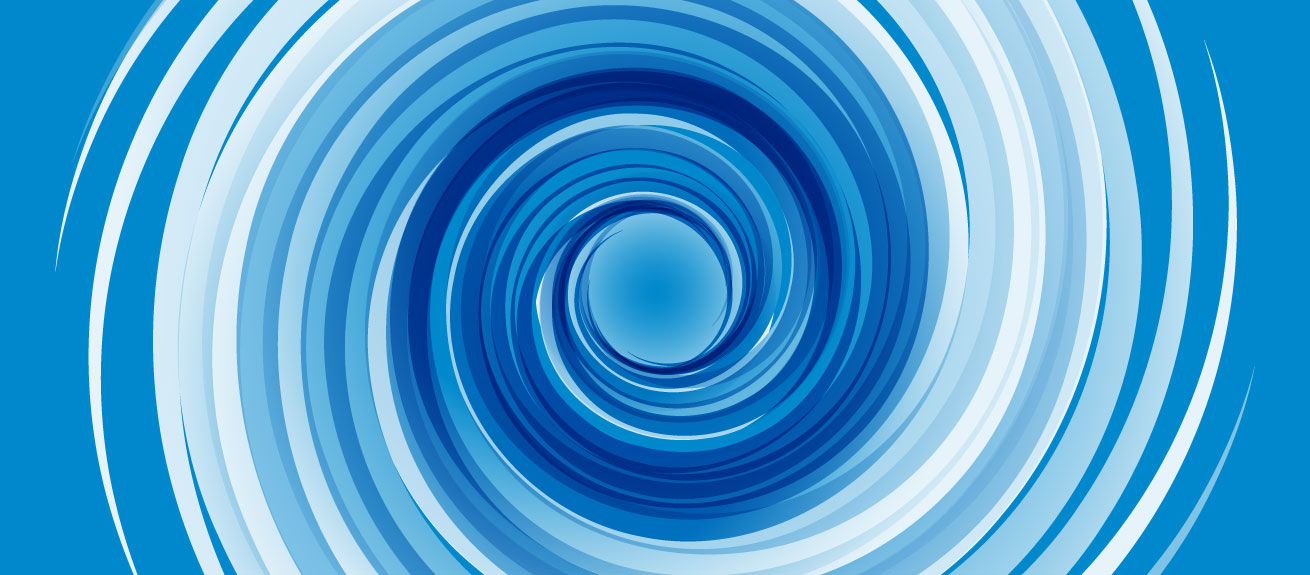

Competing in the Digital Vortex: Value Vampires and Vampire Vacancies

The DBT Center has defined a ‘value vampire’ as a company whose competitive advantage shrinks the overall market size. They are not simply companies that produce better mousetraps – what is fundamentally new about value vampires is that their success implies not just a smaller market share for incumbents, but also a smaller market size. Contrast this with most digital disruptors who are just exceptionally good at doing more or less what everyone else does, while exploiting digital technologies and business models in the process.

Value vampires may actually be relatively rare but the concept is useful for strategy not because value vampires are commonplace, but rather because they are extreme versions of digital disruption, and therefore present a learning opportunity. However, as more industries converge toward the center of the Digital Vortex and disruption intensifies it is quite possible that value vampires will increase in number.

But they are probably most apt to alight on markets where there has not been a lot of innovation (i.e., new forms of cost value, experience value, or platform value); where customers are by and large dissatisfied with services levels, or worse, feel abused; where incumbents dictate processes and circumscribe choice; and where established players have enjoyed high margins for a long stretch. Going forward, value vampires may lead to more frequent and more catastrophic revenue stalls for companies in the Digital Vortex. The most lethal value vampires, however, practice combinatorial disruption—creating cost value, experience value, and platform value simultaneously. One is bad enough, but when a value vampire kills your margin, makes your value proposition superfluous, and acquires your customers en masse, you have a major problem.

Digital disruption is not purely a bad-news story for incumbents. In fact, there is another scenario that presents itself as industries move toward the center of the Digital Vortex: the possibility of capitalizing on “value vacancies.” A value vacancy is a market opportunity that can be profitably exploited via digital disruption. These market opportunities can be in adjacent markets, entirely new markets, or digital enhancements to existing markets. If value vampires constitute the threat posed by digital business models, then value vacancies represent the upside.

But, as in the situation of a hotel room vacancy, occupants of a value vacancy must recognize that the space is theirs on a temporary basis, and that eventually, someone else will want the room. Unlike classical competitive constructs of white space, value vacancies are, by their very nature, fleeting. As Rita Gunther McGrath observes in her book The End of Competitive Advantage, managing amid this perpetual change is a formidable task: “Basing your strategies on a new set of assumptions can seem daunting, even if you know it’s the right thing to do. Even more challenging is shifting the ultimate goal of your strategy from a sustainable competitive advantage to a transient one—you can no longer plan to squeeze as much as you can out of any existing competitive advantage unless you are already well into exploring a new one.”

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications