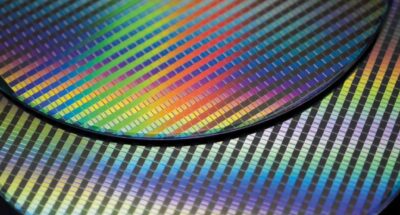

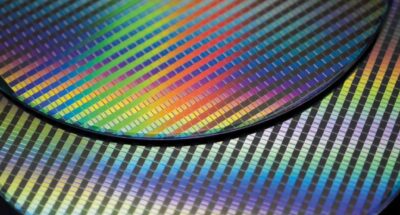

Europe needs Chips Act 2.0 to compete in digital race

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

by Julia Binder Published February 3, 2023 in Sustainability • 6 min read

Almost every company has by now adopted at least some core ESG principles, which means that they consider, measure, and report the environmental, social, and governance aspects of their business alongside financial considerations.

In fact, ESG has become so omnipresent that many companies use the term to cover all their sustainability-related activities. Yet while it has become common practice to use the terms interchangeably, there are good reasons to distinguish between them.

Have you ever wondered why ESG has conquered the business world so quickly? A key reason can be seen in the emergence of investors in the sustainability community. Investors are increasingly considering a company’s ESG characteristics alongside its financial attributes when making investment decisions.

So, ESG is primarily a risk management and investment framework that seeks to evaluate the financial risks that environmental, social, and governance factors pose for a company’s value. It adopts an “outside-in” perspective that is best described as an investor- and company-centric framework which seeks to de-risk portfolios and increase the economic resilience of a company.

As you can see, this approach is far from “woke capitalism”, as condemned by some US politicians. This is not about ideology. This is simply about solid risk management and is simply good business. The ratings and indices used by investors to identify ESG stocks are not designed to measure a company’s positive impact on the Earth and society. Instead, they assess the potential impact the world has on a company’s value and its shareholders. Doesn’t this sound very much as if Milton Friedman would approve?

Conversely, corporate sustainability adopts an “inside-out” perspective as it focuses on the impact a company has on the planet and society. The people- and planet-centric approach seeks to not only minimize harm, but to positively impact society and the environment. As such, it can be costly at times, for example when paying a fair price to everyone in the supply chain or paying a price premium for more environmentally friendly materials. This explains why business leaders have historically shied away from pursuing ambitious sustainability strategies, as true sustainable business transformations come at a price – at least in the short term.

True sustainability also involves broadening the definition of value creation when investing in a sustainable portfolio. This means that investors are willing to forego some of their return on investment in favor of the positive social and environmental impact created. Contrary to ESG investments, sustainable thematic investments and impact investments refer to investments made with the intention of solving a social or environmental problem and creating a measurable positive impact alongside financial returns. This means not just looking for investments that do less harm, but investing in companies that are making a positive difference in the world and thereby contributing to a sustainable, inclusive, and just transition.

Are you thinking about sustainability in terms of a risk, an opportunity, or a responsibility for your company?

While ESG considerations are dominating much of the sustainability conversation in the business world, the concept of ESG tends to reduce the conversation to financial risks and how to minimize them. All too often, companies and business leaders are not getting any insights from ESG analyses because they approach the issue solely as a reporting exercise. While this “tick-box” approach requires an incredible amount of data, it does not offer any insights on how to seize the enormous opportunities of sustainable transformation.

From ESG compliance to competitive advantage.

I would encourage you to move beyond a risk mindset towards embracing sustainability as an opportunity and as a responsibility of your company. Transforming your business towards sustainability can enable you to capture new markets, address changing customer needs, and attract and retain talent. A recent study by McKinsey estimated that the transition to net zero alone will provide business opportunities of $12tn a year by 2030. The question for you, therefore, as a business leader is: Will you lead, or will you follow?

Similarly, because of the emergence and growth of ESG investments, there is a growing awareness of the need to take non-financial criteria into consideration when making an investment decision. This is an important and positive development, but current ESG portfolios are based on a mindset of minimizing harm. Looking at the state of the world, we need to intensify our efforts and target investments that not only do less harm but also contribute to a sustainable, inclusive, and just transition. If you are interested in investing in companies that lead us into a new, cleaner, and more sustainable future, you need to apply a critical eye to your ESG portfolio and take a more active role in screening the activities, technologies, and products that form your investment portfolio.

In many ways, ESG must be seen as an incredible success story – in just a couple of years it has evolved from a niche topic to a subject at the top of corporate agendas around the world. However, we also need to acknowledge and address the imperfections of the ESG concept. The lack of universal standards and transparency, as well as arbitrary – and even misleading – ratings, means there are areas where there is room for improvement.

One thing that is safe to assume is that ESG is here to stay. It is true that it is receiving some pushback from some sections of society who dismiss it as “woke capitalism”, but as we have seen, ESG is not about being “woke” or even doing good. It is a risk and investment management framework.

When looking ahead, the most important message is that things are moving in the right direction. While many business leaders are understandably confused, we will see more harmonization and standardization in the years to come. The current narrow focus of ESG on issues that pose a risk to the financial value of a firm provides a very incomplete picture of a company’s sustainability performance. To complement this picture, companies will need to disclose how their activities affect – and potentially harm – both people and the planet. A lot is happening in the ESG world, and these fast and sometimes uncoordinated developments can feel overwhelming for many business leaders and investors. The good news is that the current regulatory developments, particularly the new EU Corporate Sustainability Reporting Directive, will address this problem and will likely lead to more clarity and transparency.

In its most simplified form, ESG can be seen as negative screening, which means not investing in so-called “sin stocks” – the shares of companies involved in the production of weapons, alcohol, tobacco, gaming, and fossil fuels such as coal, gas, or oil.

It can also take the form of norms-based screening, the exclusion of companies that violate some set of norms, such as the 10 Principles of the UN Global Compact.

Investors may alternatively adopt a “best-in-class” or positive screening approach by selecting companies with an especially strong ESG performance compared with their industry peers.

Finally, they might apply an ESG integration strategy in which all ESG risks and opportunities are included in the investment analysis and decision-making process.

Manage social, political, and regulatory dynamics to accelerate your sustainability transformation.

July 10, 2025 • by Bruno Le Maire in Magazine

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

Audio available

July 8, 2025 • by Mike Rosenberg in Magazine

A new framework encourages leaders to see the world as PLUTO – polarized, liquid, unilateral, tense, and omnirelational. It’s time to think differently and embrace stakeholder capitalism....

Audio available

Audio available

July 3, 2025 • by Eric Quintane in Magazine

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio available

June 26, 2025 • by Michael Yaziji in Magazine

Forward-thinking leaders proactively shape their external environment, turn uncertainty into certainty, and create substantial value in the process....

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience