Why leaders should learn to value the boundary spanners

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

by Howard H. Yu Published October 6, 2023 in Competitiveness • 7 min read

It’s impossible to execute the right strategy if there are no options. Surprises crop up no matter how carefully we plan. Who would have thought, for instance, that young people prefer moderation or that abstinence is the new cool? Old-fashioned hard drinkers might ask: “What’s the point of low or no-alcohol versions of spirits and wines?” But the vast majority of consumers aged 18 to 34 are the ones switching – driving double-digit growth in this category within the beverage industry in the US, Germany, and Spain.

The challenge in all this, if you happen to be a traditional incumbent, is the unpredictability of the business environment. When something fundamentally surprising can take off, the old way of reacting simply doesn’t work. For one, running a business always requires planning capacity. Launching a new line of products takes not just money but the attention and time of your best marketing people to work on a campaign. Then, factories need to adjust to new recipes, and the procurement folks need to hunt down the right ingredients at reasonable prices and in sufficient quantities.

All of this is obvious but serves to highlight that if any part of these complex and interrelated activities is not in lockstep and each is not optimized, the company can risk losing money. Either a hot product isn’t manufactured in enough quantity and shipped where it’s needed, or worse, a lot of products get stuck in warehouses, unwanted.

In this scenario, even the CEO’s job might be at risk from investor pressure. Wall Street might think in the short term, but it has even less tolerance for perceived incompetence.

But what’s the alternative? Doing nothing will only guarantee a long-term decline because bold upstarts are ready to catch the market trends. And thus the innovator’s perennial dilemma: damned if you do, damned if you don’t. Only the most exceptional manage to perform and transform at the same time. The question is: how?

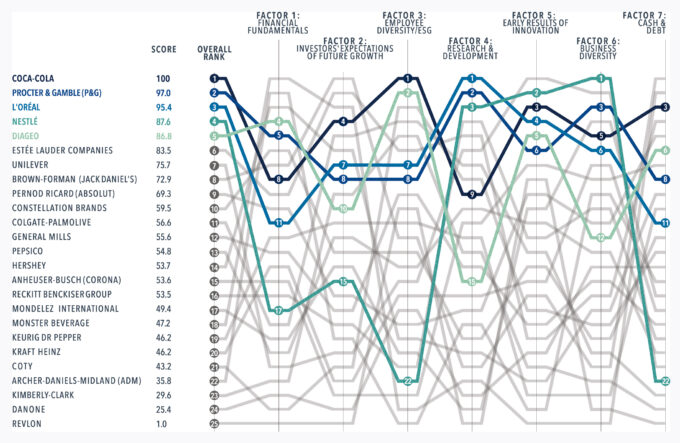

At IMD, we try to gauge a company’s readiness to operate in an inherently unpredictable business landscape. We seek to measure outcomes – that is, if a company can capitalize on new market opportunities in the form of product diversity, opening new geographical markets, or introducing innovations without sinking the company into chaos and destroying the near-term profit pool. We look at which companies can scale up and invest in new capabilities and embrace entrepreneurship while simultaneously reducing the cost of production and administrative overheads (see chart).

In other words, we want to know how top-performing companies break out from the traditional trade-off. These are tall orders, but exceptional companies have much to teach us. Here are three key lessons:

If you are the Coca-Cola Company, it would be delusional to believe that selling sugary drinks, and doing so alone, could be a viable strategy in the long run. The obesity crisis, the rise of alternatives, and the ebb-and-flow of consumer preferences due to social media demand that a company like Coca-Cola branch out into other product lines and make them central to the organization. Often, the first step to progress is to name the problem as it is.

The challenge is that carbonated soft drinks have a higher margin. Non-bubbly or still drinks are “harder to make”, at least for Coca-Cola, and they are currently made in smaller quantities. So, CEO James Quincey took a bottle of Dasani water to a town hall meeting in August 2015 and told the audience: “It’s okay if your favorite drink is not red Coke.” People gasped. “Coke is not a one-product company anymore,” he continued. “If the culture is to pretend that Coke is everyone’s favorite beverage, then there’s a conflict between culture and strategy.”1

Of course, a grand statement like that must be backed by consistent resource allocation, followed by execution to enable the new categories to flourish.

No organization can escape the need to transform to become more sustainable. The need to act is urgent. It calls for strong leadership, difficult decisions, and deep cultural change. In Issue XI, we explore how to build sustainable organizations to succeed in turbulent times.

Quincey decided it was time to eliminate some 1,200 positions from its Atlanta headquarters and work more closely with independent bottlers. Under this asset-light model, Coke could then push its flagship brand with new varieties such as Orange Vanilla, Coke Energy, and Coke with Coffee. It reformulated its Diet Coke brand and launched Coke Zero while shutting down 1,300 products that showed no sign of potential.

Coke went on to acquire Fairlife (dairy drinks), Costa Coffee (cafes), BodyArmor (sports drinks), Mojo (kombucha), Tropico (fruit juice), and Made Group (smoothies), among others. To manage the new products and to increase the odds of their success, Coke could not rely on focus groups or home visits alone. Such consumer studies are valid, but there is now a need to analyze social media using AI to spot patterns and identify what’s likely to become popular and where. The next step is to combine such demand insights and use AI again to handle procurement and sourcing, packaging, and logistics.

Decisions made by AI in real time can unearth patterns in the value chain that simply escape the purview of the human mind.

It is tempting to praise an experimental mindset. But without the proper follow-up, nothing scales. Without scaling, there is a lack of standardized data and AI infrastructure, narrow data availability and capabilities, and the absence of mechanisms for sharing results and best practices. “Standardized processes and a shared data and analytics architecture are crucial,” my colleague Amit Joshi has argued in the MIT Sloan Management Review.

At the consumer goods conglomerate Procter & Gamble (P&G), as Joshi observed, the corporate center provides a centralized platform. Microsoft Azure and a centralized data lake are there to support business units around the world as they build their analytics and AI features on top. As a result, teams can extract data from this central system and further load it with internal and external data sources to build out specific solutions that correspond to the needs of different business units.

This federal system provides the headquarters with a bird’s-eye view. The center can identify situations where a particular local solution could have multiple applications across regions. Meanwhile, local units have the autonomy to incubate bottom-up ideas. It’s P&G’s way of achieving autonomy and control simultaneously – allowing people to create local solutions, test them, deploy them, and have them quickly replicated elsewhere.

That’s also how Coca-Cola and L’Oréal evaluate marketing campaigns across channels, platforms, formats, audiences, and messages. They measure their respective returns (ROI) across dozens of markets, identify the top performers, and then allocate resources. Audience modeling, a highly valuable use case for digital marketing, does not need to be rebuilt country by country. It should apply everywhere.

A can of Coke or a pack of eyeliner might look low-tech, but it’s not about what you sell – it’s about knowing what to create and how to engage consumers, and it’s about running a seamlessly efficient operation across channels, regions, and time periods. In the dance of change, only those who move with agility and grace can lead.

Discover how IMD has derived seven factors with 23 variables for our readiness indicator here.

Jialu Shan, Alexandre Sonderegger, and Lawrence Tempel contributed to this article.

LEGO® Chair Professor of Management and Innovation at IMD

Howard Yu, hailing from Hong Kong, holds the title of LEGO® Professor of Management and Innovation at IMD. He leads the Center for Future Readiness, founded in 2020 with support from the LEGO Brand Group, to guide companies through strategic transformation. Recognized globally for his expertise, he was honored in 2023 with the Thinkers50 Strategy Award, recognizing his substantial contributions to management strategy and future readiness. At IMD, Howard directs the Strategy for Future Readiness program.

July 3, 2025 • by Eric Quintane in Audio articles

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio available

June 24, 2025 • by Jerry Davis in Audio articles

The tech broligarchs have invested heavily in Donald Trump but are not getting the payback they bargained for. Do big business and the markets still shape US government policy, or is the...

Audio available

Audio available

June 19, 2025 • by David Bach, Richard Baldwin, Simon J. Evenett in Audio articles

As governments lock horns in our increasingly multipolar world, long-held assumptions are being upended. Forward-looking executives realize the next phase of globalization necessitates novel approaches....

Audio available

Audio available

June 2, 2025 • by George Kohlrieser in Audio articles

Leadership Honesty and courage: building on the cornerstones of trust by George Kohlrieser Published 17 April 2025 in Leadership • 5 min read DownloadSave Trust is the bedrock of effective leadership. It...

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience