How to get sustainable business transformation right

Sustainable corporate change is a challenging feat to pull off. Julia Binder examines the barriers and drivers of change to increase your chances of success....

by Sophie Bacq, Ruth V. Aguilera Published October 3, 2023 in Governance • 7 min read

In Fall 2023, US journal Science Advances published an article based on research by 29 scientists in eight countries. The piece was picked up by the mainstream press and made headlines on both sides of the Atlantic. Human activity on Earth has seen us breach six out of nine “planetary boundaries,” wrote the authors: six of the nine markers, or limits for viability, in our world have already been crossed. These markers include things like climate and the availability of fresh water, and they chart the impact of pollution and greenhouse gas emission. As we breach them, warn scientists, we are pushing our world beyond a “safe operating space.” To put that another way: we’re making our planet unlivable.

The message is clear and stark. Humanity is on notice: the risks ahead of us are no longer critical. They are existential.

Public bodies and intergovernmental organizations have long led the charge on things like climate change, biodiversity, deforestation, and social inequality – another major risk to human well-being. However, businesses are catching up in their understanding of responsibility and purpose. Of the S&P 500 largest US companies, more than 85% pledged to prioritize corporate social responsibility in their innovation efforts. Other business organizations – social enterprises – go much further, deploying commercial strategies to service social and environmental goals. But there is a problem.

As businesses look to make the necessary shift in their practices and impact – doing good as much as doing well – so how do they ensure that good intentions lead to the intended outcomes? What truly effective mechanisms can organizations use to limit damage and optimize positive impact for all stakeholders – people and planet – as well as profit?

We believe that the existential challenges and risks ahead of us call for a new model of corporate governance: one that re-imagines the value chain and challenges the prevalent thinking about value creation and stakeholder engagement.

With my colleague Ruth V Aguilera from Northeastern University, we analyzed two decades of research on different governance frameworks used by private organizations. Specifically, we analyzed and compared two ideas that have taken hold over the years: value-based strategy and stakeholder theory. Simply put, value-based strategy ties value to customers and prices – the profits and revenues made from sales. Stakeholder theory governs business practices in relation to the multiple or diverse constituencies touched by an organization and its activities. Both systems use the idea that value is always and exclusively economic.

But what if this were not the case? After all, isn’t the value of something more than money?

“Simply put, value-based strategy ties value to customers and prices – the profits and revenues made from sales.”

In our paper, Stakeholder Governance for Responsible Innovation: A Theory of Value Creation, Appropriation, and Distribution, we wanted to debunk the idea that value creation in business is only about dollars, cents and the bottom line. And we wanted to challenge organizations to ask themselves two new key questions. These questions are:

Value-based strategy, stakeholder theory, and a purely economic understanding of value –all of these are strong, sticky ideas that have served the purposes of growth and prosperity for decades. But if you are serious in your intentions to innovate responsibly – to minimize any harm and deliver positive impact and outcomes for people and planet – we would argue that you need to think about value creation that is both economic and societal, not either/or.

Then, having reframed value creation, having understood value creation both in terms of dollars and in terms of your social and environmental impact, the next question becomes: who in your ecosystem do these different kinds of value belong to and how do you ensure the right kind of value is distributed to the right kind of stakeholder?

Understanding your stakeholder ecosystem in this new context is going to require you to think more broadly about the different groups that engage with your business in different ways. You are going to need to map out all stakeholders and think about how you want to engage or collaborate with them to create value according to the different kinds of power or agency they have.

What do we mean by that? Well, if value creation is no longer just about doing well and passing the benefits on to customers, employees and shareholders, if you now see value creation as the things you do to create ripples of positive impact across your broader operating context, your stakeholder map might look something like this:

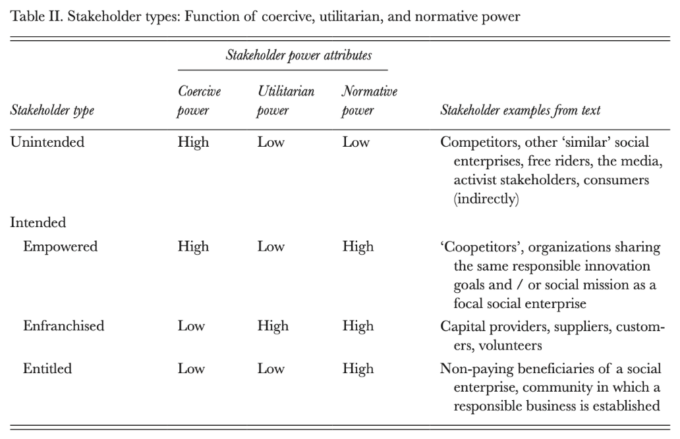

We believe you now have two core sets of stakeholders, each with different types of bargaining power or influence: unintended stakeholders, who are not your primary focus – you might want to decide what to do, whether to ignore them, re-direct them, compete with them and so on – and intended stakeholders who are important to your purpose and goals.

Let’s look at your intended stakeholders. In our model, we have grouped into three categories: empowered, enfranchised, and entitled. Again, what do we mean by this?

We see empowered stakeholders as your partners – those organizations or groups that you work with to achieve the same responsible or social goal. This might be a regulator or a company or NGO even with whom you collaborate to extend reach as you innovate together. KaBOOM!, the US non-profit that revives urban spaces for kids’ playgrounds, is a great example. And the power or agency KaBOOM! has? We would call this coercive and normative in the main: the power to force organizations to take actions and to extend or accelerate your purpose or intentions.

Enfranchised stakeholders are those directly tied to your business operations: you’re the direct customers, suppliers, or shareholders who have utilitarian and normative power over your value creation. These groups can accelerate your purpose, but you need to prioritize retributing them according to their contributions.

And finally, in our broader understanding of value creation, you will have what we call entitled stakeholders: those groups who are the non-paying beneficiaries of the value you generate. These are the disadvantaged, marginalized groups. Victims of climate change, addiction or homelessness, say, whose power is chiefly normative. They will help accelerate impact.

How you populate your stakeholder map is down to you and your business. Above all, it hinges on the answers to the two core questions our paper posits: what kind of value do you want to create, and for whom?

Once you start seeing value beyond the bottom line, you will likely have a much clearer sense of the entirety of your stakeholder system and how to apportion – how to co-create and distribute – economic and societal value among different groups according to the utilitarian power they hold, or their coercive or normative ability to mandate outcomes or accelerate impact.

We trust that our model can help you make surer decisions in your own responsible innovation efforts. Again, what that looks like in practice is specific to you and your context. But let’s say you are an IT company. And let’s say your business model till now has been a value-based strategy: you sell equipment or consultancy to other organizations for cash.

Now let’s say you reframe value creation as something more than simply economic. You might realize that you are throwing non-economic value away. You might now think about how non-economic value can be created and shared in your broader context. Who would your stakeholders be in this new scenario? Might you empower some new stakeholders—an NGO, let’s say, that works with you to deliver IT training to disadvantaged kids? Might that same NGO also be an entitled stakeholder if you donate refurbished IT kits? And might other entitled stakeholders be a quota of marginalized people that you now decide to employ – disabled or formerly incarcerated talent who now have a job and career prospects?

Organizations that embrace a broader definition of value and rethink the way different value is apportioned and shared among diverse groups of stakeholders stand to gain in the long run. We believe that you stand to drive competitive advantage while delivering outcomes that benefit people and planet.

We know it is hard to let go of the sticky profit paradigm but we urge you to understand the imperative to do so and to actively engage in stakeholder governance. New generations of impact investors, better-informed talent pools, corporate reputation, new regulation, and the existential risks that are right in front of us – all of these forces of pressure will squeeze old paradigms into extinction. And complacency has no part to play in longevity.

We believe that the sooner you and your organization start to ask these important questions and take decisive action the better. Because as human activity sees us hurtle past one boundary after another, one thing is becoming very clear: the time to act is now.

Professor of Social Entrepreneurship and Coca-Cola Foundation Chair in Sustainable Development, IMD

Sophie Bacq is Professor of Social Entrepreneurship and Coca-Cola Foundation Chair in Sustainable Development at IMD. As a globally recognized thought leader on social entrepreneurship and change, she investigates and theorizes about entrepreneurial action to solve intractable social and environmental problems, at the individual, organizational, and civic levels of analysis. At IMD, she leads the Social Entrepreneurship Initiative, which aims to inspire entrepreneurs, leaders, scholars, and organizations to change the system and to create and share new solutions for positive societal change.

Distinguished Darla and Frederick Brodsky Trustee Professor in Global Business at the D’Amore-McKim School of Business at Northeastern University

Ruth V. Aguilera (Harvard University, Ph.D.) is the Distinguished Darla and Frederick Brodsky Trustee Professor in Global Business at the D’Amore-McKim School of Business at Northeastern University and a Visiting Professor at ESADE Business School in her native Barcelona. Ruth’s research, teaching and advising interests lie at the intersection of strategic organization and global strategy, specializing in international corporate governance and corporate social responsibility/sustainability. She is an Associate Editor at Journal of International Business Studies and a Fellow at the Academy of Management, Academy of International Business and the Strategic Management Society.

May 12, 2025 • by Julia Binder in Business transformation

Sustainable corporate change is a challenging feat to pull off. Julia Binder examines the barriers and drivers of change to increase your chances of success....

March 26, 2025 • by Didier Cossin, Yukie Saito in Business transformation

Hannele Jakosuo-Jansson, Executive Vice President of People and Culture at Neste – the world’s largest producer of renewable diesel and sustainable aviation fuel (SAF) – and a board member of Finnair, has...

March 7, 2025 • by Michael D. Watkins in Business transformation

To ride the daunting wave of global economic change, CEOs must first understand their operating environment and then ensure the priorities of their leadership team are aligned, advises IMD’s Michael Watkins...

January 22, 2025 • by Patrick Reinmoeller in Business transformation

In the face of growing competition from BYD and Tesla, Honda and Nissan's large merger wager may not be sufficient to bridge the gap. Thinking outside of the box may be essential...

Explore first person business intelligence from top minds curated for a global executive audience