Why leaders should learn to value the boundary spanners

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

by John Elkington Published October 26, 2023 in Sustainability • 12 min read •

The all-electric Mustang is part of Ford's drive to accelerate into the future.

If you’ve ever tried to promote a change agenda, you’ll know the problem: it’s often easier to flag what won’t fit with your desired new order than to pull up examples of tomorrow’s solutions already operating successfully in today’s world. The future may already be here, but at times it can be damned hard to find.

Worse, if the changes you want to see in the world demand a true paradigm shift, you can pretty much guarantee that today’s market incentives are actively suppressing the necessary thinking, behaviors, and – crucially – business models.

Incumbents almost always try to crush insurgents. But ignore any emerging need for long enough and you ensure that when change does come, it does so in a destructive rush. That’s one reason why companies like Ford are beginning to split apart, in their case forming separate businesses offering cars powered, on the one hand, by incumbent internal combustion engines and, on the other, insurgent electric vehicles.

There are no guarantees that either Ford business will succeed, but you can bet your bottom dollar that, ultimately, the market reflexes of a fossils-fuels-only company would have steered the company onto the wrong side of history – and parked it there.

Similar trends now drive change in sectors as varied as chemicals, energy, food, and finance (including insurance – with severe convective storms held responsible for 70% of insured losses in the first half of 2023).

Common sense would suggest early action to ward off such threats, but cognitive dissonance ensures that those trapped inside the old, expiring paradigm often just dig in their heels. Many become increasingly unhinged from reality, terrified, or angered by the emerging threats to their vested interests and “strandable” assets. They see the challenges not simply as a threat to their bottom lines, but to their sense of identity.

Many adopt a defensive crouch, as we have seen with the vicious push-back against BlackRock – the world’s largest asset manager – by US oil-drunk states such as Texas, Louisiana, and Florida. For example, champions of the old order claim that BlackRock CEO Larry Fink has swallowed the “woke” Kool-Aid whereas it could easily be argued that the opposite is true.

Indeed, it’s possible to see Fink as somewhat conservative because he has simply been arguing the business case for ESG strategies, combining environmental, social, and governance goals, rather than promoting the necessary – and radical – disruption of markets and capitalism.

The nature and scale of the paradigm shift now underway was underscored for me on the very day I started drafting this article. Reading obituaries, as I do most mornings, I came across one for James Watt – someone I recall going down in political flames 40 years ago. A combative US interior secretary serving President Ronald Reagan, Watt was once asked whether he felt a responsibility to future generations as he fought to open up wilderness areas to development. His reply? “I do not know how many future generations we can count on before the Lord returns.”

Clearly, he was a political accident waiting to happen. Ultimately, he was forced out of office after publicly declaring that the panel reviewing his controversial coal-leasing proposals had “every kind of mix you can have. I have a black, I have a woman, two Jews, and a cripple”. And there you had it: the unmasking of an old order on the verge of radical, disruptive change.

Watt worked for a boss whose own thinking was perhaps best indicated by his infamous remark: “Once you’ve seen one tree, you’ve seen them all.” Over time, such views have come to seem Palaeolithic, but these people weren’t stupid: they, too, spoke from a worldview which they saw as undiluted common sense. Until it wasn’t.

At the time, (un)common sense suggested that such people were degenerators. They were perfectly comfortable with degrading natural and even social capital if it turned them a tidy profit. Perhaps the simplest indicator of the impact has been Earth Overshoot Day. In 1971, it was declared to be on 25 December, whereas by 2023 it had tumbled to 2 August. The implication: when the tracking started, our global needs could be met with the renewable resources of one planet, whereas today the ratio stands at 1.7 planets. Sustainable that is not. Degeneration it is, and on a planetary scale.

So, who today are the regenerators and what sort of business models are they promoting and evolving? Google “regeneration” and you will find people like Janine Benyus of Biomimicry 3.8, John Fullerton of The Capital Institute, Damon Gameau of Regenerating Australia, Paul Hawken of Regeneration.org, Laura Storm of The Regenerators, and Daniel Wahl, among many other things a Volans Fellow. But mainstream media attention to date has focused on major companies “coming out” with their regenerative ambitions.

Champions of the old order claim that BlackRock CEO Larry Fink has swallowed the 'woke' Kool-Aid whereas it could easily be argued that the opposite is true.

Among notable companies which have already declared their commitment to regeneration have been Danone North America, General Mills, Interface, Walmart, and perhaps the longest-running advocate, Patagonia. The latter has gone so far as to hand over ownership of the company to Earth itself, by proxy.

As the company’s leadership explained in 2022: “Effective immediately, the Chouinard family has transferred all ownership to two new entities: Patagonia Purpose Trust and the Holdfast Collective. Most significantly, every dollar that is not reinvested back into Patagonia will be distributed as dividends to protect the planet.” Or to put it more succinctly, “Earth is now our only shareholder”.

Clearly, if that’s your ownership structure, it should be much easier to deliver against the sustainability, circular economy, and regeneration agendas. Few business leaders will go this far, but a growing number will try to reboot their business models. So, what might these look like as we move through the remainder of the 2020s and into the 2030s?

No organization can escape the need to transform to become more sustainable. The need to act is urgent. It calls for strong leadership, difficult decisions, and deep cultural change. In Issue XI, we explore how to build sustainable organizations to succeed in turbulent times.

There is no shortage of people claiming to have the answer, but clarity and coherence are hard to come by as a market feeding frenzy boils around the still-emerging concept of the “regenerative economy”. The regenerative mindset has spread quickly. Some companies now even talk of a “triple regeneration”, linking their ambitions to new variants of the triple bottom line, a concept for reimagining business models that I proposed in 1994 and later described in my book Cannibals With Forks. So, for example, instead of my “people, planet, and profit” (or “prosperity”) formulations, we hear talk of “people, places, and planet”.

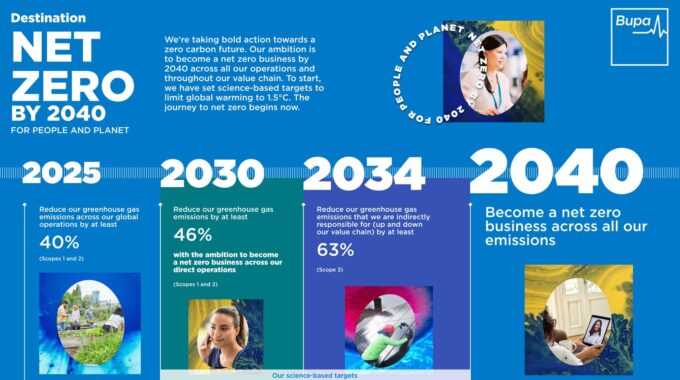

In the UK, healthcare insurer BUPA is one emerging champion of regeneration. Julia Giannini, its Head of Environment and Climate Action, put it this way: “Regenerative business is quite a new term, but it’s gaining more traction since the pandemic. Instead of doing less bad by reducing our impact on the environment, it’s about looking at how we can do ‘more good’ and understanding the interconnections between nature and health.”

What does this mean in practice? Well, BUPA has launched “Mission Regenerate”, designed to help restore the health of our planet through community-based programs that focus on regenerating the clinical environment and through “participating in partnerships to bring our clinical expertise to drive health benefits through the conservation of natural ecosystems”.

None of this is particularly new. Properly understood, the sustainability agenda has always included regeneration, but that element has been increasingly sidetracked by concepts like corporate social responsibility, shared value, and ESG. All useful as far as they go, but rarely embracing true regeneration.

To get a better idea of what that might involve, consider another long-standing sustainability pioneer, the carpet maker Interface. As part of its “Climate Take Back” mission, aiming to reverse global heating, Interface piloted a fascinating “Factory as a Forest” project in Australia. The idea was that such a plant would provide positive ecosystem services – such as clean air and energy, potable water, carbon sequestration, and nutrient cycling – services that the local ecosystem it replaces would otherwise have provided. Next, Interface partnered with Biomimicry 3.8 to make its US factory outside Atlanta, Georgia, function more like a high-performing ecosystem.

By 2018, Interface had made all its products carbon neutral. Next, it raised the bar considerably, launching the world’s first carbon-negative carpet tiles, designed to sequester more carbon than they create from “cradle to gate” – from raw material extraction through manufacturing – without the use of carbon offsets.

Big consultancies are spotting the opportunity and making their plays. Take EY, which notes: “We’ve seen the rise of positive approaches in recent years – climate-positive, nature-positive, and net-positive business – to address our interlinked natural and social challenges. At the same time, there is growing recognition that efforts to restrain climate change and halt biodiversity loss will not be successful unless we address them together as part of a broader holistic approach.”

Regeneration, EY insists, “is a concept that addresses challenges comprehensively and provides CEOs and business leaders with a new framework for creating and protecting long-term value”. Moving beyond neutrality and zero-based frameworks, “regenerative approaches aim for complete systems changes that address the root causes of global challenges”.

When we launched our business advisory firm and think tank Volans back in 2008, in the teeth of the ongoing financial implosion, we argued the need for system change – so, yes, it’s good to see some elements of the system change agenda embraced even by full-throttle capitalists. But, caveat emptor: this is the same EY where “hundreds” of auditors were recently discovered to have cheated on their ethics exams.

True regeneration, it hardly needs saying, demands sustained commitment, ambition, and integrity even when it flies in the face of current business sense – as it often will. One interesting shift over the past decade has been the accelerating expansion of earlier discussions of the business case for change, from “Tell us why we should change!” to growing interest in evolving new business models: “How can we create new forms of value and be rewarded for them?”

When Volans surveyed emerging breakthrough business models back in 2016, we argued that “the entire sustainability industry must undergo a radical reinvention, involving defragmentation and re-capitalization, if it is to tackle its current weaknesses, including intense siloing, internal competition, and a Babel-like confusion of terminologies”.

We spotlighted 60 business models that combined elements of the social, lean, integrated value, and circular economies, all with an eye to exponential – not just incremental – replication and scaling.

At the time, there wasn’t much research work being carried out on regenerative business models, but leading business schools are now showing greater interest. Recently, I keynoted the eighth International Conference on New Business Models, a series of events encouraging debate about and research into sustainable business models.

Researchers from Maastricht University, for example, are exploring the differences between sustainable, circular, and regenerative business models. Jan Konietzko and his colleagues carried out a major literature review, organizing six focus groups, and concluded that “regenerative business models focus on planetary health and societal well-being. They create and deliver value at multiple stakeholder levels including nature, societies, customers, suppliers and partners, shareholders and investors, and employees – through activities promoting regenerative leadership, co-creative partnerships with nature, and justice and fairness”.

They continued: “Capturing value through multi-capital accounting, they aim for a net-positive impact across all stakeholder levels. Regenerative business models share some design approaches with sustainable and circular models but differ in their main goals and systemic perspectives.”

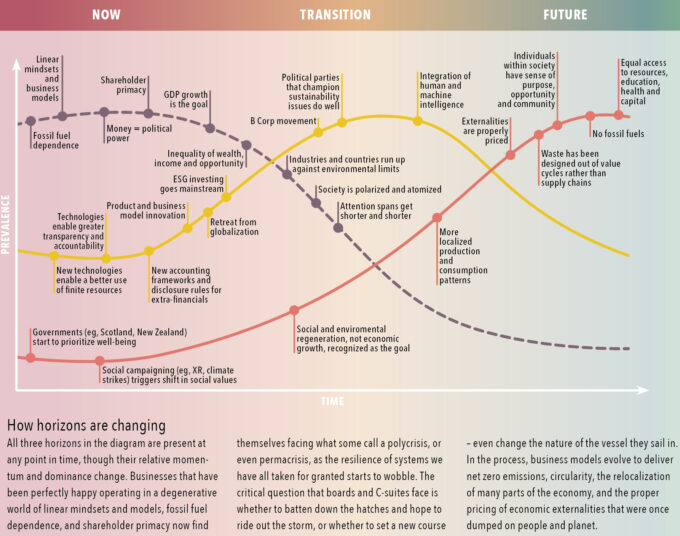

As we concluded in our own Tomorrow’s Capitalism Inquiry, and in our 2020 book Green Swans, the “people, planet, and prosperity” framing still works in many areas but it must be seen in the context of an ongoing and accelerating shift from a “responsibility” framing to firstly a “resilience” framing and then on to a “regenerative” framing. The diagram at the beginning of the article illustrates some of the underlying dynamics in this space as the sustainability agenda begins to go mainstream. As the failings of the current economic order are signaled by growing problems with the resilience of critical systems, so the need for truly regenerative strategies and business models will grow exponentially.

Current corporate responsibility and ESG strategies are necessary conditions for progress, but they have failed to ward off the system resilience challenges now compromising our economies, societies, and biosphere. To solve these challenges, we need to regenerate all these systems, more or less simultaneously.

Imagine, as an example, how the business model of a bank or insurance firm might evolve as it moves through the three stages. In the first domain, responsible practice might involve ensuring that vulnerable communities are red-lined or excluded. In the second, borrowers or those taking on insurance would be actively helped to make their operations more resilient. Then, in the third, tailored debt instruments and insurance cover would be developed and provided to regenerators to help them replicate and scale their solutions.

The further we move toward the right-hand side of the diagram, the more business models must be designed and operated as if we intended to stay on this planet of ours. One thing is clear in all of this: the coming technological and industrial revolutions will drive existing businesses way beyond their comfort zones, forcing them to experiment in radically new ways.

A key question now is whether business schools will continue to teach and support old-order solutions to tomorrow’s challenges, or whether they can shake off their own incumbent mindsets (and ranking and rating systems) to spur the evolution of the economic and business models that will define tomorrow’s regenerative economies?

The fires that earlier this year swept Maui killed more than 100 people, with many more unaccounted for. The economic losses have been initially calculated to exceed $6 billion. It is one more illustration of what happens when degeneration trumps regeneration. Wetlands that were once a key feature around the worst-affected area, Lahaina, were destroyed as industries such as whaling and sugar cane plantations grew and colonists imported new invasive grasses, posing much greater fire hazards.

Solutions must include new business models incorporating regeneration – economic, social and, crucially, environmental. One key means of stabilizing the climate, boosting soil fertility, and increasing biodiversity on farms would be to use soil carbon capture and storage (SCCS) technologies that are evolving rapidly. In a study for Shell, Carbon Nation and Arizona State University explored a spectrum of potential business models.

While the approach would depend on carbon offsets, and on an oil company notorious for changing its mind, it does underscore the multi-dimensional nature of regenerative solutions. In headlines, all the CO2 emitted from each gallon of fuel sold would be stored in the soil, verified by a third party, and purchased by the company from “soil carbon ranchers” enrolled in a special program. Ranchers would receive short-term cash to help them to reduce the risks of implementing changes in ranching operations in the form of a pre-purchase of carbon storage credits (say 10% of the estimated five-year total), plus the right of first refusal on any additional credits. An online big data community would enable best practice exchange between carbon ranchers, the relevant corporations and institutions, and government agencies. Watch this space.

Visiting professor at Cranfield University School of Management, Imperial College and University College London (UCL)

John Elkington has been described as “the godfather of sustainability”. He has co-founded four companies, including Volans, where he is described as Chairman and Chief Pollinator. He is the author of 20 books including Green Swans: The Coming Boom in Regenerative Capitalism. He has served as a member of more than 70 boards and advisory boards.

July 3, 2025 • by Eric Quintane in Audio articles

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio available

June 24, 2025 • by Jerry Davis in Audio articles

The tech broligarchs have invested heavily in Donald Trump but are not getting the payback they bargained for. Do big business and the markets still shape US government policy, or is the...

Audio available

Audio available

June 19, 2025 • by David Bach, Richard Baldwin, Simon J. Evenett in Audio articles

As governments lock horns in our increasingly multipolar world, long-held assumptions are being upended. Forward-looking executives realize the next phase of globalization necessitates novel approaches....

Audio available

Audio available

June 2, 2025 • by George Kohlrieser in Audio articles

Leadership Honesty and courage: building on the cornerstones of trust by George Kohlrieser Published 17 April 2025 in Leadership • 5 min read DownloadSave Trust is the bedrock of effective leadership. It...

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience