How to get sustainable business transformation right

Sustainable corporate change is a challenging feat to pull off. Julia Binder examines the barriers and drivers of change to increase your chances of success....

Published January 22, 2025 in CFO Horizons • 5 min read

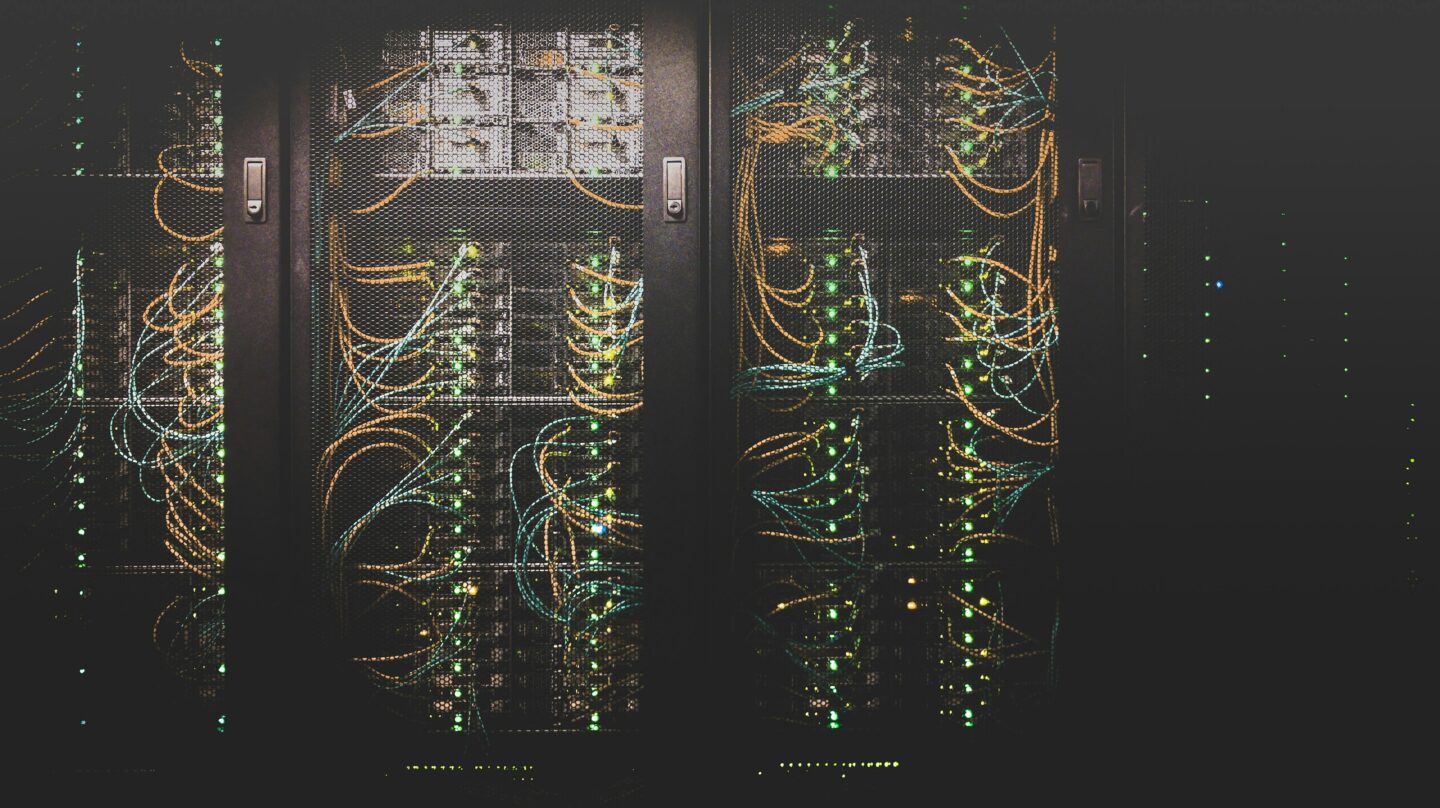

The International Energy Agency (IEA) estimates global power demand from data centers, AI, and cryptocurrencies will double by 2026 from 2022 levels. Since 2010, the computational power required to develop machine learning (ML) models has doubled roughly every six months, leading to more and larger data centers. Inevitably, this has pushed up demand for power.

Kinder Morgan, one of North America’s largest energy infrastructure companies and the largest such firm in the S&P500, is a key player in meeting this surging demand. It owns or has an interest in around 79,000 miles of pipeline and 139 terminals. Its pipelines transport natural gas and renewable fuels, and its terminals store and handle commodities ranging from gasoline to ethanol as well as other renewable fuels. Rising demand for electricity, in turn, drives demand for natural gas.

“While energy transition is still a critical issue, today’s big driver of change is the enormous growth in the traditional energy sector that we support through our infrastructure assets and associated services,” explains Michels. “Traditional power sources, especially natural gas, will be key because they offer reliability. Data center developers require 24/7 reliability.”

To meet this digitization-led surge in demand will require significant expansion of infrastructure. In early 2024, Elon Musk said the biggest barrier to the growth of AI was the electricity supply. His observation followed a warning by Amazon CEO Andy Jassy that there was “not enough energy right now” to run new generative AI services.

For Michels, the disruptive impact of AI on the industry has necessitated a change in focus. “Kinder Morgan is a large, mature company with steady cash flow and high dividend,” he explains. “The LNG [liquefied natural gas] story has played out over many years, and these are multi-billion-dollar infrastructure projects with long lead times. So, while substantial additional growth in this area is expected, it will be well-telegraphed and gradual.

“Today, however, the AI and data center revolution has moved much more rapidly and has suddenly become a key growth driver in the industry. This has meant a rapid change of focus for us, from smart operations and efficiencies to major project execution and procurement processes. We need to ensure our processes are streamlined and appropriate for this big growth phase that we’re about to enter.”

“ The AI and data center revolution has moved much more rapidly and has suddenly become a key growth driver in the industry. This has meant a rapid change of focus for us, from smart operations and efficiencies to major project execution and procurement processes.”David Michels

Digital transformation will be key to ensuring processes are primed for this growth phase. For Michels, this focus on digital has catalyzed change in both the CFO role and his personal development.

“Having a strong awareness of advances in automation and Generative AI is critical,” he says. “I have regular meetings with our CIO and use that time as a learning opportunity as well as to collaborate on project ideas. I work regularly with my leadership team on data management strategies and how to deploy advanced systems to make finance as effective as possible.”

While the productivity potential of innovative technologies is significant, Michels emphasizes the need for a growth-focused approach. “I think the best role for AI in a company is one that can help you optimize your revenue generation,” he argues. “While cost efficiency is very important, AI offers greater opportunities than reducing expenses and benefiting your bottom line.”

Michels avoids a “spray-and-pray” approach to AI, where investment is made hopefully rather than as part of a detailed long-term strategy. “The way we’re approaching it is to prioritize areas where we can see opportunities for incremental revenue generation,” he explains. “Then, we develop solutions to help achieve those gains.”

Of course, data of the required quality and format underpins this process. Kinder Morgan is consolidating its data into a centralized virtual warehouse to support analytics and AI-driven decision-making as part of a multi-year project. This structured approach ensures the company can quickly adapt to emerging opportunities in a fast-changing market.

For several years, Kinder Morgan has released a sustainability report supported by detailed metrics and data. However, while Michels sits on the disclosure committee for the sustainability report, the responsibility for gathering and reporting the data remains with the operational team, who are closer to the data and understand its nuances.

While some companies have lifted sustainability reporting wholesale into the finance function, Kinder Morgan’s approach prioritizes the input of infrastructure operations and engineering experts. The key disciplines of financial reporting are then upskilled into the team.

“Because they’re not accountants, we have provided training on reporting controls and processes and helped ensure the appropriate quality control checks and procedures are established for credible reporting,” says Michels.

Kinder Morgan’s focus on digitization is positioning it to lead in addressing the challenges and opportunities of a digital energy economy. With its strategic investments in data and digital tools, the company is well-equipped to help power the industries that are driving the digital revolution.

Vice President and CFO Kinder Morgan, Inc.

David Michels is Vice President and Chief Financial Officer of Kinder Morgan, Inc., one of the largest energy infrastructure companies in North America. David directs the company’s overall financial strategy while overseeing the firm’s treasury, tax, accounting, financial reporting, investor relations and financial planning functions.

Prior to joining Kinder Morgan, David worked at Barclays and Lehman Brothers in energy investment banking. David holds a bachelor’s degree in finance from the University of Texas and master’s degree in business administration from the University of Chicago Booth School of Business.

May 12, 2025 • by Julia Binder in Business transformation

Sustainable corporate change is a challenging feat to pull off. Julia Binder examines the barriers and drivers of change to increase your chances of success....

March 26, 2025 • by Didier Cossin, Yukie Saito in Business transformation

Hannele Jakosuo-Jansson, Executive Vice President of People and Culture at Neste – the world’s largest producer of renewable diesel and sustainable aviation fuel (SAF) – and a board member of Finnair, has...

March 7, 2025 • by Michael D. Watkins in Business transformation

To ride the daunting wave of global economic change, CEOs must first understand their operating environment and then ensure the priorities of their leadership team are aligned, advises IMD’s Michael Watkins...

January 22, 2025 • by Patrick Reinmoeller in Business transformation

In the face of growing competition from BYD and Tesla, Honda and Nissan's large merger wager may not be sufficient to bridge the gap. Thinking outside of the box may be essential...

Explore first person business intelligence from top minds curated for a global executive audience