How to harness the power of nonmarket strategy

Forward-thinking leaders proactively shape their external environment, turn uncertainty into certainty, and create substantial value in the process....

Audio available

by Anne Kawalerski, Michelle Lynn, Elisabeth Oak Published March 12, 2025 in Strategy • 8 min read •

Global forces are making corporate trust more difficult to cultivate than ever. Against a backdrop of volatile elections, economic instability, slowing momentum for ESG and DE&I initiatives, wariness of the promise and pitfalls of GenAI, and media distrust, how can business leaders ensure their corporate reputations will help them meet these challenges?

To understand the dynamics of corporate reputation – how it shows up, how it’s valued within organizations, who’s responsible for it, and how it’s measured – we surveyed 1,269 senior business leaders based in the US, the UK, Hong Kong, and Singapore. These business leaders represented diverse functions across their organizations, including marketing, sales, product, finance, human resources, IT, and legal, as well as a range of roles from VP/Director level to the C-suite.

While most corporate reputation studies focus on rankings, our study – Corporate Reputation = Good Business: The Challenges and Opportunities in Building a Strong Corporate Reputation (fielded in spring 2024) – sought to surface actionable insights for business leaders. Corporate reputation is difficult to measure and diffusely “owned” – which is to say, scarcely owned at all – throughout most companies. Yet, it influences how those companies show up and their ability to impact the world around them.

Building a strong corporate reputation requires playing the long game, and respondents across regions and functions agree it is the cornerstone of brand differentiation and market leadership.

Here are six takeaways from the study that leaders can use to influence corporate reputation approaches within their organizations.

Asked to choose between what most influences reputation – action and conduct, image and perception, or trust and credibility – responses show trust and action as the yin and yang of corporate reputation, with 26% of respondents strongly associating reputation with trust and ethical practices, and “actions and conduct” emerging as the number one element that shapes reputation.

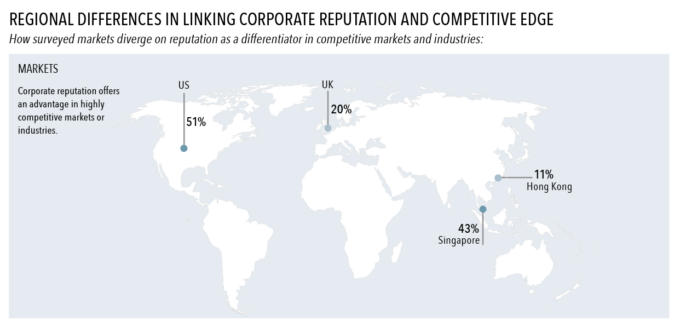

Cultural differences assert their influence. At 39%, business leaders in the US rate “trust and credibility” the highest of any market. At 13%, Hong Kong places the lowest emphasis on these authenticity and accountability markers. Instead, Hong Kong and the UK favor “action and conduct”. Singapore is alone in embracing “image and perception” – a “seeing is believing” approach to corporate reputation.

These divides echo differences in macro thinking about corporate reputation, with the US and Singapore linking reputation and competitive edge much more strongly than Hong Kong and the UK. With the currency of corporate reputation varying from region to region, global companies need to build and manage it differently depending on where they’re doing business. This regional variance affects marketing, messaging, and media strategies, as well as internal communications, requiring a nuanced global and local approach.

Survey respondents agreed that a strong corporate reputation helped to deliver the business results leaders prioritized. For example, it mitigates risk, contributes to revenue growth, inspires investor confidence, and drives brand value.

Even so, respondents acknowledged that circumstances ranging from a crisis to a need for increased revenue can deprioritize corporate reputation and the associated initiatives or campaigns. Fifty seven percent of surveyed leaders putting business results above reputation in those instances.

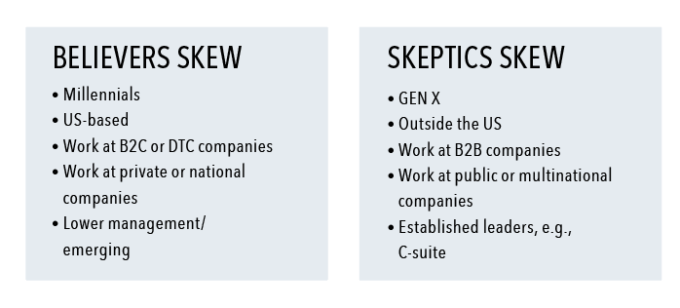

Against this dynamic, three mutually exclusive segments emerged from the results: Believers, Skeptics, and Neutrals. Understanding each one – and what they have to learn from each other – creates a framework for making all functions of an organization feel invested in driving a strong reputation.

With their Millennial skew, Believers – the 22% of respondents who prioritize corporate reputation over business results – represent an emerging generation of business leadership. They tend to be US-based and concentrated within B2C or DTC companies.

Skeptics, on the other hand, are the 54% of respondents who prioritize business results over reputation. Belonging to Generation X, this cohort has already attained their positions in the higher ranks of business leadership, often outside of the US, and within B2B organizations. More than half of the study’s Skeptics hold positions in the C-suite.

Similar to regional differences over whether action, image, or trust most influence corporate reputation, Skeptics and Believers vary on reputational priority areas and the channels most effective at improving it.

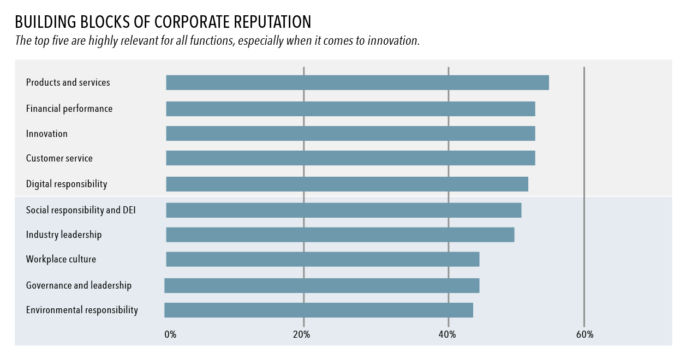

Believers rank companies’ social and digital responsibility higher on the priority list than Skeptics. Skeptics favor financial performance and industry leadership more than Believers.

Digital media is an effective channel for strengthening corporate reputation – on this point, the Skeptics and Believers agree. In keeping with their reverence for results, Skeptics regard channels like investor-relations communications as far more effective than Believers, who value the consumer voice on channels like customer-review platforms.

Perhaps linked to their leadership roles in B2B companies, Skeptics place faith in thought leadership as a forum for building corporate reputation. This preference demonstrates comfort with complexity and an appreciation for examining an issue from all sides. Far from being corporate reputation obstructionists, Skeptics simply need to be persuaded by reputation’s links to business results, placing Believers and Skeptics not in conflict but in fruitful conversation.

One area where the Skeptics are more optimistic is innovation. They see innovation as a driver of corporate reputation, even ahead of traditional avenues like corporate governance. That’s likely because openness to iteration and improvement appeals to Skeptics’ drive to draw a direct line from reputation to results.

At the same time, respondents express some reservations about innovations like GenAI. As much as the business community is embracing the technology, some respondents perceive GenAI as potentially doing more harm than good for corporate reputation. This ambivalence is felt most keenly by marketers, who are likely concerned with avoiding risks to their brands. These innovation-based qualms hold sway even as CMOs and their teams prize digital media as the top external channel for influencing corporate reputation. Even with the technological fluency associated with their generation, Believers see innovation as less of a corporate reputation priority than Skeptics.

In cataloging obstacles to building corporate reputation, budget limitations sit at the bottom of the list. This might mean that no one sees funding it as a problem because no one sees it as their problem. When it comes to whose job it is to project and protect reputation, respondents largely assign this responsibility to externally focused functions, like customer service, marketing, and investor relations. Interestingly, the divisions seen as least responsible for corporate reputation are traditionally linked with building trust: public relations, legal and compliance, and human resources.

Those in externally focused marketing and sales roles also tend to be Skeptics, which means the responsibility for corporate reputation often falls on the most skeptical employees. While skepticism can be healthy, companies should ensure that Believers are also stakeholders in building and maintaining corporate reputation.

These days, no corporate entity is an island. In a knowledge economy, complete autonomy from the reputation of other companies is a near-impossibility. When you factor in the imperative to scale and build out capabilities and customer bases via acquisition, this near impossibility narrows to the completely impossible. And while higher levels of transparency are a good thing, they also mean that the company that brands keep can quickly become part of their own narratives.

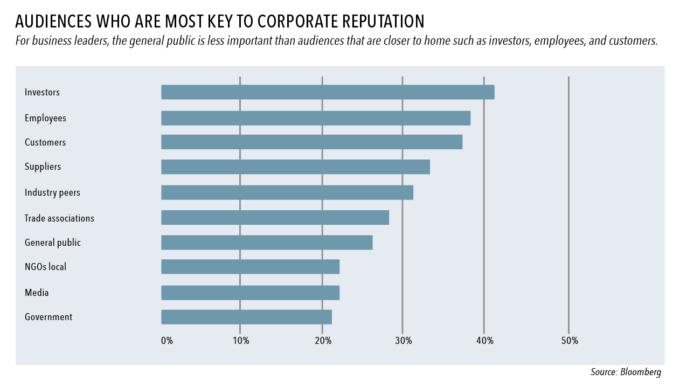

When asked to cite the audiences most key to corporate reputation, investors, employees, and customers came out on top. Right behind them, respondents named suppliers, underscoring how supply chains are scrutinized as reputational extensions of the organizations they support. In fact, suppliers rank as a more important audience than the media or government.

The idea that traditional recipients of corporate reputation messaging, like the media and government, are seen as less important than suppliers signals that leaders are cognizant of the ways they show up alongside other companies. Respondents cited partnerships with reputable organizations right behind the availability of technology and analytics for brand monitoring as the top challenges to building corporate reputation.

The takeaway? Even though measuring one’s corporate reputation can be challenging, it’s important to develop diagnostic tools for doing so, in addition to carefully choosing partners based on their corporate reputations.

In an increasingly digital economy where customers engage with companies through screens, brand loyalty is more fluid than ever. Even so, when respondents considered which business outcomes they hoped to achieve through corporate reputation, customer loyalty topped the list, indicating some appreciation for the synergies between how customers see brands showing up in the world and which brands they want to reward with repeat business. Corporate reputation is seen as more aligned with growth, underscoring its relevance on the agenda of leaders.

With the complexities that shape corporate reputation – and the obstacles to measuring it – it’s understandable leaders can feel tempted to default to quick wins. However, a strong corporate reputation is about showing up consistently and developing the right constituencies, which results from playing the long game.

How can organizations and leaders use insights from our study to deliver more effective corporate reputation initiatives? They should be cross-functional, tied to business results, conducted in trusted environments alongside trusted partners, and managed and measured throughout the organization. That way, everyone will feel like they are contributing to the company’s reputation while also being held to a higher standard.

Global Chief Client Officer of Bloomberg Media

Anne Kawalerski is the Global Chief Client Officer of Bloomberg Media, where she oversees the company’s key global partnerships, communities, and thought leadership initiatives. Since joining eight years ago, she has been integral in managing and enhancing the Bloomberg Media brand, internally and externally.

Global Head of Audience, Data Science, and Measurement at Bloomberg Media

Michelle Lynn is the Global Head of Audience, Data Science, and Measurement across the commercial and consumer organizations at Bloomberg Media. She is responsible for understanding, activating, and measuring the company’s audience and creating proprietary tools and thought leadership studies.

Global Head of Media Strategy at Bloomberg Media

Elisabeth Oak is the Global Head of Media Strategy at Bloomberg Media. She is responsible for elevating new business thinking through data and insights, working with clients to produce strategic and data-driven content, and developing thought leadership to enhance the company’s reputation and sales efforts.

June 26, 2025 • by Michael Yaziji in Strategy

Forward-thinking leaders proactively shape their external environment, turn uncertainty into certainty, and create substantial value in the process....

Audio available

Audio available

June 4, 2025 • by Stéphane J. G. Girod, David Branch in Strategy

The traditional e-commerce model is on its last legs. In a disrupted luxury landscape, brand leaders are shifting focus to unified commerce, hyper-personalization, and deeper digital storytelling to completely reinvent the customer...

June 3, 2025 • by Anna Cajot in Strategy

Donald Trump’s tariff tactics offer a bold case study in game theory in negotiations. By setting the rules early, limiting options, and projecting power through credible threats, his approach shows how negotiations...

May 27, 2025 • by Robert Earle, Karl Schmedders in Strategy

With solar power flooding grids, the duck curve creates both challenges and opportunities for businesses. Learn how smart companies can harness this shift to cut costs and boost efficiency....

Explore first person business intelligence from top minds curated for a global executive audience