Industry 4.0 and COVID-19: why the pandemic might have provided a clearing in the woods

Choosing a path through the myriad technologies that Industry 4.0 offers is hard enough, but with uncertainties generated by the pandemic, perhaps the universe of viable options has become smaller and more manageable, and the business cases clearer.

After the tumult of the spring and a rebalancing act in the summer, companies are now entering another stage of deep uncertainty brought about by the pandemic.

Without a confident view of future markets and margins, many companies are understandably scaling back their capital investments.

For supply chain managers looking to maintain the momentum of their Industry 4.0 efforts, or looking for how to get some in motion, there is room for building a compelling business case in spite of the pandemic.

Market-facing opportunities

These times are unprecedented for many reasons, one of which is the huge spikes in e-commerce demand.

In response, perhaps it would be helpful to start making a set of tools able to provide quick improvements in online experiences: investments in order management systems (OMS) that allow for integrated omni-channel capabilities, customer databases and order status; and automated customer ordering utilities are the sorts of initiatives that may get traction.

There have been some articles suggesting that now is the time to leverage Artificial Intelligence (AI) to improve demand planning. However, AI is most effective when there is a historical database to learn from and exploit, to better predict the future. It is hard to see how it would be easier to build consensus for AI-based forecasting right now.

For demand planning, the dominant uncertainty argues for better collaboration between functions to improve visibility into trade inventories and sell-out. When demand planning is difficult, demand sensing is even more critical. This thinking also bolsters arguments for investments in supply-chain control towers and transportation management systems — two other ways to improve visibility.

If we can’t reliably predict the future, quick decision making and reactivity is the best we can do.

Some companies leading the way in tackling supply challenges during the pandemic by simplifying their catalogues and removing complexity. This creates an opportunity for big data and advanced analytics to help identify those products that make the most sense to keep and focus on — and to do so by looking at products over their whole value chain.

Indeed, perhaps the collaboration success stories we have seen can be a springboard to true end-to-end Sales and Operations Planning; a fundamental practice needed for using AI in Demand Planning.

There has never been a more critical time to be able to do scenario planning (for example, high/low sales ranges or further lockdowns) that must consider customers, consumers, production capability and raw material supply.

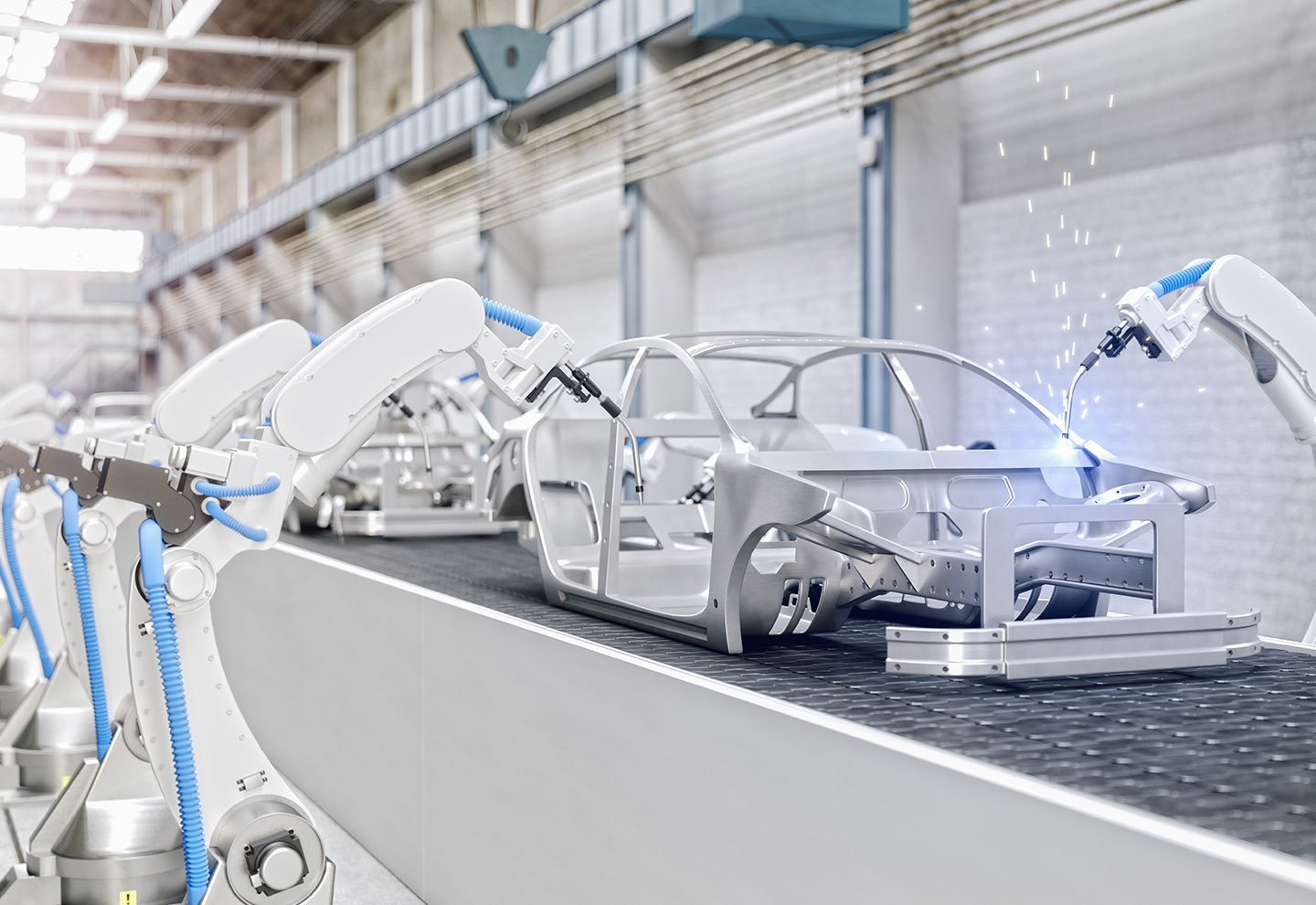

Factory-facing opportunities

One of the key variables in choosing which products to focus on was the need to maximize the use of production assets. Larger runs and fewer changeovers were a priority. This will surely not remain the case forever. However, it does create conditions for more ROI-based Industry 4.0 initiatives that emphasize efficiency, such as automated guided vehicles, logistics automation and co-bots.

Initiatives that help keep machines running and have tangible benefits, such as predictive maintenance or AI vision recognition for quality assurance, are also good fits in the current moment.

These capabilities — given that they are more removed from the strategic business drivers of other Industry 4.0 technologies — offer another dimension of appeal. At some point, the pressures around supply-chain resiliency may lead to tangible incentives designed to push companies to onshore production. Capital investments that lower operating costs will be particularly attractive, and those companies that have always moved in this direction will be better positioned to act quickly and reconfigure their supply chains.

Ideas for another day?

With e-comm and market uncertainties currently at the forefront of supply chain executives’ minds, now may not be the ideal moment for most companies to exercise ambitious strategic capabilities. For example, making the case for initiatives like product personalization is more challenging in the current moment of catalogue decomplexifying and demand questions.

In the same vein, network-scale initiatives such as blockchain traceability or 3-D printing fat-tail products are likely not going to be targets for investment.

At the factory level, augmented reality maintenance tools or digital twins could well prove to be the sort of initiatives better suited to capital investment when the horizon is clearer and confidence is higher.

Making the case for Industry 4.0 initiatives is already a fraught exercise of blending business drivers, building business cases and managing change. In a time when uncertainty rules, change is even scarier and capital investments harder to come by. But perhaps there is a way to continue forging ahead by being opportunistic and leveraging the constraints of the pandemic into new capabilities.

Ralf W. Seifert is Professor of Operations Management at IMD. Prior to joining IMD, Professor Seifert studied and worked in Germany, Japan and the US. At IMD he currently directs IMD’s Digital Supply Chain Management program, which addresses both traditional supply chain strategy and implementation issues as well as digitalization trends and new technologies.

Richard Markoff is a supply chain researcher, consultant, coach, and lecturer. He has worked in supply chain for L’Oréal for 22 years, in Canada, the US and France, spanning the entire value chain from manufacturing to customer collaboration. He is also co-founder and Operating Partner of the Venture Capital firm Innovobot.

Research Information & Knowledge Hub for additional information on IMD publications

Despite geopolitical upheavals that threaten global growth, companies continue to see business opportunities across borders. As leaders strategize how to position their operations amid war, trade disputes, disease outbreaks, and climate change, ha...

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications