IMD business school for management and leadership courses

Future Readiness Indicator

Four Charts That Show How Tesla Is Winning and New Carmakers Are Surging

These industry rankings are based solely on hard data to avoid survey biases. The sources of the data include financial reporting, investors’ calls, the LinkedIn profiles of the management team, Crunchbase, Factiva, and other publicly available reporting. From this information, we’ve produced a composite score.

Our objective is to achieve a balanced viewpoint of a company’s future readiness. You need to have a strong cash flow and healthy profit to invest in the future. You also need to have a diverse team of board members to embrace change. R&D intensity matters, but we also care about the actual results of a company’s innovation in the form of new products or services. All these lead to the investors’ expectations, rewarded by the extent of the share price performance. And as demonstrated before, future readiness is a source of resilience during crisis, but it is also a capability to capture new growth when normality returns. You can learn more about our methodology.

1. Tesla is pulling further ahead.

Our ranking goes back to 2010, some 12 years ago. Tesla had not always been a winner. It was ranked #10 in both 2010 and 2015. Then in 2018, Tesla edged up to #2, closing the gap with #1, Toyota. By 2020, Tesla topped the ranking with a full score of 100, while BMW, the #2 carmaker, had a total score of 81. A year later, in 2021, Tesla remained #1, while Toyota reclaimed its #2 position with a score of 77.9. This year, Toyota remains #2, but its overall score drops to 64.5.

The upshot? All players are getting squeezed very tightly in the middle. Tesla is pulling further and further ahead.

2. New players are surging.

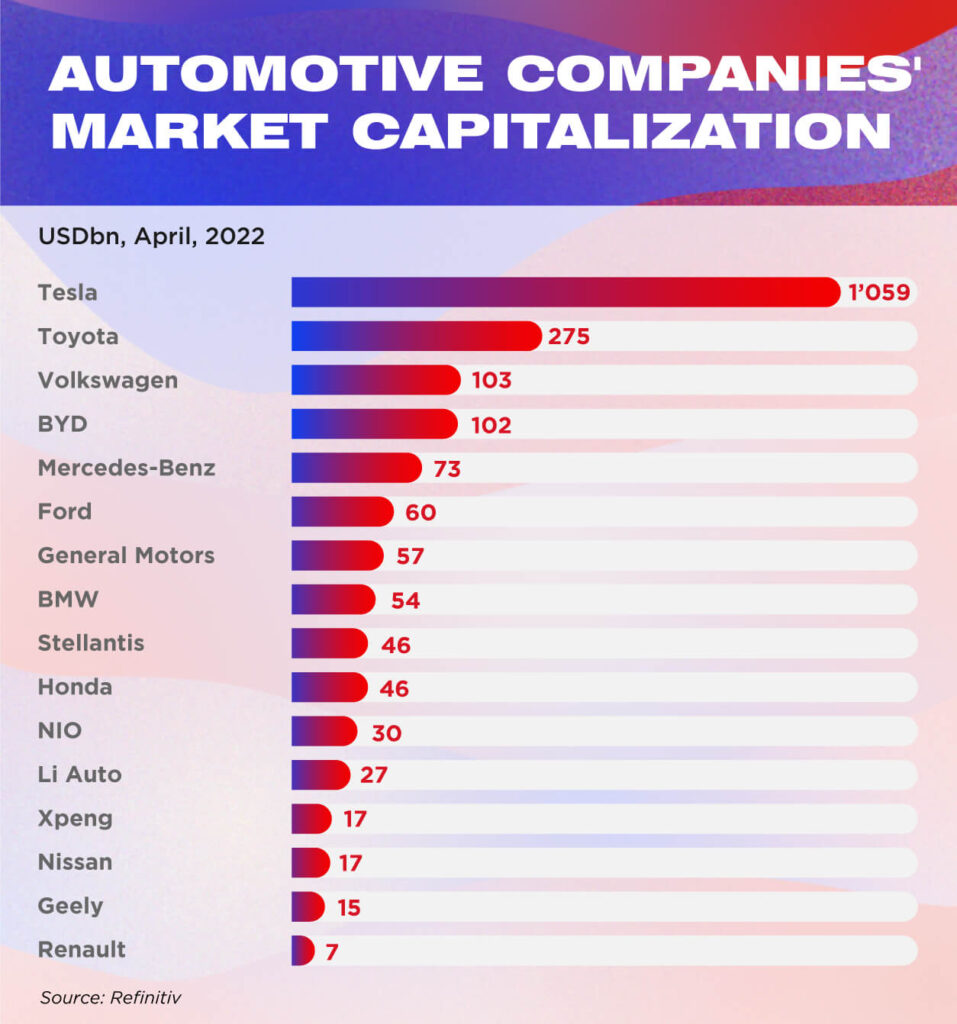

You don’t need our readiness indicator to notice that new players are coming onto the field. Take a look at the market capitalization. It speaks volumes.

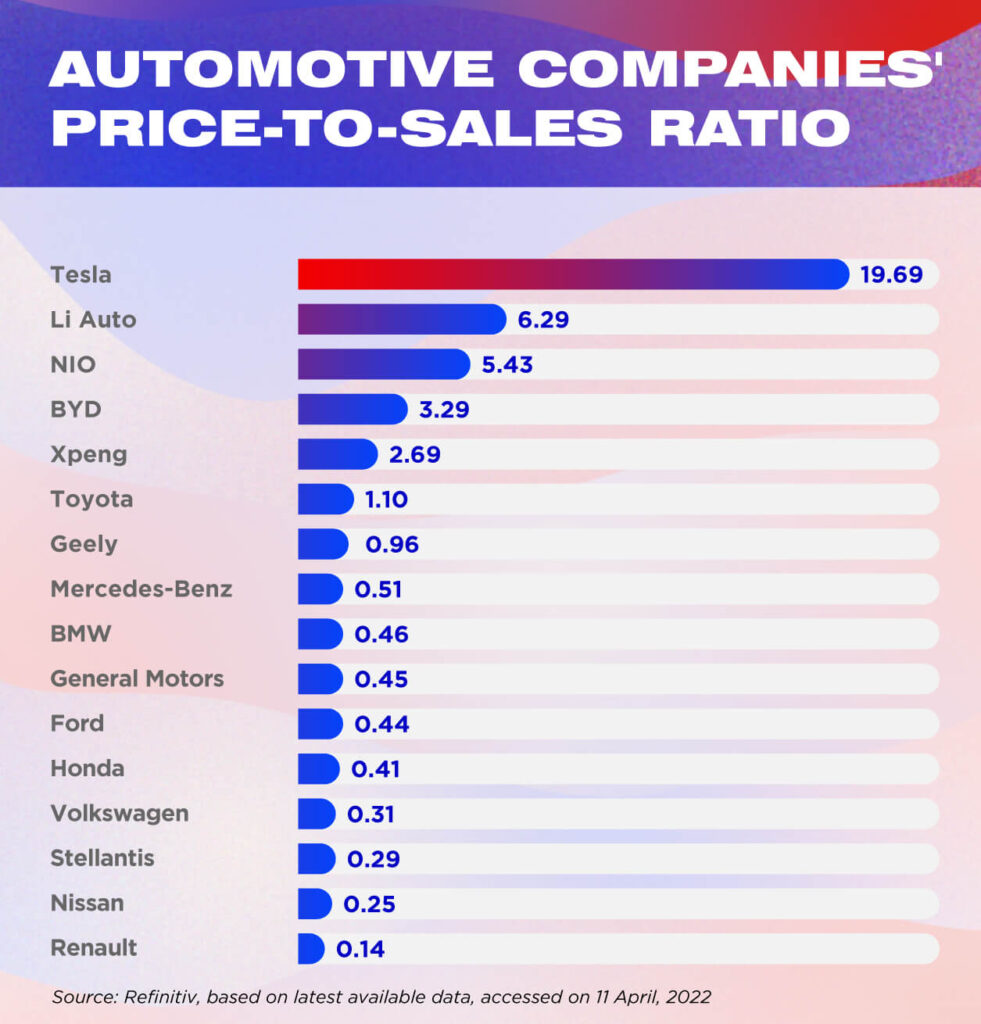

Of course, the stock market can be speculative, especially if you measure a company’s importance by its price-to-sales ratio as shown below.

Still, electric vehicle (EV) makers all stand out. The most interesting carmaker is undoubtedly BYD. Its market capitalization ranks at #4 in figure 2, while investors also possess a rosy view of it (#5) as shown in figure 3. In our readiness indicator, it has also consistently moved up, starting from #13 in 2020 and moving to its 2022 position: #5. Who is BYD?

3. A new type of carmaker

Shenzhen-based BYD (Build Your Dream) is a classic play on low-end disruption. It never intended to be a car company from day one. Back in the mid-1990s, it was a battery manufacturer, a contract manufacturer no one had heard of. BYD made nickel-cadmium batteries for Motorola, Nokia, and Sony Ericsson.

Then, like all things in China, BYD scaled up and moved up the value chain. It entered segments such as that of electric bikes. Then it went into electric scooters and mopeds. Next, it got into electric buses. Every step along the way, the company reverse-engineered other brands’ vehicles. It copied them, improved on them, and started to innovate on its own.

What BYD innovated was the engineering process. It’s a company that loves manufacturing. It has invested in battery factories; it has invested in assembly lines; it has invested in the fabrication of semiconductors. BYD has invested in precisely the areas that require heavy capital investment and are labor intensive. These are the areas that its Western counterparts have shunned.

In late 2008, Warren Buffett made a $232 million investment for a roughly 10% stake in BYD. Thirteen years later, his stake in BYD swelled to roughly $1.6 billion.

When BYD began building passenger cars, it was the only carmaker that possessed an integrated supply chain. It fed itself with batteries as well as semiconductors. Interestingly, its semiconductor plants follow the playbook of TSMC—the world’s biggest semiconductor manufacturer. BYD chooses not to compete against other carmakers on chipsets. Instead, it supplies them with the critical components. FAW and Toyota are already BYD clients. At the time of writing, BYD is spinning off its semiconductor operations to raise additional capital through an IPO. This is a crown jewel that BYD wants to scale up. Little wonder that the company said it “fared better than its peers when facing chip shortages this year.”

So if manufacturing in the past is about the mastery of internal combustion, BYD is the powerhouse of tomorrow. For good measure, it also announced in April that it had stopped the production of petrol cars. The last pure combustion engine rolled off the production line in February. Going forward, there will only be electric cars and plug-in hybrids.

Stop predicting the future, make it.

Opposing forces are at work. More expensive gas may hasten the spread of electric vehicles. But a dampening economy can dry up consumer demand just as quickly. It’s nearly impossible to make forecasts these days and still harder to align your supply chain. There are too many possible scenarios. Anything can happen.

Yet it’s not all bad, at least not in the short term. All the supply constraints have translated into price hikes. That’s how Mercedes and BMW made record profits last year despite selling fewer vehicles. But winning in the long run depends on scaling up future capabilities.

Want to read more about the semiconductor shortages?

Here’s one graph that shows why every carmaker is getting caught up by surprise.