptation perspectives.

Where M&A was more exploratory, adaptation came more naturally to both sides as they approached such a union with greater anticipation of the unexpected.

Our research shows that adaptation leads to success with M&A. However, adaptation is not equally easy to apply in all cases. For example, it is challenging in cases where the size and power differences between the acquirer and the acquired units are large. In such cases, leaders must resist pressures and temptations to disregard their partner’s business. Adaptation is also harder to use if the conviction of one side about what is best is overbearingly strong. Ignoring others’ views does not help. In cases where M&A was exclusively targeting specific assets, paradoxically, attention to (the continuity of) other parts of the business was important for successful adaptation. Where M&A was more exploratory, adaptation came more naturally to both sides as they approached such a union with greater anticipation of the unexpected.

As the need for capabilities and growth opportunities and the pace of change increase, leaders’ abilities to merge and acquire become the source of an enduring advantage in a chaotic environment. With acquisitions becoming more common, the key strategic question now for any corporate leader is: “What is the right integration to adapt?”

Patrick Reinmoeller has led public programs on breakthrough strategic thinking and strategic leadership for senior executives, and custom programs for leading multinationals in fast moving consumer goods, telecommunications, pharmaceuticals, healthcare, and energy on developing strategic priorities, implementing strategic initiatives, and managing change. More recently, his work has focused on helping senior executives and company leaders to build capabilities to set and drive strategic priorities.

Group CEO of AMANN

Markus Nicolaus is the Group CEO of AMANN and has over 25 years’ experience working internationally as an interim executive, top management consultant and managing director in the consumer goods, capital goods and professional services industries. He has supported numerous post-merger integrations, carve-outs and M&A transactions in various roles. His clients include private equity funds such as IK Partners, family offices such as Haniel, and their portfolio companies, as well as medium-sized corporations and large multinationals such as PUMA. In 2022, Markus founded BrightVest, a company that helps clients excel in their growth, internationalization, efficiency improvement, strategic realignment, restructuring, and transformation programs.

February 24, 2026 in Finance

Schindler CFO Carla De Geyseleer explains how today’s CFO acts as a strategic co-pilot, uses sustainability to drive growth, and develops future finance leaders....

February 11, 2026 • by Catherine Agamis, Hischam El-Agamy in Finance

How banks can position themselves across multiple futures to deliver on sustainability commitments while maintaining financial performance...

January 9, 2026 • by Jerry Davis in Finance

The US President is gouging out chunks of America’s long-established economic data apparatus because he doesn’t like what he sees. It’s unlikely to end well....

Audio available

Audio available

January 7, 2026 • by Salvatore Cantale in Finance

At critical moments that can shape a company’s long-term future, the balance of CEO ambition, CFO vigilance, and board oversight can determine success or failure. IMD’s Salvatore Cantale outlines how CFOs can...

Explore first person business intelligence from top minds curated for a global executive audience