The battle for digital disruption: startups vs incumbents

The Global Center for Digital Business Transformation, an IMD and Cisco initiative, surveyed nearly 1000 executives across 15 industries about their attitudes and behaviors towards digital disruption. One objective for this research was to identify the source of digital disruption – startups or incumbent firms. Many of the popularized stories of digital disruption come from startups, like Uber, Skype, iZettle, and Spotify.

However, there are also plenty of examples of incumbents pursuing digitally disruptive strategies, like GE, Disney, Nike, and BBVA. We were interested to learn what executives regarded as the main threats of digital disruption.

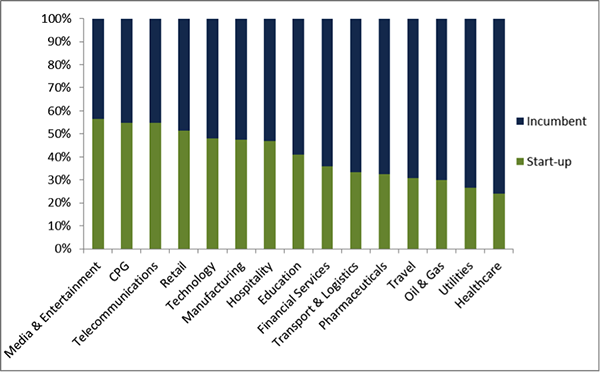

In general, executives saw a bigger threat from incumbent firms than they did from startups, but this difference varied substantially by industry. As Figure 1 shows, more than half of the executives in media and entertainment, consumer packaged goods, telecommunication, and retail sectors regarded startups as the most likely source of digital disruption. By contrast, startups were seen as a much smaller threat for companies within the healthcare, utilities, oil and gas, and pharmaceuticals sectors, perhaps due to high entry barriers in these industries.

Figure 1: Large differences in the perceived source of disruptive threats across industries

The relative advantages of startups vs incumbents

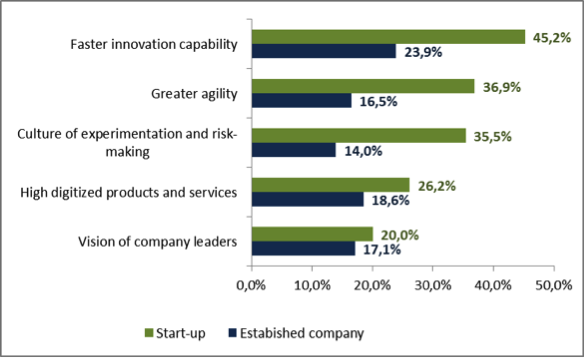

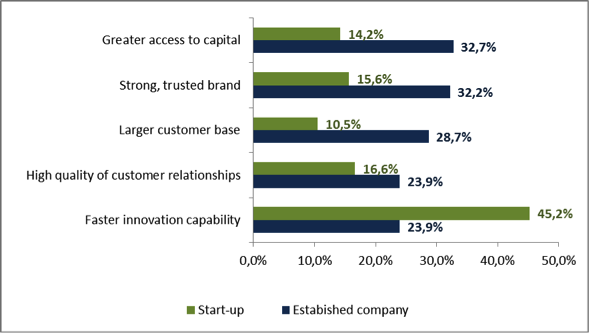

Respondents were asked about the relative advantages of startups vs incumbents. The results are shown in Figures 2 and 3. Not surprisingly, the advantages differed significantly. The top 5 advantages for startups were: faster innovation capability; greater agility; a culture of experimentation and risk-taking; highly digitalized products and services; and the vision of company leaders. By contrast, the advantages of incumbents were: greater access to capital; strongly trusted brands; a large customer base; high quality of customer relationships; and faster innovation capability.

Figure 2: The top 5 relative advantages of startups

These advantages are largely off-setting. Startups compete by being agile, innovative, and active experimenters. Unencumbered by legacy systems and heavy bureaucracies, they adapt and move quickly. Incumbents may be less agile or innovative, but they compete due to strong asset bases, well established brands, along with deep and longstanding relationships with customers and other stakeholders. Ironically, when we talked to incumbents, they were envious of the agility of the startups; when we spoke with startups, they were envious of the stability of incumbents.

Recently, however, this relative balance has shifted in favor of startups. They are maintaining their advantages in innovation and agility, while quickly gaining in the areas of traditional strength for incumbents. Let’s take each of the three top incumbent advantages in turn.

Access to capital

Traditionally, access to capital has been the domain of large, established companies with solid balance sheets, stable revenues, and large asset pools. These organizations are able to tap into debt and equity markets with relative ease. Startups, on the other hand, have traditionally struggled to access capital. This is changing.

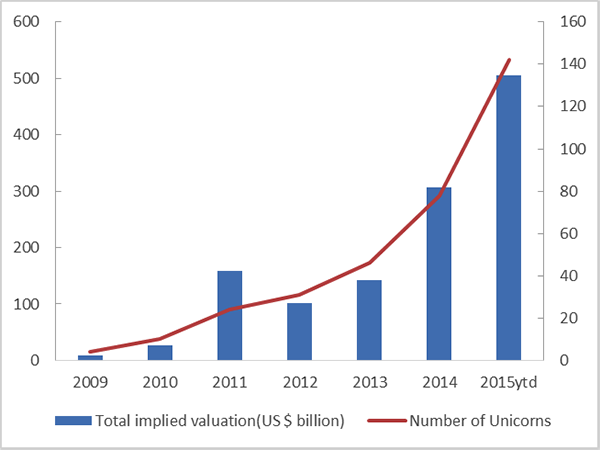

We have seen a dramatic rise in venture capital (VC) funding over past decade. According to CB Insights, $100 Billion of VC funding deals were made just in the first three quarters of 2015. The number of Unicorns – private companies valued at US$1 Billion or more – has jumped dramatically in the past 5 years, as shown in Figure 4.

Figure 4: A sharp rise in the number of unicorns

For startups, access to capital is not as much of a constraint today as it was in the past. Low interest rates, large pools of available capital, and competition among lenders lead to generous funding opportunities. While this level of investment is probably not sustainable in the long term, at least for now, the access to capital is not a big constraint for startups.

Strong brands

Brands have traditionally taken decades to build. Yet, today this is changing. New brands are appearing all the time, and it is not taking them long to become household names. Most people had not heard of WhatsApp 5 years ago, Uber 3 years ago, or WeChat 1 year ago, and yet these brands are now global powerhouses. The speed by which brands can rise is paralleled by the speed at which they can fall. Iconic brands in the 1990s like Dell, Nokia, Morgan Stanley, Avon, and Sony have seen their reputations and valuations fall dramatically.

Large customer base

The speed at which new companies are acquiring customers is astonishing. It took Snapchat and Instagram only three years to reach 200 million users and 30% penetration of smartphone users, according to ComScore. Fast customer acquisition and instant brands are not just restricted to Internet companies. Witness the rapid rise in brands such as Uniqlo in fashion, Tesla in automobiles, Xiaomi in telecommunications, and Square in financial services.

The encumbered incumbent

All in all, our analysis does not paint a pretty picture for large, legacy businesses. The strengths that traditionally protected them from smaller and more agile competitors are being whittled away. Startups are maintaining their agility edge, but with easier access to capital, strong brands, and rapid customer acquisition.

However, the future does not need to be bleak for incumbents. In many industries where they are under threat of digital disruption, like financial services, telecommunications, retail, and technology, incumbents lead from a position of strength. They are mostly well capitalized, strongly managed, and profitable. At the moment, many of them struggle to appropriate the advantages traditionally reserved for startups, such as being agile and innovative. However, this need not be the case. If they are able to improve their sensing capability for digital threats and opportunities, their digitization of products, services, and processes, and their speed of execution, then they should be well placed to compete with startups.

Michael Wade is the Cisco Chair in Digital Business Transformation, and Professor of Innovation and Strategic Information Management at IMD. His interests lie at the intersection of strategy, innovation, and digital transformation.

He is Director of the Global Center for Digital Business Transformation and co-Director of IMD’s new Leading Digital Business Transformation program (LDBT) designed for business leaders and senior managers from all business areas who wish to develop a strategic roadmap for digital business transformation in their organizations.

He is also co-director of the Orchestrating Winning Performance Program (OWP).

Jialu Shan is a Research Associate at the Global Center for Digital Business Transformation.

Research Information & Knowledge Hub for additional information on IMD publications

Digital transformation introduces a new set of parameters for firm innovation. Existing literature has found that family firms vary on their willingness to innovate. However, explanations of the factors that lead to a family firm’s (un)willingness...

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Published by International Institute for Management Development ©2025

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in Small Business Economics 24 May 2025, ePub before print, https://doi.org/10.1007/s11187-025-01057-8

Research Information & Knowledge Hub for additional information on IMD publications