Why leaders should learn to value the boundary spanners

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Published January 28, 2022 in Finance • 5 min read •

The US Federal Reserve has signalled its intention to raise interest rates in March to curtail rampant inflation. The Fed’s move towards tighter monetary policy has sparked a sharp stock market sell-off, as investors raced to position themselves for a more hawkish stance from the US central bank. The extreme volatility in financial markets in recent days provides a real-world demonstration of simple economic concepts in action. These models can help leaders make sense of the complex situation.

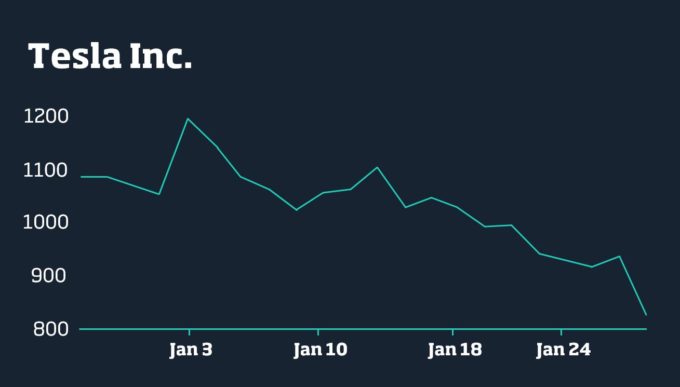

The Fed’s decision sent equities tumbling across Wall Street while there were also broad declines in Europe and across Asia Pacific markets. US equities have swung wildly in recent weeks. The S&P 500 has dropped almost 9% in January, and speculative technology stocks have proved especially vulnerable to tighter monetary policy. Higher interest rates threaten corporate profits and raise borrowing costs, but they also erode the current value of companies’ projected future earnings in investors’ models.

The tech-heavy Nasdaq composite entered correction territory last week, commonly defined as a fall of more than 10% from the record high set in November. Ultra-loose monetary policy has boosted markets since the pandemic started, and especially racier, but more opulently priced, technology shares that have prospered from people spending more time at home.

But as the Fed begins to unwind its stimulus, value stocks — companies that trade at a lower price relative to their fundamentals, such as earnings or dividends — have flourished after lagging behind the glitzier tech companies. The UK’s FTSE 100, seen as more value-orientated because of its large number of finance firms and mining companies, has outperformed broader developed market equities so far this year.

The abrupt shift in the market dynamic can be explained, in part, by a simple financial ratio called: Weighted Average Cost of Capital. WACC expresses a firm’s cost of capital from multiple sources of financing such as bonds and stock in a single figure. To calculate WACC, each capital source is proportionately weighted by its percentage of the total amount of capital, and then added together.

The rate is typically used by companies and their investors to determine the desirability of an investment. The higher a company’s WACC, the higher the return that shareholders or bondholders will demand to provide it with capital.

“Here’s the rub: when interest rates increase, loans to companies become more expensive. That means companies’ WACC goes up. And that means the investment incentive for companies decreases. So, all else equal, they will grow and earn less,” explains Karl Schmedders, Professor of Finance at IMD.

Corporate earnings and economic growth matter to investors, but the direction of interest rates is the most dominant issue in equity markets. This can be explained partly by Discounted Cash Flow (DCF): a method used by investors to estimate the value of a company based on its expected future profits.

Higher interest rates reduce the value investors place on companies’ potential future earnings. And tech companies have attracted high stock market valuations based on expectations of future rapid growth, even if they are lossmaking today.

“That’s why we see that growth companies are hit the hardest in the sell-off,” says Schmedders, “through the higher interest rates and heavier discounting of future cash flows.”

It also explains the rising price of unloved value stocks, such as energy majors BP and Royal Dutch Shell, along with financial groups HSBC and Allianz, which have all posted considerable gains in 2022. “Oil and finance make money already, they are not sitting on castles in the sky,” Schmedders says. “So they are hit less hard than Zoom or Tesla.”

This reflects an economic concept known as: the Time Value of Money (TVM), the idea that a sum of money is worth more now than at a future date, in part because of inflation, which erodes the purchasing power of a currency over time.

Annual US consumer price inflation is at its highest in nearly 40 years, reaching 7% last month because of pandemic supply chain disruption, and labor shortages and record job openings, which have pushed up wage growth. “The Fed simply had to act,” says Schmedders.

Higher interest rates have also spurred a surge in global bond yields, which move inversely to prices. Bond prices are falling because most pay a fixed rate of interest. So when rates go up, new bonds are issued with a higher rate of return. This has lowered the relative attractiveness of riskier assets such as tech stocks, says Schmedders. “The markets are moving in response to the inverse relationship between interest rates and bond prices.”

He adds that the direction of travel may well continue in the coming months: he expects the Fed and the Bank of England to raise interest rates several times this year after halting their asset purchases.

But this is a less likely prospect for the European Central Bank, which has moved less aggressively because its monetary support is seen as an important factor in holding the euro currency area together. “That is why the ECB is being so careful,” adds Schmedders.

Professor of Finance at IMD

Karl Schmedders is Professor of Finance at IMD. In his research, he applies numerical solution techniques to complex economic and financial models, shedding light on relevant market issues and industry problems.

July 3, 2025 • by Eric Quintane in Audio articles

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio available

June 24, 2025 • by Jerry Davis in Audio articles

The tech broligarchs have invested heavily in Donald Trump but are not getting the payback they bargained for. Do big business and the markets still shape US government policy, or is the...

Audio available

Audio available

June 19, 2025 • by David Bach, Richard Baldwin, Simon J. Evenett in Audio articles

As governments lock horns in our increasingly multipolar world, long-held assumptions are being upended. Forward-looking executives realize the next phase of globalization necessitates novel approaches....

Audio available

Audio available

June 2, 2025 • by George Kohlrieser in Audio articles

Leadership Honesty and courage: building on the cornerstones of trust by George Kohlrieser Published 17 April 2025 in Leadership • 5 min read DownloadSave Trust is the bedrock of effective leadership. It...

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience