Europe needs Chips Act 2.0 to compete in digital race

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

by Jerry Davis Published December 16, 2021 in Technology • 12 min read

The Biden White House is challenging corporate power more aggressively than any administration since the Progressive Era. Biden has appointed prominent anti-monopoly activists to crucial posts: Lina Khan to chair the Federal Trade Commission, Tim Wu to the National Economic Council, and Jonathan Kanter to direct the Department of Justice’s Antitrust Division. On 9 July the President signed an executive order that included 72 initiatives aimed at reining in corporate power across the board.

The executive order’s buffet of initiatives follows on from a familiar diagnosis: economic and political power has become too concentrated in the hands of monopolists. The cure is straightforward: ensure more competition and we will see lower prices, higher wages, less inequality, and more opportunity.

It is certainly long past time to take on corporate power, but the problem is much deeper than monopoly. We are in the midst of a massive technology-driven re-organization of the economy that requires a comprehensive reassessment of the categories we use to understand the economy. The definitions of employee, firm, industry, income and nationality are all in flux. After the broad adoption of work-from-home edicts during the COVID-19 pandemic and the passage of California’s Proposition 22 (which granted app-based transport and delivery firms the right to classify their drivers as independent contractors, rather than employees) we are likely to see a further shift in labor markets away from employment and toward gig and contract work. This will make labor markets much more competitive, but it will not leave Americans better off.

There is no end to the catalog of business misbehavior in recent times, from Purdue Pharma fomenting the opioid epidemic to social media platforms creating a safe space for sedition. By some measures, Big Tech companies have acquired an unprecedented amount of economic clout: at the time of writing, the combined market caps of Alphabet, Amazon, Apple, Facebook and Microsoft make up one-quarter of the value of the S&P 500. But while it is true that a few corporations have become immensely powerful in recent years, we are not living through a re-play of the Gilded Age, and the tools that tamed corporate monopolies a century ago will not save us today. Big Tech is different in kind from Big Business and requires new tools to check its power.

The three years since Tim Wu published his book, The Curse of Bigness, have seen dozens of other titles published on the resurgence of corporate monopoly power. Most adapt variations on Wu’s diagnosis, including the Biden Administration’s executive order.

The monopoly narrative goes like this: corporations grew large and concentrated at the turn of the 20th century through a combination of economies of scale, Wall Street dealmaking, and questionable business tactics. Congress sought to tame these new giants through progressive antitrust legislation that saw monopoly as a threat to liberty and democracy: the Sherman Act of 1890 and the Clayton Act of 1914. New Deal legislation further constrained the power of corporations and Wall Street and empowered organized labor as a counterforce.

The resulting post-war detente supported economic growth, opportunity, and mobility, with a corporate sector safely held in check by vigilant antitrust measures. But in 1978 Robert Bork published an infamous book, The Antitrust Paradox, which argued that the true goal of antitrust was to keep prices low for consumers, and that only those schooled in the economic arts were qualified to judge corporate behavior. Reagan-appointed regulators and judges were mesmerized by Bork, and antitrust enforcement went dormant for 40 years.

As a result, a centripetal force overtook nearly every industry, and through mergers and shady corporate behavior we found ourselves with monopolies everywhere (but especially in eyeglasses, airlines, and beer). This has raised prices, lowered wages, and undermined liberty. In the words of Barry Lynn, “Whatever you are angry about, somewhere in the chain of blame you will almost always find a monopolist.” Fortunately, if we just returned to Louis Brandeis’s vision of antitrust circa 1914, America would be redeemed through the magic of open and competitive markets.

Is Zoom a giant corporation? Should we break it up? And how did a pipsqueak like Zoom out-compete monopolists like Google, Facebook and Microsoft, all of which have rival products?

At the center of the monopoly narrative is the claim that most industries and markets have become dangerously concentrated, largely due to the malign influence of Bork. But how factual is the narrative of the anti-monopolists?

Reagan’s DOJ did indeed relax its guidelines on horizontal mergers in 1982. But his biggest impact on corporate organization was to allow the largest wave of hostile takeovers in history. The industry-spanning conglomerates that were built up in the 1960s and 1970s (thanks in large part to antitrust restrictions on horizontal and vertical mergers) were chronically undervalued by the stock market. The whole was worth less than the sum of the parts. With the availability of new forms of bridge financing such as junk bonds and a favorable regulatory climate, it became possible for raiders to buy bloated corporations from their shareholders, fire their managers, and sell off the parts for a quick profit.

A lasting legacy of the takeover wave was the ascendance of shareholder primacy; the idea that corporations existed first and foremost to create shareholder value, and that any corporate deviation from this mission should be punished. The shift from traditional defined benefit pensions to 401(k) (defined contribution) plans, and the growing popularity of retail investment in mutual funds, meant that most American households were at least somewhat invested in the stock market by 2001, which further reinforced the idea that shareholder value was the North Star.

Has industry been dominated by monopolists since 2000? The second paragraph of Biden’s executive order “fact sheet” opens, “For decades, corporate consolidation has been accelerating. In over 75% of US industries, a smaller number of large companies now control more of the business than they did 20 years ago.” Most of the anti-monopoly tracts cite this same figure, taken from a recent article in finance. But the study relies on global sales data for US-based corporations listed on American stock markets, with industry defined at the 3-digit NAICS level (I know, bear with me). Why is that a problem? First, corporations routinely operate in many different industries. In 1980 Westinghouse built nuclear plants, locomotive engines, wrist watches, high school curricula, financial services, and bottles of 7Up, among many others. Attributing all of a corporation’s revenues to just one industry gives a distorted picture of that industry’s concentration.

Second, American corporations have been global for generations, and are even more global now. Between 30% and 40% of the S&P 500’s revenues are from outside the US. Two-thirds of Netflix’s subscribers are outside North America; 67% of Apple’s revenues come from overseas; and 100% of Yum China Holdings’ sales of KFC and Pizza Hut are in China (but because Yum China is incorporated in Delaware and listed on the New York Stock Exchange, it is an “American” restaurant chain). Global sales are irrelevant for American market concentration. Likewise, some American giants have foreign parents, including Anheuser-Busch and Chrysler, which removes them from the data. And some evidently American corporations like Accenture and Medtronic are incorporated overseas for tax reasons. Third, since 2008 dozens of major corporations have left the stock market, either for a few years (GM, Dell, Hilton) or for longer (Albertsons-Safeway). Private equity has grown by several trillion dollars and owns many of the biggest firms in several industries; it is simply not possible to assess concentration using only listed companies. Lastly, 3-digit industries can be quite broad. Coach, Nike, and Skechers are all in the same NAICS industry, but are in no real sense competitors.

The evidence that industry has become dangerously concentrated in recent years is weak, unsystematic, and inconsistent, and doesn’t always tell us very much about the actual state of competition.

An industrial organization economist would point out that national sales revenues are not very informative about rivalry on the ground. Olive Garden’s corporate revenues say nothing useful about the rivalry among Italian restaurants in my town. Indeed, retail and other services are among the industries that have seen the greatest consolidation at the national level, driven in part by new technology-enabled economies of scale yet at the local level these industries have often become even more competitive, as national chains move in to contest local markets. Rivalry among car repair shops, funeral homes, therapists, and real estate agents are also mostly local.

But there is a more fundamental difficulty in figuring out how the “curse of bigness” has led to industry monopolization: the digital revolution has left basic categories such as size and industry hard to parse. Put plainly: if a monopoly is a giant corporation that dominates an industry, what happens if “industry” and “giant” and “dominance” no longer scan?

What industry is Coinbase in? It is a cryptocurrency exchange with broader ambitions, so…banking? Securities underwriting? Stock brokerage?

According to its prospectus, it is in SIC code 7389 (“Business services, not elsewhere classified”), where it joins Doordash (food delivery) and Lyft (ride-hailing). Robinhood, on the other hand, is classified in SIC 7372 (prepackaged software), where it joined Airbnb (short-term home rentals), Coursera (online courses), Olo (restaurant logistics), Palantir (nefarious spying), C3.ai (AI for enterprise), and Snowflake (something about “data clouds”). All are recent IPOs. These corporations obviously do not compete with each other, but should they instead be classified with finance, hotels, education, and restaurants?

Industry used to be straightforward. When the original trustbusters worried about monopoly, industries were defined by their products. But when the process involves writing code, classifying companies into an industry gets problematic. Most recent tech IPO companies evidently are in the “staring at a screen and typing on a keyboard” industry, but they can greatly change the forms of competition in industry, as Uber did for taxis and Airbnb did for hotels.

The Congressional Subcommittee Report on competition in digital markets, which detailed the monopolistic behaviors of Google, Facebook, Amazon, and Apple in October 2020, came up with its own market definitions: web browsers, search, e- commerce, online mapping, advertising, voice assistant, and others. Each of the four companies turns out to be neo-conglomerates competing fiercely in several markets at once, while routinely inventing new ones. In addition, the source of revenues of the new monopolists is often separated from the overt “product”, particularly for advertising-funded business models such as search and social media. In other words, they were monopolists for products that they gave away for free.

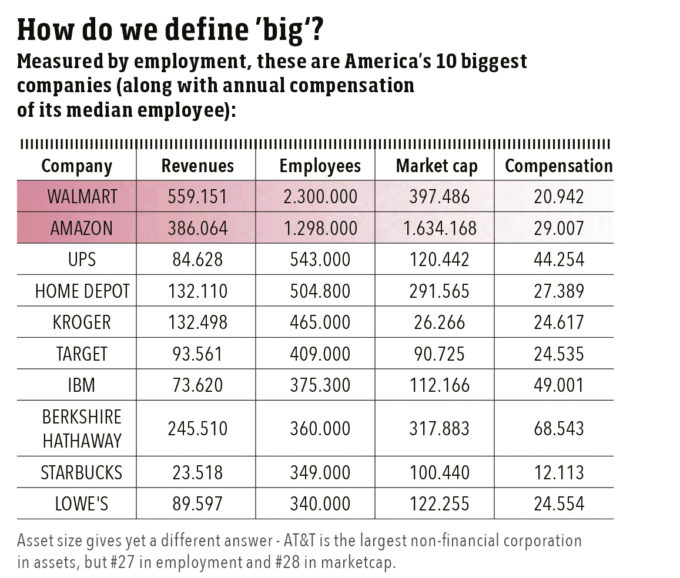

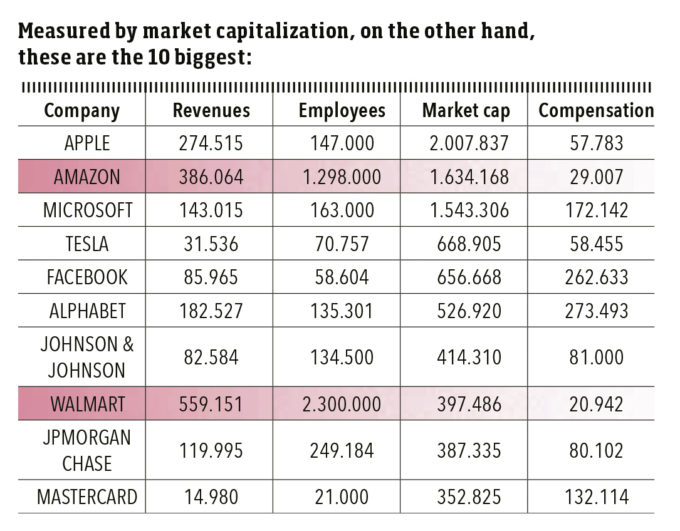

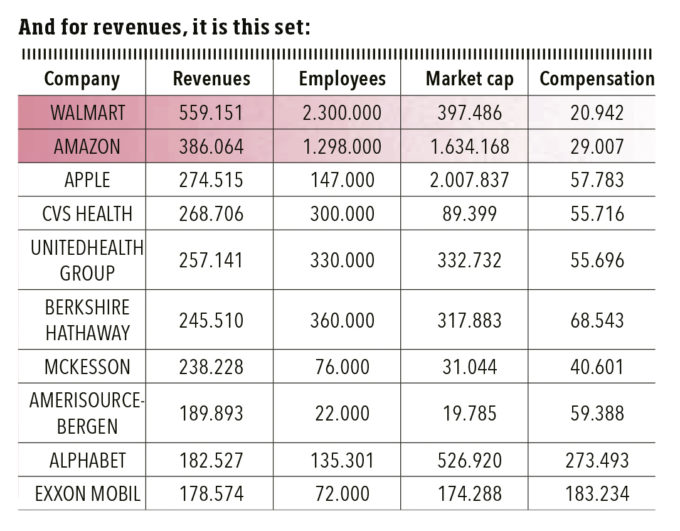

What is America’s biggest corporation? The answer depends on what you mean by “big.”

It is clear that “size” does not have a single meaning, and there are many ways to be big. Observe some regularities. The biggest employers tend to be among the lowest-paying firms, although 40 years ago the opposite was true, as there was a “large firm wage premium.” The biggest market cap companies often pay very well, which suggests that monopolists might not be that stingy when it comes to compensation. For instance, at over $270,000 per year, Alphabet’s median employee brought home twice as much as the median worker at Goldman Sachs. (Tech firms also rigorously avoid hiring full-time employees if they can. Most of the people who work at Google do not work for Google; they are temps, vendors, and contractors, or TVCs.) And the biggest revenue companies are sometimes anonymous middlemen like AmerisourceBergen. It turns out that the “curse of bigness” is underspecified.

Note that this was not true 40 years ago, when revenues, employment, assets, and market cap were very highly correlated.

Does being big confer power on corporations? There is not much sign that big employers are politically powerful. Home Depot, Kroger, and Target do not have any obvious pull in DC, despite their massive bargain-priced labor forces. Some of the biggest revenue producers (AmerisourceBergen, McKesson, and Cardinal Health) are settling a lawsuit for their role in the opioid crisis: apparently massive revenues provide no shield from state attorneys-general. And while the monopoly narrative often proclaims that some corporations are too big to fail, it is notable just how many financial giants were in fact allowed to fail, or to be acquired under duress, during the financial crisis.

Contrast these giants with Zoom, our inescapable companion during the pandemic. Zoom was downloaded a half-billion times in 2020, has 300 million daily users, and boasts a market capitalization of over $110 billion. Yet currently it has just 4,422 employees around the world and rents server space from Amazon and Oracle. Is Zoom a giant corporation? Should we break it up? And how did a pipsqueak like Zoom out-compete monopolists like Google, Facebook and Microsoft, all of which have rival products?

The digital revolution has been even more important than Bork’s writings for transforming the organization of industry. ICTs have greatly reduced the transaction costs of using markets for capital, labor, supplies, and distribution, and for managing the internal operations of a company. This is how Coinbase can have 50 million clients and over a billion dollars in revenues with just 1,249 employees and no physical headquarters. The stock market rewards corporations that promise the most future revenue growth with the least assets and employees. The logical endpoint of shareholder capitalism is corporations with no assets or people at all.

Technology companies challenge the reach of traditional antitrust, much as the anti-monopolists might wish it otherwise. As Tom Wheeler, Phil Verveer, and Gene Kimmelman point out, “it’s not realistic to expect antitrust to have an important influence on privacy, data security, hate speech, imminent incitements to violence, malign foreign influence, or misinformation,” particularly if we need action soon. Facebook is noxious not because of a high market share among the elderly who still use its flagship product, but because its ad-based business model rewards the collection of horrifyingly intrusive data and the application of insights from behavioral research to adhere people to its platform.

The Obama-appointed federal judge who threw out the FTC’s initial antitrust case against Facebook in June 2021 put it plainly: “It is almost as if the agency expects the court to simply nod to the conventional wisdom that Facebook is a monopolist…Yet, whatever it may mean to the public, ‘monopoly power’ is a term of art under federal law with a precise economic meaning: the power to profitably raise prices or exclude competition in a properly defined market.”

There are several ways to rein in the digital Goliaths that do not involve antitrust or precise measurement of market concentration. For example, a Pigovian tax on targeted ads, or even an outright ban, would limit the incentives for surveillance capitalism. A Digital Platform Agency analogous to the FCC would be more nimble than antitrust at limiting the misuse of corporate power and setting suitable ground rules for competition.

But what we face is a more fundamental shift in the organization of capitalism. Big Tech firms are more aptly thought of as gatekeepers than monopolists; by creating platforms to connect buyers and sellers, they have inserted themselves into markets that might have been infeasible before. This creates opportunities for the small businesses beloved by anti-monopolists, at least when they reside on Main Street. The Play store for Android has three million apps for sale, and Apple’s app store lists two million products. Amazon has nearly two million active sellers, of which 200,000 generate at least $100,000 in revenues annually.

In American capitalism, cheap wins, competitive markets get us to the cheapest price, and ICTs enable markets for everything. We may not love the results. Think how your work life would change if every day you competed for a shift at your job in an online auction where the lowest bidder wins. After California’s Proposition 22, such a situation may not be far off, whether you are a teacher, a dishwasher, or an emergency room physician. Everyone will be a self-employed entrepreneur running their own small (tiny, micro) business, and our yeoman dishwasher will create an LLC to receive their wage, which will vary from day to day according to market conditions. That may be a less corporate, more market-friendly future, but it will not be a better one.

Industry concentration and monopoly are a small problem. Shareholder capitalism is the big problem. Creating more competition is not the solution.

This article was adapted from Taming Corporate Power in the 21st Century (Cambridge University Press, 2022), part of the Cambridge Elements Series on Reinventing Capitalism (www.cambridge.org/ReinventingCapitalism).

Professor of Business Administration and Professor of Sociology, University of Michigan’s Ross School of Business

Jerry Davis is the Gilbert and Ruth Whitaker Professor of Business Administration and Professor of Sociology at the University of Michigan’s Ross School of Business. He has published widely on management, sociology, and finance. His latest book is Taming Corporate Power in the 21st Century (Cambridge University Press, 2022), part of Cambridge Elements Series on Reinventing Capitalism.

July 10, 2025 • by Bruno Le Maire in Magazine

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

Audio available

July 8, 2025 • by Mike Rosenberg in Magazine

A new framework encourages leaders to see the world as PLUTO – polarized, liquid, unilateral, tense, and omnirelational. It’s time to think differently and embrace stakeholder capitalism....

Audio available

Audio available

July 3, 2025 • by Eric Quintane in Magazine

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio available

June 26, 2025 • by Michael Yaziji in Magazine

Forward-thinking leaders proactively shape their external environment, turn uncertainty into certainty, and create substantial value in the process....

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience