Busting the myths of M&A: 4 steps to success

Busting the myths of M&A: New research reveals why old merger strategies fail and how fresh thinking can lead to lasting value for both sides of the deal....

by Vanina Farber Published October 6, 2023 in Sustainability • 8 min read

The warnings could not be any starker. Last week in New York the UN Secretary-General Antonio Guterres said we are now in an era of global boiling. Humanity’s foot-dragging and naked greed have “opened the gates to hell”. The question for businesses and policymakers is not what to do, but how to do it. What are the obstacles and how can we overcome them?

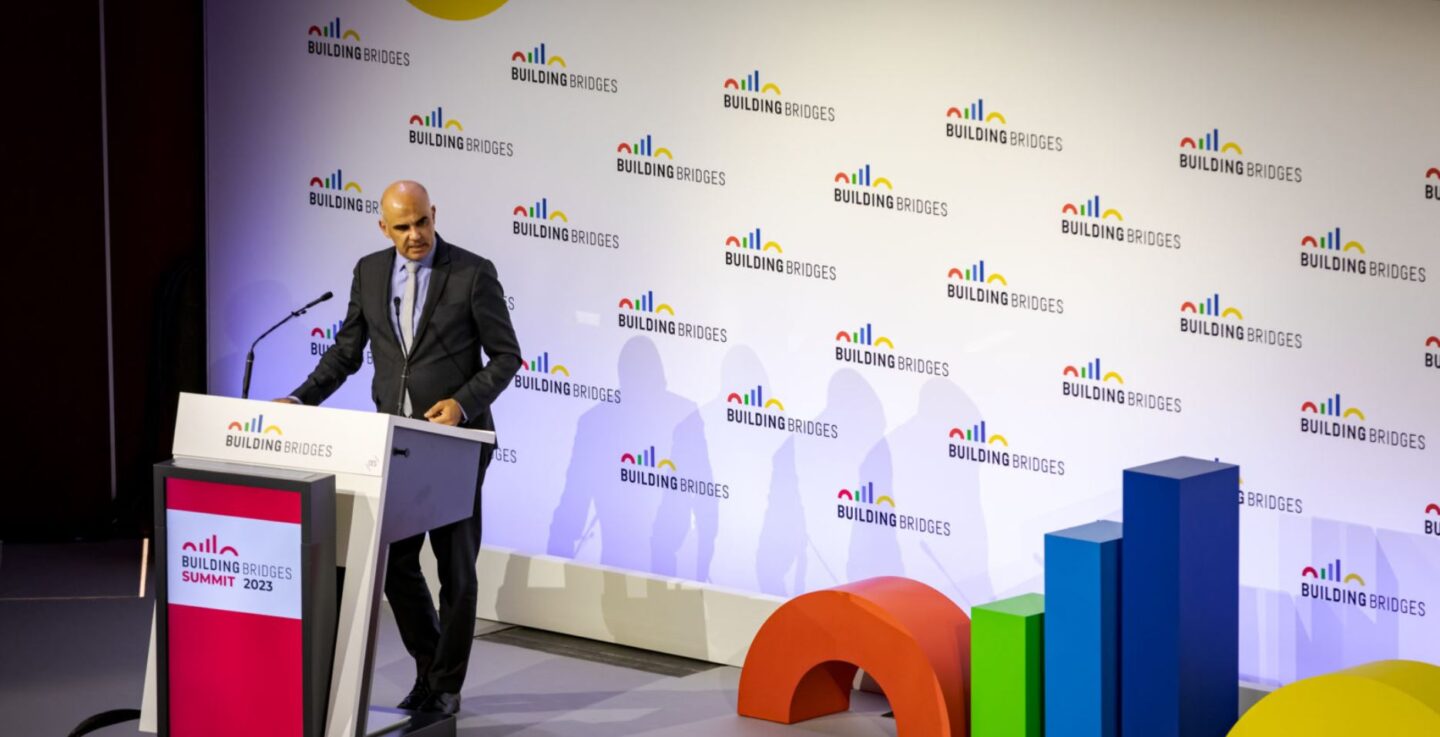

At the Building Bridges Summit in Geneva this week, 600 delegates from the very different organizations of finance, business, academic, and sustainability gathered to listen to each other’s perspectives and discuss ways to accelerate action. What will be the outcome of these talks? One thing is clear: it is only by acting together that we have any hope.

Collaboration is the foundation to achieve the SDGs, where the magic unfolds at the intersection of aligned impact goals with diverse risk-return profiles. Philanthropy, public, and private sectors all have roles in de-risking vital SDG solutions. It’s a paradigm shift, broadening the traditional notion of ‘investable’ to swiftly scale social innovations.

There was a palpable frustration at the slow rate at which economic models are transforming and capital is being unlocked towards the right solutions and regions of the world. Eva Zabey, CEO of Business for Nature, said, “There is no business on a dead planet.” We need to look at the big picture instead of treating the climate, nature, and social issues as if they were not interrelated.

Patrick Odier, President of Swiss Sustainable Finance and Chair of Building Bridges, stressed, “We know the facts, we have the technologies, the means, and the resources to act. We have to be bold and brave. We don’t need to discuss the facts, we need to discuss the implementation and the transition.”

What exactly needs to be done, and what is getting in the way? Alain Berset, President of the Swiss Confederation, said it was a question of political will. “We need to mobilize our intellectual, human and financial resources and to form courageous alliances,” he said. “Instead of focusing on our differences, we have to look at what works.”

He flagged the need for more investments in sustainable development in the global south, and the importance of establishing meaningful indicators such as the Swiss climate scores to show how climate-friendly a financial product is.

Having the courage to rise above ego and personal gain and make tough political decisions came up again and again. Sigrid Kaag, Deputy PM and Minister of Finance, Government of the Netherlands, pulled no punches: “You have to be prepared to lose an election.” She challenged decision-makers to consider the costs of responding inadequately to the climate crisis – would you rather stay in power and be mediocre while losing the planet? “I fear that politics is going down a path of avoiding political and financial risks despite the evidence being clear.”

Kaag also pointed out that it’s only in the OECD countries that we have been able to look away – the impact of climate change wasn’t as obvious as it is today. Yet it is those countries that have caused the harm, and we need to square up to that fact. “It’s about consumption and production. The political voice of the global south needs to lead. Western countries can help – to move from billions to trillions we can only rely on the private sector. There is a key role for finance ministers to play – move budgets, reallocate. Be less risk-averse.

“If we are true about global solidarity we’ve got to walk the talk and money is the way to achieve this,” she said. “Transition is tough but if we take the long-term view, you can build the business case. Make it clear for private investors where to invest, where is the biggest buck and what is the cost of inaction. There’s no shortage of good, well-costed ideas, but investors need to leap. The ultimate gains will be formidable and sustainable.”

“We need to mobilize our intellectual, human, and financial resources and to form courageous alliances.”- Alain Berset, President of the Swiss Confederation

Ngozi Okonjo-Iweala, Director General of WTO, insisted that trade can be part of the solution. Radical changes are called for. She urged governments to phase out the 1.2 trillion dollars worth of trade-distorting, environmentally unfriendly subsidies that currently exist and redirect those funds to climate finance. Advocating for re-globalization, she warned against misdiagnosing the problems. Interdependence doesn’t make us more vulnerable, overdependence does. “If we head towards fragmentation of trade into two trading blocs it will be very costly. Let us not do this, let us reimagine globalization to build resilience.”

Now is the time to include those who were left out in previous versions, she said. “Why can’t we diversify supply chains – not China plus one (Vietnam) but China plus Rwanda or Bangladesh? If we don’t become more inclusive we are going to have more populism in the rich countries and the divide between north and south will get bigger.”

Avinash Persaud, Special Envoy on Investment and Financial Services to the Prime Minister, Government of Barbados, stated the need to lower the cost of capital. Rémy Rioux, Chairman, IDFC, Chief Executive Officer, Agence Française de Développement, said, “The trillions are here – in this room, and in other rooms.” He was hopeful: at another recent meeting with 530 public banks from around the world, a new financial architecture was discussed – vast, seamless architecture at scale, with trillions of public investment. We need to build capacity and think bigger. “It’s not about standards, it’s about a common vision for the world.”

Developmental banks must be catalytic to derisk investment in the SDGs: their proactive support and financial incentives should crowd in private sector participation, making sure their intervention brings about outcomes that would not have materialized without the intervention.

There are some examples already of corporations treating the economy as a subsystem of the ecosystem and financing nature solutions as a part of a more enlightened approach. Nestlé, for example, has shifted its mindset from thinking “We’ve got to address nature” to asking “How do we help people protect and enhance their livelihoods by addressing nature?” In the Côte d’Ivoire, its coffee-growing community has a problem with child labor. Nestlé is directly addressing this by giving bonuses to people who send their children to school, along with other bonuses for engaging in regenerative farming practices, pruning and the like – and wages are paid by mobile cash transfer across the household to husband and wife.

Elsewhere, the insurance industry is using nature-based solutions such as mangroves to protect coastlines, rethinking the perceived risks vs real risks and integrating climate and nature into risk management frameworks.

Two hundred and forty organizations have joined the Taskforce for Nature-Related Financial Disclosures, which is about to start a Community of Practice to pilot solutions and share knowledge and best practices. Renata Pollini, Head of Nature at Holcim flagged the need to build capabilities and train senior management and the board of directors and investors, who might not have much visibility about what is happening across their supply chains.

The most important lever for decarbonization, according to Richard Manley, Chief Sustainability Officer at CPP Investments, is changing behavior. Inviting the entire employee base to be part of the journey makes a big difference, and crucially it’s necessary to reframe the discussion constructively. “This is not a compliance conversation. This is a value creation conversation,” he said.

Dominic Waughray, Executive Vice President, World Business Council for Sustainable Development – which includes 300 of the leading multinationals in the world that are committed to that pathway to sustainable development – emphasized a real commitment to tackling climate, nature, and inequality. The latter is key: what are the risks to society, and what can we do? One solution is to piggyback on existing supply chains to add social value, such as adding nutrients to rice and other foodstuffs – without raising the price. Innovation across the supply chain offers huge potential for change.

As I have written elsewhere, we must address the social issue, the ‘S’ in ESG. In a world that is getting poorer, where 67% of global health is controlled by the richest 10%, and that top 10% emits 52% of greenhouse gasses, if we don’t elevate the conversation on the S of ESG to the same level as climate and biodiversity, we will fail.

As Marcos Neto, Director of the Sustainable Finance Hub, UNDP, stressed, addressing the social issue is the only way to make the other policies successful. “Poor people need to see the benefits or else there will be a backlash.”

And let’s not be naïve, or duck uncomfortable truths. Doing the right thing also carries with it democratic risks. As Prof. Jean-Pierre Danthine from Enterprise for Society said: “If prices are wrong, it will not always be possible to do well while doing good. We will have to make sacrifices – profits, returns, and social. We will have to accept that we need more redistribution of wealth from rich to poor.”

A hard pill to swallow for the world’s richest – but the only medicine if we are to save the patient.

elea Professor of Social Innovation, IMD

Vanina Farber is an economist and political scientist specializing in social innovation, sustainability, impact investment and sustainable finance. She also has almost 20 years of teaching, researching and consultancy experience, working with academic institutions, multinational corporations, and international organizations. She is the holder of the elea Chair for Social Innovation and is the Program Director of IMD’s Executive MBA program and IMD’s Driving Innovative Finance for Impact program.

July 7, 2025 • by Patrick Reinmoeller, Markus Nicolaus in Finance

Busting the myths of M&A: New research reveals why old merger strategies fail and how fresh thinking can lead to lasting value for both sides of the deal....

April 24, 2025 • by Jerry Davis in Finance

Many regional developers have tried and failed to emulate Silicon Valley’s VC-driven model for innovation. Detroit, the birthplace of Ford, is following an alternative route – with promising results....

Audio available

Audio available

April 23, 2025 • by Karl Schmedders in Finance

CFOs must drive a financially disciplined way to manage environmental risks amid growing pushback against environmental sustainability efforts, explains IMD’s Karl Schmedders....

April 11, 2025 • by Jim Pulcrano in Finance

IMD's Jim Pulcrano interviews Ruchita Sinha, General Partner of venture capital firm AV8 Ventures, and explores her approach to early-stage investing....

Explore first person business intelligence from top minds curated for a global executive audience