Challenges: Regulatory risks and operational complexity

While decoupling tangible and intangible value would resolve the transfer pricing headache, the strategy is not without its challenges.

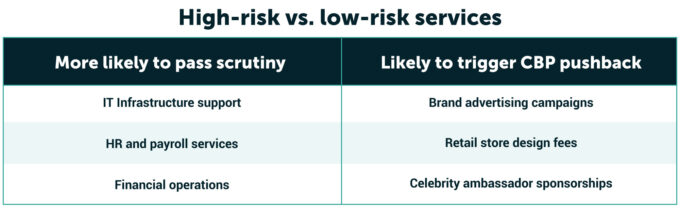

The policy may invite greater scrutiny from tax authorities, with governments challenging artificially low transfer prices. Companies must prove factory costs align with market rates (e.g., $500 handbags vs. $5,000 retail).

Second, it requires legal entities across multiple jurisdictions to host IP, design, or regulatory services, adding another layer of complexity.

Lastly, the ongoing policy volatility means that a strategy that works today, such as leveraging tariff exemptions or favorable tax rulings, may be obsolete tomorrow.