“We were so scared of our IPO”: Leaders Unplugged with former On-CEO Marc Maurer

Marc Maurer shares how ON grew from startup to IPO by defying hype, focusing on purpose, and leading with humility in this candid Leaders Unplugged episode....

by Patrick Reinmoeller Published December 2, 2024 in Strategy • 6 min read

For most of the Edo period, which lasted from 1603 to 1868, Japan followed a policy known as ‘Sakoku’, which translates as ‘a country in chains’. This consisted of almost total isolation from the rest of the world and maintaining only limited trading relationships with neighboring China and with Dutch traders living on an island in Nagasaki harbor. The policy was only ended when US President Millard Fillmore sent two naval expeditions in 1852 and 1854 to Japan with orders to bring about an end to its two-centuries-old policy of isolation and force it to trade with the US – using gunboat diplomacy if necessary.

Today, having long enjoyed trading relationships with the West, Japan has seen many foreign investors, but even after the burst of the real-estate-driven bubble economy, Japanese companies have remained highly resistant to change, and foreign-led mergers and acquisitions (M&As) have, historically, been extremely rare.

Canadian company Alimentation Couche-Tard’s attempted takeover of 7-Eleven, owned by Seven & i Holdings, however, could signal a seismic shift. In August 2024 Couche-Tard offered $39bn for its Japanese rival, later raised to $47bn.

Unsurprisingly, the visit of the Couche-Tard team was not welcomed as Japan Inc. seemingly closed ranks (again) to keep foreign ownership of its assets at bay. But, while negotiations remain stalled, Seven & i appointed a special committee consisting of outside directors and hired the services of Nomura Bank to conduct a thorough review of the bid, which it has been obliged to take very seriously indeed.

Couche-Tard operates global convenience chains and is particularly drawn to 7-Eleven’s iconic brand, which is seen as integral to Japanese society. The timing is favorable, given the weak yen and 7-Eleven’s undervalued shares. Japanese reforms, along with evolving corporate governance and pressures from activist investors, have eased the pathway for M&As, empowering foreign entities to approach Japanese firms with fewer obstacles. Recent regulatory adjustments by Japan’s Ministry of Economics, Trade, and Industry (METI) also require domestic companies to consider buyout offers seriously.

Recent(ish) outbound takeovers have also served to whet corporate appetite for M&As in Japan. These include Takeda Pharmaceuticals’ acquisition of Irish-headquartered drugmaker Shire plc in 2019 for $56bn in cash and shares (the largest overseas purchase ever made by a Japanese company) and SoftBank’s purchase of the UK’s ARM Holdings for around £24bn in 2016. In December 2023, Nippon Steel even bid to acquire US Steel in a move described by analysts as “not just a corporate transaction – it’s a strategic move in a high-stakes geopolitical game.”

“This could well mean that the market for corporate control, in which managers who make money for a firm’s shareholders replace those who don’t, is finally taking root in the country.”

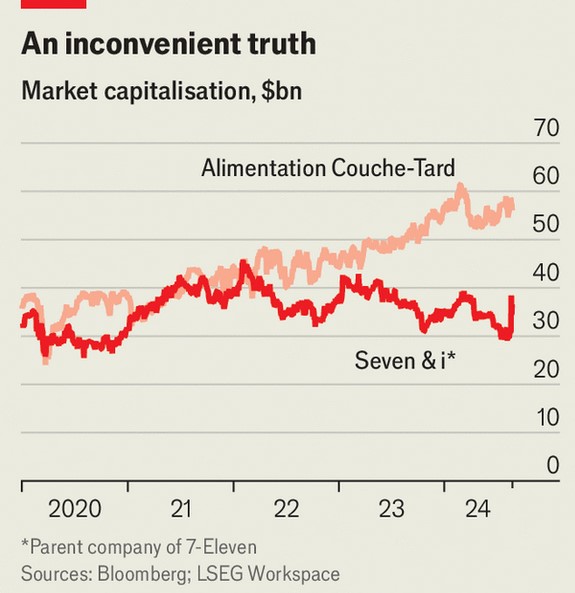

Couche-Tard’s bid represents a significant threat to traditional ways of doing business in Japan, because it is smaller yet more profitable than 7-Eleven. According to The Economist (see Figure 1 ‘An inconvenient truth’), the difference is stark, with Seven & i’s return on capital at 4% and Couche-Tard’s around 10%. This translates into a dramatic difference in investor confidence and a share price difference that allows the bid to hit its target. This year Seven & i underperformed against the Nikkei, which gained 14%, while Seven & i shed 6%. In effect, Couche-Tard can afford to pay billions for its Japanese counterpart because it makes money. When the bid came in, 7-Eleven’s share price jumped by 23%, pushing its market value above $38bn.

After economic stagnation has lowered corporate immunity against low profitability, the jump in the share price signifies a broader shift in market dynamics. Japanese companies, once nearly immune to foreign takeover pressure, now face intensified scrutiny and heightened attention from domestic and international investors. This could well mean that the market for corporate control, in which managers who make money for a firm’s shareholders replace those who don’t, is finally taking root in the country.

Japanese companies are increasingly willing to sell non-core assets to focus on profitable ventures. Seibu Railway and Hitachi, for instance, have both divested assets recently, while startups such as Sakana AI have forged partnerships with foreign investors. As domestic growth opportunities shrink, Japanese firms are also more actively pursuing international acquisitions, especially in the US, the UK, and India, reflecting Japan’s transformation from an insular economy to a more globally integrated one.

In an effort to keep 7-Eleven Japanese-owned, some stakeholders, including Seven & i’s founding family, have proposed a management buyout. Raising the capital needed, however, is challenging. The question arises: Who is best suited to enhance 7-Eleven’s profitability – those who have maintained it within Japan, or outsiders like Couche-Tard, who bring fresh strategies? For the Canadian company, acquiring 7-Eleven would mean gaining control of a vast network in Japan, with deep cultural ties and consumer loyalty.

Operating in Japan’s retail market is notoriously difficult, even for global giants like Ikea and Starbucks, who both faced challenges before adapting successfully. Couche-Tard would face stiff competition and would need to retain a highly discerning consumer base. Increasing profitability while maintaining quality could be difficult, especially for a foreign firm with less cultural insight and few relationships. Streamlining inputs and ingredients may hurt many suppliers, and compromising on cost or service might not sit well with Japanese consumers, many of whom see 7-Eleven as an essential part of daily life.

Even if it falls through, it could encourage more M&A activity and more buyouts by managers who feel shackled in traditional Japanese companies.

The bid underscores the emerging priority of shareholder value in Japan as more companies begin weighing ownership against stakeholder satisfaction. Even if it falls through, it could encourage more M&A activity and more buyouts by managers who feel shackled in traditional Japanese companies. This is particularly the case in sectors that are less tied to the general public, such as B2B markets, family-owned businesses, and companies with limited global presence but great domestic appeal and which seem ripe for renewal. Just witness the battle between two leading private equity houses, KKR and Bain Capital, as they fight over control of Fuji Soft, a leader in robotics. The complicated scenario features shareholders siding with different foreign PE companies. While this breaks ground in how hostile/friendly bids may be defined, it illustrates increasing dynamics in the M&A market.

And, with cross-border mergers increasingly being seen as a tool for Japanese firms to bolster profitability, we could see a fundamental reshaping of the corporate landscape in Japan, finally putting an end to the last vestiges of Sakoku.

Professor of Strategy and Innovation at IMD

Patrick Reinmoeller has led public programs on breakthrough strategic thinking and strategic leadership for senior executives, and custom programs for leading multinationals in fast moving consumer goods, telecommunications, pharmaceuticals, healthcare, and energy on developing strategic priorities, implementing strategic initiatives, and managing change. More recently, his work has focused on helping senior executives and company leaders to build capabilities to set and drive strategic priorities.

July 8, 2025 • by Alyson Meister, Marc Maurer in Strategy

Marc Maurer shares how ON grew from startup to IPO by defying hype, focusing on purpose, and leading with humility in this candid Leaders Unplugged episode....

June 26, 2025 • by Michael Yaziji in Strategy

Forward-thinking leaders proactively shape their external environment, turn uncertainty into certainty, and create substantial value in the process....

Audio available

Audio available

June 4, 2025 • by Stéphane J. G. Girod, David Branch in Strategy

The traditional e-commerce model is on its last legs. In a disrupted luxury landscape, brand leaders are shifting focus to unified commerce, hyper-personalization, and deeper digital storytelling to completely reinvent the customer...

June 3, 2025 • by Anna Cajot in Strategy

Donald Trump’s tariff tactics offer a bold case study in game theory in negotiations. By setting the rules early, limiting options, and projecting power through credible threats, his approach shows how negotiations...

Explore first person business intelligence from top minds curated for a global executive audience