Five key insights from the CCTI for food and beverage companies

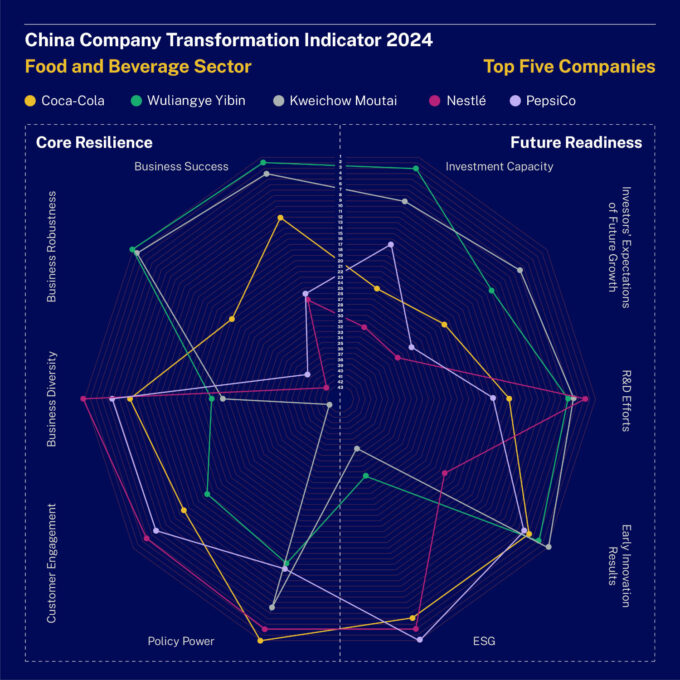

The Chinese food and beverage sector is characterized by fierce competition and changing tastes. The leading companies perform well across various factors, from R&D and innovation to China Policy Power and Customer Engagement.

1. Fierce market competition among the best companies

In an interesting shake-up in the CCTI food and beverage company ranking 2024, Coca-Cola leads because of significantly better performance across various factors, particularly in China Policy Power. This suggests effective improvement in their overall strategy and performance. However, the shifts in ranking among the top 10 companies highlight the dynamic nature of the market, requiring continuous adaptation to attract the more health-conscious post-COVID Chinese consumer.

2. Early innovation is key for sustained success

The four popular brands – drinks companies Moutai and Wuliangye and dairy companies Mengniu and Yili – are still standing strong and their performance indicates Early Innovation as a key factor influencing sustained success. These four companies have occupied the leading positions in Early Innovation for two consecutive years, although the order has slightly varied. This could suggest that a strong commitment to innovation is crucial for sustained success and long-term growth.

3. The consumer is still king

Surprisingly in the 2024 ranking, BYHEALTH, China’s dietary supplement giant joins the leaders, which could largely be thanks to a leading performance in Customer Engagement, indicating that effective consumer interaction and relationship-building could help the company better understand, anticipate, and meet consumer needs, thus maintaining a competitive edge.

4. Business Diversity contributes to Core Resilience

For two consecutive years, Nestlé has excelled in Business Diversity, significantly contributing to its Core Resilience. Nestlé’s extensive portfolio, ranging from infant formula and confectionery to coffee and bottled water, enables it to meet a wide array of consumer needs in China. This diversity is bolstered by strategic brand acquisitions, allowing Nestlé to continuously expand and enhance its product offerings, thus ensuring robust market presence and adaptability.

5. ESG can be an area of improvement for Chinese companies

The ranking also suggests that foreign MNCs in the food and beverage sector have generally outperformed local companies in ESG rankings, potentially due to a variety of factors including a global approach to ESG with high minimum standards across all their operations, regardless of location; investment in sustainability, corporate governance, social responsibility, and environmental initiatives. However, it’s also important to consider the broader context and other performance factors that contribute to a company’s overall success. Nevertheless, strong ESG practices can help build a sustainable and competitive business model that contributes to business success and long-term growth.