Why leaders should learn to value the boundary spanners

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

by Bettina Büchel Published February 7, 2022 in Sustainability • 7 min read •

Eni, an Italian oil company, claimed in an early 2020 advertisement that its oil-based “diesel” was green. In the past, they might have gotten away with it. This time, the Italian government imposed a five million euro ($6m) fine for “greenwashing”.

This type of behavior is not limited to Eni or other fossil fuel companies. Greenwashing – essentially spending more time and money on marketing than minimizing environmental impact – is in abundance. But with consumers and investors increasing the pressure on companies to take more action on not only climate but ESG change, it is time to move from checking off the “sustainability box” in a nice report to making decisions deeply embedded at the core of strategy and operations.

Reporting on sustainability has increased from 20% in 2000 to 80% in 2020, showing that boards and executives around the world are increasingly understanding the importance of environmental, social, and governance (ESG) issues. But making this shift towards embedding sustainability into core strategy where sustainability is not only about value protection but value creation is easier said than done. Enhanced reporting is not yet a sign that firms are considering combining sustainability and profitability in their decision making.

Still, several companies stand out in reshaping their activities. Neste, for example, moved from being a regional oil refiner to a global player in renewable and circular solutions. The Finnish company committed to reducing its customers’ climate emissions by 20 million tons annually by 2030. That involves a radical transformation and shift in its portfolio of business activities to compete in new fields such as sustainable aviation fuel. Yet, even without disruptive change, there is a growing need to progressively make decisions that link commercial, sustainability and financial goals.

Companies are starting to embed sustainability decisions within their day-to-day decisions to drive value and thereby achieve a competitive advantage

So what are sustainable business decisions and why should business leaders care?

The origin of sustainable development comes from the Brundtland report in 1987 where it was defined as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs”. But for the corporate world it is much more. At the core of a company are decisions about value creation: which products and services to launch or abandon, how to optimize resource usage – and value capture – where to invest, and how to price products and services.

Often, sustainability is associated with trade-offs. Many business leaders think contributing to society cannot possibly be in the best interests of profitable returns. But many have proven that becoming more sustainable can give an organization a competitive advantage.

As consumers, investors, and other stakeholders are intensifying pressure for corporate transparency around environmental and social issues, firms are reinventing their purpose and backing it up with action. During its transformation Neste defined its purpose “to create a healthier planet for our children”. This elevation of corporate purpose acknowledges the failures of short-term profit maximization and the need to find a more sustainable path that takes into account the perspectives of multiple stakeholders and society at large.

Companies such as Solvay, Evonik and Kering, are leading the way in systematically embedding sustainability into business decisions to create value and mitigate risk. These examples show how to:

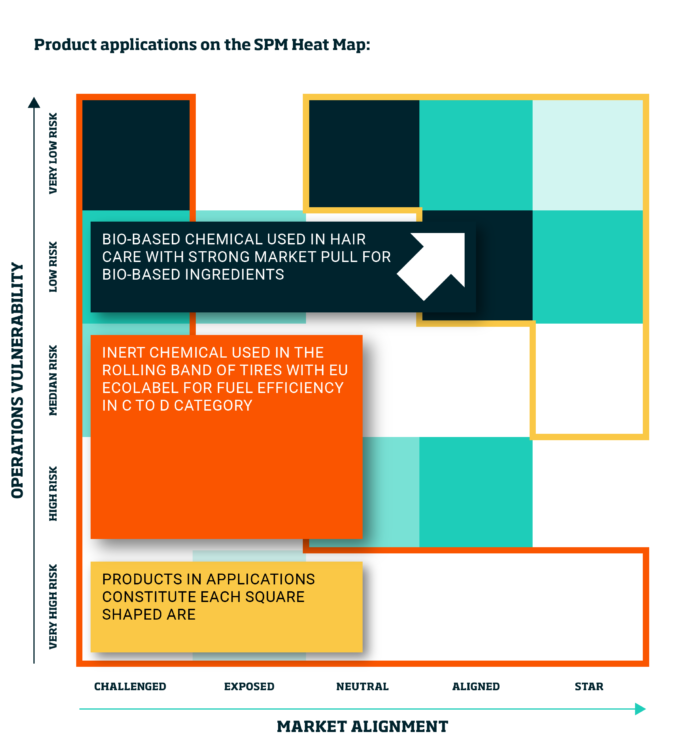

Solvay, a Belgium-based international chemicals and advanced materials company, uses an SPM heatmap (see illustration above) to steer its environmental footprint and identify its related risks and opportunities (vertical axis) and how these applications bring customer benefits (horizontal axis).

The heatmap categorizes products into three categories:

1. Solutions: products with a better sustainability contribution to Solvay’s customers and value chain, combined with a favorable balance between value and environmental impact.

2. Neutral: products without outstanding sustainability performance, if any, and low operations vulnerability which is not combined with favorable sustainability drivers in the marketplace. These are products that consumers need, but which do not contribute to environmental footprint reductions.

3. Challengers: products for which there are either strong negative signals resulting from sustainability drivers in the marketplace, or serious operations vulnerability challenges. These are products that may contribute to declining revenues over time and are likely to eventually disappear from the product portfolio (see Figure 1).

Keeping this product portfolio map on the radar of any management team can lead to non-sustainable products being discontinued and replaced with more sustainable solutions, as well as increasing marketing on solutions that are more sustainable.

