How to manage power dynamics in high-stakes negotiations

Former FBI agent Joe Navarro explains how to leverage non-verbal cues, manage power dynamics, and build trust to overcome deadlocks in negotiations....

by Carlos Cordon Published August 18, 2023 in Supply chain • 5 min read

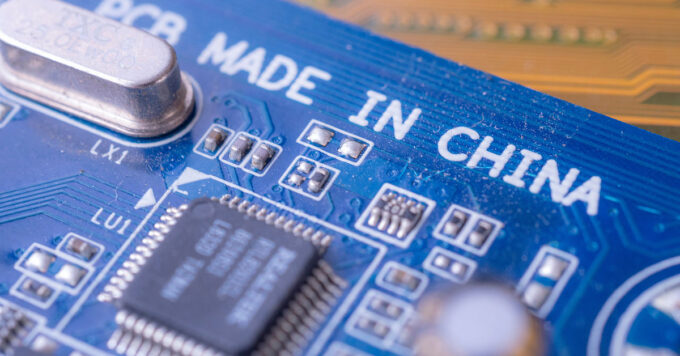

I know this is controversial, but I see globalization coming apart at the seams. It’s ending. I study the structure of supply and value chains and they are fundamentally shifting away from globalization to favor regionalization. This is happening as the global trade of goods is slowing down. And even though the global trade of services is showing more resilience, the overall outlook looks poor for our globalized world.

Why regionalization now? Because the world is increasingly uncertain, and any supply chain is only as strong as its weakest link.

The shock of COVID-19, China’s strict lockdown, and the war in Ukraine are among the reasons this truth is very apparent now. A decade or so ago, there were more compelling cost-savings far away (lower salaries, cheaper factory builds, etc.). But since around 2019, the contracts signed many years ago have started to look irredeemably old. Starting from scratch now, “local for local” looks more promising. Its potential often includes a trade-off: lower sales but higher profits. Naturally enough, that’s a trade-off many sustainable businesses are willing to make.

In this new environment, I see today’s companies increasing their supply chain resilience in many ways, including the following five:

Below, I’ll briefly look at these changes as seen in examples in three industries: big tech, cars and food.

Last holiday season, Apple had a rotten quarter. Sales and earnings from its iPhones, Macs, and more fell short of investors’ expectations for the first time in nearly seven years – and supply-chain snafus took a lot of the blame. I have written a case study for IMD on this rocky period at Apple, which delves into the Cupertino, California company’s operations in China before and after COVID-19 lockdowns, amid rising geopolitical tensions between the United States and China.

In short: Apple’s global value chain was created in a stable globalized context, one that does exist anymore. Remember, Apple began assembling its products in China over a quarter century ago, in the late 1990s.

In this time, Apple has saved an enormous amount in labor costs by assembling products in China, working closely with Foxconn and Taiwan Semiconductor Manufacturing Company (TSMC). Outsourcing so much of the production allowed Apple to focus its efforts on research and development and product design.

But now that Chinese salaries have doubled and geopolitical tensions keep mounting, there is a lot more pressure on this prized value chain. For Apple, reducing reliance on Chinese suppliers is the order of the day.

Shortages of components hurt car sales volume in 2021, compared to 2019. But those lower sales were accompanied by higher profits. Consider Ford, General Motors and Volkswagen. Together they sold 21% fewer cars in 2021 compared to 2019 but had 48% higher profits over the same period.

What happened? When car components were not available, agile companies adapted quickly – and passed on the costs to customers. Consider the chip crunch amid the pandemic. When the chips needed in Tesla cars were hard to come by, Elon Musk said they rewrote their software to use alternate chips. In the new global order, agility is key.

The chips themselves are also key to higher profits. Hybrid and electric vehicles, which contain between $1,000 to $3,500 worth of semiconductors per vehicle, are surging in popularity, compared to an average of just $330 for conventional cars. If consumers buy fewer polluting cars and the cars are a better business, that could be a win-win.

The way I see it, we used to live in a McDonald’s world. That’s not to say McDonald’s is going away anytime soon. The golden arches, Big Macs, and fries can still be reliably found in over 100 countries. But I see the globalized model underpinning its success as coming under pressure. McDonald’s standard menu and operations were optimized to suit global conditions as they were. With its value chain optimized, McDonald’s growth was fueled by a steady stream of new openings to boost market share.

But with increased global uncertainty – including recent shortages of potatoes, labor (especially with COVID-19’s omicron surge), transportation, and energy – there’s another model to look to: the chef’s model.

At the chef’s restaurant, customer preferences are, of course, still central, as they are at McDonald’s. But so is market availability. Which foods are in season? What’s plentiful and popular? In the chef’s model, the restaurant’s volume can’t approach McDonald’s. But, again, profit margins per item sold can certainly be higher. And so can the chef’s sustainability profile.

At the end of the day, with increasing protectionism (in tax policies and trade barriers), shortages prompted by war and other causes, and overall uncertainty due to climate concerns and other factors, companies are finding that “local for local,” regionalization, insourcing, friend-shoring or just plain simplification hold growing appeal. Many of the existing supply arrangements will take some years to unwind. As such, this is a change that is happening slowly for some, at the same time its logic has shifted relatively swiftly.

Professor of Strategy and Supply Chain Management

Carlos Cordon is a Professor of Strategy and Supply Chain Management. Professor Cordon’s areas of interest are digital value chains, supply and demand chain management, digital lean, and process management. At IMD, he is Director of the Strategies for Supply Chain Digitalization program.

May 6, 2025 • by Anna Cajot in Competitiveness

Former FBI agent Joe Navarro explains how to leverage non-verbal cues, manage power dynamics, and build trust to overcome deadlocks in negotiations....

April 24, 2025 • by Jerry Davis in Competitiveness

Many regional developers have tried and failed to emulate Silicon Valley’s VC-driven model for innovation. Detroit, the birthplace of Ford, is following an alternative route – with promising results....

Audio available

Audio available

April 16, 2025 • by Benoit F. Leleux in Competitiveness

How a private equity-backed corporate carve-out created a successful, sustainable consulting powerhouse...

April 11, 2025 • by Jim Pulcrano, Jung Eung Park, Christian Rangen in Competitiveness

Founders searching for funding must be targeted in their approach to securing a lead investor. A global survey of VCs offers valuable insights into what makes them tick....

Explore first person business intelligence from top minds curated for a global executive audience