How to manage power dynamics in high-stakes negotiations

Former FBI agent Joe Navarro explains how to leverage non-verbal cues, manage power dynamics, and build trust to overcome deadlocks in negotiations....

by Niccolò Pisani Published January 25, 2024 in Competitiveness • 7 min read

Much has been written about Europe’s slide in global relevance over recent years. And more is to be written. European Commission President Ursula von der Leyen has recently mandated Mario Draghi, former president of the European Central Bank and prime minister of Italy, to prepare a report that identifies ways to help the EU businesses regain their footing. This is what was on the agenda of the January meeting Draghi held with the European Round Table for Industry, a lobbying group that represents major European companies.

The task is not an easy one; EU competitiveness has been worsening steadily and reversing this trend will require some fundamental changes and a bold roadmap going forward.

To complicate things further, elevated geopolitical tensions have led to a fragmentation of the world economy. Today’s business leaders must assess geopolitical risks and connect them to important corporate decisions. While in the past weighing such risks may have only been relevant for a few sensitive industries, it is now every leader’s priority in all sectors. And it’s proving hard for many to adapt to the new reality.

Take the recent withdrawal of Western corporations from Russia and the challenges found in completing their exit. Over 1,600 international companies are still operating in Russia, with only a small percentage of Western firms having been able to close their operations in the country since its invasion of Ukraine in February 2022. Sanctions, countersanctions, restricted sales, and large markdowns are just a few of the issues that underscore the major obstacles that businesses must face to adapt to this new world – as discussed in a recently published research on “trapped” multinationals in Russia co-authored with Simon Evenett.

Looking at recent trade patterns and geopolitical shifts, three strategic priorities emerge as particularly crucial for EU business leaders today.

The US and China have started to decouple after years of tension, as seen by a sharp decline in the share of imports and foreign direct investment between the two countries. The 2022 DHL global connectedness index shows that, largely because of tariffs imposed by Trump and maintained by Biden, US imports from China declined from 21.6% in 2017 to 16.6% in 2022, while exports to China decreased from 8.4% to 7.3%.

With China emphasizing home market and innovation through its dual circulation economic strategy and the US imposing measures like limiting foreign acquisitions and extending export controls, both countries are aggressively putting policies into place to lessen their mutual reliance. This is especially true in sensitive industries, an example of this being the prohibition on US semiconductor industry sales to China starting in 2022. Additionally, China’s strategic efforts over the past years to reduce dependence on foreign technology have posed significant challenges for foreign enterprises heavily invested in China.

What should EU companies do to deal with the decoupling of the world’s two largest economies? What many corporations, including some of the world’s largest, have already started doing. That is, embracing a more regional approach that lowers dependencies across regions to contain potential crises in case of geopolitical shocks. Thus, as many companies simply cannot give up the Chinese market, embracing a “China for China” strategy will help companies appreciate their full exposure to the Asian economy, limit the consequences in other parts of the world in case of sudden geopolitical shifts, while continuing to compete in one of the world’s largest and most innovative markets. Thus, for EU companies, a “China for China” strategy includes producing in Chinese factories for Chinese customers and localizing the entire value chain. This also implies largely reducing the sourcing of goods from China that are then destined to go to other countries.

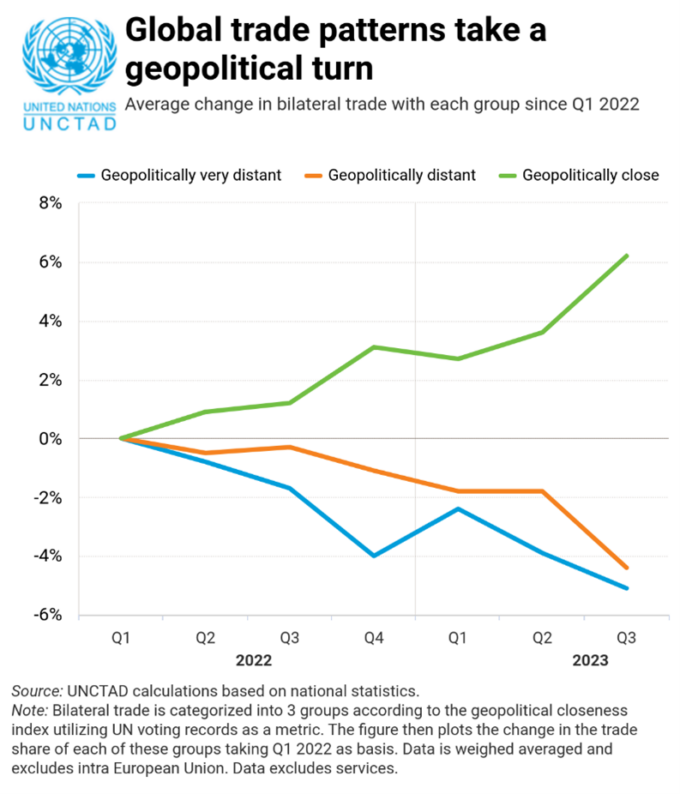

The latest report by UNCTAD issued in December 2023 speaks clearly. Global trade in 2023 is expected to be down 5% compared with 2022’s record level, shrinking by about $1.5tn to below $31tn. Particularly noteworthy is that global trade patterns are increasingly influenced by geopolitics, with countries showing marked preferences for politically aligned trade partners, a trend termed “friend-shoring”.

In other words, companies are choosing to do more business with partners residing in countries seen as geopolitical friends.

Additionally, UNCTAD data clearly suggests there has been an overall decrease in the diversification of trade partners, indicating a concentration of global trade within major trade relationships. This is a worrisome finding because fewer partners in fewer countries can lead to major sub-efficiencies that threaten competitiveness.

EU companies should continue to bet on diversification, especially in the face of growing fragmentation. That is to say, they should leverage the opportunities that exist for diversification within the region while also proactively looking for new ways to diversify business relationships across other regions.

Looking at the 2023 Global 500 ranking compiled by Fortune (which tracks the largest companies based on annual revenues), the verdict is clear. The United States – with a total of 136 companies – currently dominates, followed by China with 135. Back in 2001, only 10 Chinese companies appeared on that list, while Europe was home to more than 30% of the total. For the most recent ranking two decades later, 40% are based in East Asia (mostly China), while around 30% were in North America (mostly the United States) and 25% were in Europe (while fewer than 5% hailed from “the rest of the world”).

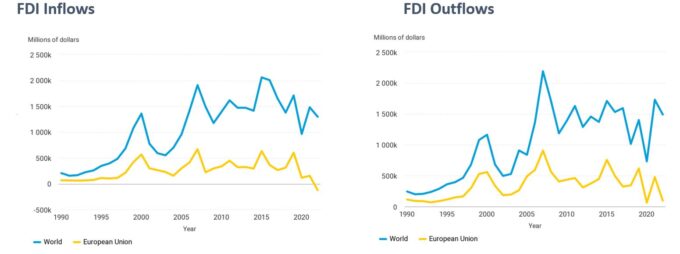

The weakening relevance of EU businesses in the global corporate landscape suggested by the analysis of Fortune stands out also when looking at the 2023 UNCTAD data on international investments, with European Union foreign direct investment (FDI) inflows and outflows showing a downward trend and becoming less and less relevant contributors to the world’s total investment pool. In other words, EU companies are responsible for a smaller share of cross-border investment taking place in other regions and are able to attract a decreasing share of investments coming out from other regions.

The only way to counter these downward trends is to bet on innovation driven by corporate R&D investment. For decades, innovation has been the key driver for EU economic prosperity. Unfortunately, looking at recent OECD data, the EU’s R&D spending is now lagging behind China, Japan, South Korea, and the United States in intensity.

To reverse this trend, European policymakers should facilitate and further incentivize EU companies to bet on innovation-related investments. And not just any investments: experimental R&D should be favored over applied R&D. While the latter tends to lead to incremental improvements only, experimental R&D gives a real opportunity to leapfrog the competition. Consider: Europe currently has the smallest share of experimental (versus applied) R&D at only 42% of its total. Compare that with 83% for China, 80% for Israel, and 65% for the United States.

To wrap up, EU business leaders are facing growing complexity as geopolitical tensions escalate. The need for adaptability amid change is further highlighted by the EU’s declining influence as an economic force. EU companies that can skillfully navigate these obstacles will not only survive but thrive in a period of unparalleled global upheaval as the geopolitical landscape continues to shift. In this context, with businesses having to make responsible decisions on their operations and competitiveness, enlightened governments can support them with appropriate regulatory frameworks to promote investments in innovation and support the creation of thriving corporate ecosystems. The moment is key for the European Commission to help EU companies in this difficult endeavor.

IMD Professor of Strategy and International Business

Niccolò Pisani is Professor of Strategy and International Business at IMD. His areas of expertise include strategy design and execution as well as international business, with an emphasis on globalization and sustainability. His award-winning research has appeared in the world’s leading academic journals and extensively covered in the media. His work has been featured in both Harvard Business Review and MIT Sloan Management Review. He has also written several popular case studies that are distributed on a global scale.

May 6, 2025 • by Anna Cajot in Competitiveness

Former FBI agent Joe Navarro explains how to leverage non-verbal cues, manage power dynamics, and build trust to overcome deadlocks in negotiations....

April 24, 2025 • by Jerry Davis in Competitiveness

Many regional developers have tried and failed to emulate Silicon Valley’s VC-driven model for innovation. Detroit, the birthplace of Ford, is following an alternative route – with promising results....

Audio available

Audio available

April 16, 2025 • by Benoit F. Leleux in Competitiveness

How a private equity-backed corporate carve-out created a successful, sustainable consulting powerhouse...

April 11, 2025 • by Jim Pulcrano, Jung Eung Park, Christian Rangen in Competitiveness

Founders searching for funding must be targeted in their approach to securing a lead investor. A global survey of VCs offers valuable insights into what makes them tick....

Explore first person business intelligence from top minds curated for a global executive audience