Evonik, a German speciality chemical company uses a framework called PARC (Product, Application, Region, Combination) to provide guidance on product innovation decisions that enhance sustainability performance.

The underlying framework, developed by the chemical industry together with the World Business Council for Sustainable Development (WBCSD), helps companies to identify material, environmental and social challenges and opportunities related to any product and its application in a specific region.

Assessing sustainability using criteria defined by relevant stakeholder groups allows the company to test its own sustainability performance using a fact-based outside-in view. It highlights areas where changes in decision-making are likely to occur because of sustainability-related reasons. For instance, Evonik might ask a supplier to change the use of a material as it wants to ensure all products are traceable.

For each of the identified signals, which could imply either perceived sustainability benefits or concerns, the company shall decide on the materiality of the signal for the PARC categories. For product innovations, the criteria to be a leader can be outlined explicitly and thereby provide guidance into the product innovation process.

As a consequence, innovation teams will have more ambitious, sustainability compatible criteria to fulfil in a stage-gate process before they receive funding to proceed. This will ensure that the product portfolio roadmap continuously has more sustainable solutions.

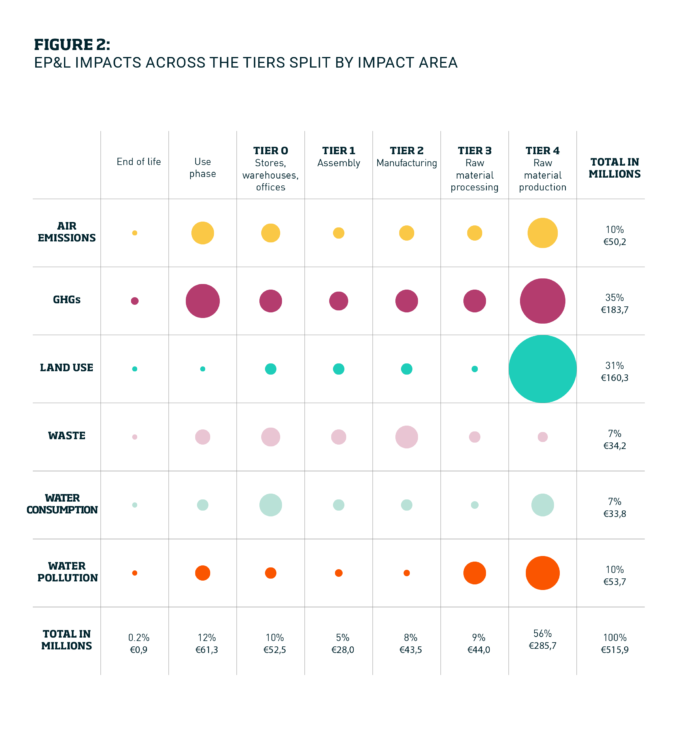

Global luxury group Kering developed an innovative tool for measuring and quantifying the environmental impact of its activities. The Environmental Profit & Loss (EP&L) account is a key enabler of a sustainable business model, and one that Kering aims to share with its peers in the luxury industry.

Kering, which manages the development of a series of renowned luxury brands such as Gucci, Saint Laurent, Bottega Veneta with a turnover of $16 billion in 2019, leverages its EP&L tool to assess the impact of air emissions, greenhouse gases, land use, waste, water consumption and pollution within its supply chain.

The fashion, leather, jewellery, and watch maker generates the most significant environmental impact in its supply chain (90%), and in particular from the production and processing of raw materials that together represent 76% of the total (see Figure 2).

By deploying this EP&L statement, Kering is constantly developing environmental improvement initiatives in its supply chain that help lower the company’s environmental footprint.

While some of the frameworks help assess where a company stands today and provides an “as is” snapshot, making sustainable business decisions means moving beyond the assessment phase towards an Integrated Sustainable Strategy Implementation framework.

Business leaders must answer the following questions:

To make these decisions, businesses must align, not just internally, but among a broader stakeholder ecosystem to ensure that longer term ambitions can be realized.

The move towards sustainable business decisions is accelerating as a result of new regulatory frameworks, pressure by investors to integrate ESG criteria and increased management awareness. Taking a value creation rather than “only a value protection and reporting” perspective to sustainability allows leaders to make the right long-term trade-offs. Are your leaders and organization ready for this new future of embedding sustainability decisions in the day-to-day context?

Professor of Strategy and Organization at IMD

Bettina Büchel has been Professor of Strategy and Organization at IMD since 2000. Her research topics include strategy implementation, new business development, strategic alliances, and change management. She is Program Director of the Strategy Execution and Change Management open programs, as well as teaching on the flagship Orchestrating Winning Performance (OWP) program.

July 3, 2025 • by Eric Quintane in Audio articles

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio available

June 24, 2025 • by Jerry Davis in Audio articles

The tech broligarchs have invested heavily in Donald Trump but are not getting the payback they bargained for. Do big business and the markets still shape US government policy, or is the...

Audio available

Audio available

June 19, 2025 • by David Bach, Richard Baldwin, Simon J. Evenett in Audio articles

As governments lock horns in our increasingly multipolar world, long-held assumptions are being upended. Forward-looking executives realize the next phase of globalization necessitates novel approaches....

Audio available

Audio available

June 2, 2025 • by George Kohlrieser in Audio articles

Leadership Honesty and courage: building on the cornerstones of trust by George Kohlrieser Published 17 April 2025 in Leadership • 5 min read DownloadSave Trust is the bedrock of effective leadership. It...

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience