Don’t believe the hype: Making good use of a blackout

The Spanish blackout of April 2025 is an opportunity to strengthen electricity systems that have higher shares of renewables and should not be used as an excuse to slow down the energy...

by Cedric Lombard Published February 16, 2024 in Sustainability • 8 min read

The International Sustainability Standards Board (ISSB) is, thankfully, losing momentum in its call for a more joined-up approach to additional “double materiality” reporting requirements introduced in the EU’s recent Corporate Sustainability Reporting Directive (CSRD).

The CSRD is moving forward toward imposing separate reporting requirements for all corporates in the EU on their “second materiality” – the impact their activities have on their stakeholders and the planet. But, according to ISSB’s Chairman Emmanuel Faber, in the name of interdependence, it would be preferable if the first stage of materiality (reporting on sustainability issues that are material to financial performance only) integrated second materiality factors without splitting them in two.

In reality, however, changing the name of something does not prevent the outcome from being the same – it’s just a matter of vocabulary. The EU’s changes are, in fact, adequate for investors seeking to understand the positive and negative impact of their investments.

Double materiality under the new EU rules means that when investors look at an investment, they first consider the financial performance of a company (the first materiality). At this stage, they look at the balance sheet and income statement, analyze the numbers, and consider the internal and external elements that have influenced those results in the past and might affect them in the future. Then they consider the second materiality – how the company affects its stakeholders and the environment. As with an income statement, this social and environmental impact could be negative, with ideally a view to being reduced or turned positive.

The conscious or responsible investor looks at the second materiality, not just the first, to understand the cost or benefit that any investment might have on the planet and society. This is what it means to be an impact investor.

Central to the notion of second materiality – and an impact investor’s ability to understand how their investments are delivering on their goals – are the concepts of additionality and attribution.

Additionality asks whether the impact would have occurred anyway without the investee’s activities and the impact fund’s investment, while attribution asks how much of that change the investor is responsible for.

Attribution can be viewed as a slice of the pie of the total impact generated: how much impact can be attributed to my investment alone, knowing that there are several investors involved?

So, how does this work in practice? And what tools are out there to help investors understand the impact of their investments?

“Rhetoric, declarations, and good intentions won’t create a more transparent economy. And transparency is the only path leading to better choices.”

In the EU, the recently implemented Sustainable Finance Disclosure Regulation (SFDR) imposes a reporting framework on investors who claim to invest in sustainable assets. It proposes a straightforward methodology to provide crucial, standardized information on additionality and attribution so that investors can make clear comparisons and assessments across their portfolios.

In short, the methodology involves multiplying the material impact of a company by the size of the investment and then dividing that figure by the company’s total assets. For a fund’s investment portfolio, the SFDR’s reporting framework enables investors to calculate and understand the portion of impact their funds have according to each underlying investment. With this information, an investor, knowing a fund’s size, could easily assess its impact for any given indicator.

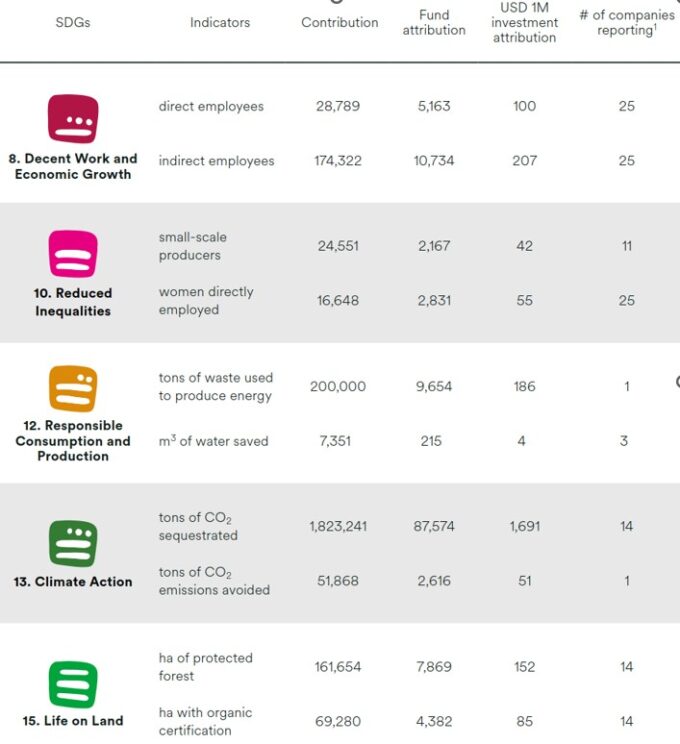

For us at Impact Finance, for example, this framework means that investors in our fund can read their impact along some 40 indicators that we report on with regard to positive impacts, with specific indicators grouped into themes such as “reduced inequalities” and “climate action” (see table). The idea is that, in due course, investors will be able to make highly informed investment choices across a set of funds, based on their different returns and their impact profile.

Let’s consider a $50m microcredit fund that invests in four microfinance institutions (MFIs). For each investment, the fund must calculate its attributable impact. One of the MFIs the fund invests in manages $100m in assets, serving 50,000 clients. The fund has invested $10m in this MFI, contributing 10% of its total assets. The fund’s attribution regarding this MFI, therefore, covers 5,000 (10%) of the MFI’s clients. Once it has undertaken that calculation for each MFI, it can add all the results up to define its overall attributable impact.

To work out the impact related to the specific MFI example above for one investor that has invested, say, $1m in the umbrella fund, we multiply the fund’s total attributable impact for that MFI (5,000 clients) by the fraction of the total assets that the investor contributes to the fund. For that specific MFI, therefore, the attribution of the investor in question relates to 100 underlying of its clients (5,000 x 1/50).

From there, of the 100 beneficiaries “supported”, the investor would then want to drill down to consider the impact of this investment on their livelihoods. Are they better (or worse) off with the loan? Do they only borrow from that specific MFI, or do they have multiple loans with others? Do the loans allow clients to achieve their business objectives, or do they saddle clients with unreasonable amounts of debt? Are they more empowered or more dependent?

As we seek to build a more sustainable world, it is crucial for the economy and companies to embrace and understand their externalities – and for the financial industry to be accountable for them. Rhetoric, declarations, and good intentions won’t create a more transparent economy. And transparency is the only path leading to better choices. The risk of too much complexity must not be used as a counterargument here; it is a reality that has to be taken into account. The choice of a uniform base of indicators, therefore, needs to be imposed and progressively extended and reviewed.

Investors, like consumers, should be able to go shopping in the full knowledge of the composition of what they are buying. Anyone who buys a chicken fed with hormones and antibiotics knows the potential health consequences. Similarly, anyone who buys a share in Nestlé or Unilever should know what externalities those companies have on society and the planet. How can an investor understand their own impact without clear, standardized rules and indicators?

Founder and Executive Director at Impact Finance

Cedric Lombard is a Swiss entrepreneur in the field of impact investing. He founded BlueOrchard in 2001 and Symbiotics four years later. Both focused on funding microfinance institutions. In 2010, he launched Impact Finance with the aim of financing SMEs that generate positive social and environmental impact. At all three companies, Lombard has been mainly in charge of the portfolio management.

July 9, 2025 • by Cédric Philibert in Sustainability

The Spanish blackout of April 2025 is an opportunity to strengthen electricity systems that have higher shares of renewables and should not be used as an excuse to slow down the energy...

July 7, 2025 • by Julia Binder, Esther Salvi in Sustainability

Lindström found that expanding its business to Asia required overcoming cultural barriers as much as building new services and infrastructure while adapting itself to local needs. ...

June 16, 2025 • by Núria Ibáñez-García in Sustainability

Driving change in a system where progress can be slow and regulation is tight isn’t easy. But for Núria Ibáñez-García, sustainable transformation starts with steady influence, applied from within. ...

June 9, 2025 • by Julia Binder, Esther Salvi in Sustainability

Dr. Kiri Trier, the beauty giant’s regional sustainability chief, explains her drive to change customer habits and make cutting waste, refilling, and recycling part of their daily bathroom routine....

Explore first person business intelligence from top minds curated for a global executive audience